|

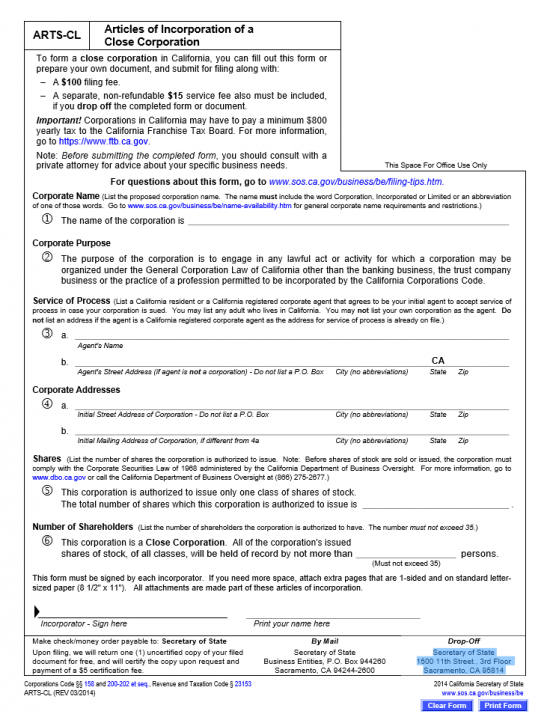

California Articles of Incorporation of a Close Corporation | Form ARTS-CL |

The California Articles of Incorporation of a Close Corporation | ARTS-CL is one of the initial filings an entity must make in the State of California before conducting business. This is a requirement of the California Secretary of State which must be fulfilled in order for an entity to activate its corporation in compliance with California State Law. The articles must be filed with a minimum payment of $100.00 for the filing fee. There is an option to obtain an certified copy upon submittal and upon request for an additional fee of $5.00. These articles may be submitted to the California Secretary of State by mail or in-person only. If by mail, the completed articles must accompany payment for all required fees and/or services, and any required provisions that will apply to the formation of this entity must be mailed to: Secretary of State Business Entities, P.O. Box 944260 Sacramento, CA 94244-2600. If one wishes to drop off the articles they must gather the same documents along with payment for the $15.00 handling fee and drop them off at Secretary of State 1500 11th Street., 3rd Floor Sacramento, CA 95814.

How To File

Step 1 – Under the heading “Corporate Name, enter the name of the close corporation being formed on the space provided.

Step 2 – Read the “Corporate Purpose” heading, your corporation must adhere to what is stated here.

Step 3 – In the section labeled “Service of Process,” enter the name of the registered agent who is approved as a recipient of court documents and/or legal notices if the corporation being formed is sued. This must be an adult or corporate entity that maintains an address in the state of California. Do this on the first line (Item 3a). On the second line (Item 3b), report the full Address of this registered Agent (P.O. Boxes are not allowed here).

Step 4 – Under the heading “Corporate Addresses,” report the Street Address, City, State, and Zip Code where the close corporation will be located on the line labeled 4a. On the next line, report the full Mailing Address should it differ from the Street Address listed above. You may not enter a P.O Box in Item 4a but you may use one as a Mailing Address in Item 4b.

Step 5 – In the “Shares” section, report the number of authorized shares this entity has been approved to issue on the blank space provided.

Step 6 – Under the heading “Number of Shareholders,” report the maximum number of parties that will be allowed to purchase stock in this corporation.

Step 7 – At the bottom of this form will be a space for one Incorporator to sign and print his/her name. Each Incorporator must present a signature as well as his/her printed name. Thus, if there is more than one Incorporator attach an 8 1/2″ x 11″ sheet of paper bearing the signature and printed name of all Incorporators.

Step 8 – There are two options for filing. If filing by mail or in person, you must submit the completed and original California Articles of Incorporation of a Close Corporation | ARTS-CL, any necessary provisions, any required supporting documentation, and a filing fee payment of $100.00. You will receive a copy of these articles upon submittal and will have the option to request it to be certified for a fee of $5.00. Note: If submitting in person, you must pay an additional $15.00 certified fee.

File By Mail To:

Secretary of State

Business Entities

P.O. Box 944260

Sacramento, CA 94244-2600

File In Person At:

Secretary of State

1500 11th Street

3rd Floor

Sacramento, CA 95814

Step 9 – You will have 90 days after filing the California Articles of Incorporation of a Close Corporation | ARTS-CL to submit Form SI-200, you may do this by paper or electronically. There will be a $25.00 fee that must accompany this form. To file by mail download form SI-200 here: Statement of Information or go to the California Secretary of State e-file page here: https://businessfilings.sos.ca.gov/