|

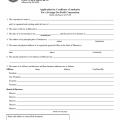

New York Application for Authority of Foreign Not-For-Profit Corporation | Form DOS 1555-1-a |

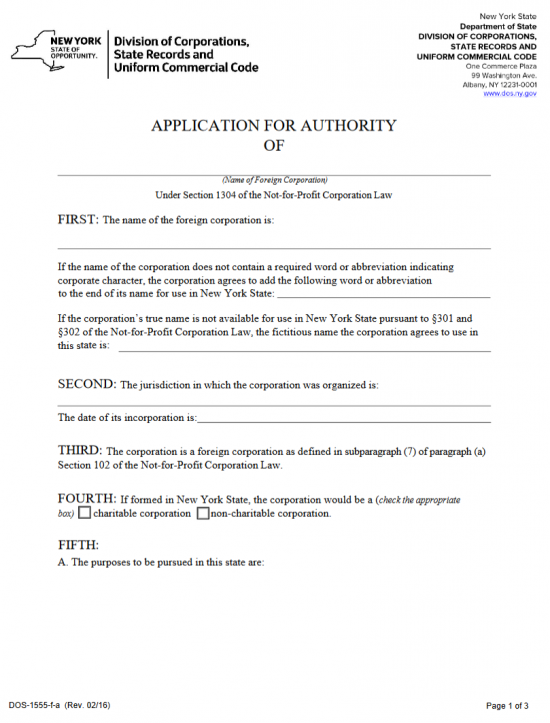

The New York Application for Authority of Foreign Not-For-Profit Corporation | Form DOS 1555-1-a is the application required by the New York Department of State Division of Corporations when a foreign not-for-profit corporation wishes to apply for a New York Certificate of Authority to do business in New York State legally. This application will require basic information such as the Name of the foreign not-for-profit corporation or the Address of the Service of Process Address, however if the type of entity filing must submit additional information some of the sections may be expanded or a new document may be drawn up altogether.

In addition to the New York Application for Authority Foreign Not-For-Profit Corporation | Form DOS 1555-1-a, the filing entity must provide a Certificate of Existence and payment of the Application Fee. The Certificate of Existence may only be obtained from the governing authority in the home state of the foreign not-for-profit corporation and the Filing Fee is $135.00. You may pay the Filing Fee with a check payable to “Dept of State” or with a Credit Card/Debit Card Authorization Form. The New York State Department Division of Corporations will accept applications by mail, in person, or by fax.

How To File

Step 1 – Select the Download Form link above to obtain a blank copy of the New York Application for Authority Foreign Not-For-Profit Corporation. You may edit this with a PDF program to enter the information required by this form and/or add enough space for the information to be presented. If you do not have a PDF program you may also print this form then fill it out manually.

Step 2 – Just below the the Title, “Application For Authority Of,” enter the Full Name of the foreign not-for-profit corporation applying for the Certificate of Authority. Make sure this is the Full True Name of the corporation and is entered exactly as it appears on the record books in the filing entity’s home state.

Step 4 – Locate the First Item then enter the Name of the applying entity on the blank line available. This Name should be the Full True Name of the foreign not-for-profit corporation as it has been reported in the Title of this document.

Step 5 – The next paragraph will provide a blank line in the event the foreign not-for-profit corporation does not have a word of incorporation to indicate the entity has corporate status. If this is the case, select an appropriate word of incorporation which the entity shall apply to its Name in the State of New York when participating in any corporate activity. This line may be left blank if the filing entity’s Name conforms to the name requirements in the Not-For-Profit Corporation Law of New York State.

Step 6 – In some cases the Full True Name of the filing entity does not conform to §301 and §302 of the Not-for-Profit Corporation Law. If this is the case, the filing entity will need to adopt a Fictitious Name. Report the Fictitious Name the foreign not-for-profit corporation will be known as and operate under at all times in the State of New York on the blank space provided in the last blank space in Item 1.

Step 7 – The Second Item will require the Name of the Jurisdiction where the foreign not-for-profit corporation is incorporated in to be entered on the first blank line. Then on the second blank line, report the Date of Incorporation in this jurisdiction. This item is meant to document where and when the foreign not-for-profit corporation incorporated.

Step 8 – The The Third Item will bind the filing entity to the definition of a foreign not-for-profit corporation in Section 102 of the Not-for-Profit Corporation Law.

Step 9 – If the foreign not-for-profit corporation would have been considered a charitable corporation should it have been formed in the State of New York then mark the first box. If not, then mark the second box.

Step 10 – In section A of the Fifth Item, report the Purpose of this corporation in the State of New York. There will be space provided for this end.

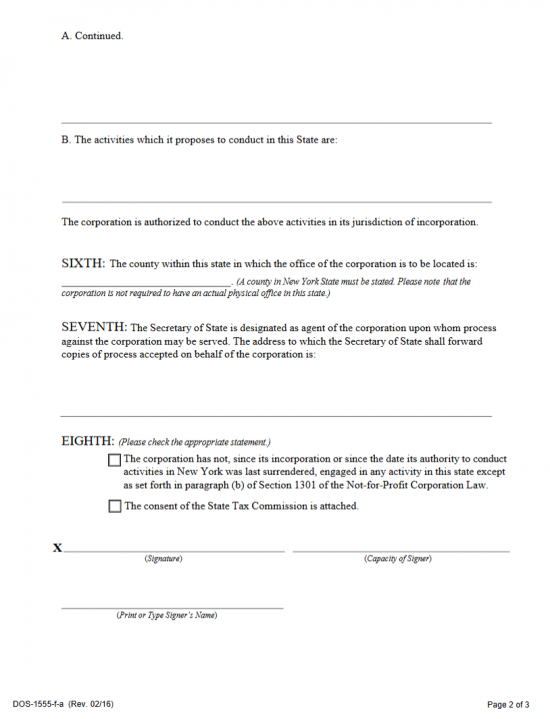

Step 11 – In section B of the Fifth Item, report the Activities the foreign not-for-profit corporation will pursue in the State of New York. Then on the next blank line, report the activities the corporation has been authorized to pursue in its parent state.

Step 12 – In the Sixth Item, enter the Name of the County where the filing entity will be conducting its business.

Step 13 – Report the Address where the New York Secretary of State may forward copies of Service of Process papers accepted by the New York Secretary of State on behalf of the filing entity. Unless otherwise indicated, this item will Name the New York Secretary of State as the Registered Agent who will accept such documents then inform the entity.

Step 14 – In the Eighth Article, check the first box if this corporation has never operated in the State of New York or check the second box to indicate the Consent of the State Tax Commission will be submitted with this application.

Step 15 – Locate the line labeled “Signature,” next to the “X.” Here the authorized representative (Director, Officer, Agent, etc.) must Sign his or her Name then, on the next line report his or her Capacity or Position. On the last line of this page the Signature Party must Print his or her Name.

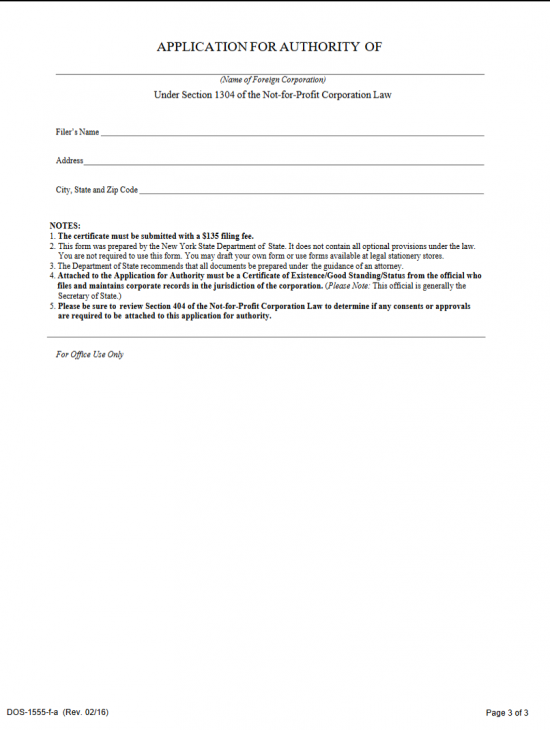

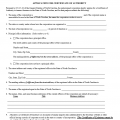

Step 16 – At the top of the next page on the first blank line, enter the Full True Name of the foreign not-for-profit corporation applying for the New York Certificate of Authority.

Step 17 – In the final area of this application, the Filer’s Name and Address must be reported. There will be three blank lines provided to report this (Filer’s Name, Address, and City, State, and Zip Code).

Step 18 – When you are ready, attach all required paper work to the New York Application for Authority Not-For-Profit Corporation | Form DOS 1555-f-a and the Certificate of Existence issued by the filing entity’s home state. Make sure to include a payment of $135.00. This is payable with a check made out to “Department of State” or a credit card provided you fill out and include a Credit Card/Debit Card Authorization Form.

Mail To:

New York Certificate of Incorporation to Department of State

Division of Corporations

State Records and Uniform Commercial Code

One Commerce Plaza

99 Washington Ave

Albany, NY 12231-0001

In Person:

Department of State Division of Corporations

One Commerce Plaza

99 Washington Avenue, 6th Floor

Albany, NY 12231

By Fax:

(518) 474-1418

(Requires Credit Card Authorization Form)