|

Maryland Articles of Incorporation for Tax-Exempt Religious Corporations |

The Maryland Articles of Incorporation for Tax-Exempt Religious Corporations is a standardized form required by the Maryland Department of Assessments and Taxation. It should be noted that other governing entities, such as the Internal Revenue Service, will have their own interests in the formation of this type of entity. As such, it is very important to make sure you are fully abreast of all legal requirements placed upon incorporators of tax exempt religious corporate entities in order to remain in compliance with State and Federal Laws. Generally, it is considered wise to consult an appropriate professional such as an attorney before filing such documents.

The Filing Fee for the Articles of Incorporation for Tax-Exempt Religious Corporation is $120.00. This is the minimum amount that must be received when filing these articles by mail or in person (at State Department of Assessments and Taxation, Charter Division, 301 W. Preston Street, 8th Floor, Baltimore, MD 21201-2395). It should be noted that it generally takes eight weeks to complete the filing process however one can expedite this to 7 days through expedited service. This will require an additional $50.00 processing fee payment.

How To File by Mail

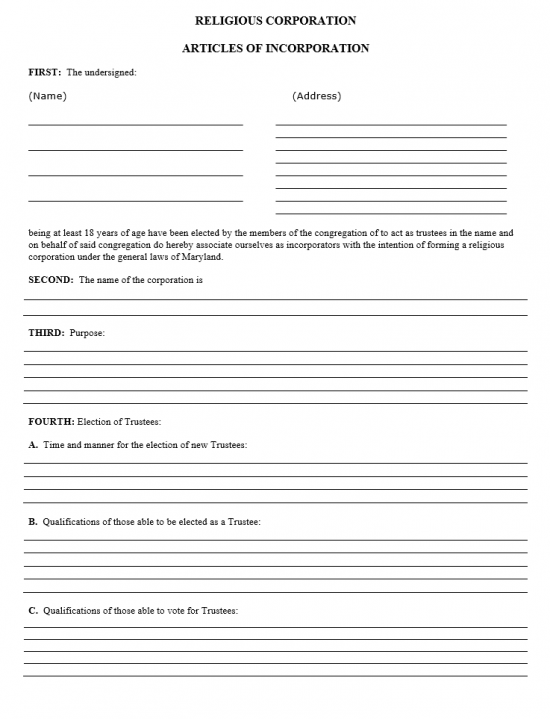

Step 1 – Download the Maryland Articles of Incorporation for Tax-Exempt Religious Corporations by selecting the link labeled “Download Form” just above this statement or the button labeled “Download PDF” at the top of the page. You will have a choice between opening or downloading this file. You may fill this out on the screen then print it provided you have a PDF program or an appropriate browser or you may print this form then use a type writer. Do not fill out by hand.

Step 2 – In the First Article, you must provide a list of the Trustees and their location. This will be done in the two columns below the words “The undersigned.” Enter the Full Name of each Trustee in the (Name) column and, on the corresponding lines, write out the Full Mailing Address for that Incorporator.

Step 3 – Next, document the Full Name of the religious corporation being formed. This must be a unique Name in the State of Maryland

Step 4 – In the Third Article, you must provide the purpose of this corporation. This should be a few sentences describing why this corporation is being formed and how it will function as a religious nonprofit corporation in the State of Maryland.

Step 6 – The Fourth Article will deal specifically with how Trustees are elected. In section A, describe when and how an election of Trustees will come about. Then in section B, list the qualities of who may be elected as a Trustee. Finally in Section C, list the qualities that a voter must possess in order to cast a respectable vote for one Trustee or another at the time of election. You must be very specific here as these provisions will dictate who runs this corporation and for how long.

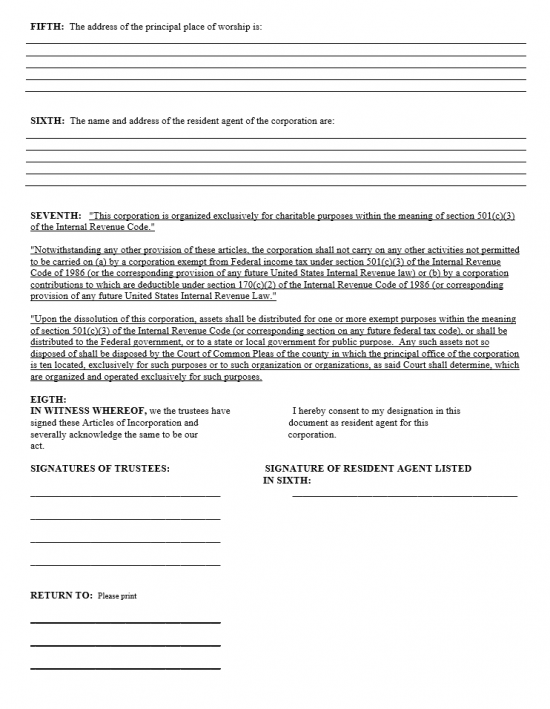

Step 7 – The Fifth Article shall require the Full Address of where the Principal Place of Worship is located. You must provide the Street Address (Building Number, Street, Site Number, City, State, and Zip Code) of the physical location. If this corporation’s Mailing Address differs from the Street Address, then provide this and label each address.

Step 8 – In the Sixth Article, report the Full Name and the Full Address of the Resident Agent. This must be an adult or other corporation that maintains a physical address in the State of Maryland.

Step 9 – The Seventh Article shall provide the 501(c)(3) language required by the Internal Revenue Service for such a corporation to form. Read this carefully as the forming entity must adhere to what is written here.

Step 10 – The Eighth Article will contain Signature Lines for the Trustees of this corporation on the left (under the words “Signature Of Trustees”). Each Trustee must sign his or her Name here. On the right will be a Signature Line for the Resident Agent listed in the Sixth Article. The Resident Agent must sign his or her Name under the paragraph beginning with “I hereby consent to my designation in this..” Finally, provide the Return Address these documents may be returned to.

Step 11 – Next you will need to arrange for payment. When filing in person, this may be in cash, check, or money order. If filing by mail, this may be by check or money order and must be made payable to State Department of Assessments and Taxation. While other fees may apply depending upon your goals and any other filings present, the minimum filing fee for the Maryland Articles of Incorporation Religious Corporation is $120.00. If you choose to expedite this to 7 day processing you must add an additional $50.00 (the total would be $170.00). If you wish to have your documents returned, you must pay an addtional $5.00. The Maryland Articles of Incorporation Religious Corporation, any necessary attachements, and Full Payment of all applicable fees may be delivered (by mail or in person) to:

State Department of Assessments and Taxation

Charter Division, 301 W. Preston Street, 8th Floor

Baltimore, MD 21201-239