|

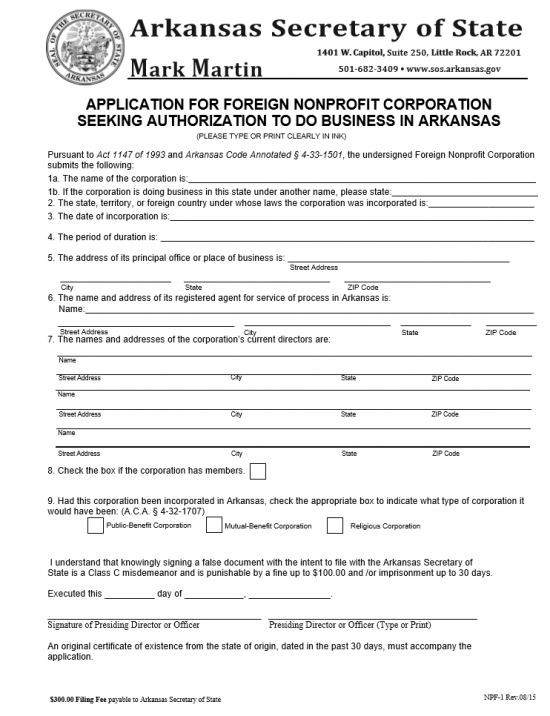

Arkansas Application for Foreign NonProfit Corporation Seeking Authorization To Do Business In Arkansas | Form NPF-1 |

The Arkansas Application for Foreign Nonprofit Corporation Seeking Authorization To Do Business In Arkansas | Form NPF-1 is a required filing when a foreign, or out-of-state, entity wishes to form a nonprofit corporation in Arkansas while remaining in its origin state. This will be one of the requirements set upon this entity. The Arkansas Secretary of State will require a completed application, the Annual Franchise Tax Report Contact Form, a Certificate of Good Standing or Certified Copy of Amendment issued by the appropriate governing body of the origin state and a filing fee payment to be submitted. This application may be submitted electronically or by mail. If submitted electronically the filing fee will be $270.oo and payable by American Express, Discover, MasterCard, VISA, or an ACH account. If the filing is done by mail, the application fee will be for $300.00 and payable by check (made out to Arkansas Secretary of State). In order to submit by mail, the submittal package should be sent to: Arkansas Secretary of State 1401 W. Capitol, Suite 250, Little Rock, Arkansas 72201. In nearly all cases, other governing entities such as the Internal Revenue Service will have requirements as well. Typically, it would be a wise decision to consult with an appropriate professional such as an attorney or a certified public accountant before forming and operating a business in Arkansas, as an entity will be held responsible to adhere to all laws and regulations that apply to its corporation.

How to File By Mail

Step 1 – The Name of the corporation forming the Arkansas nonprofit corporation must be reported in Item 1a.

Step 2 – Report the name of the corporation that will be forming in the State of Arkansas and doing business within state borders if it differs from the parent corporation’s name in Item 1b.

Step 3 – In Item 2, enter the state the parent corporation was incorporated in.

Step 4 – The Date of Incorporation in the parent corporation’s home state must be entered in Item 3.

Step 5 – Enter the period of duration of the corporate entity in Item 4.

Step 6 – Report the Street Address, City, State, and Zip Code of the corporation’s Principal Office in Item 5

Step 7- Each Arkansas Corporation must have a Registered Agent who maintains an address in the State of Arkansas and will reliably receive legal notices on behalf of the corporation that has appointed him or her to do so. Report the full Name, Street Address, City, State, and Zip Code in Item 6.

Step 8 – Report the Name, Street Address, City, State, and Zip Code of the corporation’s Directors in Item 7.

Step 9 – If this corporation has members then check the box in Item 8.

Step 10 – Indicate the type of corporation being formed in Item 9. Do this by placing a check mark in the box labeled Public-Benefit Corporation, Mutual-Benefit Corporation, and Religious Corporation. Following this, enter the Calendar Day, Month and Year this application is being executed on. Finally the Signature of the Presiding Director or Officer and his/her Printed Name are required on the last line of this application.

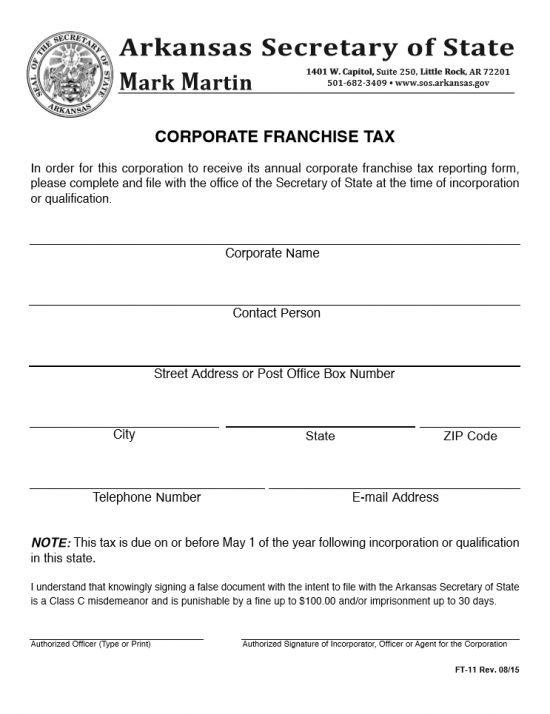

Step 11 – The next page is the Annual Report – Contact Information Nonprofit form. This form is necessary so the corporation may receive its Annual Franchise Tax Report Form. The first step will be to check the box next to the word “Foreign” to indicate this is a foreign corporation.

Step 12 – Report the Entity Name this corporation shall operate under in Arkansas and the full Name of the Contact Person in the spaces provided on the first line.

Step 13 – Enter the Street Address/Post Office Box Number and City/State/Zip Code where the Annual Franchise Tax Report Form may be mailed on the second line.

Step 14 – Report the Telephone Number and E-Mail Address of the Contact Person named above on the third line.

Step 15 – After the Acknowledgement paragraph, report the Calendar Date, Month, and Year this form is being executed.

Step 16 – The Authorized Officer must sign and print his/her Name on the last line.

Step 17 – Once you have completed all forms, gather all the required documentation that must accompany this (such as the Certificate of Existence or Certified Copy of Amendment), the completed original application, and a check made out to the “Arkansas Secretary of State” for $300.00 and mail this package to:

Arkansas Secretary of State

1401 W. Capitol

Suite 250

Little Rock, Arkansas 72201

How to File Electronically

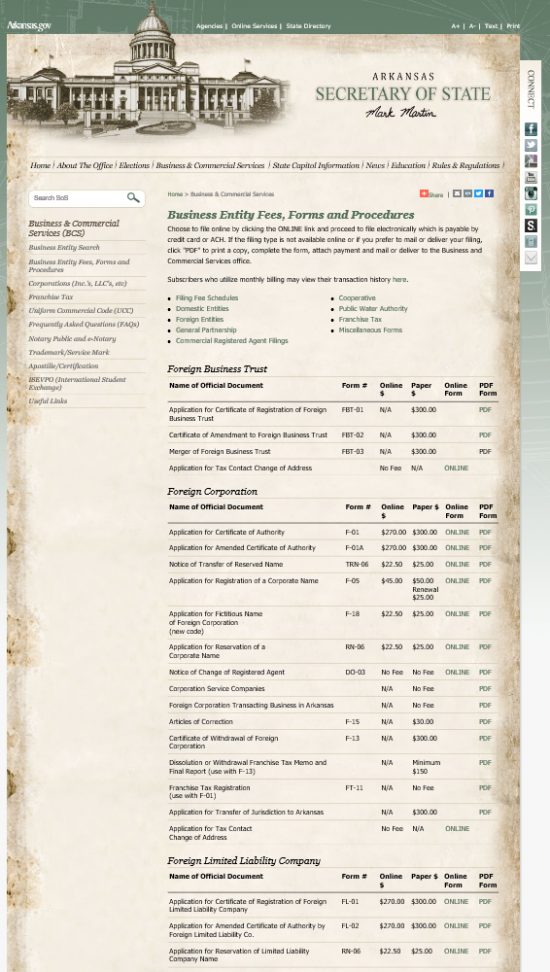

Step 1 – Go to the Arkansas Secretary of State’s Business Entity Fees, Forms, and Procedures for foreign corporations here: http://www.sos.arkansas.gov/BCS/Pages/foreign.aspx. Locate the heading “Foreign Nonprofit Corporation” near the bottom of the page and select the word “Online” on the line labeled “Application for Certificate of Authority for Foreign Nonprofit Corporation.” This will direct the browser to an instructional page.

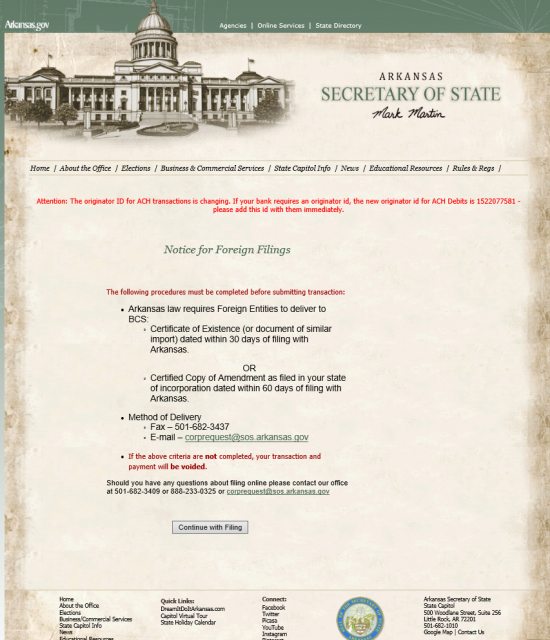

Step 2 – The instructional page for foreign entities will require that a Certificate of Existence (dated within 30 days of this filing) or a Certified Copy of Amendment (dated within 60 days of the filing date) from the corporation’s origin state be delivered to the Arkansas Secretary of State. The Method of Delivery may be Fax (501.682.3437) or by E-Mail (corprequest@sos.arkansas.gov). This is required paperwork which must be sent in for the application to be accepted. Once you have documented this information for easy reference, select the button labeled “Continue with Filing.”

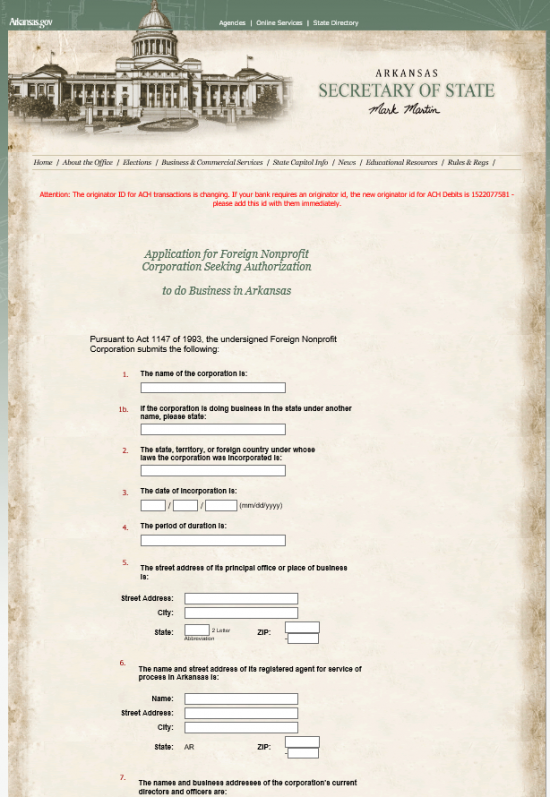

Step 3 – In Item 1, document the Name of the corporation.

Step 4 – Next, in Item 1b, report the name of the corporation as it will operate in the State of Arkansas if it differs from its original name.

Step 5 – Item 2, will require the origin state to be entered in the field provided.

Step 6 – Item 3 must have the Date of Incorporation, in the origin state, entered.

Step 7 – Report the Period of Duration for the corporation in Item 4.

Step 8 – In Item 5, document the Street Address, City, State, and Zip Code of the principal office for this corporation.

Step 9 – Enter the Name, Street Address, City, and Zip Code in the fields provided in Item 6.

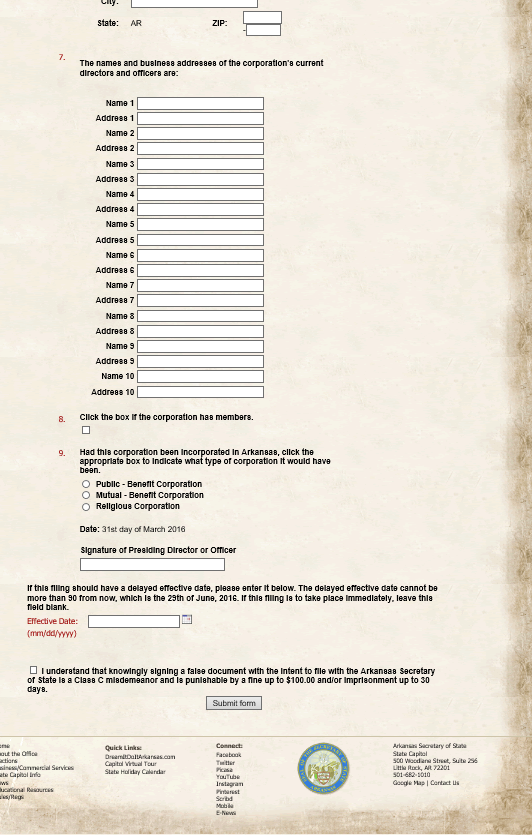

Step 10 – The Name and Address of each Officer and Director should be reported in Item 7. There will be enough room to name ten individuals.

Step 11 – If this corporation will have members, select the box in Item 8.

Step 12 – It will be necessary to indicate the type of nonprofit corporation being formed in Arkansas. You may choose Public-Benefit Corporation, Mutual-Benefit Corporation, or Religious Corporation in Item 9.

Step 13 – The electronic Signature of the presiding Director or Officer should be provided in Item 9, below the entity type.

Step 14 – If the Effective Date differs from the filing date, then enter this Date in the space provided. It should be noted the effective date may not be more than 90 days from the filing date.

Step 15 – Select the box next to the acknowledgement paragraph.

Step 16 – Select the button labeled “Submit Form.”

Step 17 – The next page will give an opportunity to pay the filing fee of $270.00. This is payable by American Express, Discover, MasterCard, VISA, or ACH. This will result in a verification code. Note: Your application will not be considered complete unless payment has been received and the Secretary of State has received either the Certificate of Good Standing dated within 30 days of this filing date or the Certified Copy of Amendment dated within 60 days of the filing date.

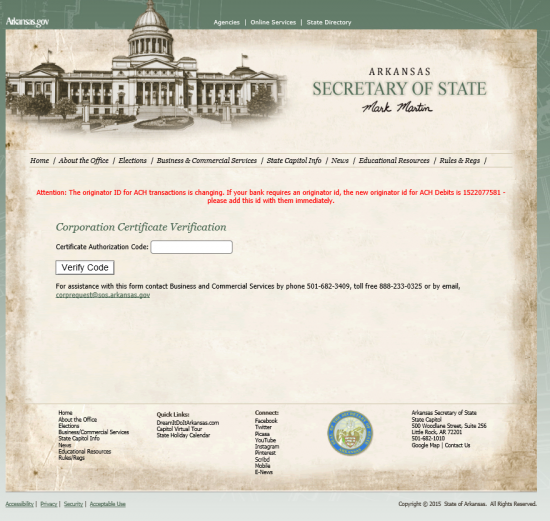

Step 18 – Once you have submitted all your paperwork and received the verification code, you may enter the code here:https://www.ark.org/sos/corpfilings/index.php?ina_sec_csrf=1b81d2061867ae11de95a9b687ac7565&do:VerifyCertificate=1 to check on your status.