|

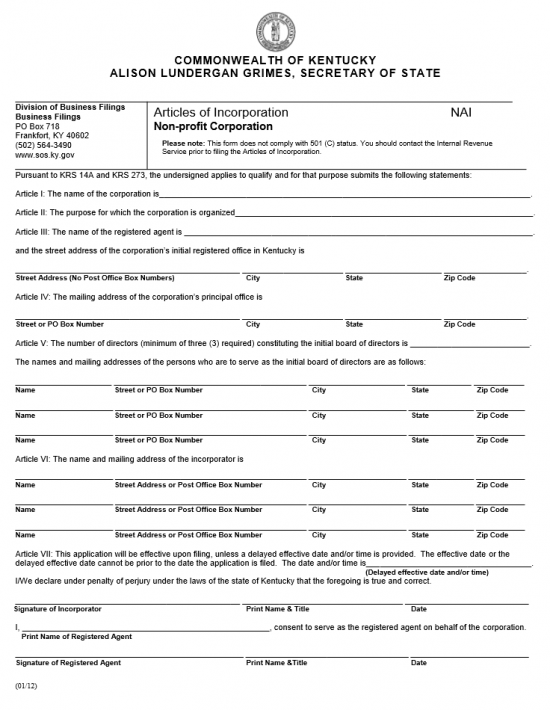

Kentucky Articles of Incorporation Non-Profit Corporation | Form NAI |

The Kentucky Articles of Incorporation Non-profit Corporation | Form NAI should be filed with the Kentucky Secretary of State Division of Business Services. This form will only provide the basic framework for the articles. If there is not enough room, additional provisions are to be included, or other documentation attached then you should draft and execute your own articles as a separate document making sure to report all the information that must be on this form (as per KRS 271B) as well as the additional information you wish to or are required to report. Whether you draft your own articles or use this form to register your nonprofit corporation you must mail the originals to Alison Lunderfan Grimes, Office of the Secretary of State, P.O. Box 718, Kentucky, KY 40602-0718. Payment for the filing fee ($8.00) must be submitted with the articles as a check or money order made out to “Kentucky State Treasurer.”

Incorporators should be aware that filing the articles satisfies the State of Kentucky’s mandatory filing for forming a nonprofit corporation and does not automatically grant Tax Exempt Status. The Internal Revenue Service will have a separate procedure to apply for tax exempt status. This is a basic form to create a nonprofit corporation and is not 501(c) compliant. Incorporators are advised to contact the Internal Revenue Service and/or an attorney prior to drawing up their own articles for this purpose.

How To File

Step 1 – You may download the Kentucky Articles of Incorporation Corporation here: Form NAI. Once this is downloaded you may either fill it out on the screen using a PDF editing program or you may print it, then fill it out.

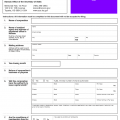

Step 2 – The first item that will require attention is Article I. Here, you must enter the Full Name of the corporation you are using these articles to form.

Step 3 – Article II is the next item. You must report the Purpose for creating this coproation on the blank line provided. Explain the reason for creating this entity and report how it will operate in the State of Kentucky.

Step 4 – The next item requiring attention is Article III. In this item, you must report the Full Name of the Registered Agent for this corporation on the first blank line available.

Step 5 – The next blank line, in Article III, will be broken up into four spaces. Here, you must report the Street Address, City, State, and Zip Code of the physical location in the State of Kentucky, the Registered Agent may be located. It should be noted that a Post Offic Box is not an acceptable Street Addresses.

Step 6 – There will be four blank lines in Article IV. These must be used to enter the Mailing Address of the nonprofit corporation’s Principal Office. On the first blank space enter the Street Address or PO Box Number of the Principal Office. On the second blank space, enter the City of the Principal Office. On the fourth and fifth blank spaces, enter the State and Zip Code for the Principal Office’s Mailing Address (respectively).

Step 7 – The next section requiring attention will be Article V. Here, you must report the number of Directors on the initial Board of Directors on the first blank space provided. There must be at least three.

Step 8 – The second section of Article V is made up of three blank lines, each reserved for a Director’s Full Name and Mailing Address (Name, Street/PO Box Number, City, State, and Zip Code) to be listed.

Step 9 – Article VI requires the Name and Mailing Address of each Incorporator to be reported. There is enough room to report three (each one getting his/her own line). You may do this by filling in the appropriate information on the spaces provided (Name, Street Address or Post Office Box Number, Cit, State, Zip Code).

Step 10 – The final section will seek to define the Date of Incorporation and bind the Incorporator and Registered Agent to this document. If you wish the Effective Date of these articles to be in the future, then locate the blank line labeled “Delayed effective date and/or time” in Article VII then report the desired Date of Incorporation. If these articles are to go in effect upon filing then leave this blank.

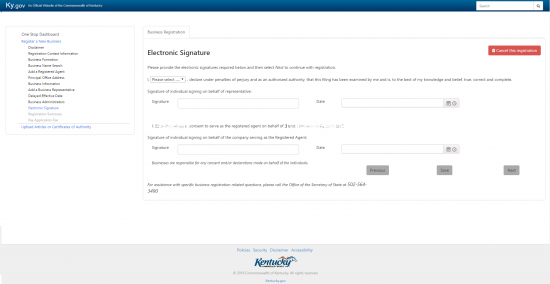

Step 11 – The first Signature line in Article VII is reserved for the Incorporator of this entity. On the blank space labeled “Signature of Incorporator,” the Incorporator must sign his or her name. He/she should then Print his or her Name and Title. Finally, on the third space, the Incorporator must report the Date of the Signature.

Step 12 – The final Signature area will provide acknowledgement and consent from the Registered Agent regarding his or her duty to this entity. On the space labeled “Print Name of Registered Agent,” the Registered Agent must print his or her name. Then on the last line, the Registered Agent must provide his/her Signature, Printed Name and Title, and Date of Signature.

Step 13 – You must mail the completed original and one copy of the Kentucky Articles of Incorporation Non-Profit Corporation | Form NAI and a check or money order that is payable to “Kentucky State Treasurer” for $8.00 to complete your part of the filing process.

Mail To:

Alison Lunderfan Grimes

Office of the Secretary of State

P.O. Box 718

Kentucky, KY 40602-0718

How To File Online

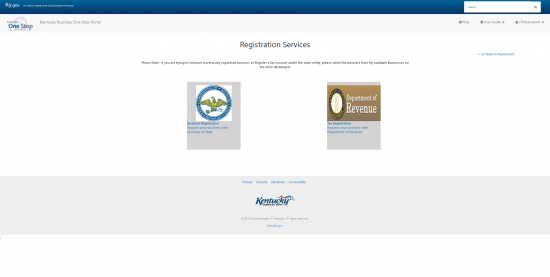

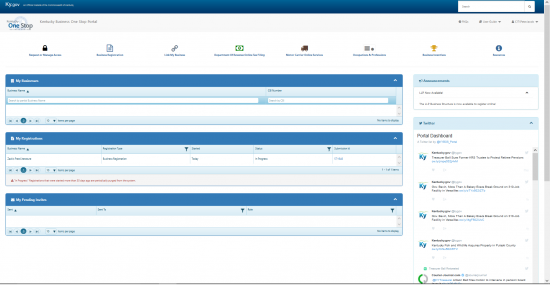

Step 1 – Go to the OneStop Business Portal page here: https://onestop.portal.ky.gov/OneStopPortal then log in with your user name and password.

Step 2 – Select the “Business Registration” button located at the top of the page.

Step 3 – Select the Secretary of State logo on the left side of the page to continue with your Kentucky Secretary of State filing.

Step 3 – Select the Secretary of State logo on the left side of the page to continue with your Kentucky Secretary of State filing.

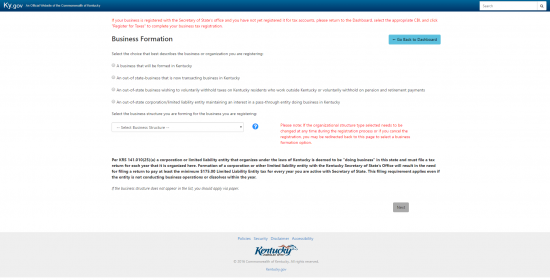

Step 4 – In the “Business Formation Page,” select the first radio button, “A business that will be formed in Kentucky.” Then using the drop down list below this first section, below the words “Select the business structure you are forming for the business you are registering,” choose “Non-Profit Corporation” from the drop down list. When ready, select the “Next” button.

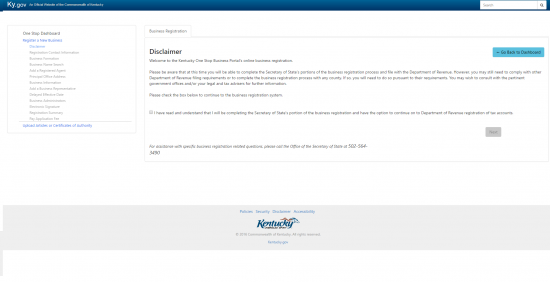

Step 5 – Read the disclaimer statement, then click on the check box next to the statement beginning with the words “I have read and understand…” Once you have done this, select the button labeled “Next.”

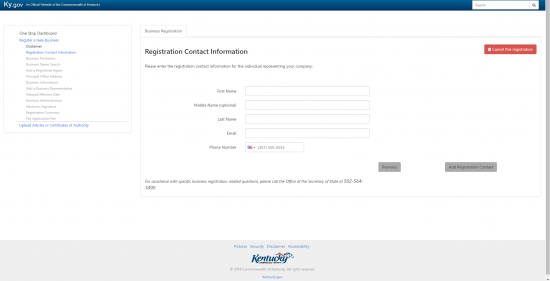

Step 6 – On this next page, you will need to enter the “Registration Contact Information.” This will require the First Name, Last Name, Middle Name (if applicable), E-Mail Address, and Phone Number for the Contact Person who is authorized to correspond with the Kentucky Secretary of State on behalf of the non-profit corporation being formed. After filling in this information, select “Add Registration Contact.” Note: If you have not previously entered this information, you will need to repeat Step 4, however the screen will retain the answers you have previously selected.

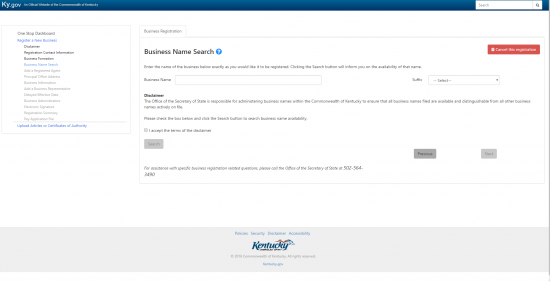

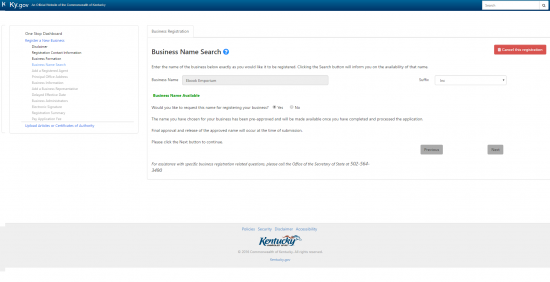

Step 7 – The next page, “Business Name Search,” shall require the Name you have chosen for the non-profit corporation being formed to be entered in the text box labeled “Business Name.” You will also be required to select a Suffix from the drop down menu on the right of this. You should select an appropriate word of incorporation suffix, such as Corporation, Incorporated, or a reasonable abbreviation of either word. Then, check the box verifying that you “accept the terms of the disclaimer.” When you are ready select the button labeled “Search.”

Step 7 – The next page, “Business Name Search,” shall require the Name you have chosen for the non-profit corporation being formed to be entered in the text box labeled “Business Name.” You will also be required to select a Suffix from the drop down menu on the right of this. You should select an appropriate word of incorporation suffix, such as Corporation, Incorporated, or a reasonable abbreviation of either word. Then, check the box verifying that you “accept the terms of the disclaimer.” When you are ready select the button labeled “Search.”

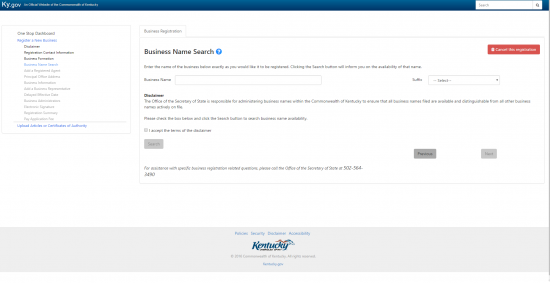

Step 8 – If the Name you have chosen is available, the statement “Business Name is available” will appear. Below this statement will be the question “Would you like to request this name for registering your business?” Select “Yes” if you do, select “No” if you would like to try a different Name. When you are ready, select the button labeled “Next.”

Step 8 – If the Name you have chosen is available, the statement “Business Name is available” will appear. Below this statement will be the question “Would you like to request this name for registering your business?” Select “Yes” if you do, select “No” if you would like to try a different Name. When you are ready, select the button labeled “Next.”

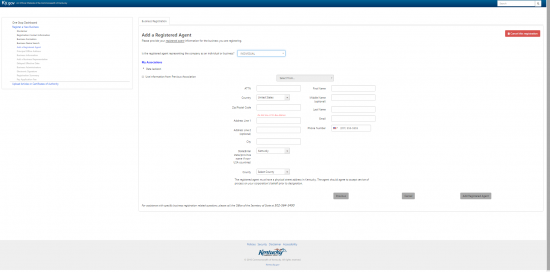

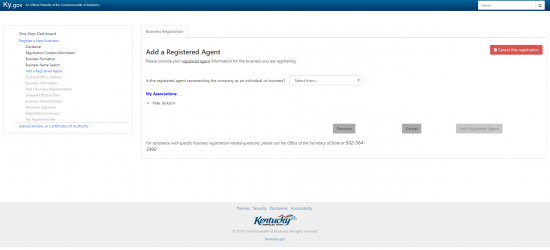

Step 9 – Next you will need to enter the Registered Agent information for the non-profit corporation being formed. The first step will be to indicate if the Registered Agent is an Individual or a Business by selecting one of these choices from the drop down list labeled “Is the registered agent representing the company as an individual or a business?” Once you make your selection the appropriate fields will appear.

Step 9 – Next you will need to enter the Registered Agent information for the non-profit corporation being formed. The first step will be to indicate if the Registered Agent is an Individual or a Business by selecting one of these choices from the drop down list labeled “Is the registered agent representing the company as an individual or a business?” Once you make your selection the appropriate fields will appear.

Step 10 – You may choose to auto populate the required fields if you have previously entered this business’s or individual’s information by select the check box labeled “Use information from Previous Association” then selecting the appropriate party from the drop down list on the right. Otherwise, in the left column, you will need to enter the Registered Agent’s Zip Code in the Zip Code Field then the Building Number, Street, and Suite Number in Address Line 1 (Address Line 2 is provided should you require more room), the City will have its own field, the State may be selected from a drop down list, and the County will be selected from the drop down list as well. In the column on the right, enter the First Name, Middle Name (if applicable), Last Name, E-mail Address, and Phone Number of the Registered Agent. The Attention line is provided should this be a specific individual in a business. Once you have entered information into the appropriate fields, select the button labeled “Add Registered Agent.”

Step 10 – You may choose to auto populate the required fields if you have previously entered this business’s or individual’s information by select the check box labeled “Use information from Previous Association” then selecting the appropriate party from the drop down list on the right. Otherwise, in the left column, you will need to enter the Registered Agent’s Zip Code in the Zip Code Field then the Building Number, Street, and Suite Number in Address Line 1 (Address Line 2 is provided should you require more room), the City will have its own field, the State may be selected from a drop down list, and the County will be selected from the drop down list as well. In the column on the right, enter the First Name, Middle Name (if applicable), Last Name, E-mail Address, and Phone Number of the Registered Agent. The Attention line is provided should this be a specific individual in a business. Once you have entered information into the appropriate fields, select the button labeled “Add Registered Agent.”

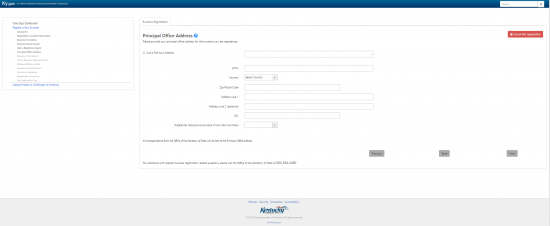

Step 11 – The Principal Office Address screen will the Full Address of the nonprofit corporation’s Principal Office. This will require the Country to be selected from a drop down menu, the Zip Code to be entered in the “Zip/Postal Code” field, the Street Address in the Address Line 1 (and if necessary the Address Line 2) field, the City entered in the City field, and the State to be selected from the drop down menu provided. Once you have entered this information select the button labeled, “Save.” Once you have done this select the “Next” button.

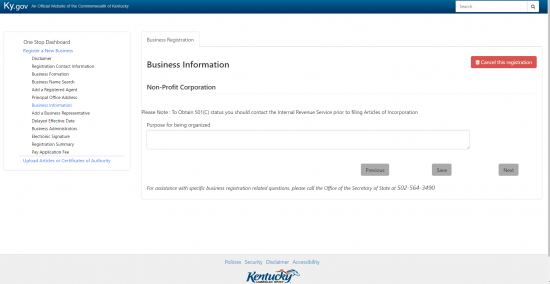

Step 12 – Next you will need to report the Purpose of this corporation. Note: if this entity plans on applying for Tax-Exempt Status at any time in the future, 501 (c)(3) compliant language may be required. It is strongly recommended to confer with the Internal Revenue Service before submitting these articles if this is the case. From the drop down lists, indicate if the Business Representative is an Individual or a Business then indicate if you are entering information for a Director or an Incorporator.

Step 12 – Next you will need to report the Purpose of this corporation. Note: if this entity plans on applying for Tax-Exempt Status at any time in the future, 501 (c)(3) compliant language may be required. It is strongly recommended to confer with the Internal Revenue Service before submitting these articles if this is the case. From the drop down lists, indicate if the Business Representative is an Individual or a Business then indicate if you are entering information for a Director or an Incorporator.

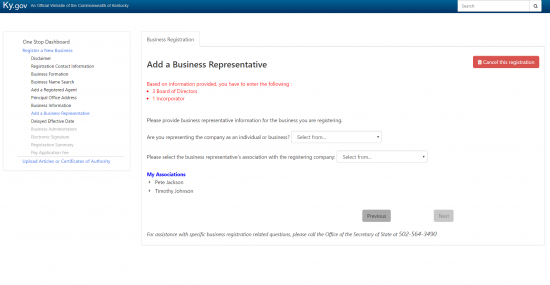

Step 13 – Next you will need to add a Business Representative for this corporation. The Kentucky Business Portal will alert you as to the type of entity you must register. In this case, we will need to report on three Board of Directors and one Incorporator. Once you define who you are entering information for, the appropriate fields will appear. You must fill in all required fields.

Step 13 – Next you will need to add a Business Representative for this corporation. The Kentucky Business Portal will alert you as to the type of entity you must register. In this case, we will need to report on three Board of Directors and one Incorporator. Once you define who you are entering information for, the appropriate fields will appear. You must fill in all required fields.

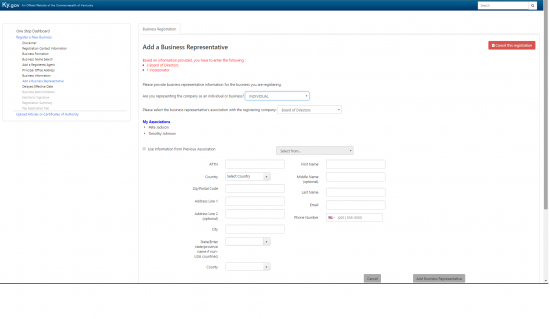

Step 14 – You must now select the Country from a drop down list, enter the Zip Code, Street Address, City, State, County, First Name, Middle Name (if applicable), Email Address, and Phone Number for each individual or business representative. Once you make an entry, you will need to select the button labeled “Save.” After entering the minimum amount of information, you may select the “Next” button.

Step 14 – You must now select the Country from a drop down list, enter the Zip Code, Street Address, City, State, County, First Name, Middle Name (if applicable), Email Address, and Phone Number for each individual or business representative. Once you make an entry, you will need to select the button labeled “Save.” After entering the minimum amount of information, you may select the “Next” button.

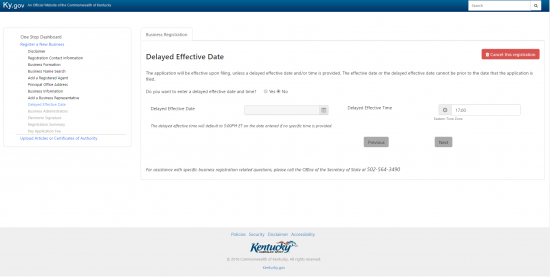

Step 15 – The next screen will be the “Delayed Effective Date” page. Here you may indicate if you would like an Effective Date that is separate from the Filing Date. If so then click the radio button labeled “Yes” then enter the Date and Time you would like these articles to go in effect. If not select the radio button labeled “No.”

Step 15 – The next screen will be the “Delayed Effective Date” page. Here you may indicate if you would like an Effective Date that is separate from the Filing Date. If so then click the radio button labeled “Yes” then enter the Date and Time you would like these articles to go in effect. If not select the radio button labeled “No.”

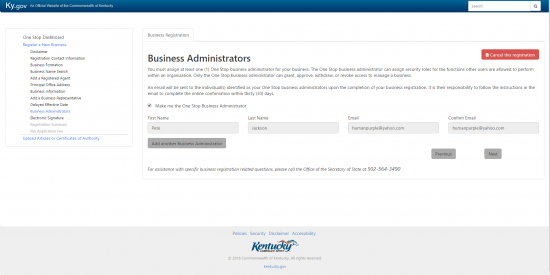

Step 16 – Next you will need to enter at least one OneStop Business Administrator. If you wish you may make this yourself by selecting the box labeled “Make me the One Stop Business Administrator.” This will auto-populate the fields necessary (if not, you may enter this information separately for anyone who consents to this role). Once you have reported the One Stop Business Administrator’s Contact Information, you may select the button labeled “Next.”

Step 16 – Next you will need to enter at least one OneStop Business Administrator. If you wish you may make this yourself by selecting the box labeled “Make me the One Stop Business Administrator.” This will auto-populate the fields necessary (if not, you may enter this information separately for anyone who consents to this role). Once you have reported the One Stop Business Administrator’s Contact Information, you may select the button labeled “Next.”