|

Arkansas Articles of Incorporation – Domestic For Profit Corporation | DN-01 |

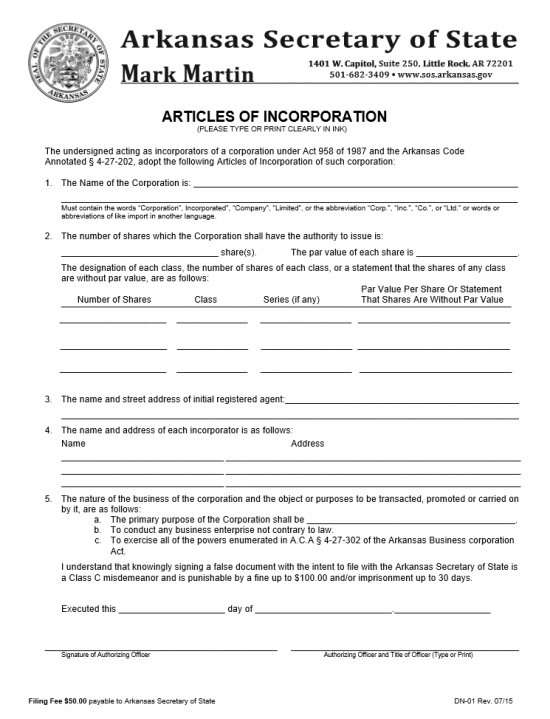

The Arkansas Articles of Incorporation – Domestic For Profit Corporation | DN-01 must be filed with the Arkansas Secretary of State when an entity wishes to incorporate and operate as a For Profit Corporation in the State of Arkansas. This is a straightforward application process which may be done by mail, in person, or online. It should be noted, this is only one of the processes required by governing entities when forming a corporation. In order to remain in compliance with Arkansas and Federal State Law, most entities will need to approach governing bodies such as the Internal Revenue Service to satisfy all formation requirements placed on an entity that wishes to conduct business in a lawful manner. For instance, this form will contain an Annual Franchise Tax Reporting Form Contact Sheet which should be filled out and sent with the Articles (especially if the entity being formed is an s corporation).

The articles should be filled out completely then submitted to the Arkansas Secretary of State, along with any and all required paperwork for the entity and a payment for the filing fee ($50.00 by mail or in person or $45.00 online). If paying by mail, checks should be made out to “Arkansas Secretary of State.” Do not attempt to mail cash. If paying online, one will have the option of paying by credit card or ACH. Mail and Walk-In submittals should be made to: Arkansas Secretary of State, 1401 W. Capitol, Suite 250, Little Rock, AR 72201.

How to File By Mail

Step 1 – Enter the name of the corporation being formed in item 1.

Step 2 – Report the number of authorized shares the corporation may issue then the par value of each share in the first two spaces of item 2. Below this will be a table where you may report the number of shares each class, series, and par value or statement that shares are without par value.

Step 3 – Report the identity and street address of the initial registered agent in item 3. Every corporation, in this state, must have a registered agent who may receive legal notices on behalf of that corporation.

Step 4 – In item 4, report the name and address of each incorporator forming this corporation.

Step 5 – In item 5, document the primary purpose of the For Profit Corporation being formed in item 5a. Then on the line beginning with the words “Executed,” report the calendar day of the month this document is being submitted on the first blank space and the month/year on the second blank space. Below this the authorizing Officer who may submit this application must provide his/her signature then his/her official title.

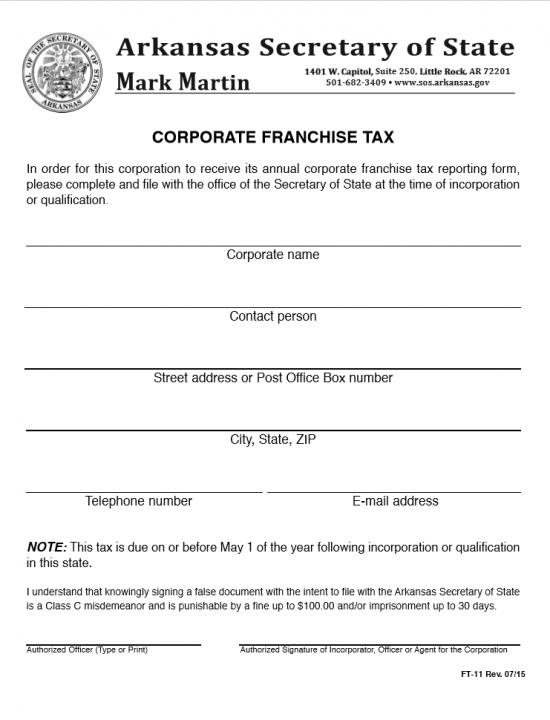

Step 6 – Proceed to the Corporate Franchise Tax contact form, you must enter the corporate name, contact person and Street address or reliable Post Office Box Number, city, state, zip code, telephone number, and email address in order to receive the annual corporate franchise tax reporting form for your corporation. The authorized officer entitled to fill this form out on behalf of the corporation must print his/her name at the bottom of this form then sign his/her name.

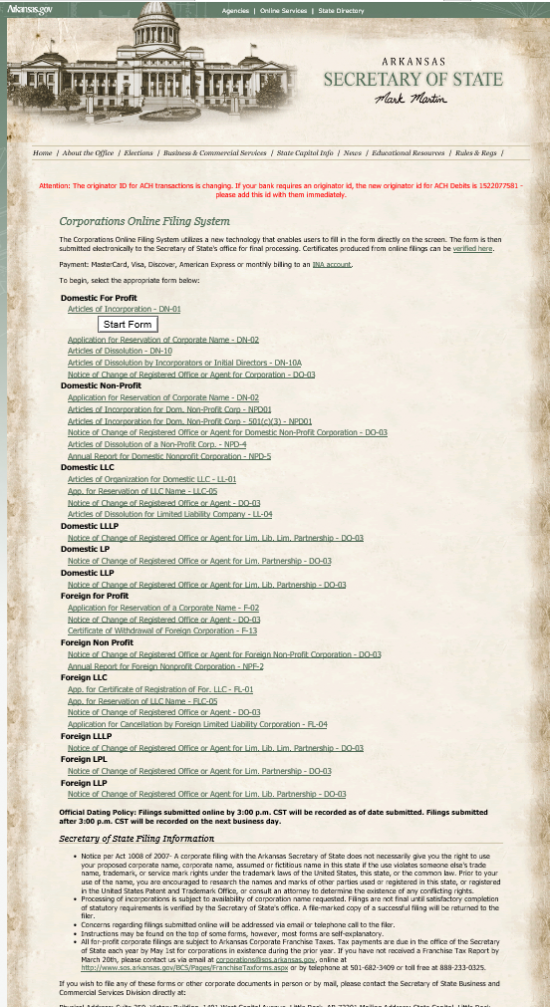

How To File Electronically

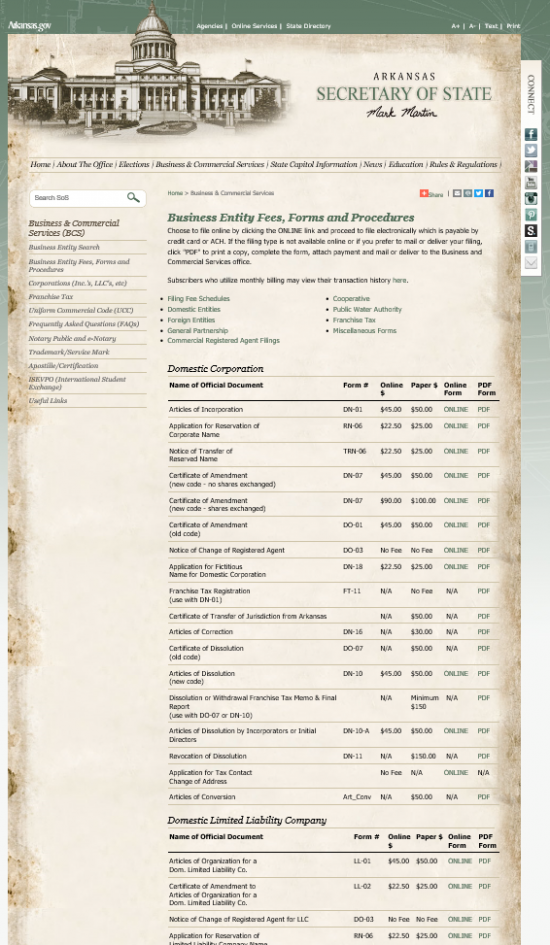

Step 1 – Go to the Arkansas Secretary of State “Business Entity Fees, Forms, and Procedures” page for Domestic Corporation Articles of Incorporation page here: http://www.sos.arkansas.gov/BCS/Pages/Domestic.aspx. Locate the line with “Articles of Incorporation” under the heading “Domestic Corporations” and select the word “Online.” This will direct the browser to the online form area of the site.

Step 2 – Beneath the line with the words, “Articles of Incorporation – DN-01,” in the “Domestic For Profit” section, and select the “Start” button. This will direct the browser to the online Articles of Incorporation form for Domestic For Profit Corporations.

Step 2 – Beneath the line with the words, “Articles of Incorporation – DN-01,” in the “Domestic For Profit” section, and select the “Start” button. This will direct the browser to the online Articles of Incorporation form for Domestic For Profit Corporations.

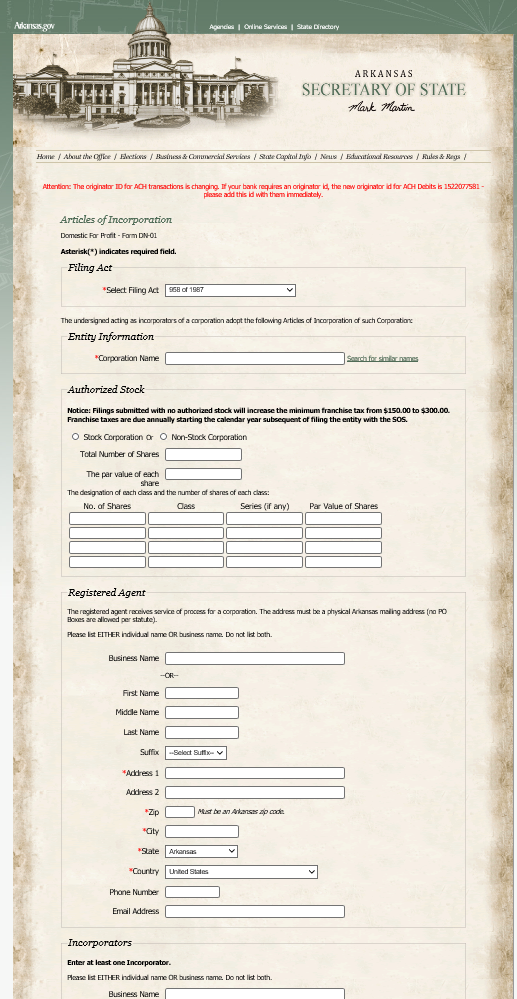

Step 3 – Make sure the Filing Act is correct for the entity type you are forming in the “Filing Act” section. The default for the For Profit Corporation is already selected.

Step 4 – Under “Entity Information,” enter the name of the corporation that shall be formed by these articles.

Step 5 – Next, in the “Authorized Stock” section, indicate if this is a stock corporation or a non-stock corporation by clicking the correct radio button. In the first two cells below this choice, report the Total Number of Shares the forming entity is authorized for then the Par Value of each Share. Finally, fill in the Number of Shares for each Class, the Class this number relates to, the Series (if applicable), and the Par Value of these Shares in the table provided. Note: If there is no authorized stock for this entity, the minimum franchise tax will be increased to $300.00 from the usual $150.00.

Step 6 – In the “Registered Agent” section, report the full name, physical mailing address (Post Office Boxes are not acceptable here), phone number, and email for the appointed registered agent of this entity. If the registered agent is a business, enter the business name in the first field. There will be a field for: Business Name, First Name, Middle Name, Last Name, Suffix, two Address lines, Zip Code, City, State, Country, Phone Number, and Email. Every For Profit Corporation that wishes to operate in Arkansas must appoint a registered agent who may reliably receive legal notices on behalf of that corporation and is physically located within the borders of the State of Arkansas.

Step 7 – In the “Incorporators” section, each Incorporating Officer must be reported. This may be an Arkansas business entity or an individual. Report the Incorporating Officer’s Name and Address in the appropriate cells. Then select “Save Officer.” You must enter and save each Incorporating Officer in this manner before moving to the next section or filing these articles. At least one party must be listed here.

Step 8 – In the “Primary Purpose” section, report the purpose of this corporation and how it will operate in the text box provided.

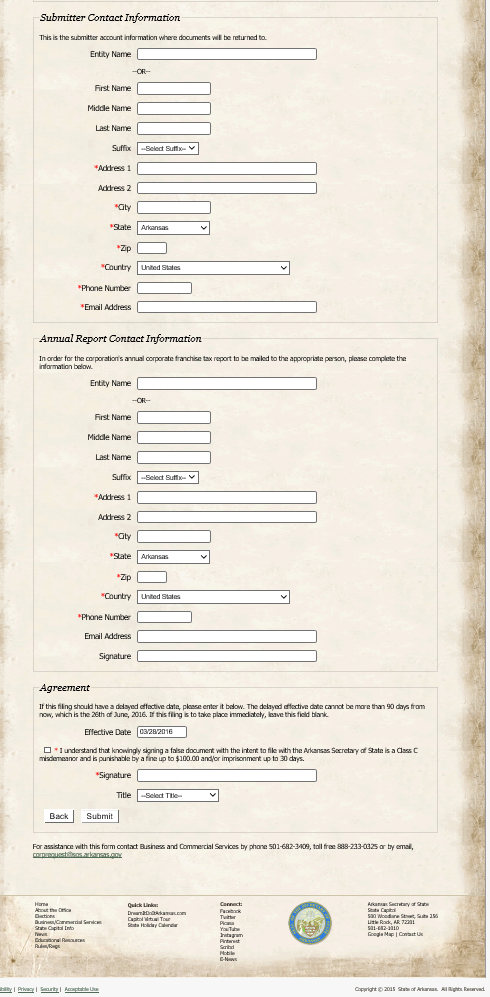

Step 9 – In the “Submitter Contact Information,” report the Identity, Physical Mailing Address, Phone Number, and Email Address where documents may be returned or sent regarding this application.

Step 10 – In the “Annual Report Contact Information” section, report the contact information where the corporation’s annual corporate franchise report may be sent. This must be a reliable address. Do this by reporting the Name of the receiving entity or individual, the full Address where this may be sent, the contact’s Phone Number, and the Contact’s Email Address. A signature must be entered at the end of this section.

Step 11 – In the “Agreement” section, you may note a specific effective date for this filing in the first cell provided so long as it is within ninety days of the present date. then you must click the box next to the acknowledgement paragraph, provide your digital Signature, and select your official title from the drop down menu provided. When this is done, select the button labeled “Submit.” This will direct the browser to the page where you may submit the $45.00 filing fee payment via American Express, Discover, MasterCard, Visa, or ACH. You will receive a verification for this payment. The application will not be considered submitted successfully until it has been accepted and payment verified.

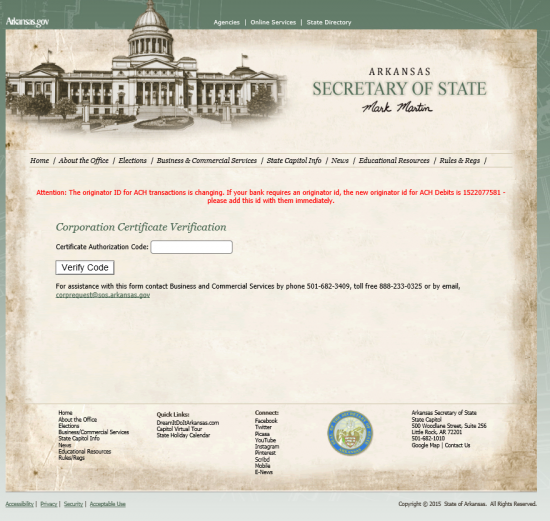

Step 12 – You may check on the status by either using the name search tool or by entering your verification code here: https://www.ark.org/sos/corpfilings/index.php?ina_sec_csrf=1b81d2061867ae11de95a9b687ac7565&do:VerifyCertificate=1