|

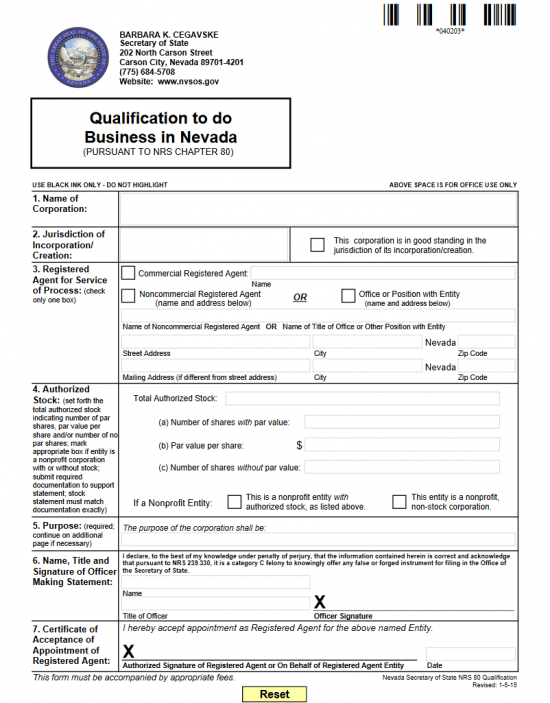

Nevada Qualification To Do Business In Nevada |

The Nevada Qualification To Do Business in Nevada must be filed in hardcopy with the Nevada Secretary of State. In addition to this form, the filing entity will need to submit the most recent document filed with its governing body that verifies the amount of authorized stock at its disposal. If filing by mail, you will also need to submit the Customer Order Instructions. These are the basic forms which must be filed in order to qualify to transact business in this state however, other documents may be necessary depending on the filing entity’s corporate type or structure. Filing entities should make every effort to understand the process for their corporation type by consulting with a professional familiar with this process, such as an attorney or an accountant.

All documents required by the Nevada Secretary of State must be submitted by or with the Nevada Qualification To Do Business in Nevada along with a full payment of the Filing Fee. Nonprofit corporations without stock will need to pay a filing fee of $50.00 whereas corporate entities with stock will need to calculate their Filing Fee based on the amount of authorized stock available to them. This will range from $75.00 to a maximum of $35,000.o0. Expediting orders is also an option for an additional fee ($125.00 for 24 hour expediting, $500.00 for 2 hour expediting, or $1,000.00 for 1 hour expediting). You will receive a stamped copy from the Nevada Secretary of State upon approval and may request a certified copy for $30.00. You may use a credit card, trust, balance owed from a previous filing, or check made payable to Secretary of State to pay for such fees.

How To File

Step 1 – Select the words “Download Form” above to download the Nevada Qualification To Do Business In Nevada application.

Step 2 – In Item 1, “Name of Corporation,” report the Full Name of the filing entity as it appears in documents issued by its jurisdiction.

Step 3 – In Item 2, “Jurisdiction of Incorporation/Creation,” enter the Name of the Jurisdiction who holds authority over the filing entity. In most, if not all cases, this is where the filing entity first incorporated. If this corporation is in good standing in its jurisdiction then place a check mark in the box beside this area.

Step 4 – In Item 3, “Registered Agent for Service of Process,” you must report the identity of the Registered Agent of the corporation being formed. If you have obtained a commercial Registered Agent who has previously registered with the Nevada Secretary of State, you need only place a check mark in the first box then on the line labeled “Commercial Registered Agent,” enter the Full Name of the commercial Registered Agent. If you have obtained noncommercial agent, skip this first section and place a check mark in the second box (labeled “Noncommercial Registered Agent”) or place a check mark in the box labeled “Office or Position with Entity.” Next you will need to enter the Full Name of the noncommercial Registered Agent in the space provided below this.

Step 5 – Directly below the noncommercial Registered Agent’s Full Name, you must report the Address for the Physical Location of the Registered Agent. The Building Number, Street, and Suite Number may be reported in the box labeled “Street Address,” the County or City may be reported in the “City” box, and the Zip Code may be reported in the box following the word Nevada. This line may not contain a P.O. Box as it must be the physical location of the noncommercial Registered Agent. If the Registered Agent has a separate Mailing Address, report this on the next line (labeled “Mailing Address”) otherwise proceed to the next section.

Step 6 – Item 4 will be used to document the amount of stock at the filing entity’s disposal. Report the Total Number of shares authorized in the box labeled “Authorized Stock.” In section 4a, report the total Number of Shares with Par Value. In section 4b, report the each individual share’s par value. Then in section 4c, report the total Number of Shares with no Par Value. Only fill out this section of Item 4, this is a stock corporation (profit and nonprofit).

Step 7 – Item 4 will also need information if this is a nonprofit corporation. If the filing entity is a nonprofit corporation with stock then make sure you have followed the directions in Step 6 then locate the line beginning with “If a Nonprofit Entity” and place a check mark in the box labeled “This is a nonprofit entity with authorized stock, as listed above.” If the filing entity is nonprofit with no stock then place a check mark in the box labeled “This entity is a nonprofit, non-stock corporation.”

Step 8 – In Item 5, write out the filing entity’s purpose (in its business affairs) for operating in the State of Nevada. This should be specific as to the way the filing entity shall conduct and transact business in this state. If there is not enough room here, you may continue on another sheet of paper that is clearly labeled then attached.

Step 9 – Item 6 will act as the binding effect to the party submitting these documents. Hence, it will require the Full Name of the individual submitting these documents printed in the box labeled “Name.” Then it will require the submitter’s official title in the filing entity in the box labeled “Title of Officer.” This must be an authorized Officer. Finally the submitter being reported must Sign his/her Name on the line labeled “Officer Signature.”

Step 10 – Item 7 will also require a Signature. The Registered Agent who has agreed to accept service of process on behalf of the filing entity must provide his/her Signature then Date the Signature by filling in the Date they are signing (at the time of signing) in the box labeled “Date.”

Step 11 – If the filing entity has been authorized to dispense stock then it must calculate its filing fee for the Nevada Qualification To Do Business in Nevada. This may be done by calculating the total dollar amount of all stock then using that to determine which Filing Fee bracket you are in. If the total dollar amount of authorized stock is less than $75,000.00 then you must pay $75.00. If the total dollar amount of authorized stock is between $75,000.00 and $200,000.00 dollars, then you must pay $175.o0. If the total dollar amount of authorized stock is between $200,000.00 and $500,000.00 then you must pay $275.00. If the total dollar amount of authorized stock is between $500,000.00 and $1,000,000.00 then you must pay $375.00. If the total dollar amount of authorized stock exceeds $1,000,000.00, you must pay $375.00 plus an additional $275.00 for every increment of $500,000.00 (i.e. if the total dollar amount of authorized stock is $1,250,000.00 then you must pay $375.00 + $275.00= $650.00. This filing fee applies to stock with or without par value. If

Step 12 – Make sure you attach all necessary documents to the Nevada Qualification to Transact Business in Nevada. This must include a copy of the last document the filing entity has submitted to its domicile state’s governing body. This document must contain the total Number of Authorized Stock the filing entity may dispense. This document must have been accepted by the filing entity’s governing body. You will also need to fill out the Customer Order Instructions form. Here you will report how you wish to receive your documents, if you wish the processing to be expedited, and how you will submit payment. Remember that you must pay an additional amount if you wish for expedited service. You may expedite this to a 24 hour processing for $125.00, 2 hour processing for $500.00, or 1 hour processing for $1000,00.00.

Step 13 – Once you have organized all documents, the payment method, and verified all the facts reported on the Nevada Qualification to Transact Business in Nevada you must submit it by mail:

Mail to:

Seretary of State

New Filings Division

202 North Carson Street

Carson City, NV 89701-4201

Expedited Filings May Also Mail To:

Secretary of State – Las Vegas

Commercial Recordings Division

555 East Washington Avenue, Ste 5200

Las Vegas, NV 89101