|

South Carolina Application by a Foreign Corporation to Transact Business in the State of South Carolina |

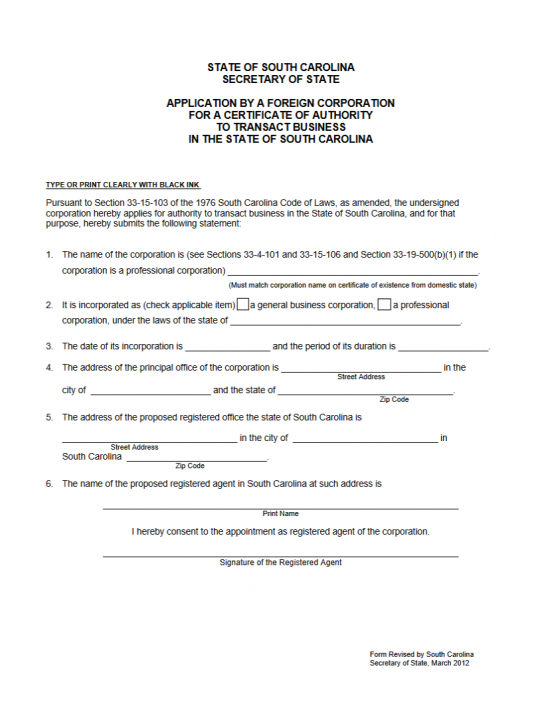

The South Carolina Application by a Foreign Corporation to Transact Business in the State of South Carolina must be filed in duplicate with a completed Initial Annual Report of Corporations (Form CL-1) and a Certificate of Existence issued by the parent state within 30 days of the Filing Date with the South Carolina Secretary of State prior to beginning operations as a profit corporation in this state. This is by no means the only paperwork required for the legal formation of a foreign profit corporation in this state, however, these are minimum requirements for all foreign corporations.

The South Carolina Application By a Foreign Corporation to Transact Business in the State of South Carolina was developed by the South Carolina Secretary of State for the simple purpose of providing the information required to be filed with this governing body to be presented in a standardized manner. Some of the information required will be the Identity and location of the forming corporation’s Principal Office, Registered Agent, Directors, Officers, and some basic information regarding any Authorized Shares of Stock the forming entity may issue.

The combined Filing Fee for the articles and the initial report is $135.00. Any additional required paperwork may carry its own fee and this should be added to the base Filing Fee of $135.00. All such filings may be submitted by mail directly to the South Carolina Secretary of State to Secretary of State, Attn: Corporations, 1205 Pendleton St., Ste. 525, Columbia, SC 29201.

How To File

Step 1 – Save the two PDF files listed above (“Download Application” and “Download Initial Report”) to your computer. Both of these files must be filled out and submitted to the South Carolina Secretary of State. You may use an up to date appropriate PDF editing program to enter the information onscreen or print it then fill it out. If the filing entity may not operate under its True Name in this state, then download and fill out the link labeled “Download Fictitious Name Form” as it must too be submitted in such a case.

Step 2 – Enter the Full Name of the foreign corporation in Item 1. The Name must be written exactly as it is reported on the Certificate of Existence. If the filing entity’s True Name is not compliant with Section 33 of the 1976 South Carolina Codes of Law, then you must also fill out a South Carolina Adoption of a Ficitious Name (this will require an additional $10.00 Filing Fee) and submit simultaneously with the articles.

Step 3 – In Item 2, define whether this is a general business corporation or a professional corporation. If this is a general business corporation then mark the first box. If this is a professional corporation then mark the second box. Below this on the blank line following the words “…state of,” enter the Name of the state whose governing body holds jurisdiction over the foreign corporation’s activities and existence.

Step 4 – In Item 3, enter the exact Date the filing entity incorporated (legally) in its parent state, as it is recorded with the governing body in that state, on the first blank line. Then, on the second blank line in Item 3, enter the Duration of Lifespan of the filing entity. If there is no Date of Dissolution then write in the word “Perpetual” to indicate the filing entity has no intention of dissolving on a specific date.

Step 5 – In Item 4, you will need to enter the Street Address of the foreign corporation’s first blank line (Building Number/Street/Unit). Then on the second blank line, enter the City of the filing entity’s Principal Office. Finally on the third line, enter the State and Zip Code of the Prinicpal Office’s Address.

Step 6 – In Item 5 locate the blank line labeled “Street Address” then enter the Building Number, the Street, and any applicable Unit Number of the Registered Office. On the blank line following the words “in the city of,” enter the City where the Registered Office is located. After the words “…South Carolina,” enter the Zip Code where the Registered Office is located. Note: This must be a physical location and not only a Mailing Address (i.e. you may not enter a P.O. Box number or anything similar).

Step 7 – In Item 6, locate the blank line labeled “Print Name,” just below the words “…at such address is,” then Print the Full Name of the Registered Agent. Below this will be a blank line labeled “Signature of Registered Agent.” Make sure the Registered Agent obtained by the filing entity to accept service of process in the State of South Carolina (on behalf of the Filing Entity) signs this document.

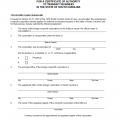

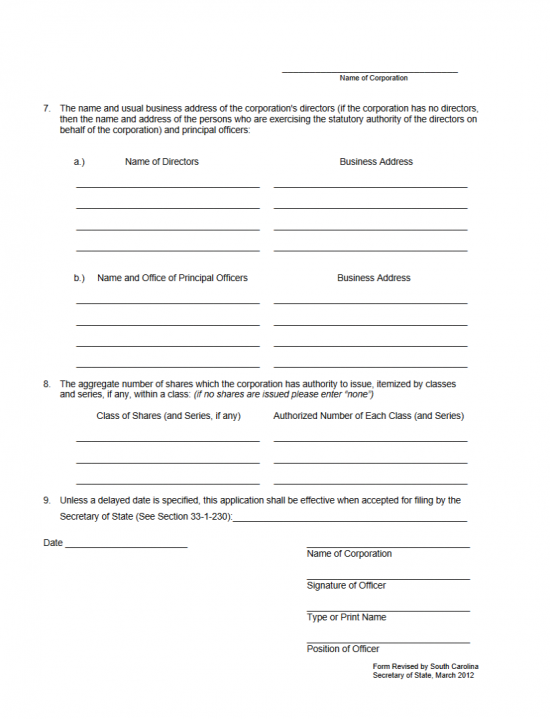

Step 8 – At the top of the second page, and on the right, locate the blank line labeled “Name of Corporation,” then enter the Full Name of the corporation as it was reported in Item 1.

Step 9 – In Item 7, report the Identity and Address of the Directors and Principal Officers. In section a, enter the Name of each Director on a blank line under the column labeled “Name of Directors,” then enter the Address of that party on the same line under the heading “Business Address.” In section b, enter the Full Name and Title of each Principal Officer in the column on the left and the Address of each Principal Officer in the column on the right.

Step 10 – In Item 8, report the Class of each Series of Shares (if any) this corporation is authorized to issue in the column labeled “Class of Shares (and Series, if any).” Then report the Total Number of Shares in each of theses Classes (and Series) on the corresponding line in the column on the right.

Step 11 – In the next section, Item 9, you may indicate if the filing entity wishes to delay its Date of Effect by entering the desired Date of Effect on the blank line provided. Then on the blank line, labeled “Date,” enter the Date this document is being Signed by an Authorized Officer of the foreign corporation.

Step 12 – In the lower right hand corner of the page, you must enter the Full Name of the foreign corporation applying for the Certificate of Authority on the blank line labeled “Name of Corporation.” Then on the blank line labeled “Signature of Officer,” an Authorized Officer serving the foreign corporation must provide his or her Signature. On the blank line labeled “Type or Print Name,” enter the Full Name of the Signature Party. Finally, report the Title the Authorized Officer holds on the blank line labeled, “Position of Officer.”

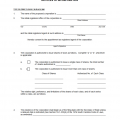

Step 13 – Next, you must fully complete and the Initial Annual Report of Corporations | Form CL – 1.

Step 13 – Next, you must fully complete and the Initial Annual Report of Corporations | Form CL – 1.

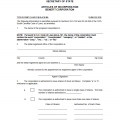

Step 14 – You will need to gather all the documents necessary for this filing into one package. This should include two original South Carolina Application by a Foreign Corporation to Transact Business in the State of South Carolina or one original and one conformed copy, the Certificate of Existence issued by the filing entity’s parent state (and dated within 30 days of the Filing Date), the completed Initial Annual Report of Corporations | Form CL – 1, and any other required paperwork which must accompany these articles. You must also include a check for $135.00 made payable to “Secretary of State.” This is the minimum payment for submitting the South Carolina Application by a Foreign Corporation to Transact Business in the State of South Carolina and Initial Annual Report Initial Annual Report of Corporations | CL-1. All other applicable fees must be added to this figure and submitted. Make sure to include a self addressed stamped envelope. You may file mail to the South Carolina Secretary of State.

Mail To:

South Carolina Secretary of State to Secretary of State

Attn: Corporations

1205 Pendleton St., Ste. 525

Columbia, SC 29201