|

Ohio Nonprofit Articles of Incorporation Nonprofit Domestic Corporation | Form 532B |

The Ohio Nonprofit Articles of Incorporation Nonprofit Domestic Corporation | Form 532B is a mandatory filing with the Ohio Secretary of State when a nonprofit corporation, of any kind, wishes to operate in this state. Since there are several types of nonprofit corporations, it is highly recommended to make sure you are aware of the process that must be completed successfully as different types of nonprofit corporations will need to form in different ways. For instance, if the nonprofit corporation will seek Tax-Exempt Status, the Ohio Board of Taxation and the Internal Revenue Service will need to be consulted. The Internal Revenue Service is the only entity that may grant Tax-Exempt Status and will have its own paperwork requirements, including IRS 501(c)(3) compliant language to be used in the Ohio Nonprofit Articles of Incorporation Nonprofit Domestic Corporation.

The Ohio Nonprofit Articles of Incorporation must be submitted with a Full Payment of the Filing Fee of $99.00. You may pay this fee with a check or money order made out to the Ohio Secretary of State if you are submitting the paperwork by mail. If you are submitting the paperwork electronically, you may pay with a major credit card or an account set up with the Ohio Secretary of State. This is a separate payment from any additional filings or expediting service options. At the time of submittal all payments must be received.

How To File

Step 1 – Download the form from the link above then either open it with a PDF program or print it then fill it out.

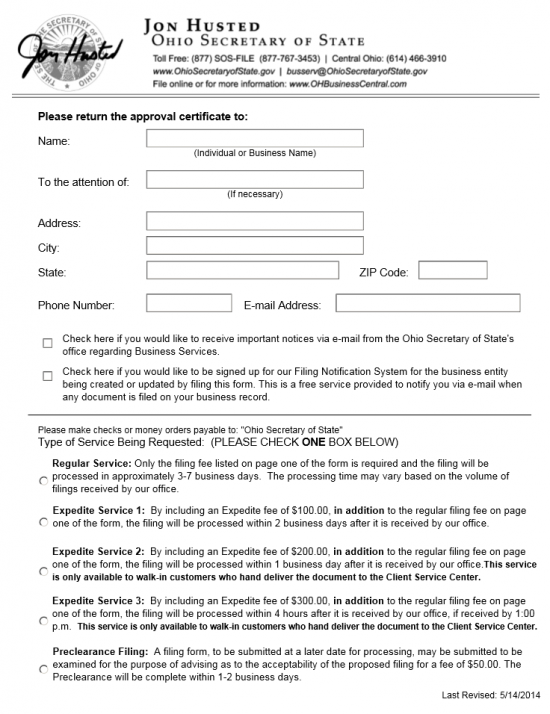

Step 2 – On the first page, below the heading “Please return the approval certificate to” locate the box labeled “Name.” Here you must enter the party who the Ohio Secretary of State should send your Certificate to. This may be either an individual or a business.

Step 3 – The next box, “To the attention of,” is optional and should be filled out only if the Name in box 1 is a business or the return of should be returned in the care of.

Step 4 – The next three lines will require the Return Address to be filled out (Address, City, State, Zip Code).

Step 5 – Next, you will need to enter the Phone Number and Email Address for a reliable contact person the Ohio Secretary of State may correspond with.

Step 6 – The next two paragraphs will each have a check box next to them. Check the first box to receive notices via the email provided and/or check the second box if you would like to receive alerts through the Filing Notification System. You may leave both of these blank if you wish .

Step 7 – Next there will be five bubbles. Each one will correspond to a level of Expedited Processing. Regular Service (3-7 business days) will be no extra charge and is the first choice. The rest will reveal some expedite options for a certain additional Fee. Expedite Service 1 (2 business days) will cost $100.00, Expedite Service 2 (1 business day) will cost $200.00, Expedite Service 3 (4 hour service) will cost $300.00 but you must hand deliver this to the Client Service Center by 1:00 p.m., or Pre-clearance Filing (preliminary review with a 1-2 business turnaround) will cost $50.00

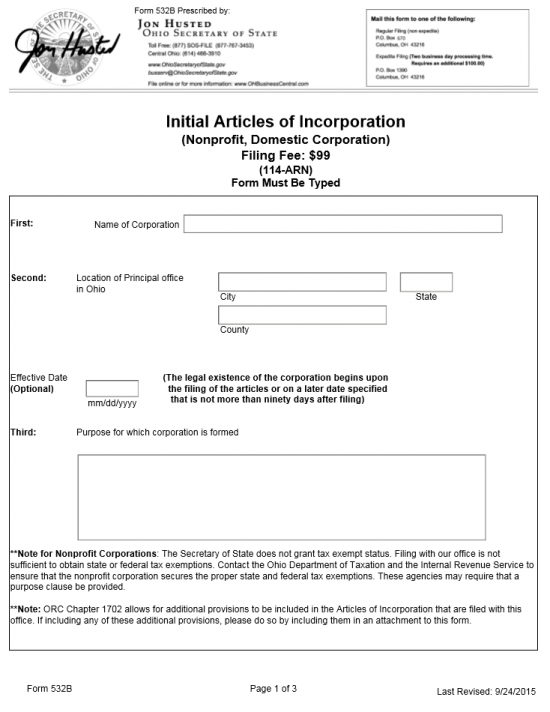

Step 8 – The next page is the “Initial Articles of Incorporation Nonprofit Domestic Corporation. Here, the First Article requires the Full Name of the nonprofit corporation being formed including the words of incorporation (Company, Corporation, Incorporated, or an abbreviation of any of these words).

Step 9 – In the Second article, you will need to report some information regarding the Principal Office of the nonprofit. In the “City” box, enter the City where the Principal Office is located, enter the the State where the Principal Office is located in the “State” box, then enter the County where the Principal Office is located in the “County” box.

Step 10 – In the box labeled “Effective Date,” you may enter a date that is later than the filing date. You may select any date from the time of filing to 90 days after the Filing Date for these articles to go in effect or you may leave it blank.

Step 11 – In the Third Article, report the Purpose of this nonprofit corporation. In some cases, you may need to include IRS compliant language especially if the entity plans on applying for Tax-Exempt status.

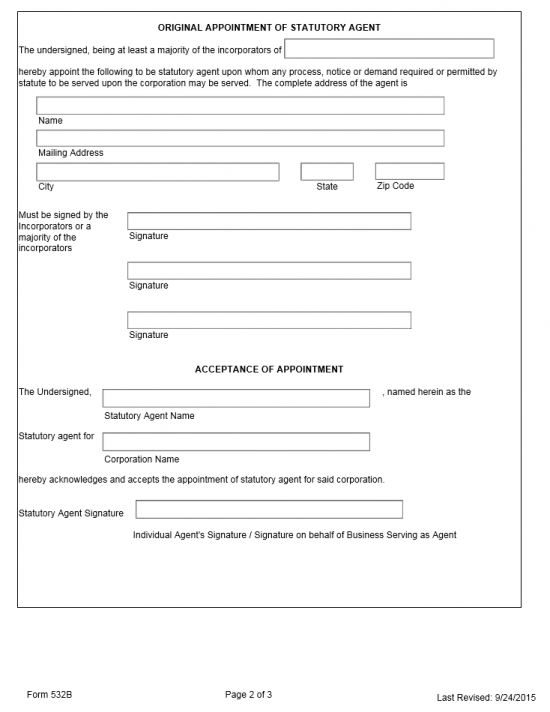

Step 12 – The next page is the “Original Appointment of Statutory Agent.” In the first box, next to the statement “The undersigned being at least a majority of the Incorporators of” requires the exact Name of the forming nonprofit to be entered.

Step 13 – Next in the “Name” box, enter the Full Name of the Statutory Agent who has agreed to receive court documents or service of process aimed at the nonprofit, then enter the Street Address in the box labeled “Mailing Address,” the City of the Statutory Agent in the “City” box, the State in the “State box, and the Zip Code of the Statutory Agent in the Zip Code box.

Step 15 – The next section must contain the Signatures of a majority of the Incorporators. There are three signature boxes for this purpose, however if this does not constitute a ‘majority’ then attach a sheet of paper with the balance of the Signatures.

Step 16 – In the box labeled “Undersigned,” the Statutory Agent must sign his/her Name, then enter the name of the nonprofit entity he/she may need to serve in the box labeled “Corporation Name.” Afterward, in the last box, the Statutory Agent will need to sign his/her Name.

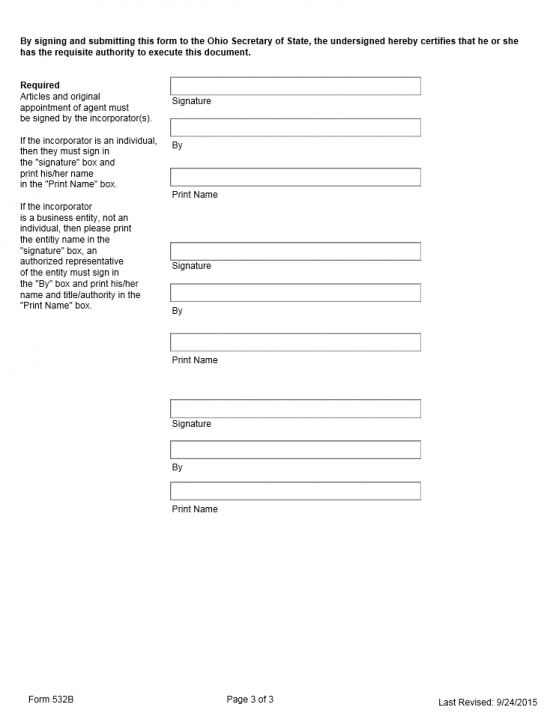

Step 17 – The last page is the Signature page. Here, all Incorporators must provide their Signatures in the “Signature” box then Print their Names in the “Print Name” box. If the Incorporator is a business, enter the name of the Business in “Signature.” Then have a representative of that Incorporator (business) sign the box labeled “By.” Such a representative of an Incorporating Business should Print his/her Name in the “Print Name” box.

Step 18 – You may submit the Ohio Articles of Incorporation Nonprofit Domestic Corporation | Form – 532B, all supporting documents, and a check or money order made out for the Filing Fee ($99.00) and all applicable fees, payable to Ohio Secretary of State.

By Mail:

Ohio Secretary of State

P.O. Box 670

Columbus, OH 43216

How To File Electronically

Step 1 – Go to the Secretary of State website at: http://www.sos.state.oh.us. The second button from the top left, “Businesses,” will contain a drop down menu. Select this button then, under the submenu item, “Business Services,” heading, select “File Online with Ohio.”

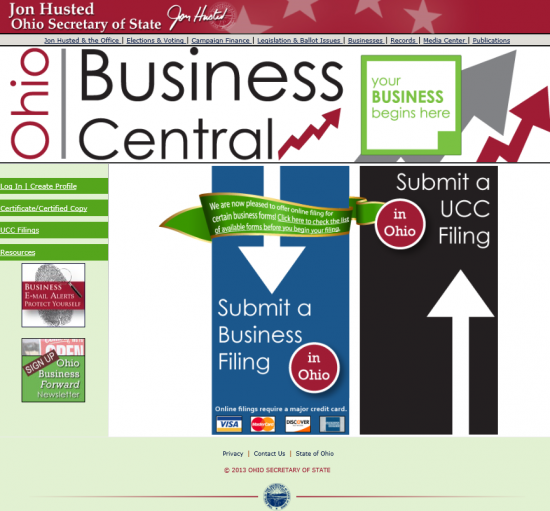

Step 2 – Click on the blue banner labeled “Submit a Business Filing.”

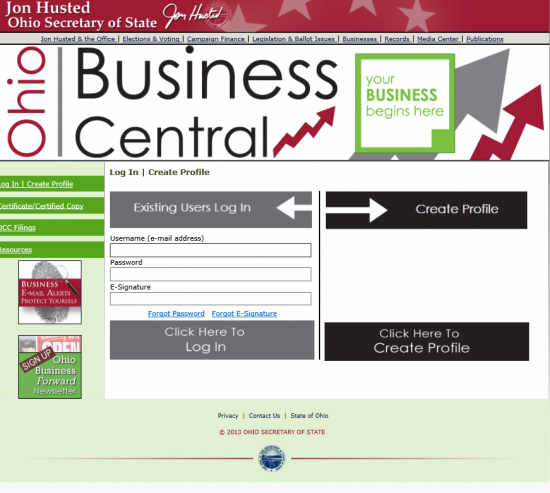

Step 3 – Enter the Email Address you used to set up your account then enter your Password and the E-Signature you received. Once this is done select the “Click Here to Log In” button below.

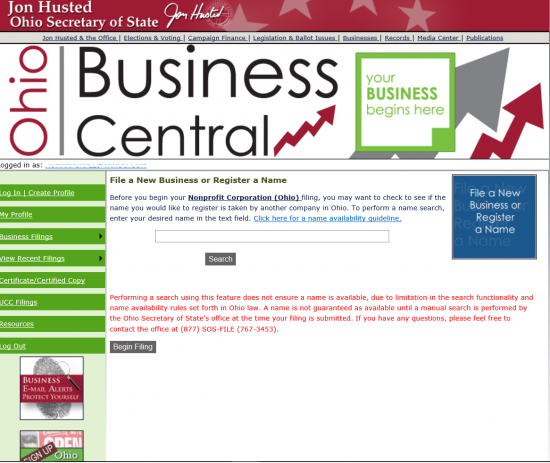

Step 4 – There are several options here, locate and select the blue tile labeled “File a New Business or Register a Name”

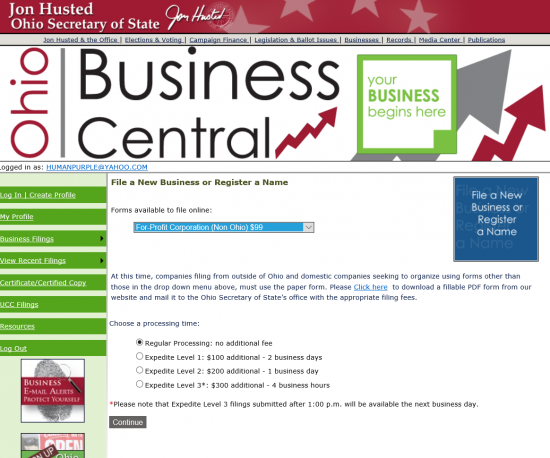

Step 5 – From the “Forms available to file online” drop down list, top and center in the main area, select “Nonprofit Corporation ($99.00).

Step 6 – Next select your preferred Processing Level. You may choose Regular Processing, Expedite – No Additional Fee, Expedite Level 1: $100 additional – 2 business days, Expedite Level 2: $200 additional – 1 business day, or Expedite Level 3: $300.00 additional – 4 business hours. You may only choose one. Keep in mind all fees are in addition to the Filing Fee. Also Expedite 3 Filings must be received by 1:00 p.m. Once you have done this select the “Continue” button at the bottom.

Step 7 – Next you have the option of checking to see if the Name you wish the corporation to operate and file under is available. This step is strongly recommended. Type the Full Name of the corporation you are forming in the available text box. If the Name is available you will receive a notice stating there are no matching entries in the Ohio Secretary of State Records. Once you have found a unique Name, select the button labeled “Begin Filing” at the bottom of the page.

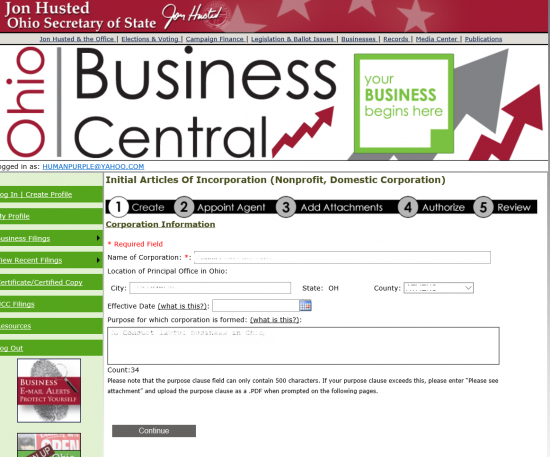

Step 8 – The next page shall require the Name of the forming nonprofit corporation in the first field (labeled “Name of Corporation”), the City where the Principal Office is located in the second field, and the County of the Principal Office selected from the drop down list labeled “County.”

Step 9 – If you wish a different Effective Date to seize corporate status (if granted) then enter this Date in the field labeled “Effective Date.” You may choose any date within 90 days of the Filing Date but not before the Filing Date. You may also leave this field blank.

Step 10 – The large text box at the bottom of the page will require the Purpose of the nonprofit corporation to be recorded. If this Purpose is more than 500 characters then document it on a separate document, convert that file to a PDF, and attach it later in this process. Once you have entered all the information, click on the “Continue” button.

Step 11 – Next, you must report the Identity and Location of the initial Statutory Agent that shall accept service of process on behalf of this corporation. In “Agent’s Name,” enter the Full Name of the Statutory Agent. Then, in “Address,” enter the Full Address of the Statutory Agent. The third line will require the City and Zip Code to be entered (the Statutory Agent must be in Ohio). Enter the Email (if available) on the fourth line. The Statutory Agent must then enter his/her Name in the text field directly below the word “appointment.” Once you have done this, click “Save and Continue.”

Step 12 – Next, you will be given the opportunity to attach any files that must accompany this form. Do this by selecting the “Browse” button then selecting the file from you computer. Note: Any attached files will be considered public information. If you have attached files, select the button “Save and Continue” if you have not then select “No Attachment(s) Needed, Continue.”

Step 13 – The Incorporators of this nonprofit corporation must enter their Digital Signature in the field labeled “Name or Business Entity.” If the Incorporator is a Business Entity, enter the Full Name of that entity in the first text field, next enter the Full Name of the representative of that business in the “By” field. Once you have entered an Incorporator, you may select the “Add” button to add another Incorporator. Each one will be added to a table that displays with the the option to “Edit” that entry. Once all the Incorporators have provided their Digital Signatures, select the “Save and Continue” button.

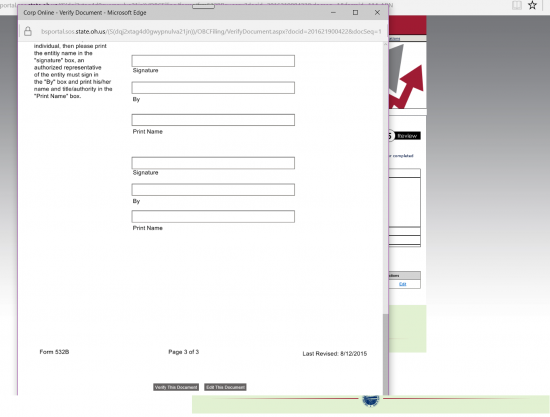

Step 14 – The information you have just entered will be displayed in a table. You may edit any entry you have made by selecting the “Edit” button in that section. Once you have made sure everything is accurate, select the button “Save and Preview.” This will produce a preview of the PDF being sent with the information you have entered.

Step 15 – Go through the document that is displayed in the popup window. At the bottom of the pop window will be two choices, “Verify This Document” or “Edit This Document.” Selecting “Verify This Document” will direct the browser to the payment area where you may enter your credit card information for the base Filing Fee of $99.00 and all other applicable fees. Your document will be processed according to the Service Level you have indicated at the beginning of this form.