|

California Articles of Incorporation of a Nonprofit Mutual Benefit Corporation | Form ARTS-MU |

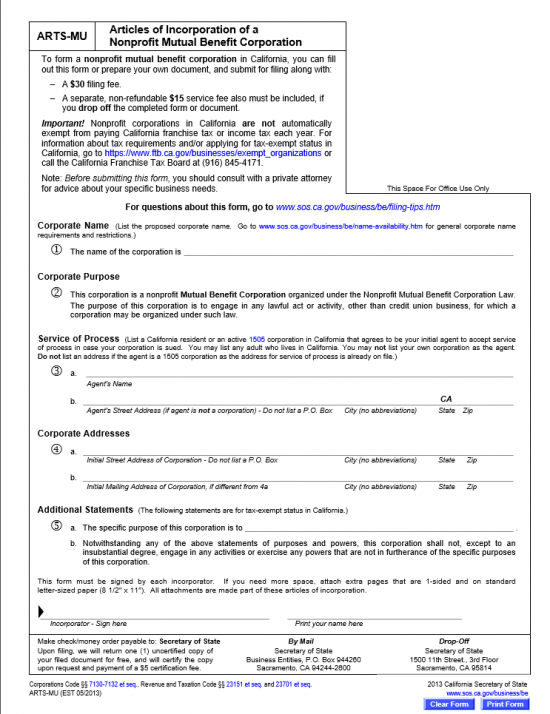

The California Articles of Incorporation of a Nonprofit Mutual Benefit Corporation | ARTS-MU is a form that must be filed with and accepted by the California Secretary of State before an entity can operate as such a corporation in the State of California. When forming a nonprofit corporation, California, it is generally suggested to seek a consultation with an appropriate attorney as several entities will be involved. For instance, filing this application for the formation of a nonprofit mutual benefit corporation will not automatically exempt the entity from being responsible for the California franchise tax. Incorporators must contact the California Franchise Tax Board to assess their standing. You may find more information regarding the California franchise tax by visiting this page: https://www.ftb.ca.gov/businesses/exempt_organizations). Other entities such as the Internal Revenue Service will also need to be contacted separately on both the federal and state levels. The articles, themselves, may be submitted by mail or in person. All required paperwork (which depends upon the nature of the forming entity) must be submitted with payment for required fees simultaneously. The standard filing fee of $30.00 is the minimum amount. If one wishes to receive a certified copy of the articles submitted to the state, it may be done by request for an additional fee of $5.00. Thus when mailing the articles to Secretary of State Business Entities, P.O. Box 944260 Sacramento, CA 94244-2600 and requesting a certified copy of them, include a check or money order payable to the Secretary of State in the amount of $35.00. If filing in person, an additional service charge of $15.00 will require payment. Thus, for example, submitting in person at Secretary of State 1500 11th Street., 3rd Floor Sacramento, CA 95814 will require a minimum payment of $45.00. If submitting in person and requesting a certified copy of the articles being submitted you must submit a payment of $50.00.

How To File

Download Application Step 1 – Enter the name you have chosen for the nonprofit corporation being formed in Item 1. Step 2 – Item 2 will state the “Corporate Purpose” of the mutual benefit corporation these articles are forming. Read this as this entity must adhere to what is stated here. If this corporate purpose does not match the purpose of the corporation being formed it would be considered wise to consult and attorney before filing this document with the state. Step 3 – In Item 3a, report the name of the registered corporate agent who has been appointed to receive the service of process paperwork that must be issued if this corporation is sued. In Item 3b, report this agent’s address. This may not be a P.O. Box and must be in the State of California. If this is a corporate agent has already been registered with the Secretary of State for another entity, leave Item 3b blank as the information is already on file for this party. This may be an individual or a corporation but may not be a minor or your corporation. Step 4 – You must report the Street Address where this corporation will be located when it becomes active and operational in Item 4a (Do Not report a P.O. Box). Next, if the corporation being formed has a Mailing Address that differs from the street address listed, it must be reported in Item 4b. Step 5 – If the corporation being formed will seek tax exempt status, state the specific purpose of the mutual benefit corporation being formed in Item 5. Step 6 – At the bottom of the page, the Incorporator must provide a signature and the printed version of his/her name. All Incorporators must sign and print their names with this document. If there is more than one, his/her signature and printed name should be provided on a separate standard size (8 1/2″ x 11″) sheet of paper then attached.  Step 7 – The final step, once all the information presented has been verified as true, the Incorporator’s signature and name provided, and all required documents that must accompany this filing have been obtained will be to submit the California Articles of Incorporation of a Mutual Benefit Corporation to the California Secretary of State. This may be done by mail or in person. If doing so by mail, you must submit a payment of $30.00. If doing so in person, you must submit a payment of $45.00. If you intend on requiring a certified copy of these articles you must add $5.00 to the appropriate amount. All checks or money orders must be made payable to “Secretary of State.”

Step 7 – The final step, once all the information presented has been verified as true, the Incorporator’s signature and name provided, and all required documents that must accompany this filing have been obtained will be to submit the California Articles of Incorporation of a Mutual Benefit Corporation to the California Secretary of State. This may be done by mail or in person. If doing so by mail, you must submit a payment of $30.00. If doing so in person, you must submit a payment of $45.00. If you intend on requiring a certified copy of these articles you must add $5.00 to the appropriate amount. All checks or money orders must be made payable to “Secretary of State.”

To File By Mail, Send Submittal Package And Payment To:

Secretary of State Business Entities

P.O. Box 944260

Sacramento, CA 94244-2600

To File In Person, Bring The Submittal Package And Payment To:

Secretary of State

1500 11th Street., 3rd Floor

Sacramento, CA 95814

Step 8 – You must file Form SI-100 (Statement of Information) within ninety days after you have filed the California Articles of Incorporation of a Nonprofit Mutual Benefit Corporation | ARTS-MU. This may be done electronically or by mail. To file Electronically, go to this page: https://businessfilings.sos.ca.gov. If filing by mail you may download the form here: Form SI-100. This filing must be accompanied with payment of a $20.00 filing fee and a $5.00 disclosure fee. If filing electronically, payments may only be made using MasterCard or VISA. If filing by mail checks and money orders must be made payable to “Secretary of State.”