|

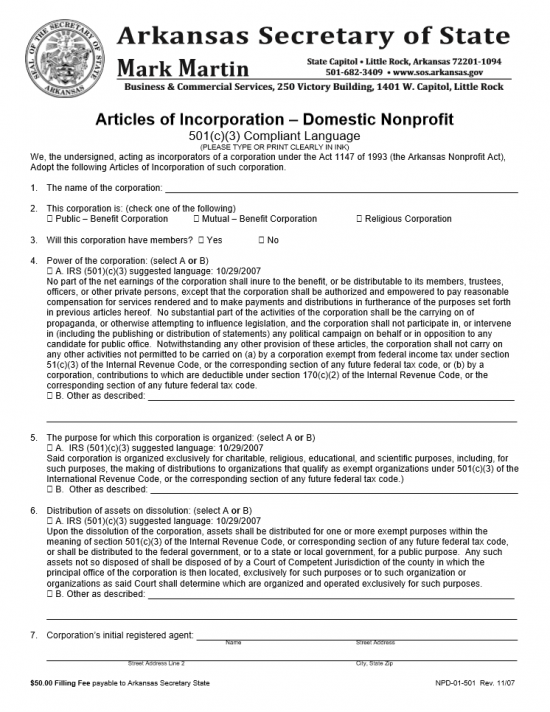

Arkansas Articles of Incorporation – Domestic Nonprofit, 501(c)(3) Compliant Language | Form NPD-01-501 |

The Arkansas Articles of Incorporation – Domestic Nonprofit 501(c)(3) Compliant Language form provides the necessary language when the entity being formed intends to apply for IRS Federal Tax Exempt Status. Several items will contain suggested wording along with the option for the incorporator to use his/her own. Either way is acceptable, however it is highly recommended to seek consultation with an attorney or an accountant when filing such a form with the Arkansas Secretary of State. There will be several steps one must take when incorporating this type of entity, in the State of Arkansas, including contacting the Internal Revenue Service directly to apply for tax exempt status, then registering with the Attorney General’s office for solicitation purpose (if a charitable organization). These are the bare minimums but in no way should they be considered the only requirements as other governing entities may require information or registration depending upon the type of corporation formed.

The Articles of Incorporation should be submitted to Arkansas Secretary of State Business and Commercial Services 1401 West Capitol Avenue, Ste. 250 Victory Building Little Rock, AR 72201 with a payment for the filing fee. This should be a check made payable to “Arkansas Secretary of State” for $50.00. This should be accompanied with Annual Report – Contact Information Nonprofit Corporation and any other required documentation.

How To File

Step 1 – In Item 1, report the name of the Domestic Nonprofit corporation being formed on the space provided.

Step 2 – In Item 2, select the type of nonprofit corporation being formed by placing a check mark next to Public-Benefit Corporation, Mutual-Benefit Corporation, or Religious Corporation. You may only choose one.

Step 3 – In Item 3, place a check mark next to the word “Yes,” if this corporation will have members. If not, place a checkmark next to the word “No.”

Step 4 – In Item 4, you must define the power of the corporation by checking either A or B. Choice A will use preset IRS suggested language. If this applies to your corporation and the language is appropriate check A and proceed to Item 5. If there is a distinctive language or aspect that must be reported and option A is inadequate then choose option B, and report the power of the corporation.

Step 5 – In Item 5, you must define the purpose of the corporation. Here, you will have a choice between choice A which will use IRS suggested language and choice B. If choice A is accurate and nothing needs to be added then place a check mark in the box for choice A and proceed to Item 6. If, choice A is inappropriate for the corporation being formed then place a mark next to choice B, and describe the purpose of the corporation.

Step 6 – In Item 6, you must report how the assets of this nonprofit corporation will be distributed upon its dissolution. You may choose the IRS suggested language of choice A if it is accurate and fully describes the distribution of these assets. If not, you may choose option B then report how assets will be distributed on the blank lines provided.

Step 7 – In Item 7, enter the Name, Street Address, City, State, and Zip Code of the corporation’s registered agent. This party may change in the future (though make sure to file the proper paperwork), however one must be appointed and in the State of Arkansas at the time of formation. To be in compliance of Arkansas State Law, your corporation must have an active registered agent at all times.

Step 8 – In Item 8, each Incorporator must print and sign his/her Name. Then he/she must report the date of his/her Signature, his/her Address, and the City/State/Code.

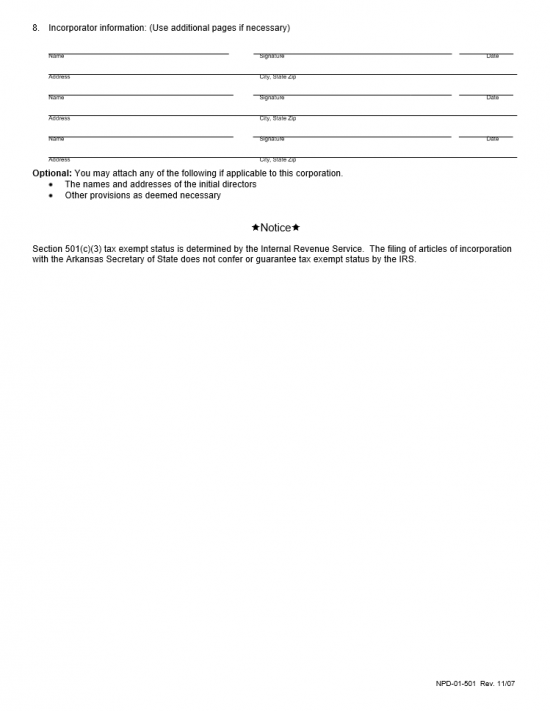

Step 9 – The next page will be the “Annual Report – Contact Information Nonprofit Corporation.” This must be filled out and submitted with the articles to ensure the forming entity will receive its annual reporting form. First enter the nonprofit corporation’s name on the space labeled “Entity name as used in Arkansas.” In the space next to this, labeled “Contact Person,” report the full name of the designated contact person in the nonprofit corporation.

Step 10 – On the second line, enter the Street Address or Post Office Box Number then the City, State, and Zip Code where the annual reporting form may be sent.

Step 11 – On the third line, enter the Telephone Number and Email Address that may be contacted regarding the annual reporting form for this corporation.

Step 12 – You must date this document beneath the acknowledgment paragraph. The first blank space requires the Calendar Day of the month entered, the second will require the Month to be entered, and the third blank space requires the year to be entered.

Step 13 – The Officer authorized to fill out and submit this form must sign and print his/her Name the bottom.s

How To File Electronically

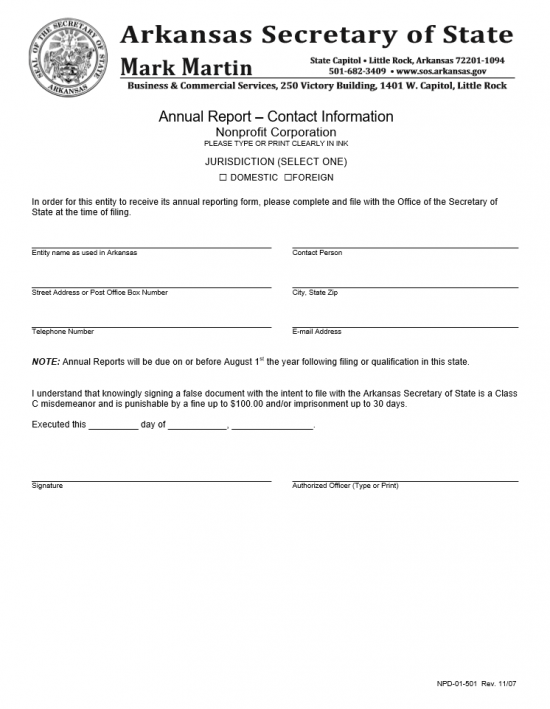

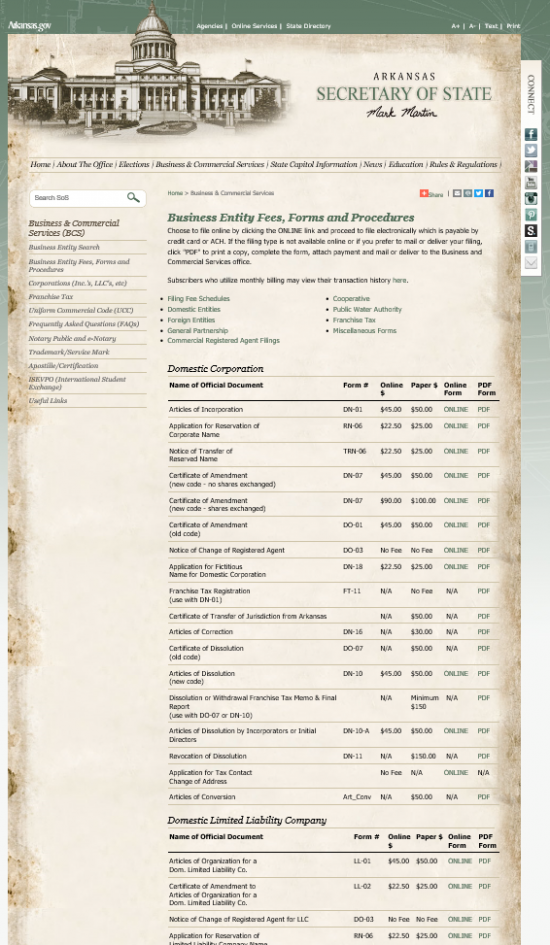

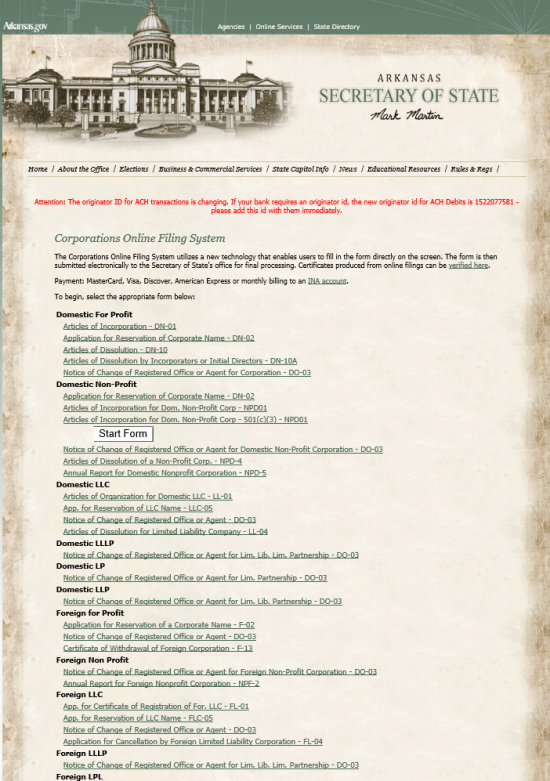

Step 1 – First go to the Arkansas Secretary of State’s page for “Business Entity Forms, Fees, and Procedures.” This is located here: http://www.sos.arkansas.gov/BCS/Pages/Domestic.aspx. Locate the heading “Domestic Nonprofit Corporation.” This is near the bottom of the page. On the line for “Articles of Incorporation For Domestic Non-Profit Corporation,” select the word “Online.” You will be directed to the online articles of incorporation form area.

Step 2 – Under the second heading, “Domestic Non-Profit,” locate the link labeled “Articles of Incorporation for Dom Nonprofit Corp. – 501(c)(3) – NPD-01-501” and select it. This will reveal a “Start Form” button. Select the button labeled “Start.”

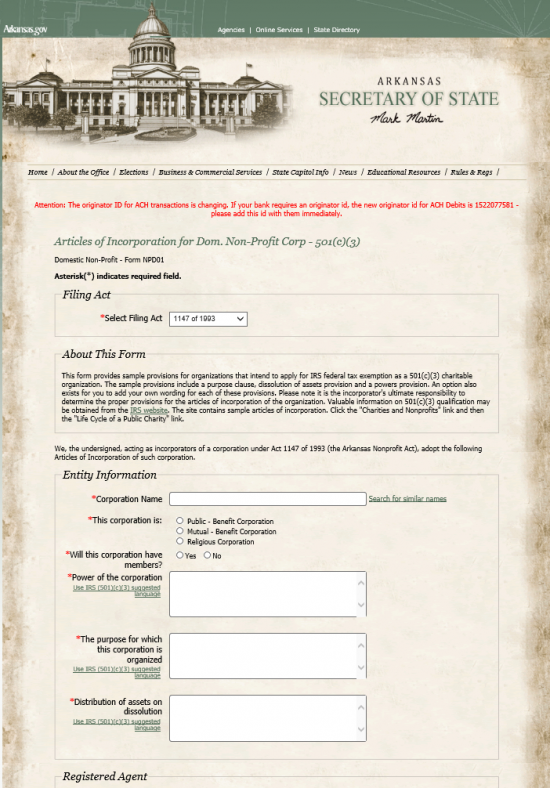

Step 3 – This is the online form for filing an Articles of Incorporation Domestic Non-Profit 501(c)(3) compliant language form. Begin by verifying the proper filing act for your nonprofit corporation is reported. The default for this form is 1147 of 1993.

Step 4 – Enter the name of the nonprofit corporation being formed in the first field of the “Entity Information” section.

Step 5 – Below the entity name use the mouse to select the type of corporation being formed. You may choose Public-Benefit Corporation, Mutual-Benefit Corporation, or Religious Corporation.

Step 6 – If this corporation will have members indicate this by selecting “Yes.” If not, then select “No.”

Step 7 – Next, report the power of the corporation in the text box provided. If you wish to use the Internal Revenue Service’s suggested language, click on the link next to the box labeled “Use IRS (501)(c)(3) suggested language,” this will auto-populate the text box for the Power of Corporation item.

Step 8 – In the second text box provided, enter the purpose for the formation of this nonprofit corporation. If you wish to use the Internal Revenue Service’s Suggested language, select the link next to this box labeled “Use IRS (501)(c)(3) suggested language.” This will automatically populate this text box with IRS suggested language.

Step 9 – In the third text box provided, define how the assets of this corporation will be distributed upon its dissolution. There will be the option to automatically populate this field with IRS compliant language in the text box provided by selecting the link labeled “Use IRS (501)(c)(3) suggested language,” on the left.

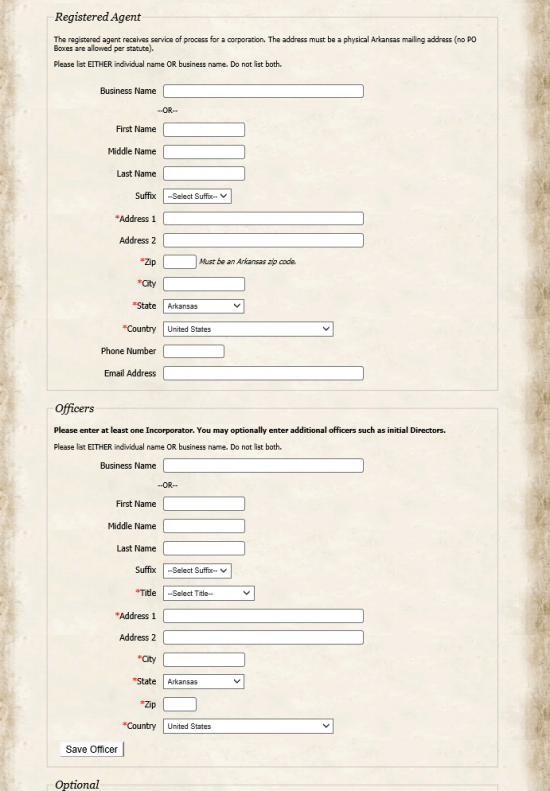

Step 10 – In the item labeled “Registered Agent,” report the Identity (whether a business or individual) of the initial registered agent of the nonprofit corporation being formed. Then enter the Address, Zip Code, City, State, Country, Phone Number, and Email Address of this party.

Step 11 – In the “Officers” section, enter the Identity, Address, Suffix (if applicable), Title, Address, City, State, Zip Code, and Country of each Officer. You must select the “Save Officer” button after each Officer entry.

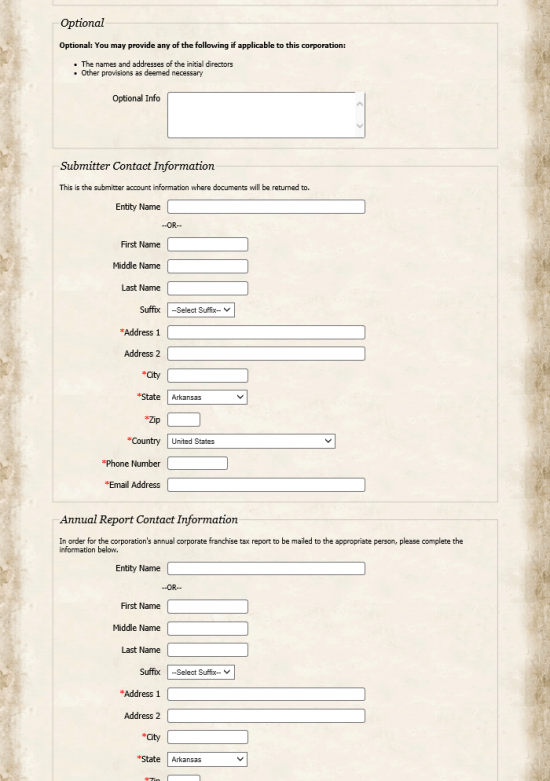

Step 12 – In the “Optional” section, you may enter the names of Directors and/or report any provisions or facts that are relevant or required.

Step 13 – In “Submitter Contact Information,” report the Identity, Suffix (if applicable), Address, Phone Number, and Email Address for the party authorized to submit this information and will be able to receive any documents from the Arkansas Secretary of State regarding this filing.

Step 14 –In the “Annual Report Contact Information,” it will be necessary to document where the Corporation’s Annual Corporate Franchise Tax may be sent. Report the Identity, Suffix (if applicable), Address, Phone Number, and Email Address for this task. The party authorized to receive this mailing must provide an Electronic Signature at the end of this section.

Step 15 – The item labeled “Agreement,” will provide an opportunity to name the Effective Date of this nonprofit corporation’s formation, if it differs from the date of this filing (Note: it must be within 90 days of this submittal). If this is desired, then enter the date in the first cell of this section.

Step 16 – Place a mark in the box next to the acknowledgement paragraph with your left mouse button.

Step 17 – Enter your Signature in the last field.

Step 18 – Select the “Submit” button. This will direct the web page to an area where you may pay the $45.00 filing fee these articles. This is payable by American Express, Discover, MasterCard, VISA, or an ACH account. You will receive a verification code once you have successfully submitted and paid for this application.

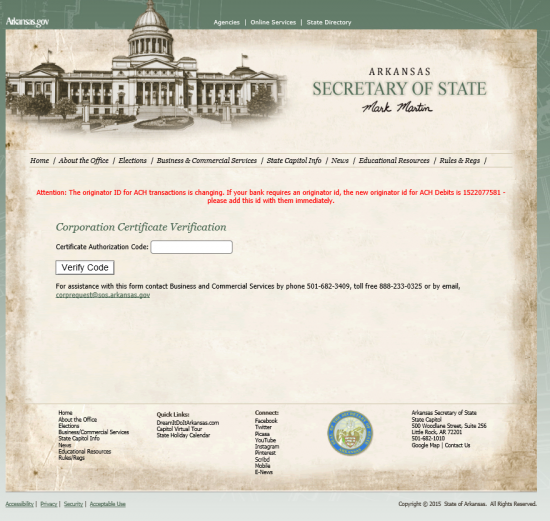

Step 19 – You may check on your filing using the verification code by going to this page: https://www.ark.org/sos/corpfilings/index.php?ina_sec_csrf=1b81d2061867ae11de95a9b687ac7565&do:VerifyCertificate=1 and entering it in the space provided.