|

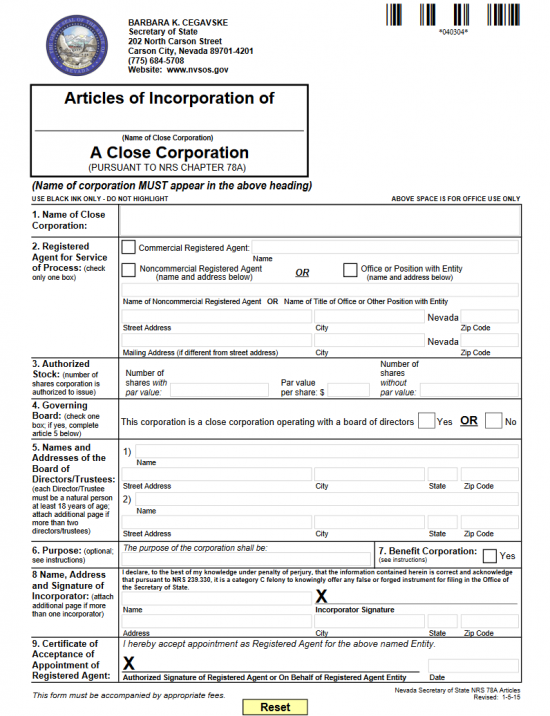

Nevada Articles of Incorporation of a Close Corporation |

The Nevada Articles of Incorporation of a Close Corporation is provided as part of an incorporation packet by the Nevada Secretary of State. This will include several forms, some of which are required to be filed when incorporating with the Nevada Secretary of State. From this packet, the Nevada Articles of Incorporation of a Close Corporation and the Customer Order Instructions must be submitted simultaneously. If you are paying with a credit card, you must submit an ePayment Checklist containing your payment information. The Registered Agent Acceptance Form may be submitted at the time of filing or beforehand by the Registered Agent. If the Incorporators or Registered Agent have not submitted this form at the time of or before filing, this may cause a delay or even denial. Other documents may also be necessary depending on the nature of the close corporation (i.e. it is a professional close corporation which falls in the jurisdiction of governing bodies such as a licensing or regulatory boards).

This may be filed online as a domestic corporation with the appropriate PDF attachments or it may be filed as is with the necessary paperwork by mail. If you are expediting, you will have the option between two locations (Carson City or Nevada). This package must be accompanied with a full payment for all applicable fees. Filing Fees will be determined by the total dollar amount of stock the close corporation has available. Close corporations with less than $75,000.00 worth of stock will need to pay $75.00 to file. If the amount is over $75,000.00 and under $200,000.00, a $175.00 fee will need to be paid. For corporations with between $200,00.00 and $500,000.00 worth of stock available, a fee of $275.00 will be assessed. Corporations with over $500,00.00 and under $1,000,000.00 in stock will need to pay $375.00. If there is more than $1,000,00.00 of authorized shares, the entity will need to pay a base of $375.00 and an additional $275.00 for every $500,000.00 worth of stock above this (including an increment there of). The Filing Fee does not include any other services. Thus, if you wish to expedite the filing, you must indicate the level and add the expediting fee to your payment. Similarly, you may order a certified copy for an additional $30.00. All filings may be mailed to: Secretary of State, New Filings Division, 202 North Carson Street, Carson City, NV 89701-4201.

How To File

Download Form

Step 1 – Download the complete Nevada Articles of Incorporation Packet. This will contain all the documents provided by the Secretary of State and represent the minimum amount of information that must be filed. You may do this by choosing the “Download Form” link above or by clicking on this link: Nevada Articles of Incorporation of a Close Corporation.

Step 2 – Locate the first page of this PDF. This is the Articles of Incorporation. Now, list the Full Name of the Close Corporation in Article 1. Make sure to include the suffix of incorporation (i.e. Corporation, Incorporated, Corp., Inc., etc.).

Step 3 – The first part of Article 2 will require a definition of the Registered Agent. That is what type and who. If you have obtained a commercial Registered Agent then place a check mark in the first check box and enter the Full Name of the commercial Registered Agent in the text box on this line. If the Registered Agent is noncommercial then skip the first line and choose one of the entity types on the second line. You may place a check mark either in the box labeled “Noncommercial Registered Agent (name and address below)” or the box labeled as “Office or Position with Entity (Name and Address Below). You may only choose one. If you have identified a noncommercial Registered Agent then proceed to the next step. If you have defined your Registered Agent as commercial then proceed to Step 6.

Step 4 – Locate the box, in Article 4, labeled “Name of Noncommercial Registered Agent or Name of Title of Office or Other Position with Entity,” then enter the Name of the noncommercial Registered Agent for the forming corporation.

Step 5 – Below the noncommercial Registered Agent’s Name, enter the actual geographical location in the box labeled “Street Address.” You will need to enter the City and Zip Code as well. If the noncommercial Registered Agent receives mail elsewhere, you must report this on the line beginning with box labeled “Mailing Address (if different from street address).”

Step 6 – In the Third Article, “Authorized Stock,” you must report how many Shares with Par Value this corporation may dispense in the first box then the Par Value Per Share in the second box. The third box of this article will require the total Number of Shares without Par Value be documented.

Step 7 – Article 4 will require you to indicate if the close corporation being formed by these articles will operate with or without a Board of Directors. If so, place a check in the box labeled “Yes.” If not, place a check in the box labeled “No.”

Step 8 – If you have answered “Yes” to the question in Article 4, then you must fill out Article 5. List the Full Name and Full Address of each Director or Trustee in the spaces provided. There will be enough for two entries, however if there are more than two Directors/Trustees then you must continue this list on a separate sheet of paper as each one must be documented as such with the Nevada Secretary of State. If you must continue this list on a separate sheet of paper make sure it is clearly labeled.

Step 9 – You must define the Purpose of the corporation being formed in the first box of Article 6. This will be a statement or statements that define how the forming corporation shall conduct its business in the State of Nevada. Note: If this is to be a Benefit Corporation, make sure to address this in the Purpose.

Step 10 – Indicate if this is a Benefit Corporation by checking the “Yes” box in Article 7. If this is not a Benefit Corporation then leave Article 7 blank.

Step 11 – In Article 8, the submitter of these articles must Print his/her Full Name in the box labeled “Name.” Then enter his/her Address on the next line. Finally, the Incorporator Signature line (beginning with the big “X”) The Incorporator must sign his/her name.

Step 12 – Article 9 must be signed by the Registered Agent of this forming close corporation. This signature must also be dated at the time of signing in the box labeled “Date.”

Step 13 – You must now calculate the Filing Fee for these articles by gathering your stock information. The total value of the authorized stock this corporation must be assessed then located in the filing bracket. The Filing Fee is $75.00 if there is less than $75,000.00 worth of stock. The Filing Fee will be $175.00 if the total value is between $75,000.00 and $200,000.00. The Filing Fee will be $275.00 if the total value is between $75,000.00 to $200,000.00. The Filing Fee will be $275.00 if the total value is between $200,000.00 and $500,000.00. The Filing Fee will be $375.00 if the total value is between $500,000.00 and $1,000,000.00. If the total value is above $1,000,000 the Filing Fee will be $375.00 plus an additional $275.00 for ever $500,000.00 above $100,000.00. The maximum Filing Fee allowed is $35,000.00. If you have calculated such a fee, you should contact the Nevada Secretary of State.

Step 14 – Fill out the Customer Order Instructions. This will give you the opportunity to expedite the service or request a certified copy. You will also be able to define your payment instructions. The expediting service must be paid for at the time of filing along with the Full Filing Fee you calculated. You may have the articles expedited to 24 hour service for $125.00, 2 hour service for $500.00, or 1 hour service for an additional $1,000.00. You will have to submit a 1 or 2 Hour Expedite Customer Order Instructions should you wish either of the last two expedite levels. If you wish to order You will receive a stamped copy but may order one for an additional $30.00. All checks should be made payable to “Secretary of State.” If you are paying by credit card, you must also submit the ePayment checklist with your credit card information.

Step 15 – When it is time to mail in the Nevada Articles of Incorporation for a Close Corporation, its supporting paperwork, and Payment, you may do so at:

Secretary of State

New Filings Division

202 North Carson Street

Carson City, NV 89701 – 4201

If expediting you may also mail to:

Secretary of State – Las Vegas

Commercial Recordings Division

555 East Washing Ave., Suite 5200

Las Vegas, NV 89101