|

Oregon Articles of Incorporation Business/Professional Corporation |

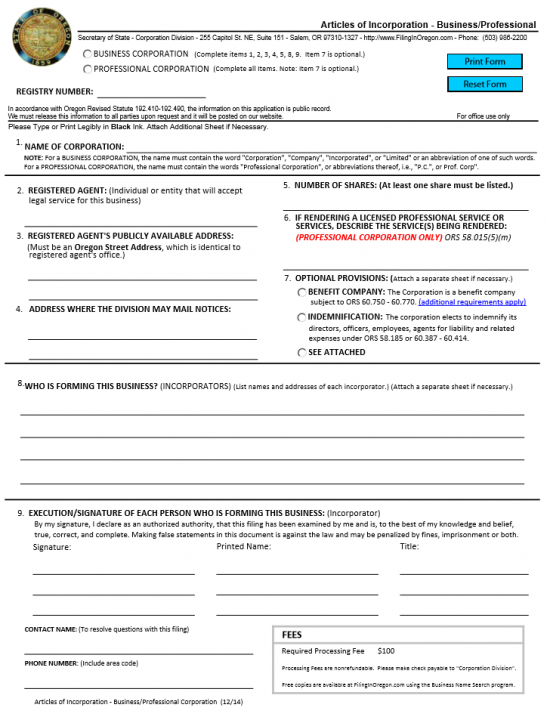

The Oregon Articles of Incorporation Business/Professional Corporation is the form used by the Oregon Secretary of State for Incorporators to report the information required by this governing body when forming a Business or Professional corporation. It is worth mentioning that while this form will convey the basic information that must be covered with this entity, it is not all inclusive in terms of all the requirements that must be fulfilled with this agency and other governing bodies. Incorporators should, therefore, make every effort to be very familiar with the process of forming a corporation of their chosen entity type in this state before beginning the process.

Incorporators may file this form either by mail or electronically. This will require a Filing Fee of $100.00. This is payable with a check made out to Corporation Division if filing by mail or payable with a credit card if filing online. You may mail the Oregon Articles of Incorporation to Secretary of State, Corporation Division, 255 Capitol Street NE, Ste 151, Salem, OR 97310-1327 or you may sign up for a login so that you may file online at https://secure.sos.state.or.us/cbrmanager/index.action#stay.

How To File

Step 1 – Select the “Download Form” link above then save the document. This will be a PDF form which is editable with an appropriate program or may be printed then filled out.

Step 2 – Locate the first article, “Name Of corporation.” Enter the Full Name of the corporation being formed and make sure it includes one of the corporate designators in it (i.e. Corporation, Corp., Incorporated, Inc.).

Step 3 – In the second article, “Registered Agent,” enter the Full Name of the Individual or Business Entity that has agreed to act as the forming corporation’s Registered Agent. Do this on the blank line provided.

Step 4 – In the third article, “Registered Agent’s Publicly Available Address,” enter the Street Address (Building Number, Street, Suite Number, City, State, Zip Code) where the Registered Agent may be physically located.

Step 5 – In the fourth article, “Address Where The Division May Mail Notices,” enter the Full Mailing Address where the Oregon Secretary of State may mail notices to the corporation being formed.

Step 6 – In the fifth article, “Number of Shares (At least one share must be listed),” report the total Number of Shares this corporation may issue in the space provided.

Step 7 – The sixth article, “If Rendering A Licensed Professional Service Or Services, Describe the Service(S) Being Rendered,” requires a professional corporation’s Incorporator to define the service the professional corporation shall provide on the line provided.

Step 8 – In the seventh article, “Optional Provisions,” you may select the first radio button which shall name the corporation as a Benefit company, the second radio button which shall define Indemnification according to ORS 58.185 or 60.387-60.414, or the third radio button labeled “See Attached.” You may attach any provisions to these articles deemed necessary for the proper formation of this corporation.

Step 9 – In the eighth article, “Who Is Forming This Business,” report the Full Name and Complete Address of each Incorporator on the blank lines provided.

Step 10 – The ninth article, “Execution/Signature Of Each Person Who Is Forming This Business,” each Incorporator must provide his/her Signature, Printed Name, and Title in the appropriate areas of the blank lines provided.

Step 11 – Below the signature area, you will need to enter a Contact Name and a Phone Number for that Contact. This is the individual who will receive and handle inquiries from the Oregon Secretary of State regarding these filings.

Step 12 – Organize all the documents that must be mailed in simultaneously with the Oregon Articles of Incorporation Business/Professional Corporation along with a check for $100.00 (Filing Fee) made payable to the Corporations Division into one package and submit this to the Oregon Secretary of State Corporations Division by mail.

Mail To:

Secretary of State

Corporation Division

255 Capitol Street NE Ste 151

Salem, OR 97310-1327

How To File Electronically

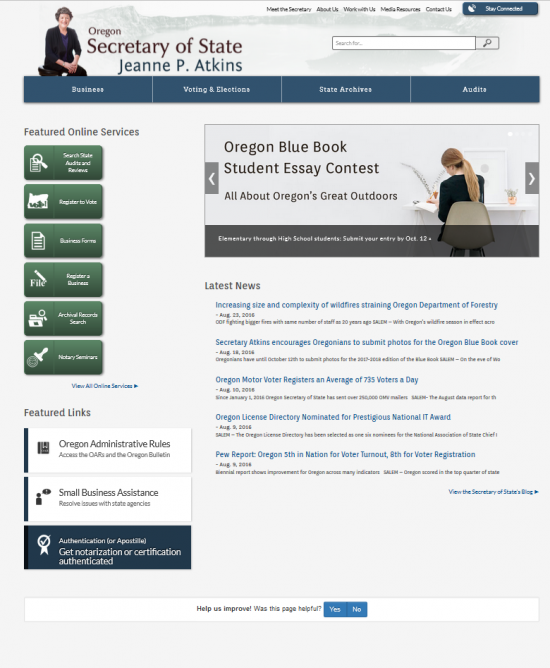

Step 1 – Go to the Oregon Secretary of State home page, then select the green button located on the left side of the page labeled “Register a Business” (http://sos.oregon.gov/Pages/index.aspx).

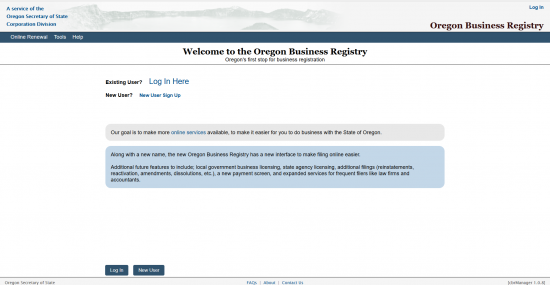

Step 2 – You will be prompted to Log In or Create an Account. Select Login.

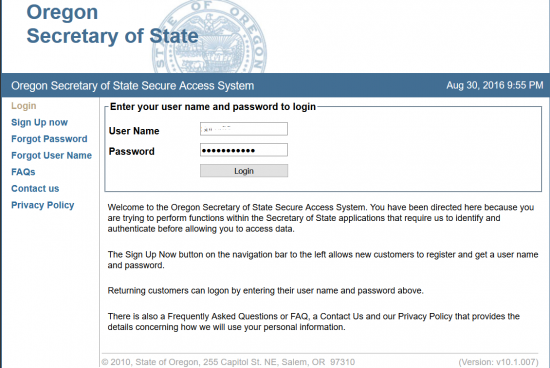

Step 3 – Enter your User Name and Password then select the button labeled “Login.”

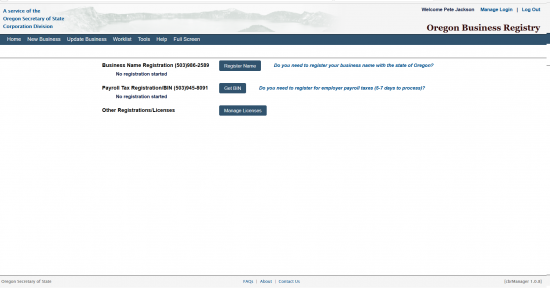

Step 4 – From the home page of your account, select the first button labeled “Start” under the words “Register Business Name, get a BIN, and other registrations/licenses.”

Step 5 – Select the button labeled “Register Name” to begin the online filing process.

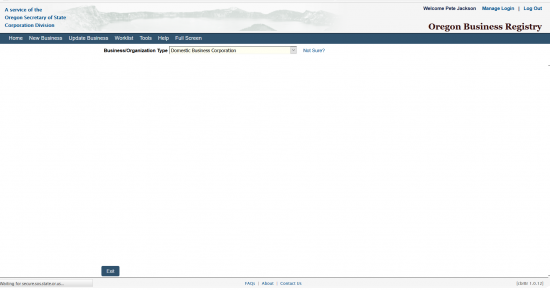

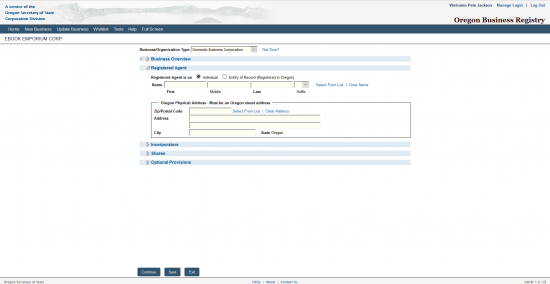

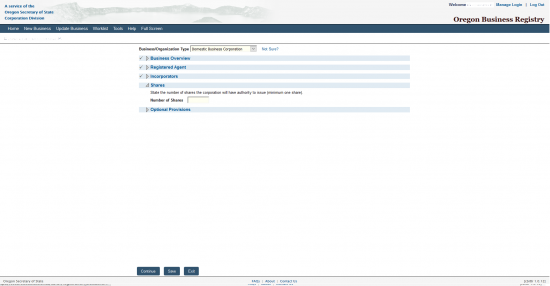

Step 6 – From the drop down list labeled “Business/Organization Type,” select “Domestic Business Corporation.” This will automatically direct the browser to the next page.

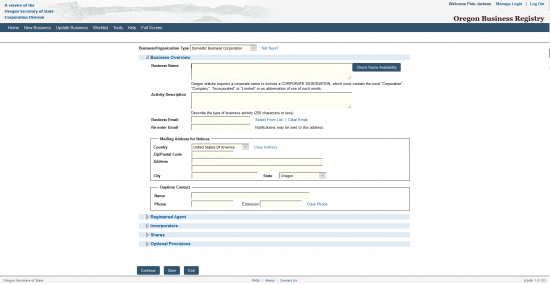

Step 7 – In the first field, “Business Name,” you will need to enter the Full Name of the forming corporation. This should include a Corporate Designation such as Corporation, Incorporated or a generally accepted abbreviation of such. Once you have done this select the box labeled “Check Name Availability.” This will open a new browser tab either confirming its availability or denying it. While it will still have to be reviewed to be accepted select a Name that appears to be available.

Step 8 – In the second text box, you must describe the purpose or Activity of the forming corporation. You will have 250 characters to do this.

Step 9 – The next two fields “Business Email” and “Re-enter Email” requires that you provide an Email Address the Oregon Secretary of State may send notices directed at this corporation. Enter the same email in both of these fields.

Step 10 – The next section will require the Mailing Address the forming corporation wishes to use to receive Notices from the Oregon Secretary of State. First select the Country for this Mailing Address from the drop down list labeled “Country.” Then enter the Zip/Postal Code, Address, City, and select the State from the drop down list in the fields provided.

Step 11 – Next, under the heading “Daytime Contact,” enter the Full Name and Phone Number for the party the Oregon Secretary of State may contact regarding this form. You may either select the “Continue” button or the link labeled “Registered Agent” to proceed to the next screen.

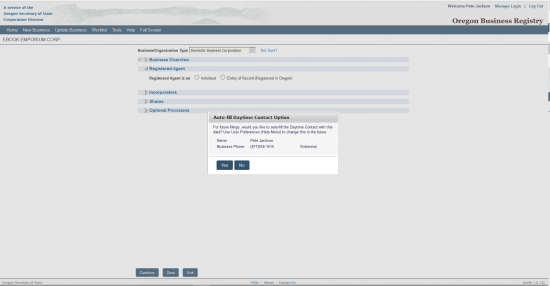

Step 12 – A pop up window asking if you would like the site to save the Daytime Contact information for future filings. You may choose either the “Yes” button or the “No” button to proceed. Make the appropriate choice to move to the next section.

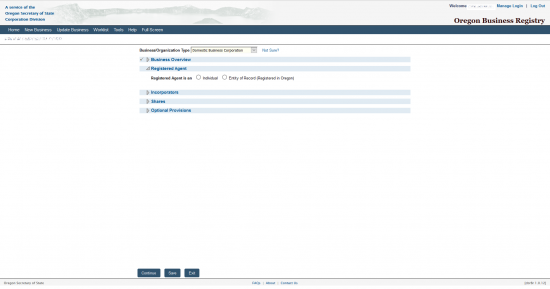

Step 13 – The next section, “Registered Agent,” will require a definition to what type of Registered Agent shall accept service of process aimed at the forming entity. You may select the radio button labeled “Individual” or the radio button labeled “Entity of Record (Registered in Oregon).” You may only choose one. For our purposes, select “Individual.”

Step 14 – In the fields next to the word “Name,” enter the First Name, Middle Name, and Last Name of the Registered Agent that has been obtained then, select a Suffix from the drop down list.

Step 15 – Next you will need to enter the Full Address of the Registered Agent’s Office in Oregon. First, enter the Zip Code in the first field of this section. Then enter the Street Address and City for this location. Once you have entered this information you may either select the button labeled “Continue” or you may choose the link labeled “Incorporators.”

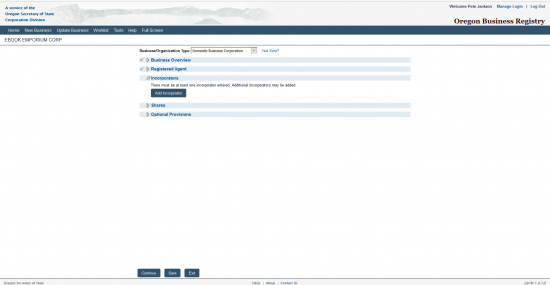

Step 16 – Under the “Incorporators” heading, select the button labeled “Add Incorporator.”

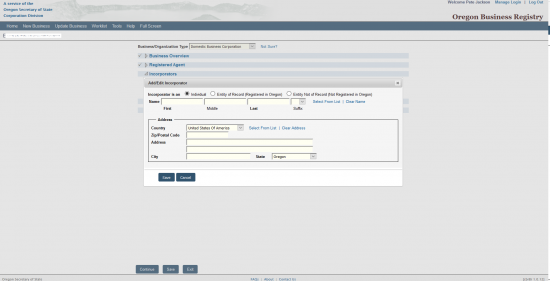

Step 17 – A pop up window requiring attention will appear. First indicate if this is an “Individual,” “Entity of Record (Registered in Oregon),” or an “Entity Not of Record (Not Registered in Oregon.” You may only choose one of the radio buttons corresponding with one of these choices. For our purposes choose the third radio button.

Step 18 – Next, enter the First Name, Middle Name (Optional), Last Name, and select a Suffix (Optional) from the drop down menu.

Step 19 – You may now enter the Incorporator’s Address. Do this by entering a the Zip Code in the first field, the Street Address in the second field, the City in the field labeled “City,” and select the State of the Incorporator from the drop down list.

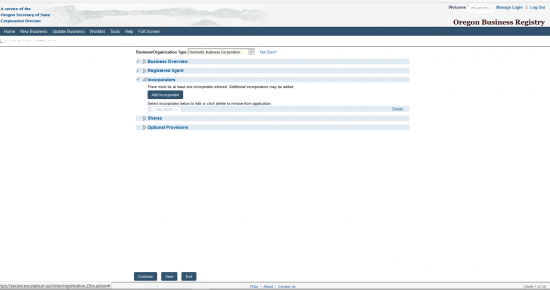

Step 20 – The Incorporator will be displayed. You may add another one by selecting the “Add Incorporator” button. Once you are done, select the next link, labeled “Shares,” or select the button labeled “Continue.”

Step 21 – Enter the Total Number of Shares available to this corporation in the field labeled “Number of Shares.” Once you have done this, select either the button labeled “Continue” or select the link labeled “Optional Provisions.”

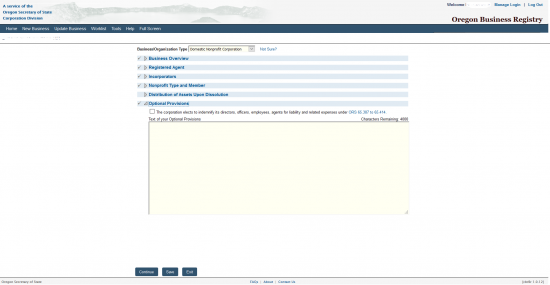

Step 22 – Next you may place a check mark in the first box if the corporation will indemnify its Directors, Officers, Employees or Agents for liabilities under ORS 60.387 – 60.414. If the corporation is a benefit corporation you must place a check mark in the second box. Below this will be a text box where you may use up to 4,000 characters to outline any provisions that must be present for the formation of this corporation. Once you are finished, select the “Continue” button.

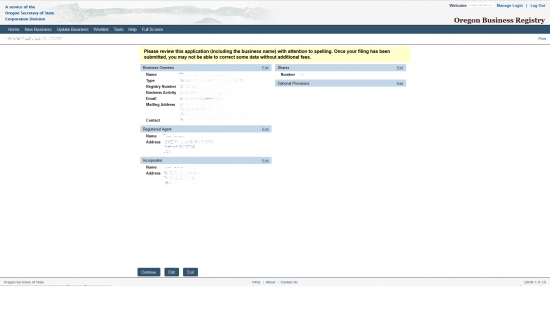

Step 23 – This page will give you the opportunity to review the information you have entered. If this is correct, you may select the “Continue” button. This will produce a pop up window for verification. Once you select “Yes” in the pop up window, the browser will be directed to an area where you may enter your credit card information to pay the $100.00 Filing Fee.