|

Louisiana Articles of Incorporation Domestic Nonprofit Corporation | Form SS395A |

The Louisiana Articles of Incorporation For Non-Profit Corporation is a template form which will outline the basic information the Louisiana Secretary of State requires of an Incorporator creating a nonprofit corporation. This document will need to be completed and will include a section for the required Affadavit and Acknowledgment of Acceptance statement for the Registered Agent. It should be noted that filing these articles does not automatically give this entity Tax Exempt status. This will require a separate process with the I.R.S. and Incorporators should seek consultation with this entity as well as appropriate professionals (i.e. attorney, accountant). It will be up to the Incorporator to make sure sure this company is formed properly and in accordance with Louisiana State Law.

If you have an active GeauxBIZ account you may file the articles online. To get such an account visit https://geauxbiz.sos.la.gov. You may submit these articles by mail to: Commercial Division, P.O. Box 94125, Baton Rouge, LA 70804-9125. The Louisiana Articles of Incorporation Domestic Nonprofit Corporation | Form SS395A must be accompanied by an affidavit of the registered agent (this requires a notary) and full payment of the $75.00 Filing Fee. This may be paid with a check, money order, or major credit card and the method used should be defined in the Transmittal Information Sheet accompanying these articles. All checks and money orders must be payable to “Secretary of State.” Once payment has been accepted and the articles are successfully filed you will receive a certified copy of the articles you have submitted. This and the Certificate of Incorporation must be submitted to the Office of the Recorder within thirty days.

How To File

Step 1 – Obtain the PDF Louisiana Articles of Incorporation Domestic Nonprofit Corporation by downloading it here: SS95A. You may also obtain this by selecting the “Download Form” link above. Clicking on either will give a choice to open the document or save it. It is recommended to download it. You may use a PDF program to enter the information then print it or you may print it then enter the information via type writing or printing (be neat).

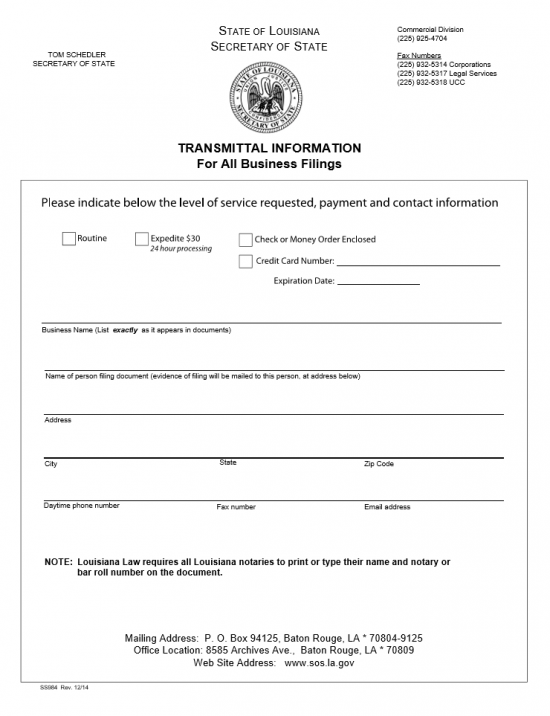

Step 2 – The first page, Transmittal Information, must be attended to before sending this. On the first line, indicate if you would like expedited service or not. The expedited processing will cost an additional $30.00 but will guarantee a turnaround time of 24 hours after receipt in filing these articles. If you do not need this service then place a check in the box labeled “Routine.” If you do wish to expedite this filing to 24 hours then place a check mark in the box labeled “Expedite $30.00.” Next you will need to indicate if you are paying all applicable fees by Check/Money order or by Credit Card. If by Check/Money Order mark the box labeled “Check or Money Order Enclosed” and make the payment payable to “Secretary of State.” If paying by Credit Card, then place a mark in the box labeled “Credit Card Number” and report the Credit Card Number and Expiration Date on the spaces provided.

Step 3 – On the line labeled “Business Name” list the business entity filing these articles. Then, on the line below it, enter the Name of the individual physically filing these documents. The next two lines are reserved for the Address (Building Number, Street, Site Number), City, State, and Zip Code of the individual filing these articles. The last line will require the submitter’s Daytime Phone Number, Fax Number, and Email Address.

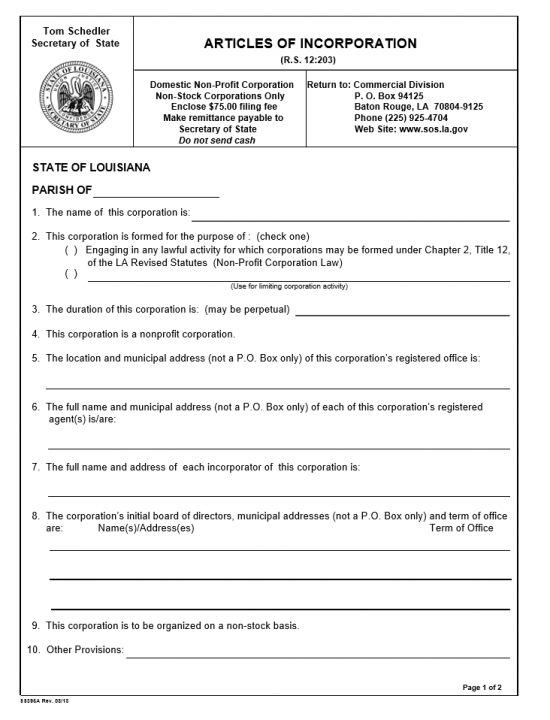

Step 4 – The first line of the second page (titled “Articles of Incorporation”) will require the County or Parish the entity being created is located in. Enter this on the blank space next to the words “Parish Of”

Step 5 – In the second item, you must indicate why this corporation is being formed. That is, its purpose. If the purpose falls under the purposes listed under LA Revised Statutes Chapter 2, Title 12 then you may place a check mark in the first parenthesis. If there is a limitation or specific purpose to this corporate entity’s activities/goals then place a check mark in the second parenthesis and enter the specific or limiting purpose on the blank line provided.

Step 6 – The third item requires that if any Date of Dissolution or Termination of this corporation’s lifespan is intended, then it must be reported on the blank space provided. If there is no real Termination Date of this corporation’s activities or existence then leave this line blank.

Step 7 – The fourth item will bind these articles and the entity being formed to operating as a nonprofit corporation in the State of Louisiana. Its activities will be limited to the laws and definitions listed in Louisiana State Law.

Step 8 – Next, in the fifth item, report the location (physical address) of the Registered Office of this entity on the space provided. Here, the Street Address may not be a P.O. Office Box, it must be a Building Number, Street, and Suite Number followed by the City, State, and Zip Code. Do this on the blank line provided in this item.

Step 9 – In the sixth item, report the Full Name and Street Address of the corporation’s Registered Agent on the blank line in this section. All Registered Agents must be listed here. This must be a physical Street Address (Building Number, Street, Site Number) in the State of Louisiana and may not be a P.O. Box.

Step 10 – In the seventh item list the Full Name and Full Address of each Incorporator of this nonprofit corporation on the blank line.

Step 11 – Document the Initial Board of Directors as well as each one’s Term in Office. There will be several lines provided for this. On each line, for each Director, enter the Full Name, Full Address, and the Term of Office for that Director under the appropriate headings.

Step 12 – The ninth item shall bind this corporation to be formed on a non-stock basis.

Step 13 – If there are any other Provisions which must apply to this nonprofit corporation then list them all in the tenth item.

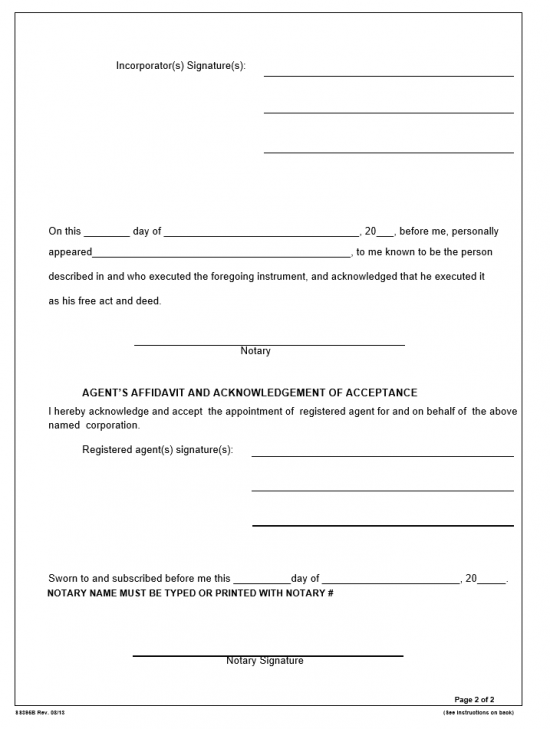

Step 14 – The next page is the Signature and Notarization page. This document must be Signed and Notarized. The signature of the Incorporator(s) and Registered Agent(s) must be made in the presence of a Notary. The only part of this document requiring attention are the Signature Lines of the Incorporator(s) and Registered Agent(s). The Notary must identify the Date, Signature Parties, Him/Herself, and Notarize this Affidavit.

Step 15 – Once all the information has been verified as correct and you have visited a notary to finalize the affidavit attached, you may submit the Louisiana Articles of Incorporation Domestic Nonprofit Corporation | Form SS395A with affidavit and full payment of the $75.00 Filing Fee. This fee must be paid in full with a check or money order made out to “Secretary of State” or via credit card at the time of submittal. You will receive a certified copy of the articles and Certificate of Incorporation once they are successfully filed.

Mail To:

Commercial Division

P.O. Box 94125

Baton Rouge, LA 70804-9125

Note: You must submit a copy of the returned Certified Louisiana Articles of Incorporation Domestic Nonprofit Corporation | Form SS395A and a copy of the Certificate of Incorporation within thirty days.