|

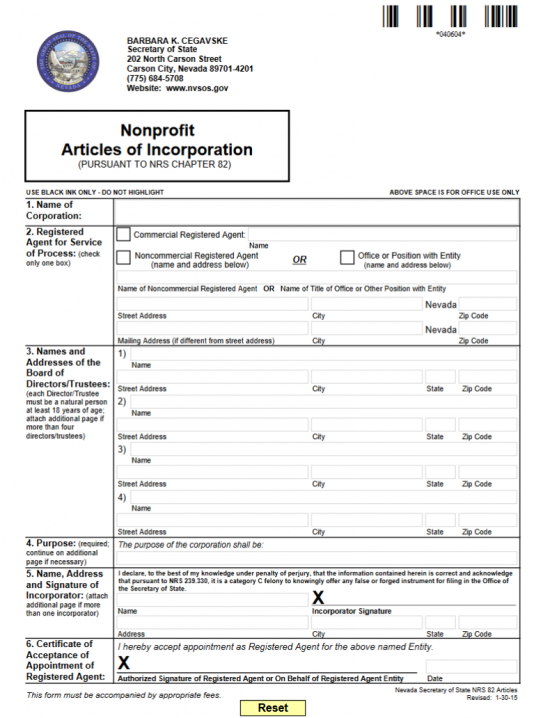

Nevada Nonprofit Articles of Incorporation |

The Nevada Nonprofit Articles of Incorporation is the form provided by the Nevada Secretary of State to Incorporators wishing to form a nonprofit corporate entity in this state. This is a required filing which must be approved by the Nevada Secretary of State before the entity can participate in any corporate transactions. It is important to be aware that certain conditions will apply to nonprofit corporations depending upon the nature of their business or corporate purpose at the time of filing. For instance, if this entity intends to have an effect on public elections, it must submit a list of its Officers’ Names and Addresses in addition to the minimal requirement of reporting its Directors/Trustees. Seeking Tax Exempt Status will also be affected and affect this filing. If the nonprofit corporation intends on applying for Tax-Exempt Status, it is strongly recommended the Incorporators consult with the Internal Revenue Service prior to filling out and filing this form. The Internal Revenue Service will have its own process which must be satisfied when an entity wishes to obtain Tax Exempt Status. The Internal Revenue Service is the only governing body which can grant Tax Exempt Statu. Usually, when forming any such entity, Incorporators should consider consulting with a qualified professional, such as an attorney or an accountant.

The Nevada Nonprofit Articles of Incorporation will need to be filed after or with the Registration Agent Acceptance form. The Registered Agent may submit this form prior to the Nevada Nonprofit Articles of Incorporation but it must be approved beforehand or there may be a delay in processing or even cause a rejection. The Customer Order Instructions Form must also be submitted if one wishes Regular or 24 hour Expedited Service. If one wishes 1 hour or 2 hour expediting for their filing, then the 1 Hour – 2 Hour Customer Order Instructions must accompany te Nevada Nonprofit Articles of Incorporation. If you are paying with a credit card, you must also submit the ePayment Checklist form. The Filing Fee for the Nevada Nonprofit Articles of Incorporation is $50.00. Additional services will require additional payments. For instance it will cost an additional $1,000.00 for one hour expediting, $500.00 for two hour expediting, or $125.00 for twenty-four hour expediting. If you wish a certified copy to be mailed back with your stamped copy, you must request as much in writing and include an additional $30.00 in the total payment. You may pay these fields with a credit card, trust, balance from a previous job, or a check (make check payable to “Secretary of State”).

You may mail the Nevada Nonprofit Articles of Incorporation any and all required or relevant documents and payment arrangements for the Filing Fee and all applicable fees to Nevada Secretary of State, New Filings Division, 202 Carson City, NV 89701-4201.

How To File

Step 1 – You may download the Nevada Nonprofit Articles of Incorporation by selecting the “Download Form” link above. This is a PDF file which may be edited with a valid PDF program or it may be printed then filled out.

Step 2 – Enter the Full Name of the nonprofit corporation being formed in Article 1 (“Name of Corporation”). You must include an appropriate suffix (Corporation, Corp., Incorporated, Inc.). This must be a unique name does not mislead the public.

Step 3 – Next in Article 2, “Registered Agent for Service of Process,” check the first box if the Registered Agent you have obtained for your corporation is a commercial Registered Agent. If this is the case, you will only need to fill in the commercial Registered Agent’s Full Name in the space provided. If the Registered Agent is a noncommercial one then you may check the Second check box. If the Registered Agent is an Office or Position with Entity then place a check in the third box. If you have placed a check mark in the second or third box then you must enter the Full Name of this entity on the third line. Then on the fourth line document the actual location of the noncommercial Registered Agent. This may not be a P.O. Box as it must be where the Registered Agent may be physically found. If the noncommercial Registered Agent does have a separate address to receive mail, you must report this on the last line of this article. Each Address will have a separate box for the Street, City, and Zip Code. The State is filled in because the Registered Agent must maintain an Address in the State of Nevada.

Step 4 – The Third Article must contain the Full Name and Full Address of each Director/Trustee. The first line will be for the Name, while the second line will be for the Full Address. There is enough room to report four individuals however if there are more individuals holding such positions, you must document this on a separate sheet of paper and provide the Full Name and Full Address of each one. Make sure this is clearly labeled.

Step 5 – Document the Purpose of the nonprofit corporation in Article 4. This should be a statement(s) describing the nature of the corporation and how it will conduct its affairs in the State of Nevada. This, too, may be continued on a separate sheet of paper(s) that is clearly labeled and attached.

Step 6 – Each Incorporator who is forming this corporation must provide his/her Printed Name, Address, and Signature. This must be done in Article 5. There is enough room for one Incorporator. If there are more you may continue on a seperate sheet of paper.

Step 7 – You must have the Registered Agent verify he/she/it has accepted the responsibility of this title by signing his/her Name and providing a date for that Signature in the box labeled “Date.”

Step 8 – You must mail the Nevada Nonprofit Articles of Incorporation and its supporting paperwork and either the Customer Order Instructions form or 1 Hour – 2 Hour Expedited Customer Order Instructions form to the Nevada Secretary of State with Full Payment for the Filing Fee ($50.00) and any other applicable fees. Remember if you are paying by check to make it payable to “Secretary of State” or to include the Epayment Checklist form if you are paying by credit card.

Mail To:

Secretary of State

New Filings Division

202 North Carson Street

Carson City, NV 89701-4201

If Expediting, You May Also Mail To:

Secretary of State – Las Vegas

Commercial Recordings Division

555 East Washington Ave, Ste 5200

Las Vegas, NV 89101