|

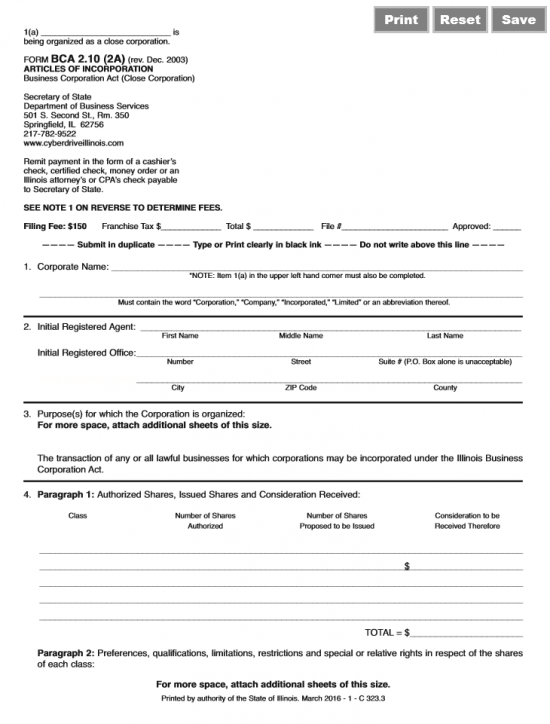

Illinois Articles of Incorporation Close Corporation | Form BCA 2.10 (2A) |

The Illinois Articles of Incorporation Close Corporation | Form BCA 2.10 (2A) must be submitted when an entity wishes to operate in the State of Illinois as a close corporation. There are many pros and cons to operating a close corporation where a small group of individuals own and control the entity. Since, this corporation type is different enough to have its own classification, it will have to be reported on Form BCA 2.10 (2A). Other governing entities are likely to have their own requirements as well thus, it is highly recommended to consult an attorney and/or accountant. Incorporators and the entities they form will be expected to remain in full compliance with their defined responsibilities in the Business Corporation Act of 1983.

The articles must be accompanied by full payment of all applicable fees by check or money order payable to “Secretary of State.” The Filing Fee is $150.00 The full payment must also consist of the Franchise Tax placed on this corporation. This is claculated at the rate of 15/100 of 1 percent on paid-in capital not to be less then $25.00. That is, the minimum amount to be paid will be $175.00.

How To File

Step 1 – The first Article requires the Full Name of the close corporation these articles will form. Make sure this is a unique name and contains one of these words: corporation, incorporated, company, limited, or an abbreviation of these terms.

Step 2 – The second Article will provide two sections to identify the Registered Agent of this corporation. On the line labeled “Initial Registered Agent,” enter the First Name, Middle Name, and Last Name of the Registered Agent. Then, on the line labeled “Initial Registered Office,” report the Building Number, Street, Suite Number, City, Zip Code, and County the Registered Agent is located. This address may not be a P.O. Box and must be a physical location in the State of Illinois.

Step 3 – In the third Article, document the Purpose of forming this corporation. If you require more space you should continue on a separate document, clearly title it, and attach it to the articles.

Step 4 – Paragraph 1 or the fourth Article requires that a list the classes of stock available, the number of authorized shares of in each class, the proposed number of shares to issue for each class, and each class’s consideration to be recieved thereof. Paragraph 2 requires a report on each class’s Preferences, qualifications, restristions, and relative rights. This section may be continued on a separate document and attached to the articles. Make sure it is clearly labeled.

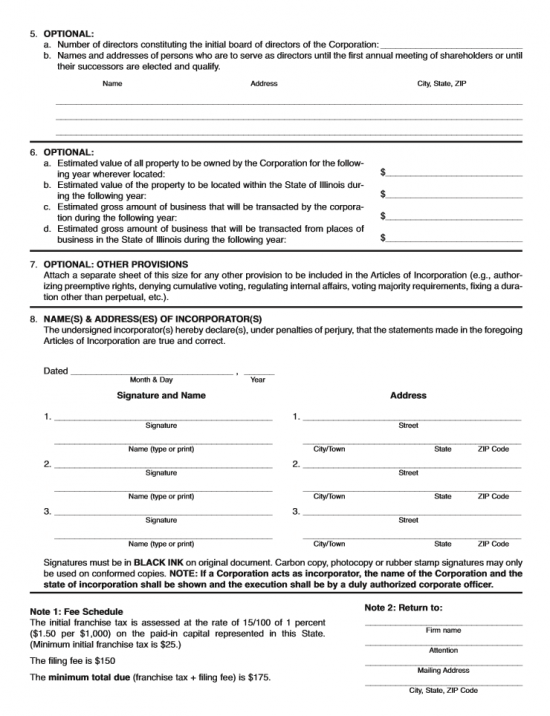

Step 5 – The fifth Article is Optional. In section “a” report the number of individuals on the initial Board of Directors on the space provided.

Step 6 – In section “b,” of the fifth Article, list the Names and Addresses of the initial Board of Directors.

Step 7 – The sixth Article is also optional. If deciding to address this article then enter the estimated value of all the corporation’s assets in Article 6a.

Step 8 – In Article 6b, estimate the total value of corporate assets and property in Illinois and report it on the space provided.

Step 9 – In Article 6c, report the estimated gross business that is believed to be transacted in the next year by this corporation on the space provided.

Step 10 – In Article 6d, report the estimated gross business that may be transacted by this corporation in the State of Illinois on the blank space provided.

Step 11 – The seventh Article allows the option to attach additional provisions, continuations, and/or required documents to these articles.

Step 12 – In the eighth Article, locate the line labeled “Dated,” then enter the Month, Day, and Year these articles are being signed.

Step 13 – Under the heading “Signature and Name” and “Address,” each Incorporator must Sign and Print his or her Name then document his/her Full Address. This must be done in Black Ink. If the Incorporator is a business entity, its Name must appear and authorized officers must Sign and Print their Names along with reporting their Addresses.

Step 14 – The first Note under the Signature lines will document the method by which you may calculate the Initial Franchise Tax for this corporation (15/100 of 1 percent on paid-in capital). A payment of this must accompany the articles and Filing Fee payment. If the Franchise Tax is calculated below $25.00, you must pay $25.00. This is the minimum amount.

Step 15 – Organize all the paperwork including the Articles of Incorporation Close Corporation | Form BCA 2.10(2A), a check or money order payable to Secretary of State for the Filing Fee amount of $150.00 plus the calculate Initial Franchise Tax, and any additional paperwork into a submittal package then mail to Secretary of State, Department of Business Services, 501 S. Second St. Rm 350, Springfield, IL 62756.