|

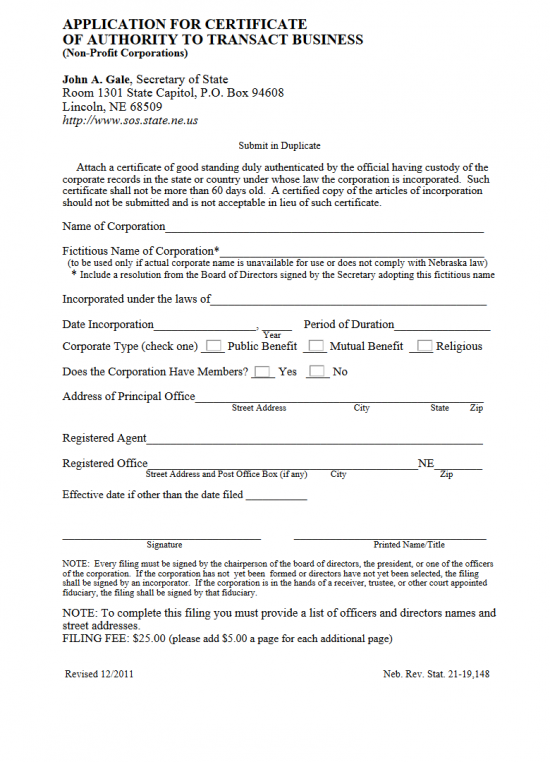

Nebraska Application for Certificate of Authority to Transact Business for a Nonprofit Corporation |

The Nebraska Application for Certificate of Authority to Transact Business for a Nonprofit Corporation is an application form made available through the Nebraska Secretary of State website. This form may be submitted electronically or by mail and represents the minimum amount of information that must be reported to the Nebraska Secretary of State when a foreign corporation wishes to operate as a nonprofit corporation in the State of Nebraska.

Several additional required documents must accompany this application depending upon the nature of the foreign entity’s corporate purpose or corporate type. Regardless of the type of paperwork that must be submitted, the filing entity must submit a Certificate of Good Standing issued by the filing entity’s domicile state and dated within sixty days of this application’s Date of Signature. It should be noted that regardless of the type of attached documents, each additional page will carry a $5.00 fee. The Filing Fee of $25.00 must also be paid in addition to this page processing fee. If submitting by mail, you may mail the submittal package to: John A. Gale, Secretary of State, Room 1301, State Capital, P.O. Box 94608, Lincoln, NE 68509 or you may visit the Nebraska Secretary of State’s site here: http://www.sos.ne.gov/business/corp_serv/corp_form.html.

How To File

Step 1 – Obtain a blank Nebraska Application for Certificate to Transact Business for a Nonprofit Corporation by selecting the link above (labeled “Download Form”). You may print this form then fill it out or you may choose a PDF program to edit this application. Make sure to use Black Ink.

Step 2 – The Identity of the filing entity must be reported on the first available blank line, labeled “Name of Corporation.” Make sure this is reported precisely as it appears on the Certificate of Good Standing being submitted.

Step 3 – If the Name of the filing entity is unavailable or not compliant with the Nebraska Corporate Act, the filing entity must operate under an assumed Name. In such a case, the filing entity must report this as well. This may be done on the blank line following the words “Fictitious Name of Corporation.” Make sure to attach a statement of intent to operate under this name and signed by the Board of Directors. If this is not the case and the original Name of the filing entity is usable, this section may be left blank.

Step 4 – On the blank line following the words “Incorporated under the laws of,” report the name of the jurisdiction where the filing entity first incorporated. This may be a country, state, or tribe. Below this, report the Date this entity became a corporation on the blank lines following the words “Date Incorporation.” You must report the Month and Calendar Date, then after the comma report the Year of Incorporation. Beside this, indicate if this corporation will expire. If so, enter the amount of time until the Termination Date occurs on the blank line following the words “Period of Duration.” If no such date exists you may write in the word “Perpetual.”

Step 5 – Next you must further define the nature of the filing entity’s operations. Locate the words “Corporate Type.” Then, select the box next to the appropriate corporate type. You may only choose one of the following: Public Benefit, Mutual Benefit, or Religious. You will need to provide the appropriate paperwork for your corporation’s nature and purpose.

Step 6 – The next line bears the question “Does the Corporation Have Members?” You may place a check mark in the box labeled “Yes” or “No” as an answer. You may only choose one.

Step 7 – The next line will require the Address of the Principal Office. On the blank line provided, report the Street Address, City, State, and Zip Code.

Step 8 – On the blank space labeled “Registered Agent,” report the Full Name of the Registered Agent who has agreed to act as such for the filing entity. This may be an adult or an organization separate from the filing entity. The filing entity may not be its own Registered Agent. Below this you must enter the Full Address of the Registered Agent. This must be a Street Address in the State of Nebraska. If there is a separate Mailing Address, include it on a separate sheet of paper that is clearly labeled.

Step 9 – The next line will allow the filing entity to choose a date within 90 days of submitting this application to be assigned corporate status. If the filing entity desires this, enter it on the line beginning with the words “Effective date if other than date filed.” Otherwise you may leave this line blank.

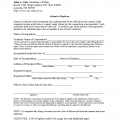

Step 10 – Finally, an authorized Officer, Director, or (in some cases) an Incorporator must sign this application. Next to this signature the authorized party must also Print his/her Name and Title.

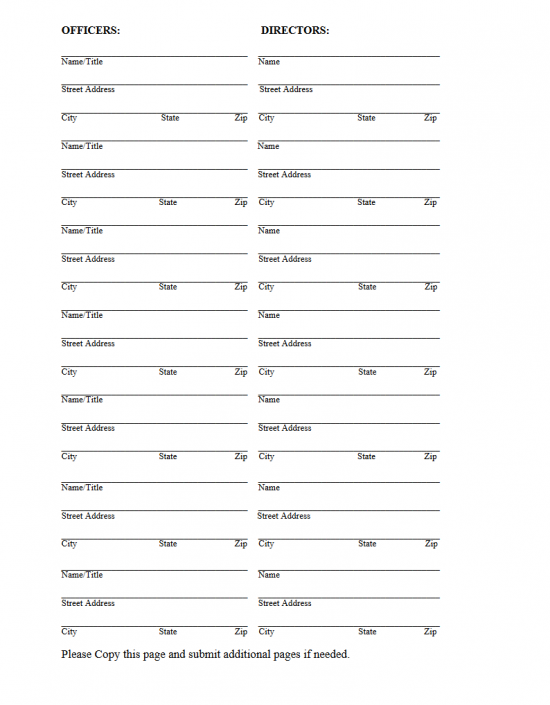

Step 11 – The next page has been provided since the filing entity must report all of its active Officers’ and Directors’ Full Name and Address. The Officers may be reported in the column on the left while the Directors may be reported on the column on the right.

Step 12 – When it is time to submit this package, you must include a check or money order made payable to the Secretary of State. This must be in the amount of $25.00 (Filing Fee) plus $5.00 for each additional page. This must accompany the Nebraska Application for Certificate of Authority to Transact Business, a Certificate of Good Standing issued within 60 days of the application date (issued by the filing entity’s home state), and all supporting documents. This may be mailed to:

John A. Gale

Secretary of State

Room 1301, State Capital

P.O. Box 94608

Lincoln, NE 68509

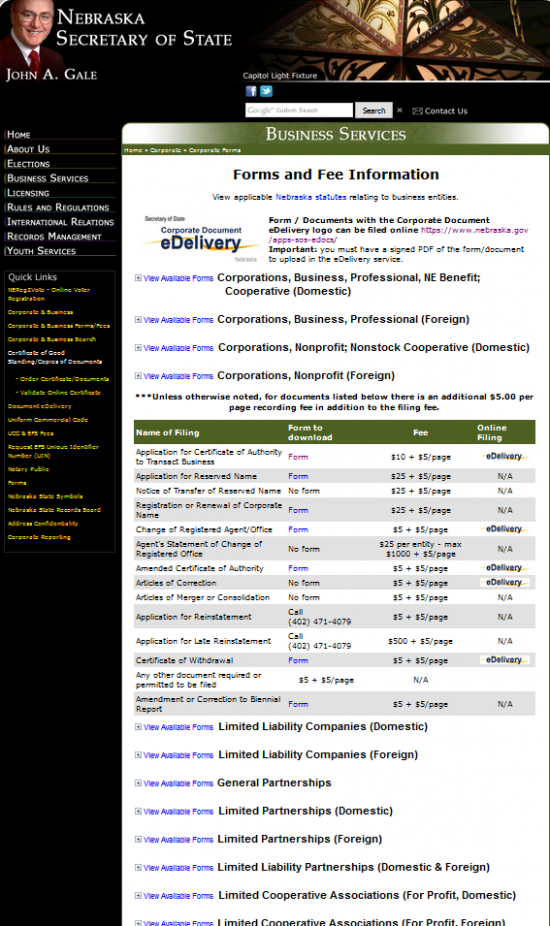

How To File Electronically

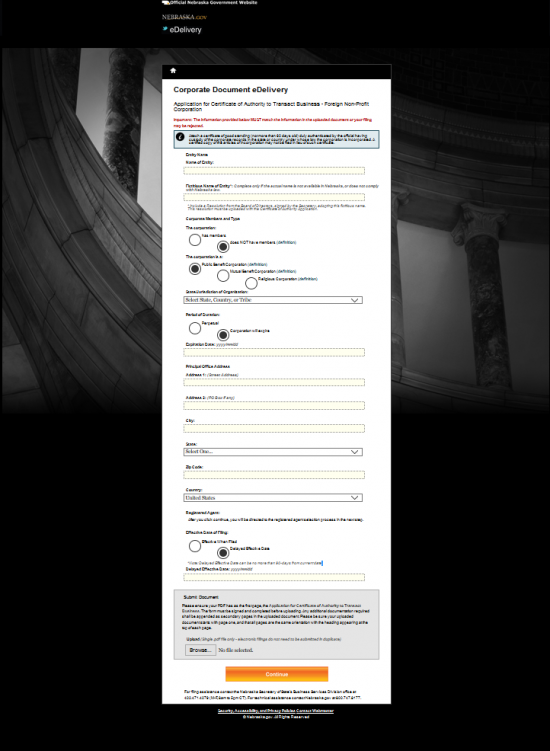

Step 1 – Go to the “Forms and Fees” page maintained by the Nebraska Secretary of State website (http://www.sos.ne.gov/business/corp_serv/corp_form.html). Here, you will find a heading labeled “Corporations Nonprofit (Foreign).” Select this link, then on the first line, “Application for Certificate of Authority to Transact Business,” select the link labeled “eDelivery.” This will direct the browser to the first page of the online form.

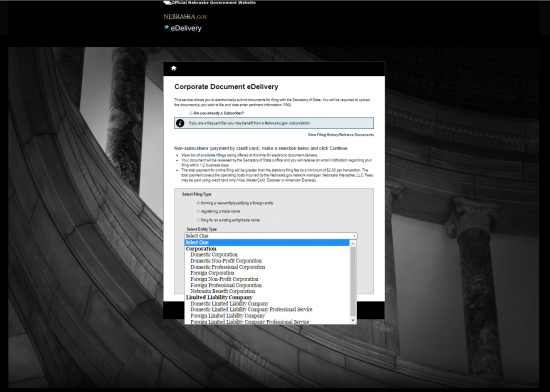

Step 2 – On the first page, select the radio button under the heading “Select Filing Type” labeled “Create a new entity/qualifying a foreign entity.” Once you do this, a drop down menu labeled “Select Entity Type” will appear. Select “Foreign Nonprofit Corporation” from this list then click on the yellow “Continue” button.

Step 3 – The first two fields of this page will attempt to define the name of the filing entity. In the first field, “Name of Entity,” report the Full Name of the filing entity as it is written on the Certificate of Good Standing you must submit with this application. If the filing entity is not allowed to use its True Name in this state, you must report the Assumed Name it will operate in the field labeled “Fictitious Name of Entity.” If the entity will operate under a Fictitious Name, you must include a signed resolution from the Board of Directors stating as much.

Step 4 – There will be two questions under the heading “Corporate Members and Type.” The first section, under the words “The corporation,” indicate if this corporation has members by selecting the first button. If this corporation does not have members, you must indicate this by selecting the second button. You may only choose one of these radio buttons.

Step 5 – Next, under the words “The corporation is a,” you must define the type of nonprofit the filing entity operates. If this is a Public Benefit Corporation, then select the first radio button. If this is a Mutual Benefit Corporation, select the second radio button. If this is a Religious Corporation, select the third radio button.

Step 6 – Below this will be a dropdown menu labeled as “State/Jurisdiction of Organization.” Select the jurisdiction the filing entity operates in from the drop down list.

Step 7 – If the filing entity has a defined lifespan, then report this in the “Period of Duration” section. Do this by selecting the second radio button, “Corporation will expire,” then entering the Date of Termination in the field that appears (labeled “Expiration Date”). If the filing entity has not defined its lifespan with a Termination Date, then select the first button, “Perpetual.”

Step 8 – The “Principal Office Address,” requires the Address for the filing entity’s Principal Office. Report the Building, Street Number, and Suite Number in “Address 1.” If you require a second line, you may continue in “Address 2.” The next field will require the “City.” Below the “City” field will be a dropdown list where you must select the state or province of the Principal Office. Finally, enter the Zip Code in the appropriately named field and select the applicable country from the drop down menu labeled “Country.”

Step 9 – In the “Effective Date of Filing,” you may either choose the first radio button to indicate that corporate status should be granted upon approval of this application or you may choose the second radio button should you wish to name a specific Date of Effect. If you require a future date, enter it in the field labeled “Delayed Effective Date.”

Step 10 – The final section of this page will give you the opportunity to upload a PDF document which should bear all the documents required by this application process as one PDF. There will be a cost of $5.00/page submitted. Once this is done, select the “Continue” button at the bottom of the page. This will take your browser to the “Registered Agent” page.

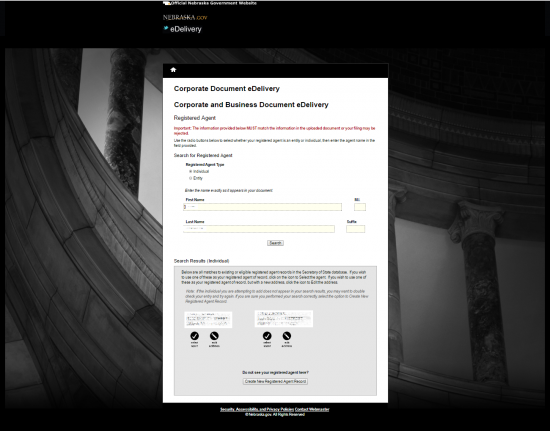

Step 11 – Locate the “Search for Registered Agent” section then select the appropriate type of Registered Agent who has agreed to receive service of process documents issued to the filing entity on behalf of the filing entity. You will need to enter the Full Name of this party in the field that appears, then select the “Search” button.

Step 12 – The results of your search will be displayed on this page. Each result will have a round button with a check mark on it. If you see the Registered Agent the filing entity has obtained then select the check mark below this entry. This will automatically direct the browser to the final page. If the Registered Agent is not present then select the button labeled “Create New Registered Agent Record.” For our purposes select the button labeled “Create New Registered Agent Record.”

Step 13 – If you must enter a new Registered Agent, make sure that your information is up to date and accurate. A pop up window which will allow for the Full Address of the Registered Agent to be entered. There will be an Address 1 and Address 2 field for the Building Number, Street and Suite Number, a field to report the City, and a field for the Zip Code. The Registered Agent must be in the state of Nebraska and this field is autopopulated. Once you have entered this information, select the word labeled “Finish.”

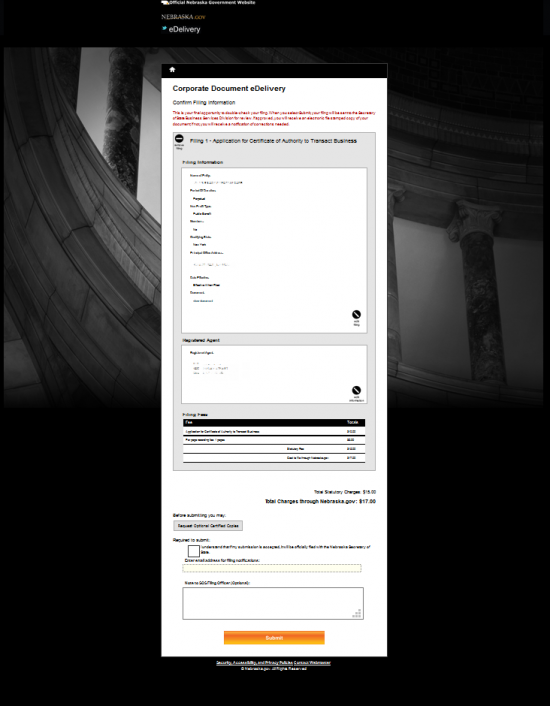

Step 14 – The final page will allow you to review the information you have entered. You may choose the edit button of a particular section in order to navigate to that area should you need to update or correct the information. This page will also display the calculated Filing Fee (including the $5.00/page fee). You will be given the option to order Certified Copies by selecting the “Request Optional Certified Copies” button ($10.00/copy). When ready, you must place a check mark next to the acknowledgement statement beginning with the words “I understand…” Below this, enter your email address in the field provided. If you wish to write any notes to the Secretary of State reviewer you may do so in the text box labeled “Note to SOS filing officer.” Once you have finished reviewing this page and entering the appropriate information, you may select the “Submit” button which will direct the browser to an area where you may enter your payment information. You may pay for this with a credit card.