|

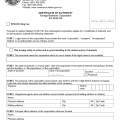

Arkansas Application for Certificate of Authority | Form F-01 |

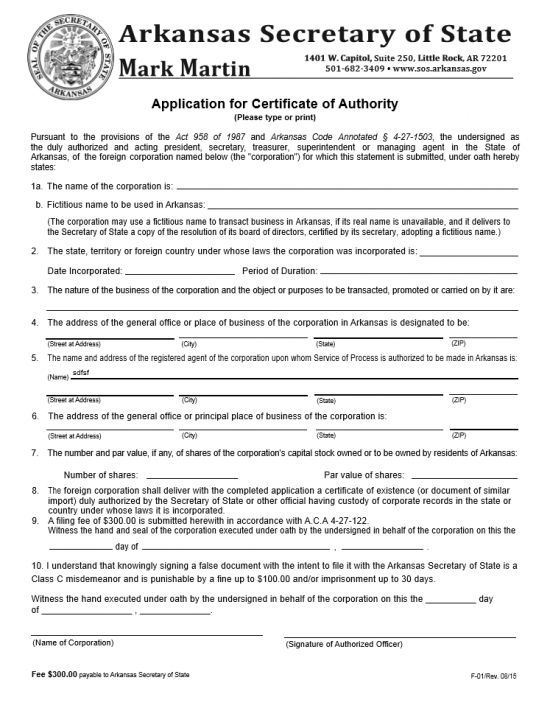

The Arkansas Application for Certificate of Authority | Form F-01 will satisfy one of the filing requirements set by the Arkansas Secretary of State when an out-of-state entity wishes to own and/or operate a for profit corporation within Arkansas State Borders. A full submittal package may depend upon the nature of the corporation being operated in this state, the nature of the corporation’s operation in its origin state, and its location however every filing will at least require the Application for Certificate of Authority (Form F-01), a Certificate of Existence from its origin state’s Secretary (or something equivalent), and a filing fee payment for $300.00 (payable to “Arkansas Secretary of State”). This filing or submittal should be delivered by mail or in person to Arkansas Secretary of State 1401 W Capitol, Suite 250, Little Rock, AR 72201.

This form may also be filed online at: http://www.sos.arkansas.gov/BCS/Pages/foreign.aspx at a reduced filing fee of $270.00. This would be payable by American Express, Discover, MasterCard, VISA, or an ACH account. This does not discount any requirements for separate documentation thus any and all required paperwork must be attached as well.

How To File By Mail

Step 1 – In Item 1a, enter the actual name of the foreign corporation as it exists and operates in its original state.

Step 2 – In Item 1b, enter the fictitious name (if desired or necessary to assume) the corporation shall exist and operate under in the State of Arkansas.

Step 3 – In Item 2, enter the state or country where the corporation operates. That is, the jurisdiction that holds authority over this entity. Do this on the first blank space provided. On the second blank space provided, enter the Date this corporation was formed. Then on the third blank space, enter the Period of Duration, in years and/or months, for this corporation.

Step 4 – In Item 3, define the nature of the business on the space provided. This should include its purpose and how it will operate its transactions.

Step 5 – In Item 4, enter the Arkansas Address this business’s general office will be located. There will be a separate space for Street at Address, City, State, and Zip Code. This must be an address in Arkansas.

Step 6 – In Item 5, report the Name, Street Address, City, State, and Zip Code of the Registered Agent that shall receive legal notices on behalf of this corporation in the State of Arkansas. This address must be located in Arkansas and be reliably maintained.

Step 7 – In Item 6, report the principle office for this corporation.

Step 8 – In Item 7, define the number of shares this corporation is authorized to issue and the Par Value of those Shares on the spaces provided.

Step 9 –Item 8 will require an authorized Certificate of Existence from this entity’s origin state to be attached to this Certificate of Authority when submitting it to the Arkansas Secretary of State.

Step 10 – In Item 9, enter the Date this Certificate of Authority is officially being executed.

Step 11 – On the last line of this page, the Name of the Corporation seeking an Arkansas Certificate of Authority should be entered, then the Authorizing Officer must sign the Signature line provided.

Step 12 – In order for the forming corporation to receive its Annual Corporate Franchise Tax Reporting Form, the next page (“Corporate Franchise Tax”). On the first line enter the Corporate Name. Then on the following lines (in this order) report the Contact Person Name, the Street Address or Post Office Box, City, State, and Zip Code where the Annual Corporate Franchise Tax Reporting Form may be mailed. Next, enter the Telephone Number and Email Address for the Contact Person named in this form. Finally, at the bottom of the page, the Authorized Officer must type or print his or her Name. This must be followed by the Authorized Signature of the Incorporator, Officer, or Agent who may legally submit this information to the Arkansas Secretary of State.

Step 13 – The final step will be to file the Arkansas Certificate of Authority to the Arkansas Secretary of State. This will require the completed original Application for Certificate of Authority (Form F-01), an authorized Certificate of Existence from its origin state’s Secretary, filing fee payment for $300.00 (if by mail make check payable to “Arkansas Secretary of State” – Do not send cash), and all required documents delivered to

Arkansas Secretary of State

1401 W Capitol

Suite 250

Little Rock, AR 72201

How To File Electronically

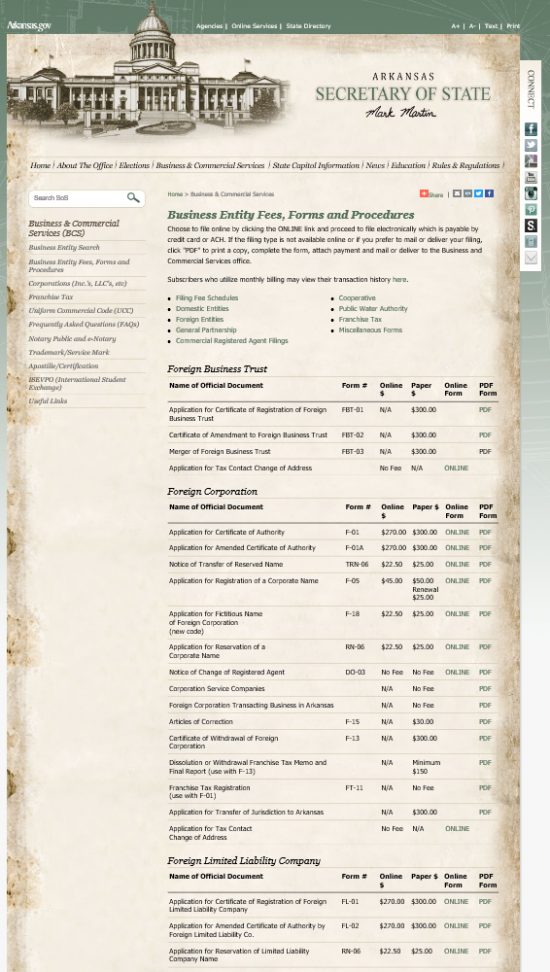

Step 1 – Go to the Arkansas Secretary of State’s web page for “Business Entity Fees, Forms, and Procedures,” for foreign entities here: http://www.sos.arkansas.gov/BCS/Pages/foreign.aspx

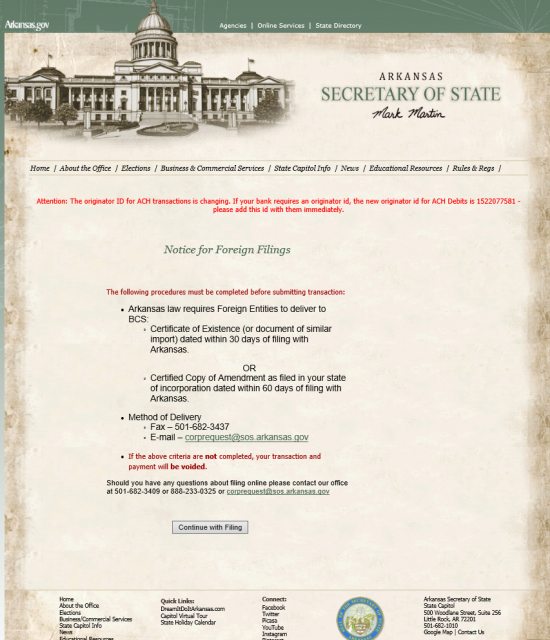

Step 2 – Locate the second heading, “Foreign Corporation,” and select the link labeled “Online.” This will open an instructional page which will give the method of delivery for the Certificate of Existence (this must be dated within thirty days of filing) or Certified Copy of Amendment (this must be dated within sixty days of filing). When filing electronically, you may deliver these and any necessary documents by fax (501.682.3437) or by E-Mail corprequest@sos.arkansas.gov. Once you have reliably documented this information for easy reference, select the button labeled “Continue with Filing.”

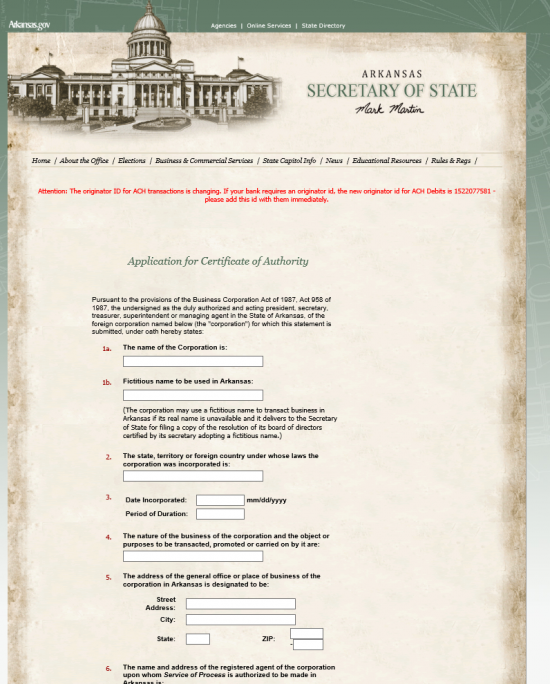

Step 3 – In Item 1a, enter the true name of the corporation as it is listed on its state of origins articles of incorporation.

Step 4 – In Item 1b, if this corporation will use a fictitious name in the State of Arkansas then report it in the cell provided.

Step 5 – In Item 2, report the state whose laws this state must follow in the field provided. Typically this will be the state where this corporation was incorporated.

Step 6 – In Item 3, report the Date of Incorporation in this entity’s origin state. Then enter the Period of Duration for this corporation’s lifespan.

Step 7 – In Item 4, report the purpose of the corporation being formed. Include why it is being formed and how it will conduct business.

Step 8 – In Item 5, report the Arkansas address where the corporation being formed will maintain a general office. There will be a field for Street Address, City, State (this must be Arkansas), and Zip Code.

Step 9 – In Item 6, document the Name, Street Address, City, and Zip Code for the Registered Agent appointed to the corporation that is being formed in Arkansas.

Step 10 – In Item 7, enter the Street Address, City, State, and Zip Code of the principal office of this corporation.

Step 11 – In Item 8, report the number of Authorized Shares the corporation being formed may issue along with the Par Value of the Shares in the spaces provided.

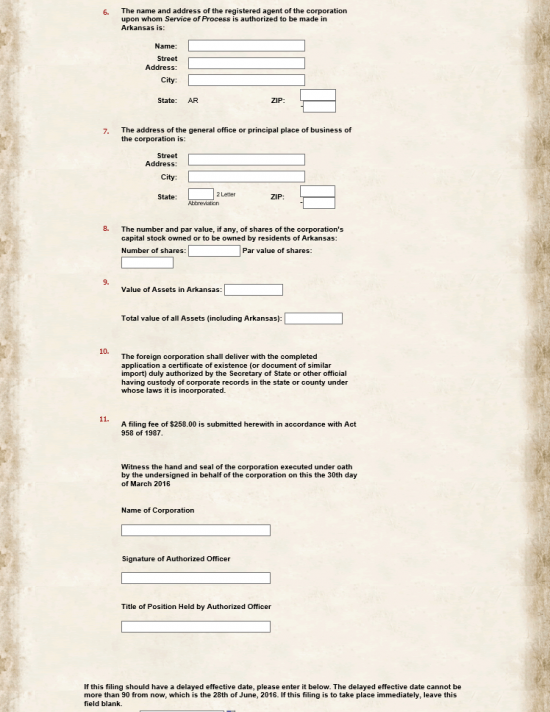

Step 12 – In Item 9, document the value of Assets in Arkansas then the total value of all Assets (including those in Arkansas).

Step 13 – Item 10 requires that a Certificate of Existence from the origin state be sent with the completed application.

Step 14 – In Item 11, report the Name of the Corporation, the electronic signature of the Authorized Officer, and the Title of Position held by the Authorized Officer.

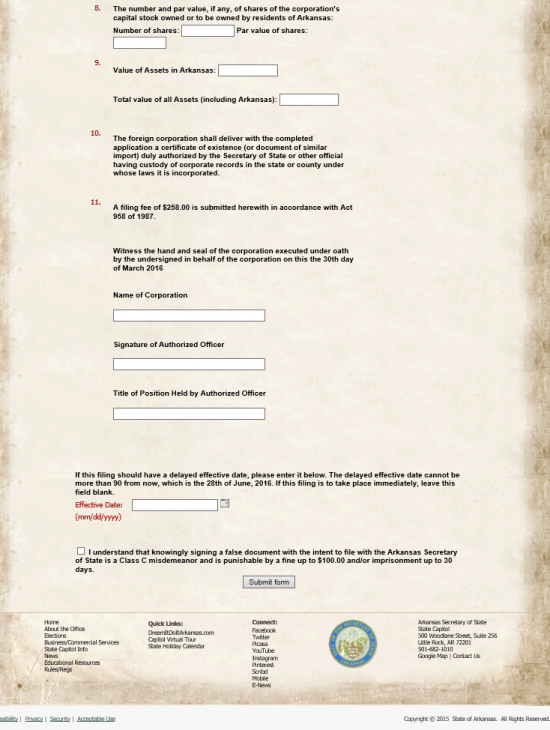

Step 15 – You may designate an Effective Date that differs from the filing date after Item 11. It should be noted this date may not be more than 90 days from the filing date.

Step 16 – Select the box next to the acknowledgement paragraph, then select the button labeled “Submit Form.” This will give an opportunity to submit a payment for the filing fee of $258.00. This is payable by American Express, Discover, MasterCard, VISA, or an ACH account.

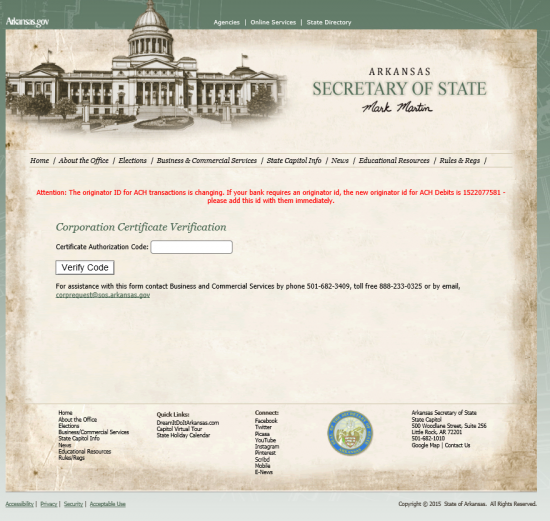

Step 17 – This site will then deliver a verification code where you may check the status of your filing. The web page where you may do this is: