|

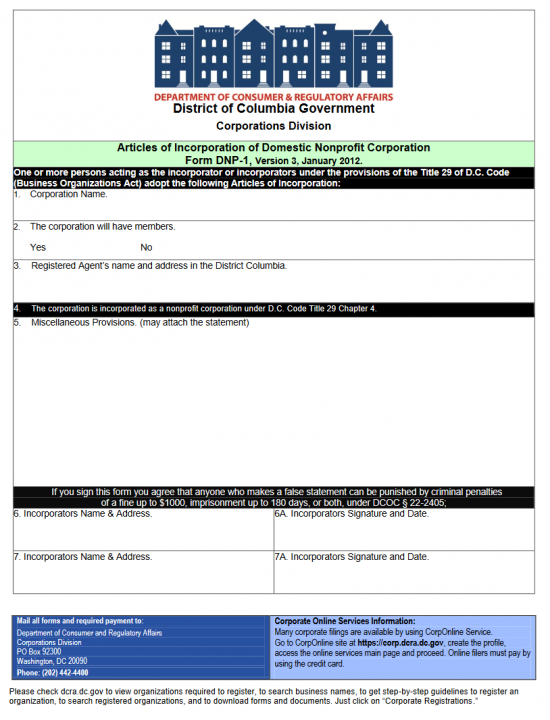

District of Columbia Articles of Incorporation Nonprofit Corporation | Form DNP-1 |

The District of Columbia Articles of Incorporation Nonprofit Corporation | Form DNP-1 is used by the Washington DC Department of Consumer and Regulatory Affairs to gather the information necessary form forming domestic nonprofit corporations that seek to satisfy reporting requirements when seeking corporate status. A good example of this would be entities such as those expecting to gain Tax-Exempt Status. Since only the Internal Revenue Service may grant Tax-Exempt Status however one of the requirements is to include 501(c)(3) language in that nonprofit corporation’s articles of incorporation. This form may provide for one of the requirements in this case but in and of itself does not grant such status. Incorporators should be aware that not every nonprofit corporation will seek Tax-Exempt Status and, in fact, will differ in more specific ways. Thus a religious nonprofit corporation will have to fulfill a different set of requirements then a mutual benefit nonprofit corporation. It is the imperative of Incorporators to be proactive in their research and even contact a Washington DC attorney regarding this process and the paperwork involved before attempting to undergo it.

The District of Columbia Articles of Incorporation Nonprofit Corporation | Form DNP-1 may be submitted by mail or you may submit this information online. The Washington DC Department of Consumers and Regulatory Affairs will accept this form at Department of Consumer and Regulatory Affairs, Corporations Division, PO Box 92300, Washington D.C. 20090. This will need to accompanied by a check to the DC Treasurer for the Full Filing Fee plus all additional Fees. The Fee for filing this form is $80.00. This fee must be paid in order for this paperwork to be reviewed. You may pay by credit card if filing online (http://dcra.dc.gov) but must first obtain a log in.

How To File

Step 1 – You may download the District of Columbia Articles of Incorporation Nonprofit Corporation | Form DNP-1 by selecting the link labeled “Download Form” above. This file may be filled out with a PDF Editor program or an up-to-date browser with the extensions necessary to fill out PDF forms. If you do not have either of these programs you may print the form out then fill it out with a typewriter.

Step 2 – Article 1 shall require you to report the Full Name of the nonprofit corporation being created and registered in this document on the blank line under the words “Corporation Name.”

Step 3 – If this corporation will have members then circle the word “Yes” in Article 2. If this corporation will not have members, then circle the word “No.”

Step 4 – In Article 3, report the Full Name and Address of the District of Columbia Registered Agent for this nonprofit corporation. This must bear the Complete Address (Building Number, Street, City, State, City, and Zip Code) for the Physical Location of the Registered Agent. Note the Registered Agent reported here must maintain a physical location in the District of Columbia.

Step 5 – Article 4 will bind the forming entity to operating as a nonprofit corporation as per DC Code Title 29 Chapter 4.

Step 6 – If there are Provisions not stated in these articles that must be documented at the time of formation, you may enter this in Article 5. There will be ample space provided however, you may attach a clearly labeled separate document if there is not enough room to report such Provisions.

Step 7 – Next, each Incorporator must have his or her Name and Address. In addition, the Incorporators must Sign their Names and Date their Signatures. Article 5 will provide enough space for one Incorporator to report the Incorporator Name and Address in the first box, then provide the Incorporator Signature and Date of Signature in the box labeled 5A. Article 6 will provide the same for a second Incorporator. You may report as many Incorporators as necessary on a separate sheet of paper, if there are more than two, so long as each Incorporator provides a Signature and Date of Signature.

Step 8 – You may now organize the submission package to the District of Columbia Department of Consumer and Regulatory Affairs. This should consist of the District of Columbia Articles of Incorporation of a Nonprofit Corporation | Form NP-1, a check payable to “DC Treasurer” in the amount of $80.00 (Filing Fee), and all required documents. Note: All applicable fees must be paid in addition to the Filing Fee in order for these articles to be processed.

Mail To:

Department of Consumer and Regulatory Affairs

Corporations Division

PO Box 92300

Washington D.C. 20090

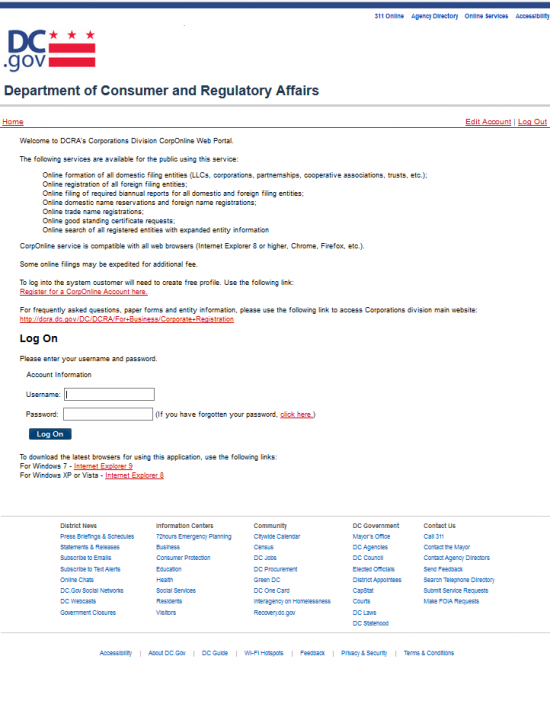

How To File Online

Step 1 – Log in to your account here: https://corp.dcra.dc.gov/Account.aspx/LogOn?ReturnUrl=%2fHome.aspx.

Step 2 – This is your home page. Under the heading “Domestic Non-Profit Corporation” select the link labeled “DNP-1 Nonprofit Articles of Incorporation Web.”

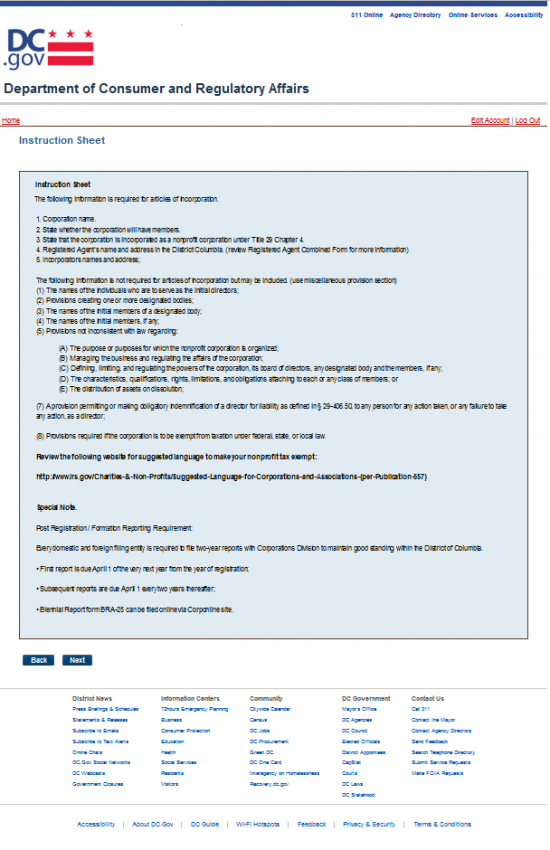

Step 3 – This information will contain some instructional information, read this thoroughly. When you are ready, select the button labeled “Next.”

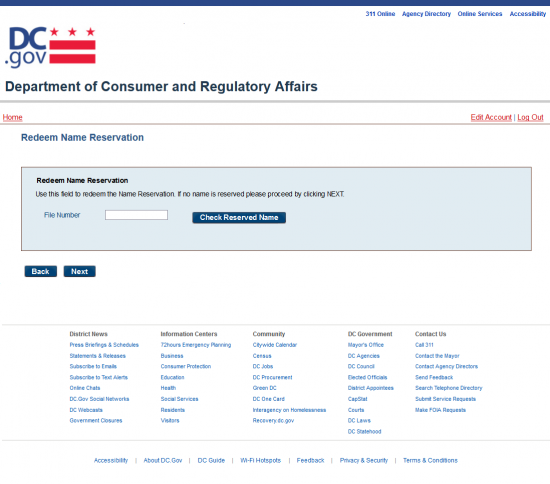

Step 4 – This page will give an opportunity to claim any Name Reservation you may have made. If so, enter the “File Number” you were assigned. Then select “Check Reserved Number.” If you do not have a Name Reservation then leave the “File Number” field blank and select the button labeled “Next.”

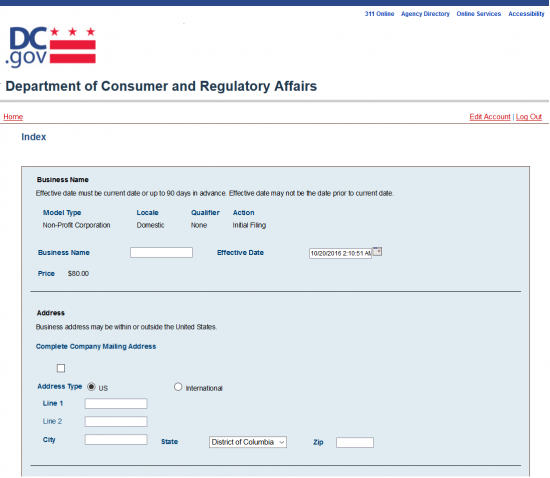

Step 5 – In the first field, “Business Name,” enter the Name you wish to give your corporation precisely as it should appear on the record books.

Step 6 – The “Effective Date” will be populated with the Current Date however, if you may name any Date of Effect, in this field, between the Filing Date and 90 days after the Filing Date.

Step 7 – Next, report the Business Address of the nonprofit corporation being formed. If this is a Mailing Address then check the box under the words “Complete Company Mailing Address.” Then select either the radio button labeled “US” or “International” to indicate where this Address is. Finally, utilizing the fields “Line 1,” “Line 2,” “City,” “State,” and “Zip Code” to enter the Business Address of this nonprofit corporation.

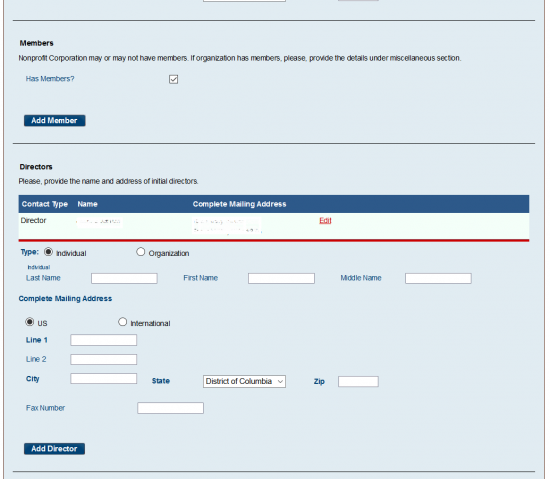

Step 8 – In the “Members” section, check the box if the nonprofit corporation has members. Currently, you will need to add information regarding Members in the “Miscellaneous” section.

Step 9 – The “Directors” section will require a report on the initial Directors of this nonprofit corporation. First select radio button labeled “Individual” if the Director being reported is a person. If the Director being reported is a business, then select the radio button labeled “Organization.”

Step 10 – There will be three fields to fully report the Name of a Director: Last Name, First Name, and Middle Name. Use these fields to report the Name of a Director

Step 11 – In the “Complete Mailing Address” section, indicate if the Mailing Address of the Director being reported is in the US or in another country. If in the United States then select the radio button labeled “US.” If the Mailing Address is in another country, select the radio button labeled “International.” Below this, you may enter the Directors Mailing Address using the “Line 1” and “Line 2” fields to document the Street Address Person and the “City,” “State,” and “Zip” fields to report the City, State, and Zip Code of the Director’s Mailing Address (respectively). Below this, enter the Fax Number (optional) in the field labeled “Fax Number.” Once you have done this, select “Add Director.” This will display the Director and his/her/it’s information in the table directly above this section. You may add as many Directors as necessary.

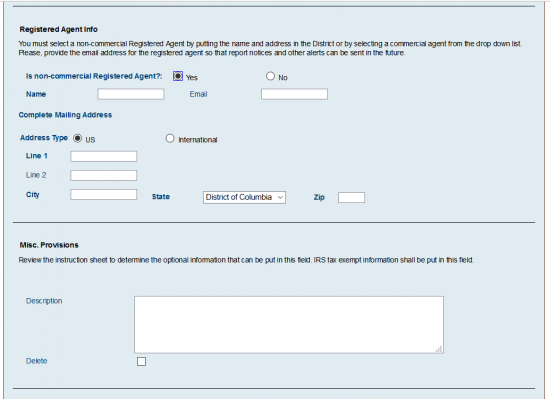

Step 12 – Next you will need to define the Identity and Location of the District of Columbia Registered Agent who will serve the nonprofit corporation being formed. You may report either a commercial and noncommercial Registered Agent here. First locate the radio buttons following the question “Is non-commercial Registered Agent?” If you select “No” the current fields will be replaced with a drop down list of available commercial Registered Agent. For our purposes select “Yes,” then report the Full Name of the Registered Agent in the field labeled “Name” and the Email Address of the Registered Agent in the field labeled “Email.” Note: If you have obtained a commercial Registered Agent and that party is not in the drop down list, then contact the Registered Agent you obtained regarding this.

Step 13 – In the “Complete Mailing Address” section, indicate whether the Address is in the United States or outside the United States by selecting either the radio button labeled “US” or the radio button labeled “International,” respectively. Once this is done utilize the fields provided to enter the Full Address of the Registered Agent.

Step 14 – In the “Misc Provisions” section, you may document information that may be required for your nonprofit corporation. For instance, if there are Members, report a Description of a Member Type, the Qualifications for that Member Type, and if that Member Type has Voting Rights. Also, if this corporation intends on applying for Tax-Exempt Status, then enter the 501(c)(3) compliant language required by the I.R.S. in this field. If there are no additional provisions, you may leave this section blank.

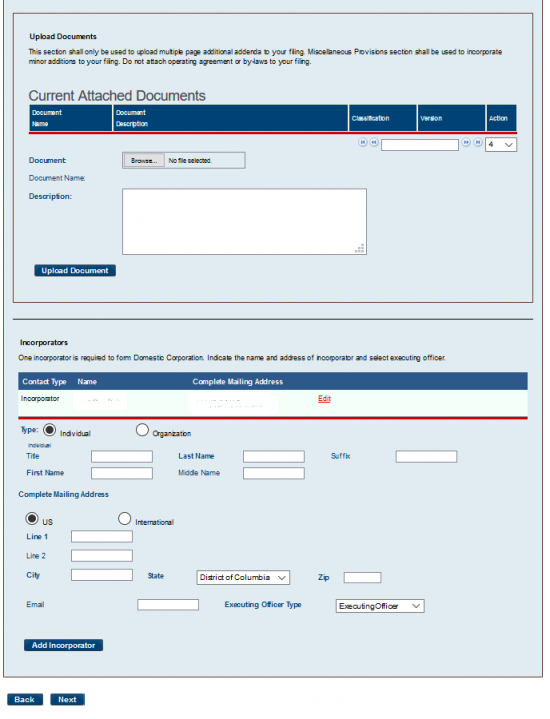

Step 15 – If there are any additional documents that need to be attached to this filing (i.e. an addendum for the Misc Provisions section) then, in the “Upload Documents” section, report use the “Browse” button to locate the appropriate file on your computer, enter a description for that file in the “Description” field (optional), then select the button labeled “Upload Document.” The files you have selected will be displayed in a table just above this section.

Step 16 – The “Incorporators” section will require at least one Incorporator to be entered. First indicate if this is a person or an organization by selecting the radio button labeled “Individual” or “Organization.” For our purposes, select the radio button labeled “Individual.”

Step 17 – Locate the field labeled “Title.” Here, you must report the position held by the Incorporator being reported. Then in the next four fields, report the Incorporator’s Last Name, Suffix (if applicable), First Name, and Middle Name. Below this, you must indicate if the Incorporator Address for this party is in the United States by marking the radio button labeled “US” or if it is outside of the United States by marking the radio button labeled “International.” You will then need to utilize the “Line 1,” “Line 2,” “City,” “State,” “State,” and “Zip” to report the Mailing Address of the Incorporator being reported. Finally, you may report the Email Address in the “Email” field and the Officer/Director type using the drop down list in the “Executing Officer Type” field. All Incorporators reported will appear in a table directly above this section. When you have entered all the information required on this screen, select the “Next” button.

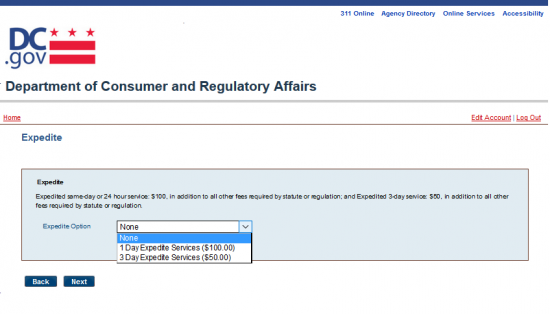

Step 18 – Next, you will need to define if you would like this review process to be expedited or not. If not then select “None” from the drop down list in the “Expedite Option” field. You may also choose “1 Day Expedite Service ($100.00)” or “3 Day Expedite Service ($50.00).” When you have made the appropriate choice, select “Next.”

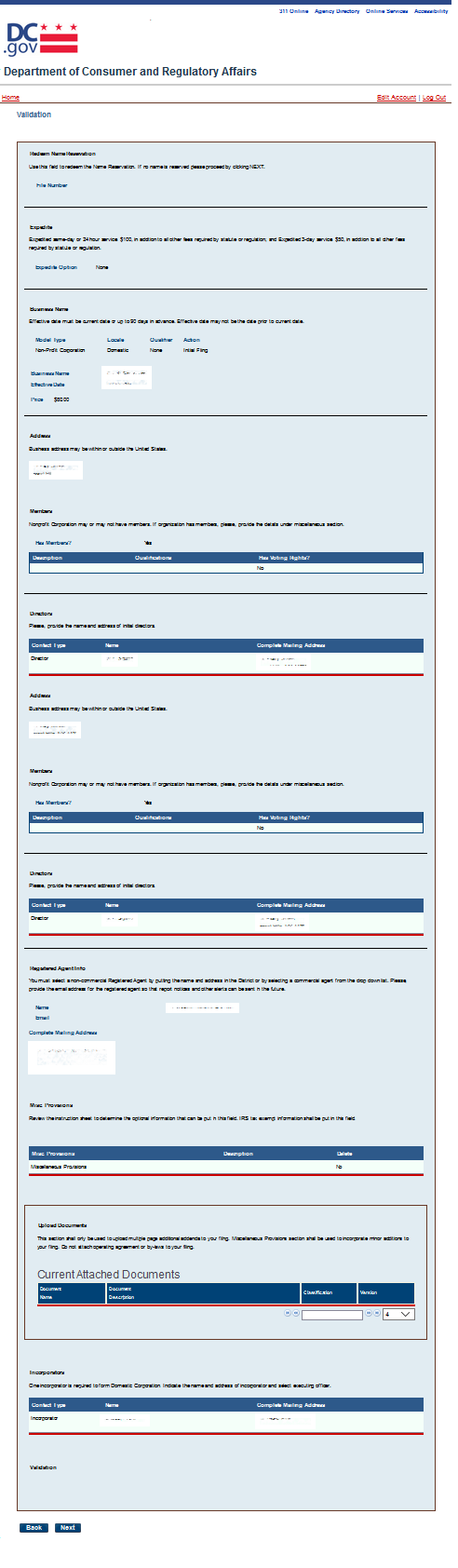

Step 19 – This page will contain all the information entered for easy review. You may use the button labeled “Back,” at the bottom of the page to navigate to any areas that need to be edited or you may select the “Next” button to continue.

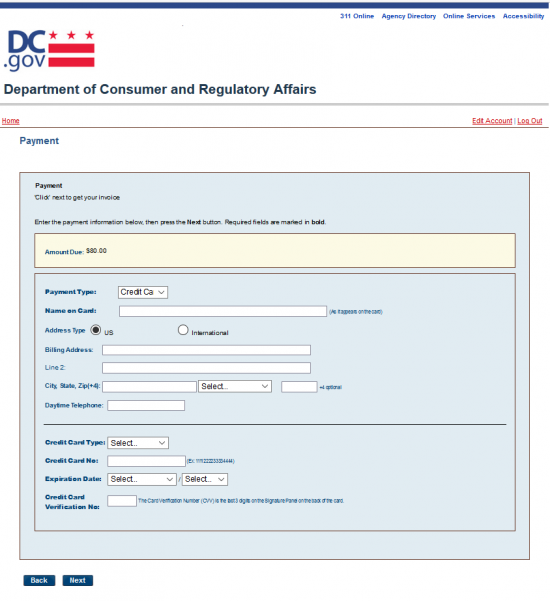

Step 20 – Next you will need to pay the $80.00 Filing Fee in order for these articles to be reviewed. Use the drop down list to choose “Credit Card” this will generate the appropriate fields needed to fill in the card holder information to be entered. Once you are done, select “Next” so that you may be charged. Note: This filing will not be reviewed unless the Filing Fee is paid in full.