|

Florida Application by Foreign Not For Profit Corporation For Authorization To Conduct Its Affairs In Florida |

The Florida Application by Foreign Not for Profit Corporation for Authorization to Conduct Its Affairs in Florida must be submitted by mail with the minimum $70.00 filing fee to the Florida Division of Corporations. This is a required step when an out of state entity wishes to conduct business in the State of Florida. This form will deliver several pieces of information, including the Registered Agent, and should be accompanied by the required documentation it summarizes. This should be submitted in duplicate.

You may mail the articles to Registration Section, Division of Corporations, P.O. Box 6327, Tallahassee, FL 32314 or send by courier to Registration Section, Division of Corporations, Clifton Building, 2661 Executive Center Circle, Tallahassee, FL 32301. Payment should be in the form of a check made payable to “Florida Secretary of State.” As mentioned above, the full filing fee of $70.00 must be submitted. If you wish the documents being returned to be Certified or if you wish to receive a Certificate of Status, the payment must be for $78.75. If you would like both a Certified Copy of the articles and a Certificate of Status, the payment amount must be $87.50.

How To File

Step 1 – Go to the Florida Department of State’s Division of Corporations home page (www.sunbiz.org). Then select the link labeled “Print Filing Forms.”

Step 2 – The “Forms” page will contain several links. Locate and select the link labeled “Foreign Corporation (Profit and NonProfit).”

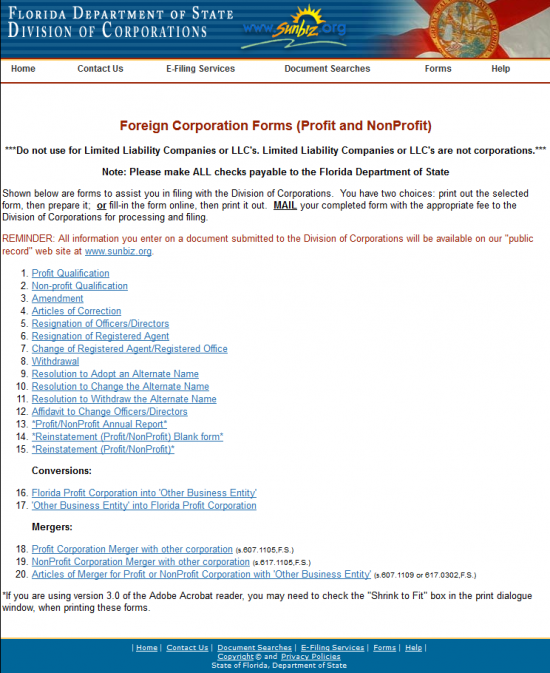

Step 3 – The Foreign Corporation Forms (Profit and NonProfit) page has several numbered items. Locate and select Item 2, labeled as “Non-profit Qualification.”

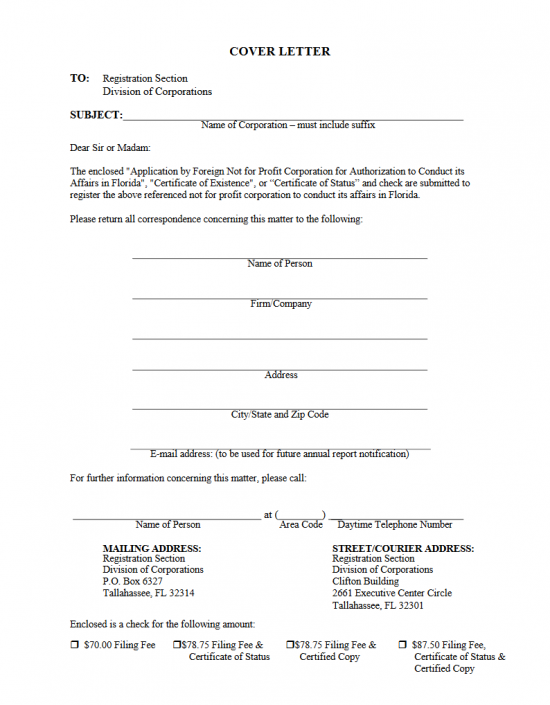

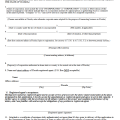

Step 4 – This first page is the Cover Letter that must accompany the articles being submitted. On the first line, labeled “Subject,” report the Full Name of the corporation that shall do business in the State of Florida. This should include any applicable state required suffix.

Step 5 – On the next two blank spaces, enter the Name of the Person sending this document and the Name of the Firm/Company being responsible for sending these articles.

Step 6 – On the next three blank lines, enter the Full Address of the entity filing these articles.

Step 7 – Next, enter the E-mail Address where future correspondence regarding this filing may be sent. For instance, if you choose to have a Certificate of Status sent to you, it will be emailed as an image.

Step 8 – Under the sentence “For further information concerning this matter, please call” enter the Full Name and Phone Number of a reliable Contact person.

Step 10 – Next, you must determine which services you want. Each will require a payment and you must check at least one box. The baseline filing fee is $70.00 as noted in the first choice. You may choose to have either a Certificate of Status or a Certified Copy of the articles for an additional $8.75. The next two choices (Filing Fee & Certificate of Status or Filing Fee & Certified Copy) will require a $78.75. The last choice will require a payment for $87.50, this will pay for the filing fee, a Certificate of Status, and a Certified Copy of the articles.

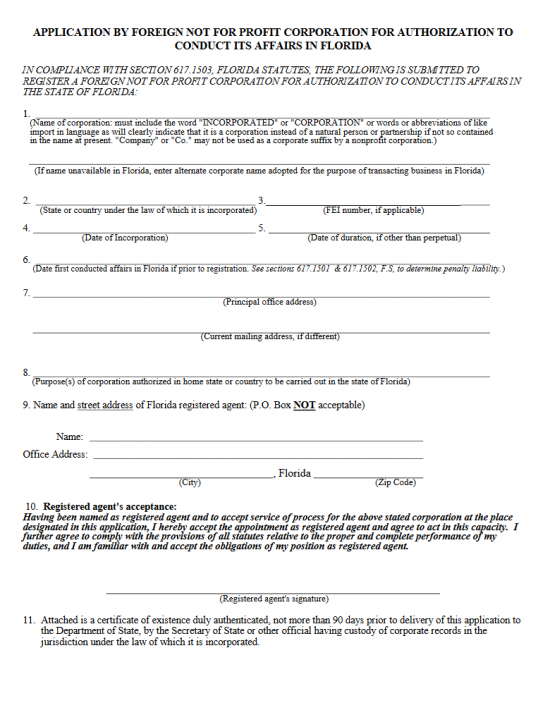

Step 11 – The next page is the Application by Foreign Not For Profit Corporation For Authorization to Conduct Its Affairs In Florida.” In the first item, report the Full Name of the Corporation. This should be the true name of the corporation submitting this application and should contain the appropriate suffixes. If you must use a fictitious name in the State of Florida because the true name of the company is unavailable then enter the fictitious name on the second blank line.

Step 12 – In Item 2, enter the State who holds jurisdiction over this corporation’s activities. Typically this is the state the corporation originally formed in.

Step 13 – Item 3 is located on the same line as Item 2 on the right. If this corporation has an FEI number enter it here. If not, leave Item 3 blank.

Step 14 – In Item 4 enter the Date of Incorporation of this corporation in its origin State.

Step 15 – In Item 5, enter the Date of Duration of the corporation. If the corporation shall remain active indefinitely then leave this item blank.

Step 16 – In Item 6, enter the First Date this corporation has conducted business in the State of Florida if it has done so. If this corporation has conducted business in any way within the State of Florida, it must be reported here. If not, then leave this item blank.

Step 17 – In Item 7, report eh Principal Office Address on the first line. If the corporation has a separate Mailing Address, it should be documented on the second line.

Step 18 – Item 8 will require the purpose of the corporation to be documented. This must be the same purpose as noted in the original articles that have formed the corporation in its origin state.

Step 19 – Report the Full Name and Office Address of the Registered Agent for this corporation. This entity must maintain an address in the State of Florida.

Step 20 – The Registered Agent must sign his/her Full Name on the Signature Line in Item 10 as acknowledgement of his/her responsibility.

Step 21 – Item 11 will obligate the submitter of this application to obtain and attach an official Certificate of Existence from its home state dated within ninety days of the submission of this application.

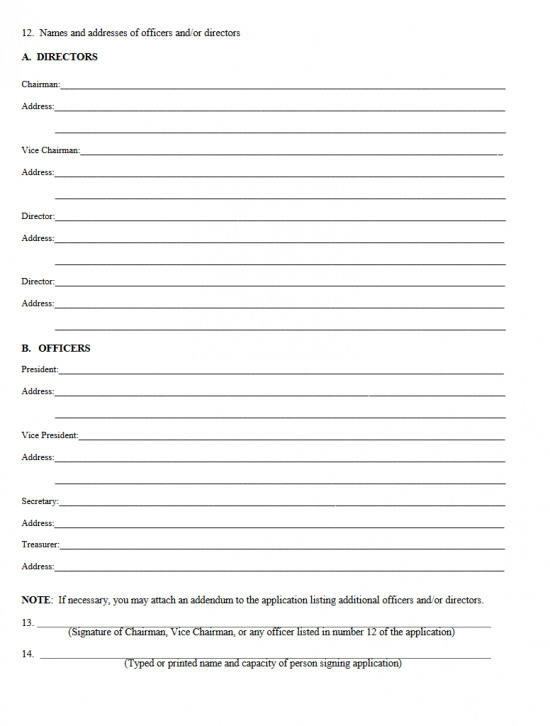

Step 22 – Item 12A requires the Full Name and Full Address of the Directors of this corporation (Chairman, Vice Chairman, and 2 Directors).

Step 23 – Item 12B requires the Full Name and Full Address of the Officers to be reported (President, Vice President, and Secretary)

Step 24 – Items 13 and 14, will require the Signature then the Printed Name and Title of the Officer/Director authorized to submit these articles.

Step 25 – Once this form has been filled out and any attachments (i.e. supporting paperwork, required documents) have been organized. Gather the articles, the Certificate of Existence (dated within the past ninety days), the appropriate payment for the service required ($70.00 for Filing, $78.75, or $87.50 for Filing and receiving both a Certified Copy and a Certificate of Status) for Filing and either receiving a Certified Copy or a Certificate of Status, and any additional licenses or documents that may be required by separate entities (depending upon the nature of the business) and mail to:

Registration Section

Division of Corporations

P.O. Box 6327

Tallahassee, FL 32314

or you may have a courier deliver to:

Registration Section

Division of Corporations

Clifton Building

2661 Executive Center Circle

Tallahassee, FL 32301