|

Arkansas Articles of Incorporation – Domestic Nonprofit | Form NPD-01 |

The Arkansas Articles of Incorporation – Domestic Nonprofit Corporation | Form NPD-01 is the first step for successfully satisfying the Arkansas Secretary of State’s requirements to form and operate an entity as a nonprofit corporation in this state. The articles are only part of the process as other entities will require and provide documentation for the entity to be in compliance with state law. For instance, if forming a charitable nonprofit corporation, the Internal Revenue Service must receive an application for tax exempt status, from the forming entity after the articles have been filed. The Internal Revenue Service’s Tax Determination letter will be required by the Attorney General to register for solicitation purposes. As a note: this form may be considered particularly useful for entities, that will not seek Federal Tax Exemption status.

The Arkansas Articles of Incorporation may be submitted by mail, online, or in-person. If submitted online, a filing fee of $45.00 must accompany the application. This may be payable by major credit card or an INA account. If submitting by mail, a filing fee of $50.00 must accompany the submittal package. A mail submittal will require payment by check (payable to “Arkansas Secretary of State.” The original and completed articles, accompanying documentation, and payment must be sent to Arkansas Secretary of State, 1401 W. Capitol, Suite 250, Little Rock, AR 72201.

How to File By Mail

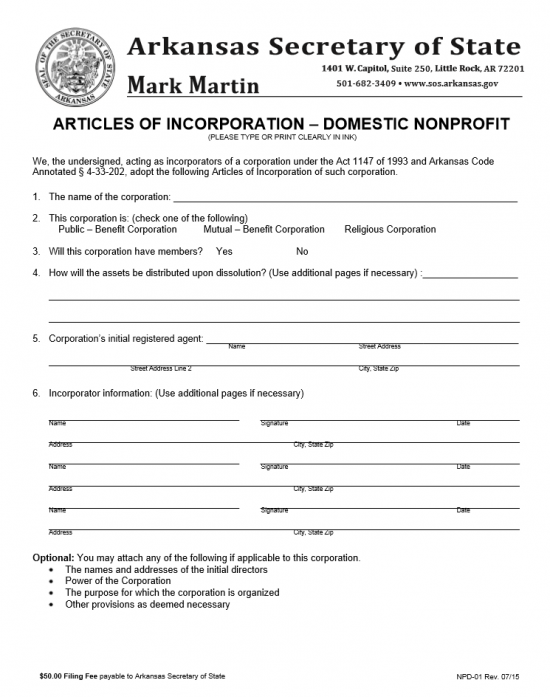

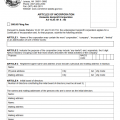

Step 1 – In the first item, record the name of the nonprofit corporation being formed.

Step 2 – In the second item, you must define the type of nonprofit corporation being formed. Here you will have three choices: Public-Benefit Corporation, Mutual-Benefit Corporation, or Religious Corporation. Circle the entity type that appies to this nonprofit. You may only choose one. Make sure you submit any relevant documents that may be required based on corporation type.

Step 3 – In the third item, indicate if there will be members in this nonprofit corporation. Do this by either circling the word “Yes” or the word “No.”

Step 4 – In the fourth item, describe (fully) how all assets of the nonprofit corporation will be distributed upon its dissolution. If there is not enough room, continue on a clearly labeled separate sheet of paper and attach to the articles.

Step 5 – In the fifth item, report the identity and street address of the registered agent that has been appointed by the nonprofit corporation to receive legal notices on behalf of the nonprofit corporation.

Step 6 – In the sixth item, each incorporator must print his/her name, sign his/her name, and provide a date for the signature. below each signature line, the signing incorporator must provide his/her address.

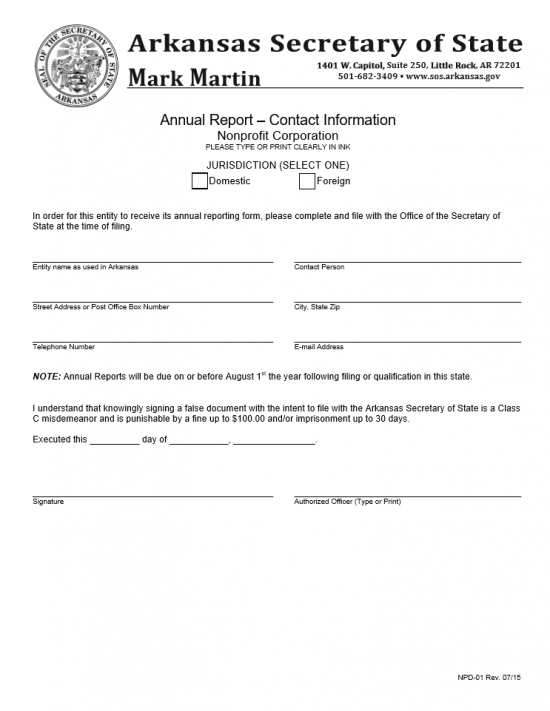

Step 7 – In order for this corporation to receive its annual reporting form, the incorporators must submit the “Annual Report – Contact Information Nonprofit Corporation” form. This will be the next page in the PDF document. First place a check mark next to the word “Domestic” or the word “Foreign” to indicate the nonprofit corporation’s jurisdiction.

Step 8 – On the first line, enter the full name of the nonprofit corporation in Arkansas then enter the full name of the contact person for this nonprofit corporation.

Step 9 – On the second line, enter the street address or post office box number of the nonprofit corporation then enter the city, state, and zip code. This should be a reliable address where the entity may receive information.

Step 10 – On the third line, report the Telephone Number then the Email Address where this corporation may be contacting regarding the annual reporting form.

Step 11 – Below the disclosure paragraph, list the date this document is being filed.

Step 12 – Below the date entered for this agreement, an Authorized Officer of the nonprofit corporation must sign his/her name then print his/her name.

Step 13 – Once completed, gather all required documents, the completed articles, and a check for $50.00 (filing fee) made payable to the “Arkansas Secretary of State.” Mail this to:

Arkansas Secretary of State

1401 W. Capitol

Suite 250

Little Rock, AR 72201.

How To File Electronically

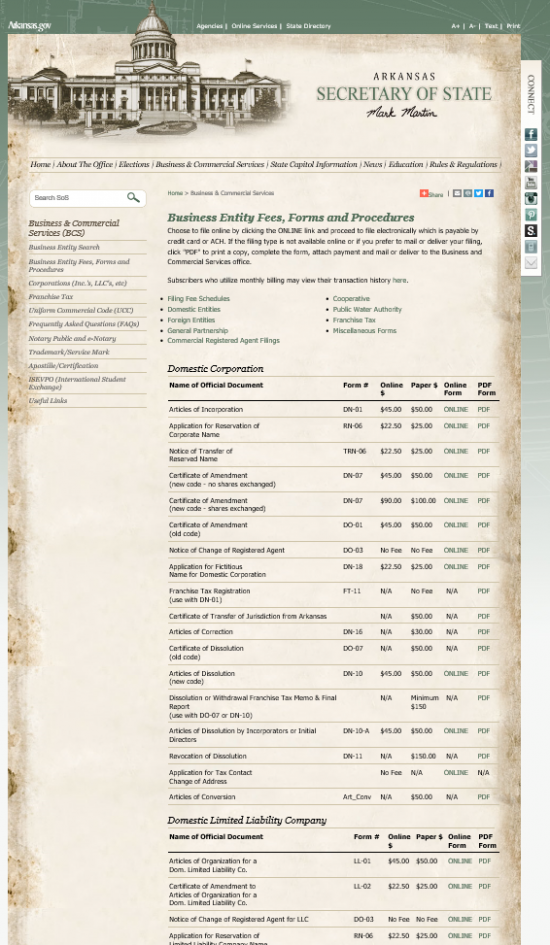

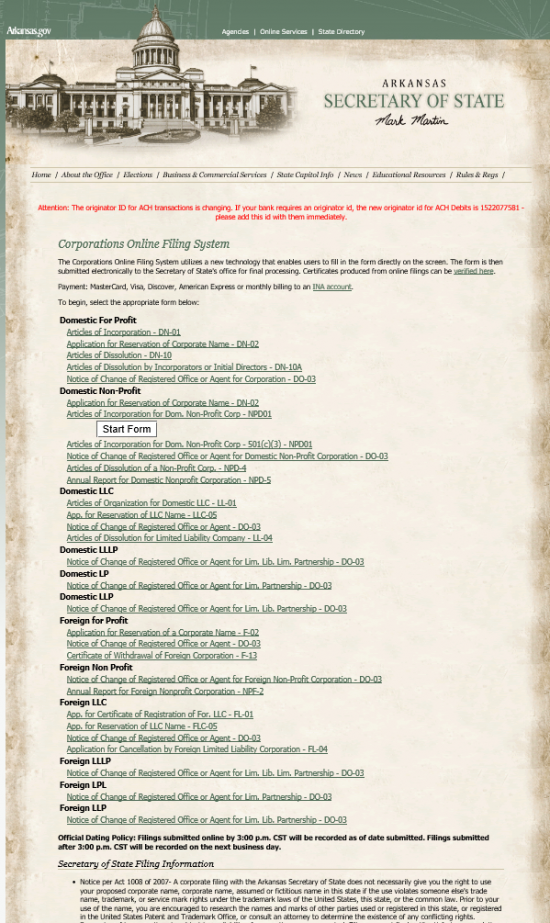

Step 1 – Go to the home page of the Arkansas Secretary of State’s “Business Entity Fees, Forms, and Procedures” for domestic entities. There will be several types of entity types listed. Locate the heading “Domestic Nonprofit Corporation” (at the bottom of the page), then select the word “Online” on the line starting with the words “Articles of Incorporation for Domestic Nonprofit Corporations.” This will direct the browser to an area where you may locate the online form to file for a domestic nonprofit corporation in the State of Arkansas.

Step 2 – Locate the second heading on this page, titled “Domestic Non-Profit.” Select the link labeled “Articles of Incorporation for Domestic Non-Profit Corporation – NPD01.” This will open a button labeled “Start” directly below this link. Select the “Start” button. Once selected your browser will open to the online form.

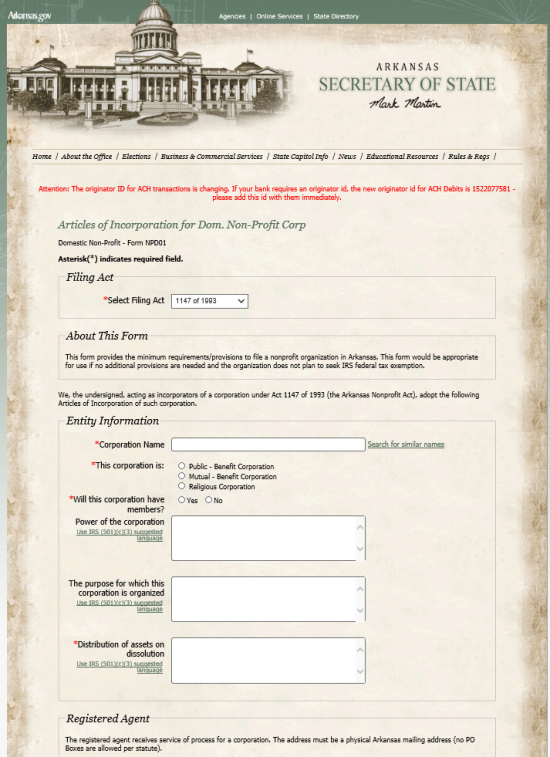

Step 3 – The first step will be to make sure the correct filing act is selected in the dropdown list under the heading “Filing Act.” The correct one for this type of form (1147 of 1993) should already be selected.

Step 4 – In “Entity Information,” report the chosen name you wish the nonprofit corporation being formed to possess, operate under, and be known as in the space provided. Next you will need to indicate the type of nonprofit being formed. Next to the words “This Corporation is” use your mouse to select the proper radio button. Each will have a label, they are: Public-Benefit Corporation, Mutual – Benefit Corporation, and Religious Corporation. You may only select one of these. Then you will need to provide some defining information in the following text boxes. Define the Power of the Corporation, the Purpose of the Corporation, and how Assets will be distributed upon Dissolution in the appropriately labeled text boxes.

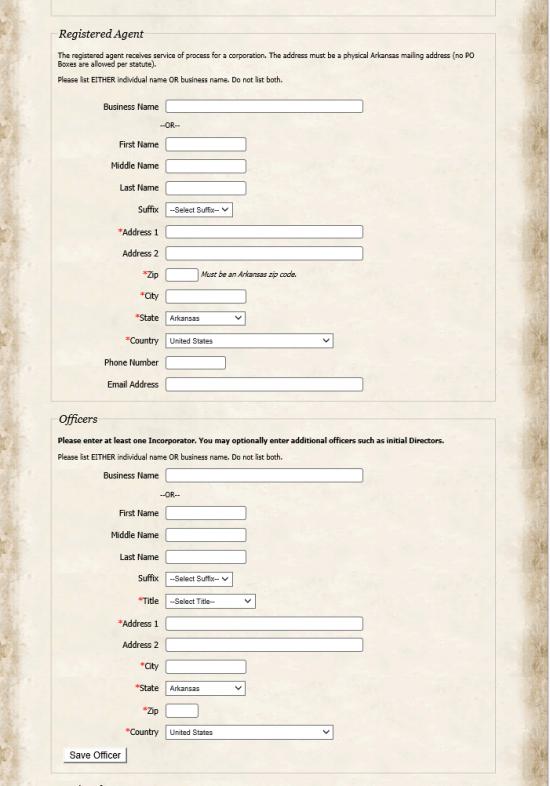

Step 5 – The State of Arkansas requires that every corporate entity have appointed a Registered Agent. This is an individual or business, physically located in Arkansas, who shall reliably receive legal notices directed to the corporation that has appointed him/her/it. This party’s identity and contact information must be reported in the section titled “Registered Agent.” Do this by entering, in the appropriate fields, the Registered Agent’s Business Name or Full Name (first name, middle initial, last name), any applicable suffix, Street Address, Zip Code, City, State, Country, Phone Number, and Email Address.

Step 5 – The State of Arkansas requires that every corporate entity have appointed a Registered Agent. This is an individual or business, physically located in Arkansas, who shall reliably receive legal notices directed to the corporation that has appointed him/her/it. This party’s identity and contact information must be reported in the section titled “Registered Agent.” Do this by entering, in the appropriate fields, the Registered Agent’s Business Name or Full Name (first name, middle initial, last name), any applicable suffix, Street Address, Zip Code, City, State, Country, Phone Number, and Email Address.

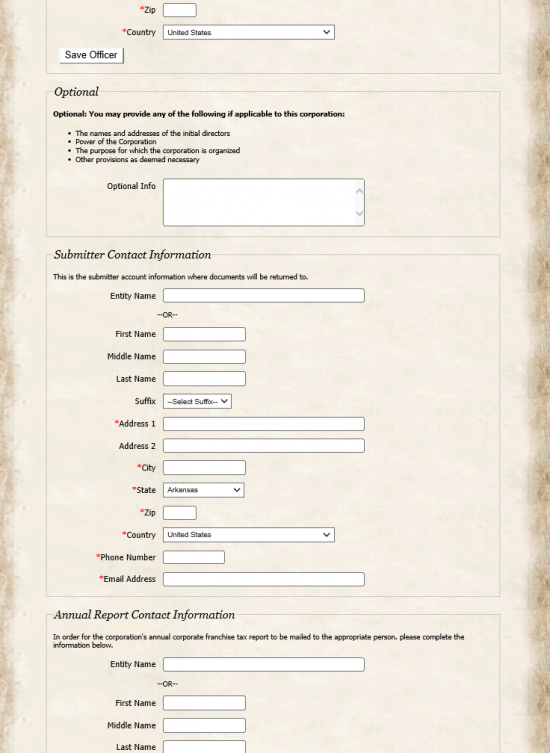

Step 6 – In the “Officers,” you must define who the Officers of the corporation being formed are (i.e. President, Vice-President, Treasurer, Secretary, Directors, etc.). Again these may either be businesses or individuals. Fil in the fields with the identity of each Officer, any applicable Suffix, Title held (use the dropdown menu), Street Address, City, State, Zip Code, and Country. Select “Save Officer” when finished entering one’s information to enter the next one.

Step 7 – You will have an opportunity to provide additional relevant information in the section labeled “Optional.” In the text box provided, you may report on such things as the identities and addresses of the initial Directors, the Power of the Corporation, the Purpose of the corporation, and/or any other provisions that may or should be reported.

Step 7 – You will have an opportunity to provide additional relevant information in the section labeled “Optional.” In the text box provided, you may report on such things as the identities and addresses of the initial Directors, the Power of the Corporation, the Purpose of the corporation, and/or any other provisions that may or should be reported.

Step 8 – The next section, “Submitter Contact Information,” provide the Identity, Address, Phone Number, and Email of the party submitting this information. This will be where any documents being returned will be sent.

Step 9 – The next section, “Annual Report Contact Information,” requires a definition for where and to who this corporation’s Annual Corporate Franchise Tax Report should be mailed. Here, you may list an business or an individual (enter the full name of either one), the full Address, Phone Number, and Email. Additionally, this party must provide a signature in the field provided.

Step 10 – The final section, “Agreement,” will allow a specific effective date to be named. You may name any effective date for your corporation, however it cannot be more than ninety days from the date of the submittal of these articles to the Arkansas Secretary of State. Below this will be an acknowledgement paragraph which must be read then the box next to it must be selected. Finally, enter your signature on the Signature line. When you have looked over all the information provided, select “Submit.” This will take you to an area where you may submit a $45.00 filing fee payment to the Arkansas Secretary of State via American Express, Discover, MasterCard, VISA, or an ACH account. You will receive a verification upon the successful submittal of these articles.

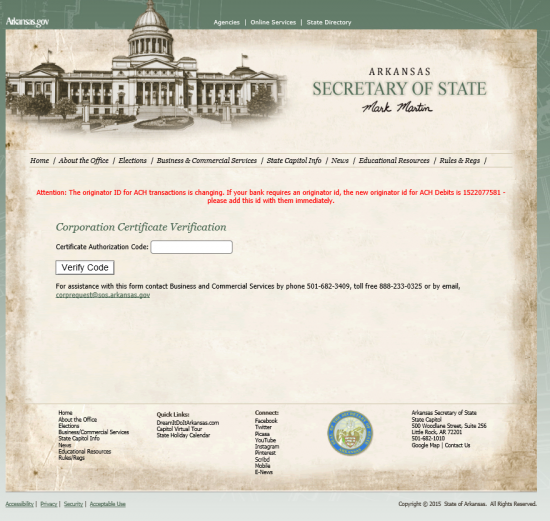

Step 11 – After receiving your verification code you may enter it here: https://www.ark.org/sos/corpfilings/index.php?ina_sec_csrf=1b81d2061867ae11de95a9b687ac7565&do:VerifyCertificate=1 to check on your corporations status.