|

Indiana Articles of Incorporation Domestic NonProfit Corporation | State Form 4162 (R14 / 3-16) |

The Indiana Articles of Incorporation Domestic NonProfit Corporation | State Form 4162 (R14 / 3-16) must be filed with the Indiana Secretary of State’s Business Services Division whenever an entity wishes to operate as a domestic nonprofit corporation. These articles will satisfy the Secretary of State’s requirements to form a nonprofit corporation however they do not satisfy every requirement with every governing entity. For instance, whether applying for Tax Exempt Status or not, all nonprofit corporations within this state must also meet the expectations of the Internal Revenue Service and the Indiana Department of Revenue. Incorporators are advised to confer with these two entities before approaching this form and/or seeking counsel from an appropriate professional (i.e. attorney, C.P.A., etc.).

These articles may be submitted online provided the submitter has an account with the Indiana Secretary of State. To obtain an account or login visit: https://inbiz.in.gov/business-entity/start. If not, you may submit these articles by mail. In both cases, you will need to submit the filing fee. The filing fee for this form is $30.00. If submitting by mail, you may pay with a check or a money order made payable to “Secretary of State.” The articles may be filled out by hand (you must use ink and print neatly), typed, or filled out using a PDF program and printed. When they have been completed and all additional paperwork organized and gathered, submit the package and full payment of the filing fee to Secretary of State, Business Services Division, 302 West Washington Street Rm. E018, Indianapolis, IN 46204.

How To File

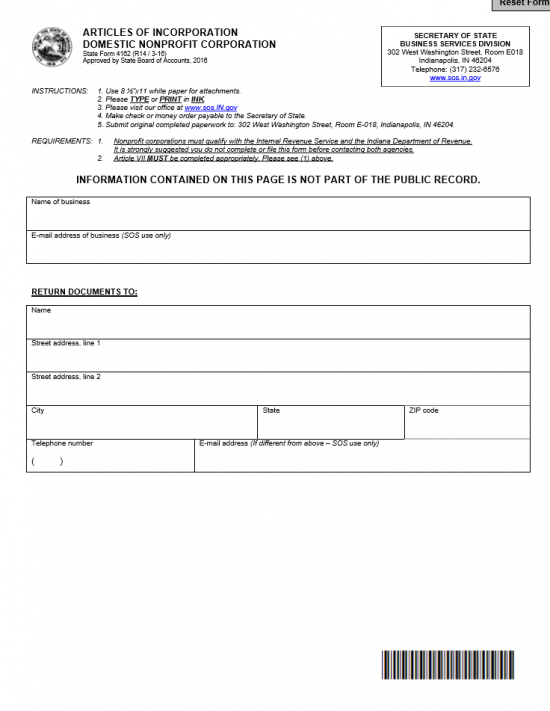

Step 1 – This form is composed of two pages with several sections. The first page is a cover sheet and must be submitted. In the first section of the first page, enter the Full Name of the Business then on the second line, enter the Address of this Business.

Step 2 – The section labeled “Return Documents To” is where the Secretary of State will return documents or send mail regarding this form. There will be several lines here. The first three lines will contain one box a piece. Enter the Name of a Contact on the first line then that Contact’s Street Address on the second and third lines. Next you will need to enter the City, State, and Zip Code in the appropriately labeled boxes on the third line. The fourth line is reserved for the Contact’s Telephone Number and E-mail Address.

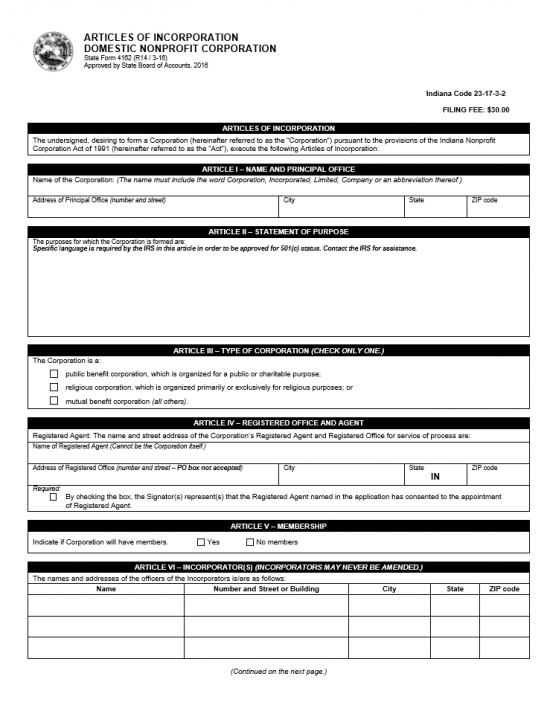

Step 3 – The next page is the Articles of Incorporation. In Article I, “Name and Principal Office,” report the Full Name of the nonprofit corporation being formed. This must be a unique name and must contain the appropriate words or abbreviations of incorporation required by Indiana State Law. Enter this on the first line.

Step 4 – On the second line, enter the Street Address of the Principal Office, the City, the State, and the Zip Code.

Step 5 – In Article II, “Statement of Purpose,” report the reason this corporation is being formed and how it will conduct business. If you seek Tax Exempt Status, then you must use some specific language that would be required by the Internal Revenue Service (if so, contact the IRS).

Step 6 – In Article III, “Type of Corporation,” you will be given a way to define what entity type this corporation will be. You may only choose one. If this corporation is a Public Benefit Corporation, indicate this by placing a check mark in the first box. If this corporation is a Religious Corporation, then place a check mark in the second box. If this corporation is a Mutual Benefit Corporation, then you must choose the third box.

Step 7 – In Article IV, “Registered Office and Agent,” you will report on the Registered Agent’s Identity and Location. The Registered Agent must differ from the corporation being formed and must maintain an address in the State of Indiana. Document the Full Name of the Registered Agent on the first line. Then, on the second line, report the Physical Address of the Registered Agent’s office. The third line will contain a box that shall act as verification the Registered Agent is aware of his/her responsibilities and will carry them out on behalf of the corporation being formed. Place a check mark in this box, if the Registered Agent has acknowledged and agreed to serve as such.

Step 8 – In Article V, “Membership,” report if this nonprofit will have members or not by choosing the appropriate box. If it does, then place a check mark in the box labeled “Yes.” If not, then place a check mark in the box labeled “No members.”

Step 9 – In Article VI, the Full Name and Address of each Incorporator must be documented. Each Incorporator must have his/her own row and each column (Name, Number and Street or Building, City, State, and Zip Code) must have the appropriate information for that Incorporator filled out.

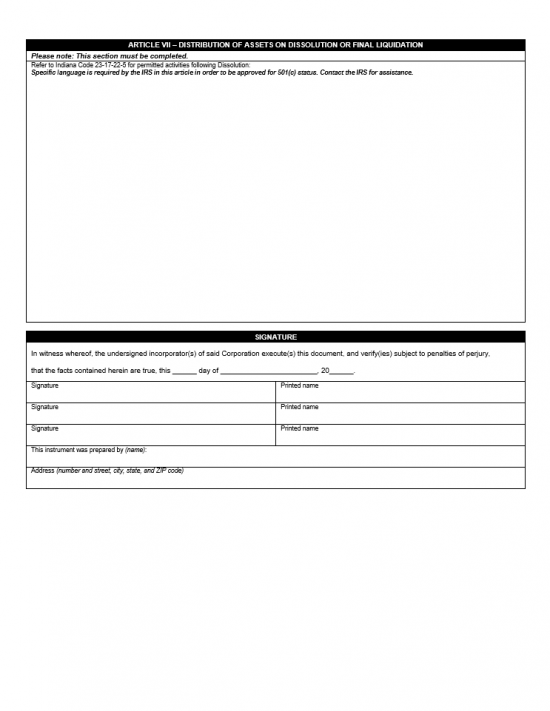

Step 10 – In Article VII, “Distribution of Assets on Dissolution or Final Liquidation.” Here, you must report the results of Dissolution of the nonprofit corporation being formed. Be as specific as possible when it comes to documenting how assets and properties will be handled. The I.R.S will require some very specific language here if this nonprofit corporation intends on seeking Tax Exempt Status. It is strongly recommended to contact the I.R.S. for assistance if one has any questions or is unfamiliar with such language requirements.

Step 11 – In the “Signature” section, you must provide the Date (Day, Month, Year) this form is being signed on the first three spaces, in the first box.

Step 12 – Below the date will be three lines, each composed of two boxes. Each Incorporator must sign this section (if necessary, you may attach a clearly labeled sheet of paper should there be more than three). Have the Incorporator(s) provide his/her signature in the first box and his/her Printed Name in the second box.

Step 13 – The identity of the individual who has prepared these articles should be reported on the next line (beneath the words “This instrument was prepared by”). On the last line of this form, the individual who has prepared these articles should report his/her address.

Step 14 – To successfully file, mail the Indiana Articles of Incorporation Domestic NonProfit Corporation | State Form 4162 (R14 / 3-16), all accompanying paperwork, and a check or money order payable to “Secretary of State” for the full filing fee amount of $30.00 to:

Secretary of State

Business Services Division

302 West Washington Street Rm. E018

Indianapolis, IN 46204.