|

Massachusetts Articles of Organization Domestic For Profit Corporation | Form D |

The Massachusetts Articles of Organization Domestic For Profit Corporation are to be filed with the Secretary of the Commonwealth of Massachusetts prior to the commencement of any corporate activities. The Commonwealth of Massachusetts will require a minimum amount of information from even the most basic corporations. Such information is covered by the Articles of Organization For Profit Corporation. For instance, you will have to report the Total Number of Shares the corporation has been authorized to issue, the Par Value of each Class, the Classes themselves, and the Purpose of forming this corporation. When filling out this form you should also have the Identies and Addresses of such parties as the Incorporators, Resident Agent, Officers/Directors, and the Address of the Principal Office. This information will create the corporation in compliance with M.G.L.A. c156D § 2.02 (2004); 950 CMR 113.16.

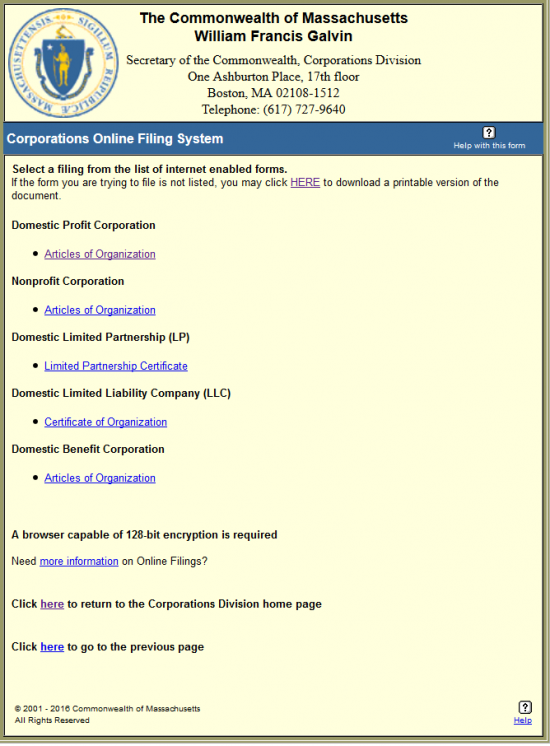

You may files these articles by mail, fax (617-624-3891), in person, or online. You may mail or bring the Articles of Organization to William Francis Galvin, Secretary of the Commonwealth, One Ashburton Place, Boston, Massachusetts 02108-1512, fax them to 617.624.3891, or file them online by visiting http://www.sec.state.ma.us/cor/corpweb/cordom/dominf.htm. In addition to the Articles of Organization you are faxing, you must create a Fax Voucher Cover Sheet. This may only be done online here: http://corp.sec.state.ma.us/corpweb/faxvouchers/faxentry.aspx. Any additional filings must contain their own fax voucher cover sheet with its own unique bar code. Regardless of how you file, Full Payment of the Filing Fee must be submitted with the articles.

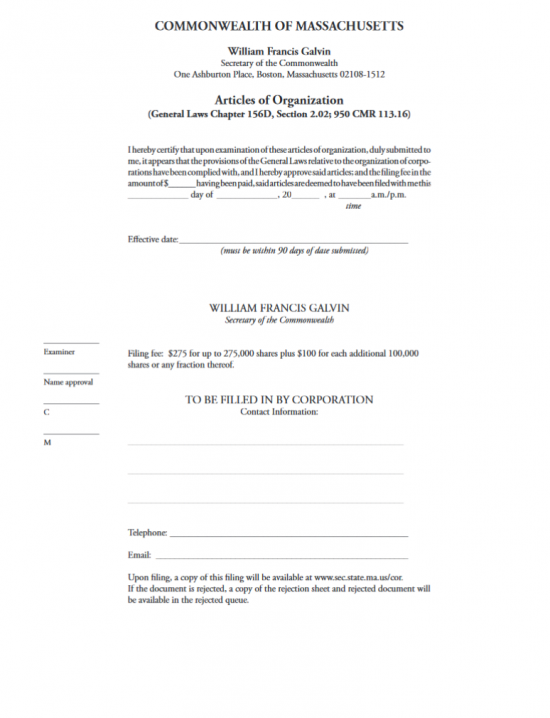

The Filing Fee for the Articles of Organization is $275.00 for the first 275,000 shares. If there are more than 275,000 authorized shares, you must add $100.00 for every additional 100,000 shares. Payment may be remitted by check, credit card, or e-check. Checks are not acceptable if filing by Fax or by Email.

How To File By Mail or In-Person

Step 1 – In Article I, document the Name of the corporation being created by this form document. This must be a unique name in the State of Massachusetts that is not in use or reserved by another business entity. It must also contain the suffix Corporation, Incorporated, Limited, Corp., Inc., or Ltd.

Step 2 – In Article II, write out several sentences regarding the reason you are forming this entity and how it will operate as a corporation in the Commonwealth of Massachusetts.

Step 3 – In Article III, describe the different classes of members (if any). Include the dsignation, election or appointment requirements, membership duration, what qualifies one for right (such as voting).

Step 4 – In Article IV, list and specifically describe any provisions that shall apply to the corporation (i.e. conduct, dissolution, limitations or priveleges of its directors or members). If there are no additional provision, write in the word “None.”

Step 5 – Article V will state the by-laws of the corporation have been adopted.

Step 6 – In Article VI, will give the opportunity to name a future effective date of these articles of organization. This may be no more than thirty days from the date of this filing. If you wish the effective date to occur upon successfully filing the Articles of Organization, leave this blank.

Step 7 – In Article VIIa, document the Street Address of the Principal Office. This may not be a P.O. Office Box and must contain the Building Number, Street, any applicable Site or Suite Number, City, State, and Zip Code.

Step 8 – In Article VIIb, report the Name, Street Address, and Mailing Address of the President, Treasurer, Clerk, and Officers (with Director Power) or Directors. There will be three columns for this Name, Residential Address, and Post Office Address. If one of these parties has a separate Mailing Address it should go in the Post Office Address column.

Step 9 – In Article VIIc, enter the last day of the month the corporation’s Fiscal Year shall end.

Step 10 – In Article VIId, report the Name and physical Address of the Resident Agent for this corporation.

Step 11 – At the end of the paragraph “I/We”, provide an explanation if any Incorporator, Officer, or Director has been conviceted of an alcohol or gaming crime in within the past ten years (of the filing date). Include the circumstances and results. If this does not apply to any of these parties, leave this blank.

Step 12 – On the last line of the paragraph beginning with the words “In Witness Whereof,” enter the Date this document is being signed by entering the Calendar Day on the first blank space, the Month on the second blank space, and Year on the third blank line. Below this each Incorporator must Sign his/her name then provide a clearly printed or typed version of his/her Name and Residential Address.

Step 13 – On the last page, locate the words “To Be Filled In By Corporation.” Here, you must enter the Contact Information for the individual who shall deal directly with the Massachusetts Secretary of the Commonwealth. On the first three blank lines, enter this individual’s Full Name and Address. Then report a reliable Telephone Number and Email Address where the Secretary of the Commonwealth of Massachusetts may reach this individual.

Step 14 – You may mail the Massachusetts Articles of Organization Domestic For Profit Corporation | Form D, any and all attachments and a check or money order in the amount of $275.00 (Filing Fee) made payable to Secretary of State to:

Secretary of the Commonwealth

One Ashburton Place

Boston, Massachusetts 02108-1512

You may also pay by Visa, MasterCard, or Electronic Check but this may only be done if faxing in the documents. You may fax all documents to (617) 624-3891 however each filing must be accompanied by a Fax Voucher Cover Letter. This may only be obtained here: http://corp.sec.state.ma.us/corpweb/faxvouchers/faxentry.aspx as the system will generate a unique bar code for your filing. Do not include a separate cover letter of your design.

How To File Electronically

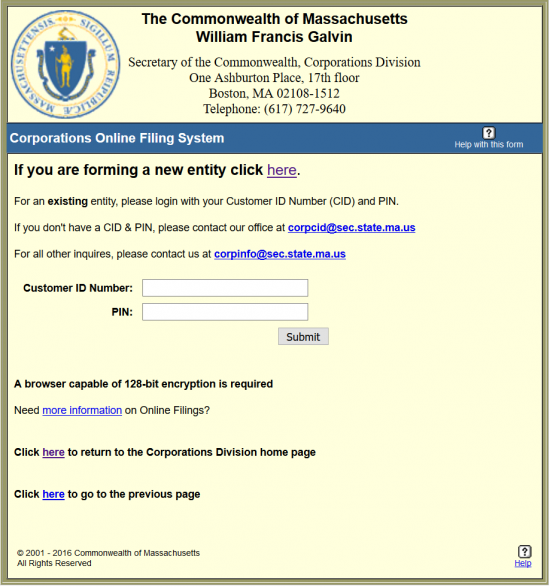

Step 1 – Go to the first page of the Massachusetts Articles of Incorporation for Profit Corporation’s online form here: https://corp.sec.state.ma.us/corp/loginsystem/login_form.asp?FilingMethod=I. If you have a Customer Id Number, you may log in by entering it in the field labeled “Customer ID Number” and your password in the text box labeled “PIN.” If not then select the link labeled “here” located on the first line of this form above the login area.

Step 2 – Select the link on the “Articles of Organization” link under the heading “Domestic Profit Corporation.”

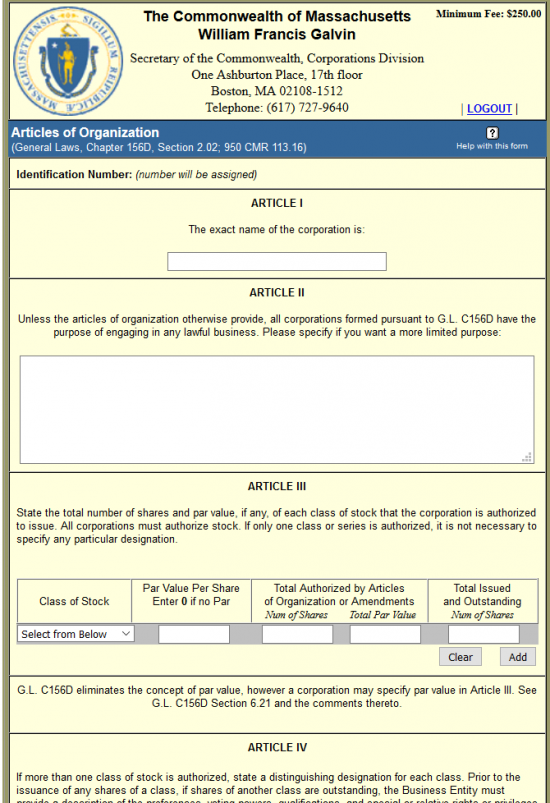

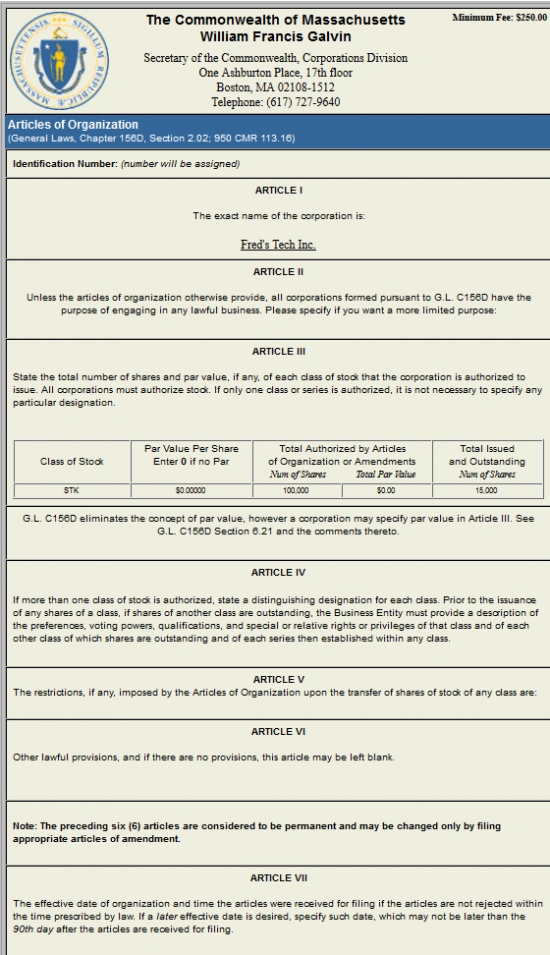

Step 3 – This page is the Commonwealth of Massachusetts Articles of Organization online form. Locate the heading “Article I,” then enter the Full Name of the corporation being formed exactly as you wish it to be registered and known in the text box provided. Your entry must contain one of the following suffixes: Corporation, Incorporated, Corp., Inc., Limited, or Ltd.

Step 3 – In Article II, you may solidify a limited purpose or method of operation in the text boxes provided. Otherwise, this entity will be created under general statutes as per G.I. C156D.

Step 4 – In Article III, you must provide the Class of Stock, Par Vaule Per Share, the total Number of Shares this corporation is authorized to issue, the Total Par Value of those Shares, and the Total Issued and Outstanding Number of Shares. You may do this via the available table. First, use the dropdown in the Class of Stock column to indicate the Class of Stock you will describe in that row. You may choose from Undesignated Stock, Common with Par, Common with No Par, Preferred with Par, or Preferred with No Par. You may only select one per row. You may add other classes by selecting the button labeled “Add” in the lower right hand corner of the table.

Step 5 – If the Class of Stock you are describing has a Par Value, enter this number in the Column labeled “Par Value Per Share.” You must enter a “0” if the stock class has no par value.

Step 6 – Next, in the column labeled “Total Authorized by Articles of Organization or Amendments,” you must enter the Total Number of Shares this corporation is authorized to issue under the heading “Num of Shares.” Then, under the heading “Total Par Value,” enter the total Value of the Shares with Par Value.

Step 7 – In the “Total Issued and Outsanding” column, enter the Number of Shares that have been issued to stockholders. If there is only one class of stock to be described you may proceed to Article IV. If there are other classes, select the button labeled “Add” to add another row.

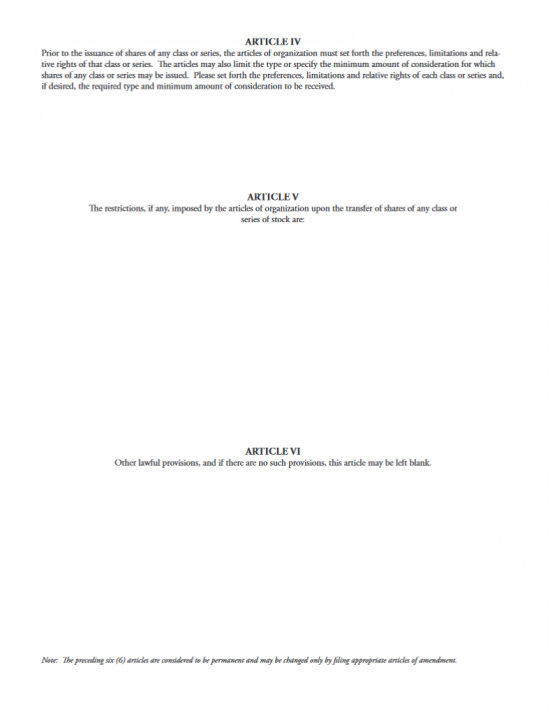

Step 8 – In Article IV, you must describe fully and specifically describe each class of stock (if there are different classes). This should include such things as preferences, voting powers, qualifications, and privledges of each class. If there are different series of classes, you must describe them as well.

Step 9 – In Article V, describe any restrictions that are imposed on the transfer or sale of stock shares. If there are no restriction you may leave this blank.

Step 10 – In Article VI, write out any additional provisions that should be applied to this corporation as a result of being formed by these articles (if applicable).

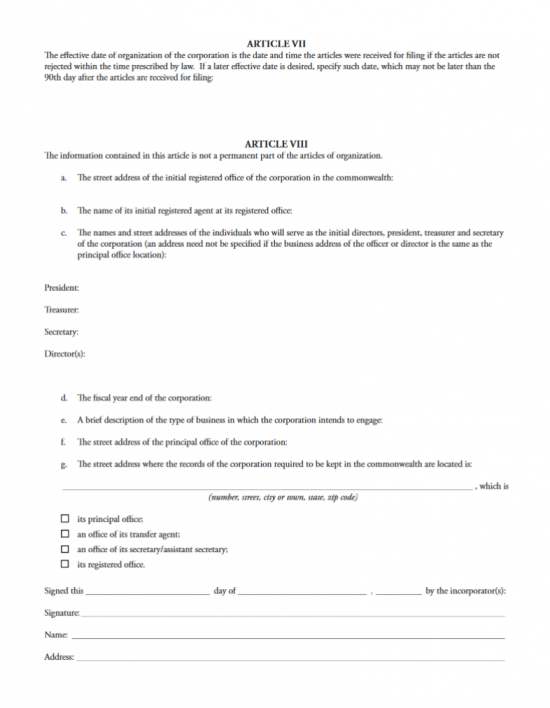

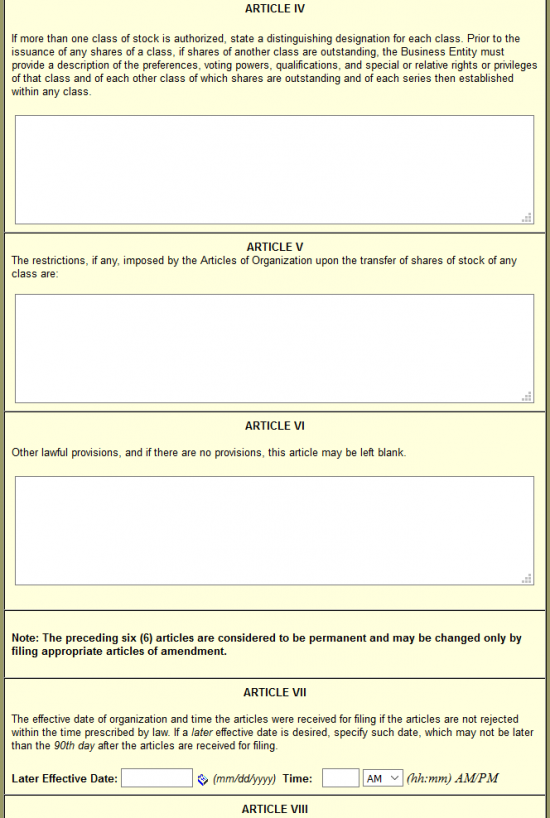

Step 11 – In Article VII, you will have the option to define an Effective Date and Time that differs from the actual successful filing of these articles. You may enter a Date in the field labeled “Later Effective Date” that is no more than 90 days after the date of filing (mm/dd/yyyy) and then enter the Time. Note whether it is AM or PM by selecting the appropriate choice from the drop down provided.

Step 12 – In Article VIII, enter the Full Name of the Initial Registered Agent in the field labeled, “Name.”

Step 13 – In the field labeled “No. and Street” enter the street address (physical location) of the Registered Agent. If there is a Site Number, you may use the field below this to enter it. This may not be a P.O. Box.

Step 14 – Next, you must report the City, State, Zip Code, and Country of the Initial Registered Agent’s Street Address.

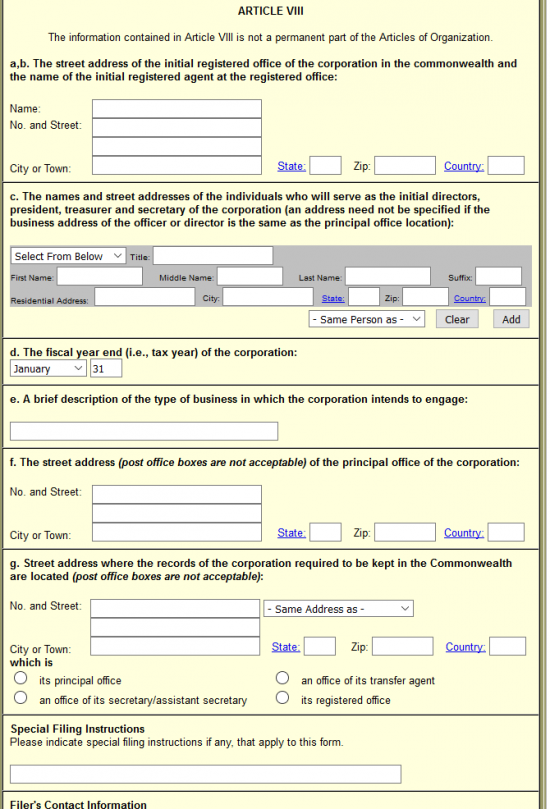

Step 15 – In Article VIIIc, you must enter the Full Name and Address of the corporate Officers. Do this by locating the greyed out area with the white text boxes. First use the dropdown menu labeled Title to select one of the following: President, Vice President, Director, Treasurer, Secretary, Assistant Secretary, Other Officer, CEO or CFO. At a minimum, there must be a President, Secretary, and Treasurer or appropriate Directors.

Step 16 – Next, enter the First Name, Middle Name, Last Name, and any applicable Name Suffix for the Officer you are entering information for in the appropriate text boxes.

Step 14 – Enter the Officer’s Street Address in the text box labeled “Residential Address,” then enter the City, State, Zip Code, and Country of that officer. When you are ready, select the word “Add” to finalize the entry.

Step 15 – In Article VIIId, use the dropdown menu to select the month then enter the Calendar Date of the end of this corporation’s fiscal year.

Step 16 – In Article VIIIe, write out a description of what business this corporation will engage in in the text box provided.

Step 17 – In Article VIIIf, report the Street Address of this corporation’s Principal Office. This may not be a Post Office Box as it must be the physical location where this corporation will be conducting business. Enter the Street Address in the text box labeled “No. and Street.” Then enter the City, State, Zip Code, and Country where this corporation’s Principal Office Address is located in the appropriate text fields.

Step 18 – In Article VIIIg, in the box labeled “No. and Street,” enter the Buidling Number and Street where this corporation will store its records (if this is a previous address, such as Principal Office or Registered Agent, you may select this to be autofilled in the dropdown menu next to this field. Below this is a text box where you may fill in the Site Number. Then enter the City, State, Zip Code, and Country in the appropriate boxes.

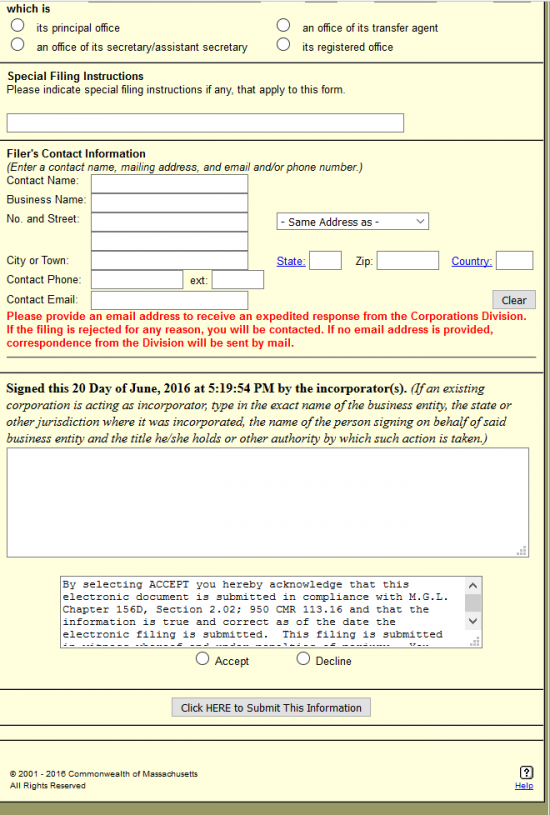

Step 19 – Use the radio buttons to indicate if this is the Prinicpal Office, an Office of its Secretary/Assistant Secretary, Office of the corporation’s Transfer Agent, or its Registered Office by clicking the appropriate one.

Step 20 – You may include additonal filing instructions in the text box located below ARticle VIIIg, under the heading “Special Filing Instructions.”

Step 21 – In the section labeled, “Filer’s Contact Information,” the contact information for the individual who is submitting this form to the Secretary of the Commonwealth of Massachusetts must be entered. Enter the Full Name of the individual who will receive all queries from the Secretary of the Commonwealth of Massachusetts in the field labeled “Contact Name.” If there is a Business where the contact is located, then enter the Name of this Business in the box labeld “Business Name.”

Step 22 – You may autofill this Address if it is identical to one of the previous addresses entered by selecting it from the drop down menu to the left of the text box labeled “No. and Street.” There will also be three fields to enter the City, State, Zip Code, and Country where the submitter of these articles may be reached.

Step 23 – Report the Phone Number of the submitter and corporate contact of these articles in the text field labeled “Contact Phone.” Then enter the “Contact Email.”

Step 24 – Finally below the paragraph starting with the words “Signed this…” each Incorporator must provide his/her electronic signature by typing his or her Full Name in the text box provided. Then, select the radio button labeled “Accept” beneath the aknowledgment statement. You may then select the button labeled “Click HERE to Submit this Information.” This will allow you to proceed to an area where you may give a final review and make payment arrangements.

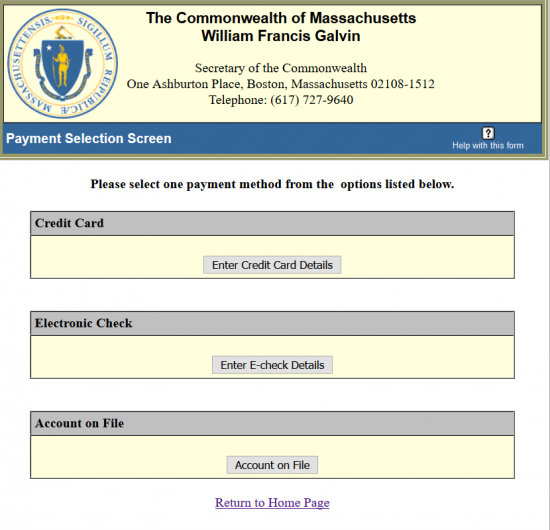

Step 25 – The next page will give you an opportunity to review the information you have just entered. Select the submit payment button at the bottom of the page.

Step 26 – Now you will be given a choice of payment options. Do this by selecting the button under the heading you wish to use. You may pay by Credit Card (Mastercard, Visa,), Electronic Check, or the Account on File. The total filing fee required will be $265.00 (Filing Fee: $250.00 + Expedited Service Fee $15.00).