|

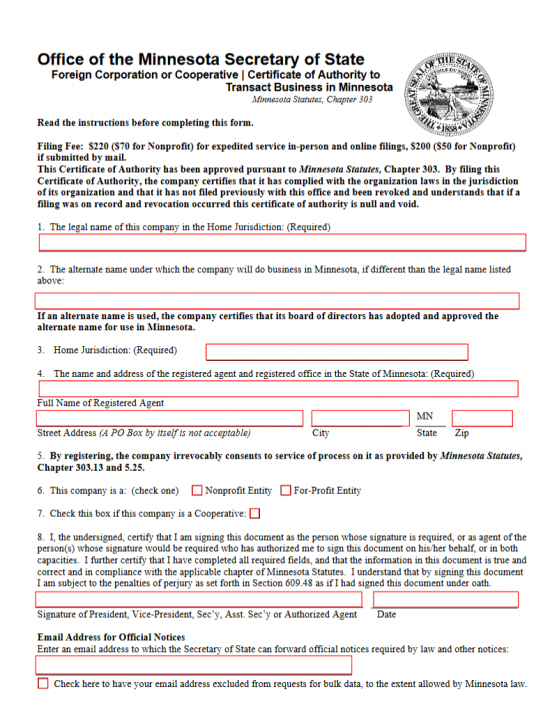

Minnesota Foreign Corporation or Cooperative | Certificate of Authority to Transact Business in Minnesota |

The Minnesota Certificate of Authority to Transact Business in the State of Minnesota must be submitted to the Minnesota Secretary of State whenever a foreign profit corporation or a foreign nonprofit corporation wishes to transact business in this state. While this form has been composed by the Minnesota Secretary of State, it may not be applicable to use for every entity type. This will only provide the basic information regarding straight forward foreign profit corporations and foreign nonprofit corporations.

The Filing Fee which is due upon receipt of this application will be determined by the method of submission and must be satisfactorily remitted in full at the time of filing. If you are submitting this application by mail then you must pay $200.00 (for profit corporations) or $50.00 for Nonprofit corporations. If, however, you are submitting this application in person then you must supply a payment of $220.00 (for profit corporations) or $70.00 (for nonprofit corporations. Whether submitting my mail or in person, you may apply at: Minnesota Secretary of State – Business Services, Retirement Systems of Minnesota Building, 60 Empire Drive, Ste 100, St. Paul, MN 55013. If you wish to, you may submit these articles online however, you must have an online account with the Office of the Minnesota Secretary of State. You may obtain such a login by visiting: http://www.sos.state.mn.us/

How To File

Step 1 – Download the Minnesota Foreign Corporation or Cooperative | Certificate of Authority to Transact Business in Minnesota by clicking this link: Download Form or the link above.

Step 2 – Locate Item 1. This will require the full legal Name of the filing entity as it appears on the Certificate of Existence issued by its home state’s governing body.

Step 3 – If the filing entity must operate under an Alternate Name in the State of Minnesota because its current Name may not be used, then you must report the assumed or Alternate Name in Item 2.

Step 4 – In Item 3, identify the jurisdiction where the filing entity was formed and originally filed its articles. There will be a box provided for this information to be entered.

Step 5 – Item 4 shall require you to report the Full Name of the appointed Minnesota Resident Agent for the filing entity in the first box. This must be an individual or organization physically located in the State of Minnesota.

Step 6 – You must also report the Physical Location of the Resident Agent in Item 4. In the first box of this section, enter the Street Address, City, and Zip Code. This must be a physical location in the State of Minnesota and may not be a P.O. Box.

Step 7 – In Item 6, you must further define the entity type by either placing a check mark in the box labeled “Nonprofit Entity” or by placing a check mark in the box labeled “For-Profit Entity.”

Step 8 – If the filing entity is a Cooperative Corporation then place a check mark in the check box in Item 7. If this is not a Cooperative Corporation then leave this check box blank.

Step 9 – In Item 8, an individual who is Authorized by the filing entity to submit these articles must provide his or her signature. This may be the President, Vice-President, Secretary, Assistant Secretary, or another Agent provided he/she has been authorized by the Board in control of this corporation.

Step 10 – In the section labeled “Email Address for Official Notices,” report a reliable E-Mail Address the Minnesota Secretary of State may use to contact the filing entity reliably. If you do not wish to receive bulk data at this address, then place a mark in the box directly below this.

Step 11 – Next organize all required documents with the Minnesota Foreign Corporation or Cooperative | Certificate of Authority to Transact Business in Minnesota. You will need to submit a $200.00 Filing Fee payment with a check or money order payable to MN Secretary of State.

Mail or Deliver To:

Minnesota Secretary of State – Business Services

Retirement Systems of Minnesota Building

60 Empire Drive, Suite 100

St. Paul, MN 55103

How To File Electronically

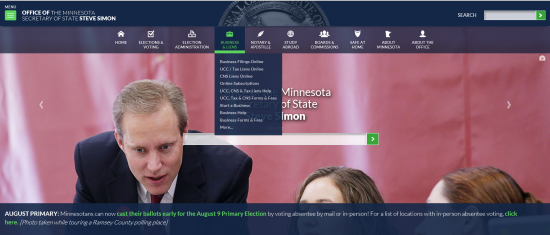

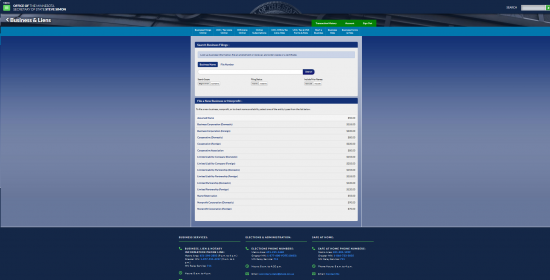

Step 1 – Open the Office of the Minnesota Secretary of State home page at http://www.sos.state.mn.us/. Then, from the menu button “Business and Liens,” select “Business Filings Online”

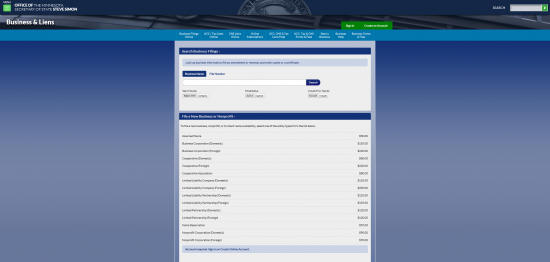

Step 2 – Select the Sign In button in the top right hand corner and Sign in to this web page. After you have signed in you will be directed to your account home.

Step 3 – From this page, select the button labeled “Business Filings Online.”

Step 4 – From this page (now that you are logged in), select the link labeled “Business Corporation (Foreign).”

Step 5 – If this will be a professional firm operating within Minnesota Statutes, Sections 319B.01 to 319B.12 then select the radio button labeled “Yes” on the bottom. If this will not be a professional firm then select the top radio button, labeled “No.” Once, you have done this, select the button labeled “Next.”

Step 5 – If this will be a professional firm operating within Minnesota Statutes, Sections 319B.01 to 319B.12 then select the radio button labeled “Yes” on the bottom. If this will not be a professional firm then select the top radio button, labeled “No.” Once, you have done this, select the button labeled “Next.”

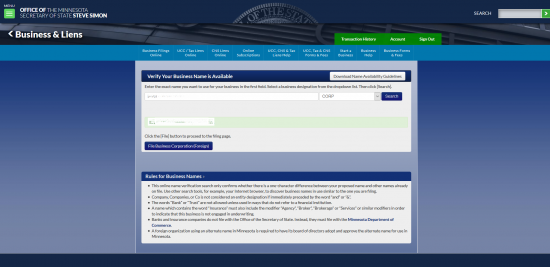

Step 6 – You must now enter the Full Name of your corporation as it appears on your Certificate of Existence in the first text field. Then in the drop down menu on the right, select the Business Designation. If this is available the site will allow you to progress with a button, “File Business Corporation (Foreign),” that appears. Once this happens, select the “File Business Corporation (Foreign)” button.

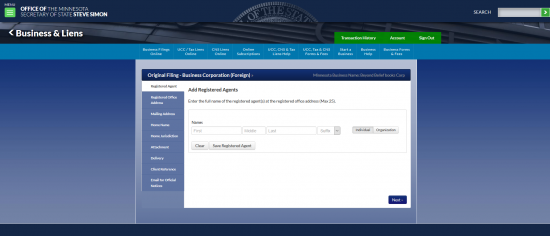

Step 7 – Next, enter the First and Last Name of the Registered Agent(s) that you have obtained for your corporation then select either “Individual” or “Organization” on the right. Once you have done this select the “Save Registered Agent” button.

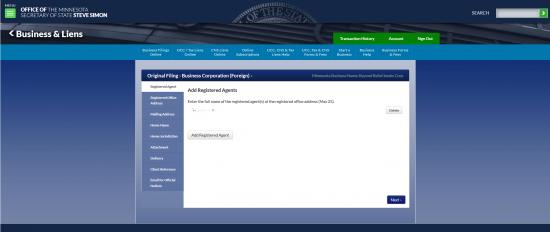

Step 8 – This next page will display the Registered Agent information you have entered. If this is correct, select the button labeled “Next.”

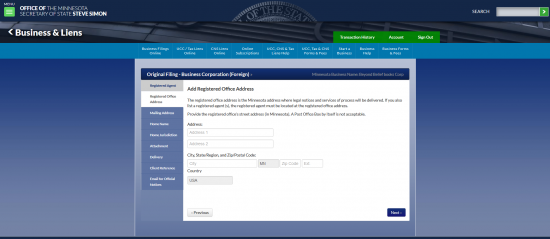

Step 9 – On this page, you will need to enter the Registered Office Address for the Registered Agent. This is where legal notices aimed at the foreign corporation will be delivered. Enter the Building Number, Street, and Suite Number of the Registered Agent in Address 1 (Address 2 may be used if there is not enough room in Address 1). Then enter the City and Zip Code of the Registered Agent’s Address. This must be a physical location and may not contain a P.O. Box. When you have done this select the link “Next.”

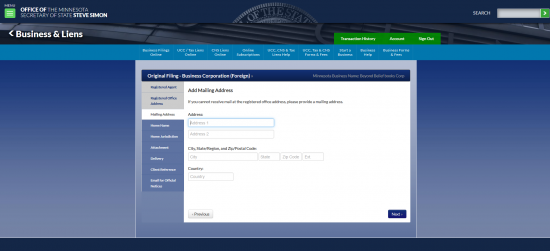

Step 10 – If the Registered Agent has a separate Mailing Address, it may be entered in this screen. Enter this information if this is the case. If this is not the case you may leave this screen blank. When you are ready select the “Next” button.

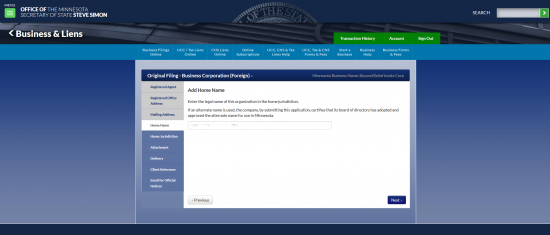

Step 11 – If you were unable to use the Name in the State of Minnesota and had to enter an Assumed Name earlier, the “Add Home Name” screen is where you must enter the Full Name of the foreign corporation as it appears on official documentation with the governing body in its home state.

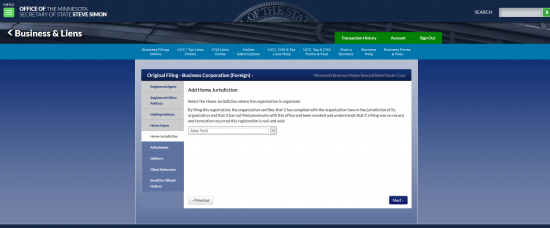

Step 12 – Select the Home Jurisdiction of the foreign corporation filing this form. That is, where is this corporation located.

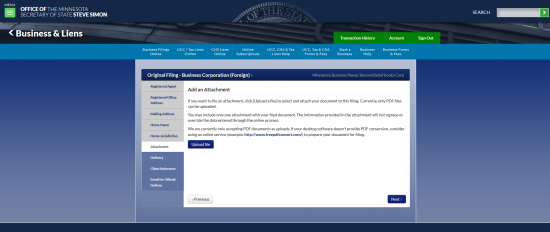

Step 13 – This page will allow you to upload any supporting documents or required documents necessary for these articles to be submitted successfully for the entity type of the foreign corporation. You may use the “Upload File” button to locate the file on your computer. This should be a PDF file. When you are done, select the button labeled “Next.”

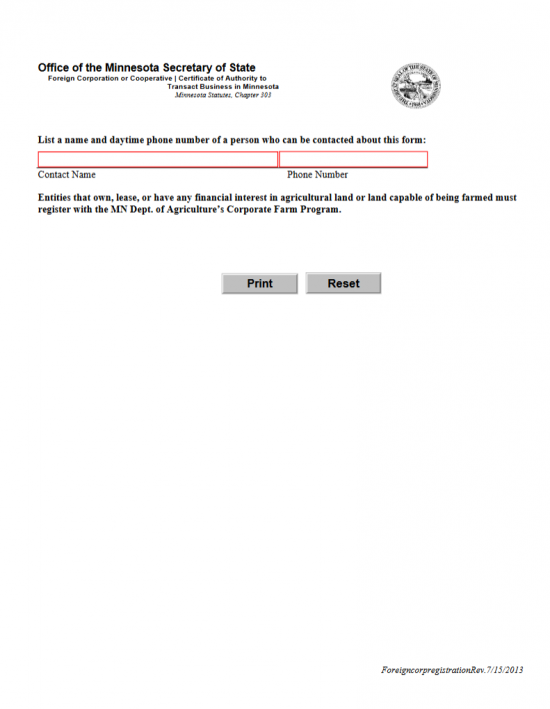

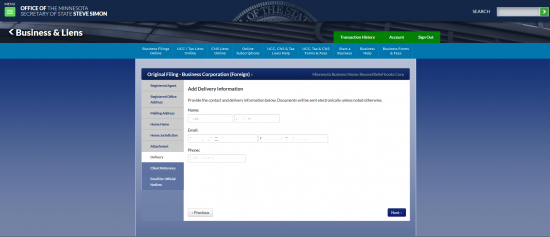

Step 14 – The next screen will require Delivery Information. This will require of the First and Last Name of the recipient on the first line, the Email Address on the second line, and the Phone Number on the third line. When your ready to proceed, select the “Next” button.

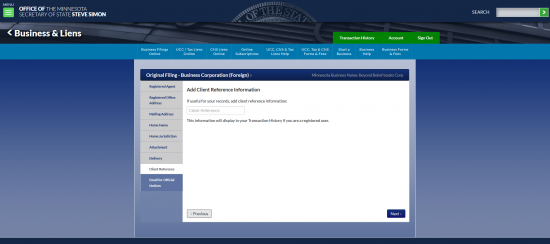

Step 15 – The Client Reference Information is an optional screen. If you wish you may enter a client reference here. When you are ready select the “Next” button.

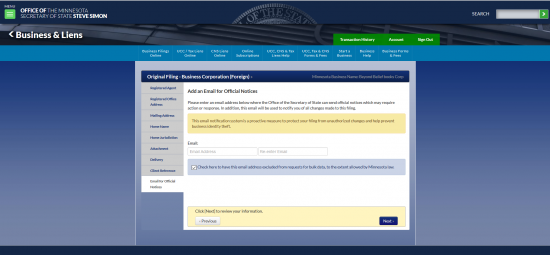

Step 16 – If you would like to receive official notices through the Minnesota Email Notification System then enter your Email in the first text field present then, in the second box re-enter your Email Address. If you would like to exclude this Email from bulk requests place a check mark in the box below this.

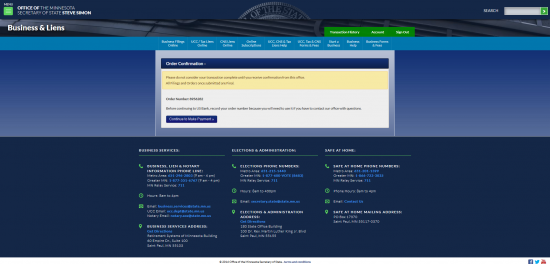

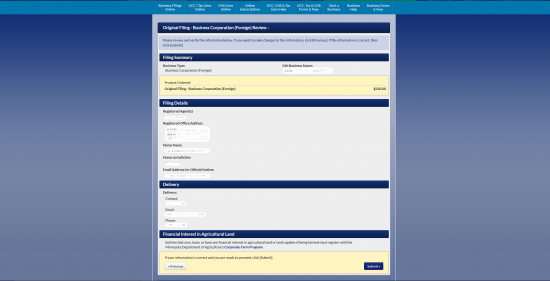

Step 17 – This is the final page of the form. Here you will be able to view all of the information you entered in the previous screens. You may use the “Previous” button to navigate to any sections necessary to edit. When ready, select the “Submit” button. This will give you an order number then you will be directed to the U.S. Bank site. Here you may create an account with the bank or make a one time payment, by following the screen prompts. Be prepared to pay the Filing Fee of $220.00