|

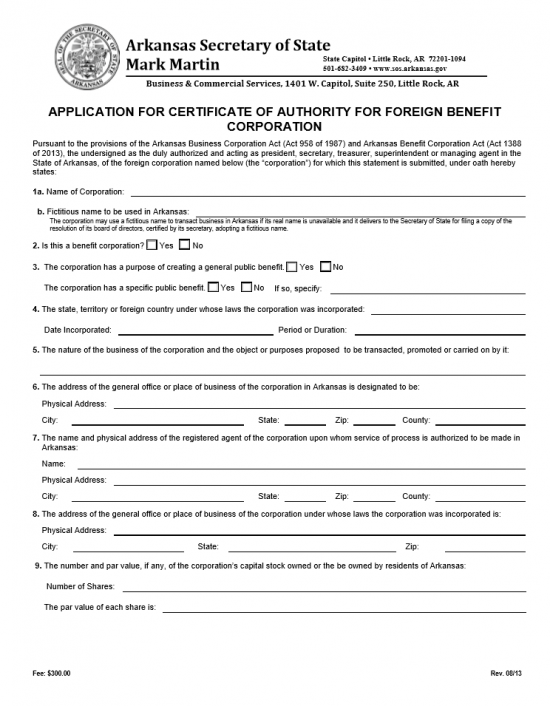

Arkansas Application for Certificate of Authority for Foreign Benefit Corporation |

The Arkansas Application for Certificate of Authority for Foreign Benefit Corporation, when filled out and submitted correctly, will satisfy a major requirement the Arkansas Secretary of State places on foreign entities wishing to own and operate a benefit corporation in this state. This document will solidify several important pieces of information the Secretary of State requires such as the name of the corporation being formed, the Tax Contact, Officers, and Registered Agent. All of these are mandatory to report before submitting this paperwork. When it is completed an entity wishing to form a benefit corporation may attach a Certificate of Existence from its origin state, any required documentation (some entities will require additional paperwork), and a check made payable to the Arkansas Secretary of State for the $300.oo filing fee. Applications for a foreign benefit corporation are not available online. They may be mailed in to: Arkansas Secretary of State, 1401 W. Capitol Suite 250, Little Rock, AR 72201. Since this is a benefit corporation, it is highly recommended for the entity forming it to be abreast of Arkansas law and seek consultation with an attorney or accountant in order to make sure the forming corporation is in full compliance with Arkansas State Law.

How To File

Step 1 – In Item 1a, enter the Name of the corporation in its home state.

Step 2 – Item 1b provides the opportunity to report the name of the corporation being formed in Arkansas if a Fictitious Name is to be used. A Fictitious Name may be used for any reason ranging from compliance to preference but must be reported here.

Step 3 – Indicate if this will be a benefit corporation by marking the box labeled “Yes” in Item 2. If not, mark the box labeled “No” (its recommended that one consults a professional regarding this form if the box labeled “No” is marked.

Step 4 – In Item 3, check the box labeled “Yes,” if this corporation’s purpose is of general public benefit. If not then check the box labeled “No.”

Step 5 – Next, also in Item 3, report if there is a Specific Public Benefit to this corporation. Do this by checking the box labeled either “Yes” or “No.” If you have marked “Yes,” then describe the specific public benefit in the space provided.

Step 6 – In the fourth item, report the state, territory, or country where the parent corporation was formed. That is its place of origin. Do this in the space provided.

Step 7 – Next, also in Item 4, report the Date this corporation first incorporated then its Period of Duration (if applicable) in the spaces provided.

Step 8 – On the blank line provided in Item 5, describe the nature or purpose for forming this corporation. This should include how business will be transacted.

Step 9 – In the sixth item, report the Physical Street Address, City, State, Zip Code, and County in Arkansas where this benefit corporation’s general office will be located.

Step 10 – Item 7 will require the full Name and Physical Address of the Registered Agent appointed by the corporation to receive legal notices for the Arkansas foreign benefit corporation being formed. This must be an Arkansas address and every corporation in the State of Arkansas is required by law to have an appointed Registered Agent.

Step 11 – Every foreign corporation (by definition) was formed outside the State of Arkansas. This means that it will be subject to the laws governing its existence in its origin state because it maintains a physical address in that state. In Item 8, report the Physical Address, City, State, and Zip Code whose laws govern the existence of the parent corporation.

Step 12 – In Item 9, report the Number of Shares this corporation has been authorized to issue on the first blank line. On the second blank line, report the Par Value of each share.

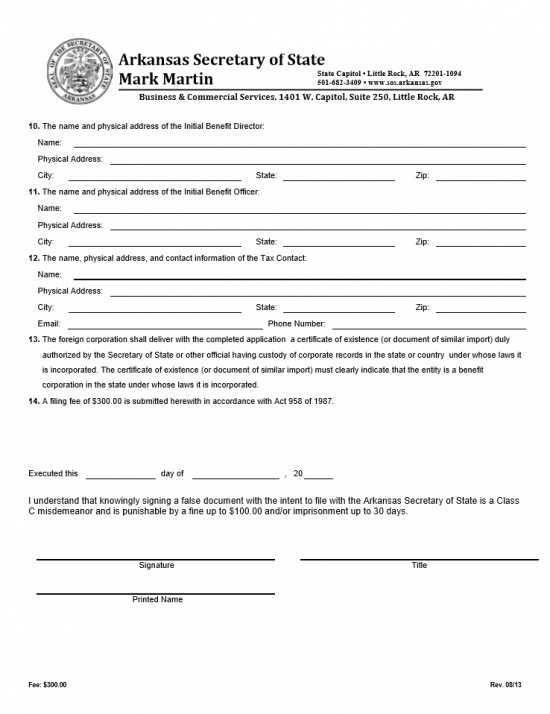

Step 13 – In Item 10, report the full Name and Physical Address of the Initial Benefit Director. This party may change in the future however must be reported now. Do this by entering the Initial Benefit Director’s full Name, Physical Address, City, State, and Zip Code in the spaces provided.

Step 14 – In Item 11, report the full Name and Physical Address of the Initial Benefit Officer. As with the Initial Benefit Direct, the present Benefit Officer may change may change in the future however must be reported now. Do this by entering the Initial Benefit Officer’s full Name, Physical Address, City, State, and Zip Code in the spaces provided.

Step 15 – The foreign benefit corporation being formed must have a Tax Contact. Report the full Name, Physical Address, City, State, Zip Code, E-Mail Address, and Phone Number of the foreign benefit corporation’s tax contact in Item 12.

Step 16 – Item 13 will require that a Certificate of Existence from the origin state of the corporation forming the Arkansas benefit corporation accompany this application. If one cannot be issued, other similar documents may be acceptable however one should consult a professional before submitting this application without an official Certificate of Existence from the origin state.

Step 17 – Item 14, will require that payment for a filing fee of $300.00 must be submitted.

Step 18 – Below Item 14, report the execution date of this document (Calendar Day, Month, Year) in the spaces provided.

Step 19 – Below the acknowledgement paragraph, the corporate Officer authorized to submit this application must sign and print his/her Name in the spaces on the left. Then provide his/her title in the blank space on the right.

Step 20 – Once all the information on this application has been verified as true and accurate, attach the Certificate of Existence and any required supporting documentation (depending upon the nature of the benefit corporation being formed) to the completed Application for Certificate of Authority. Include a check for $300.00 made payable to the Arkansas Secretary of State then deliver to:

Arkansas Secretary of State

1401 W. Capitol

Suite 250

Little Rock, AR 72201.