|

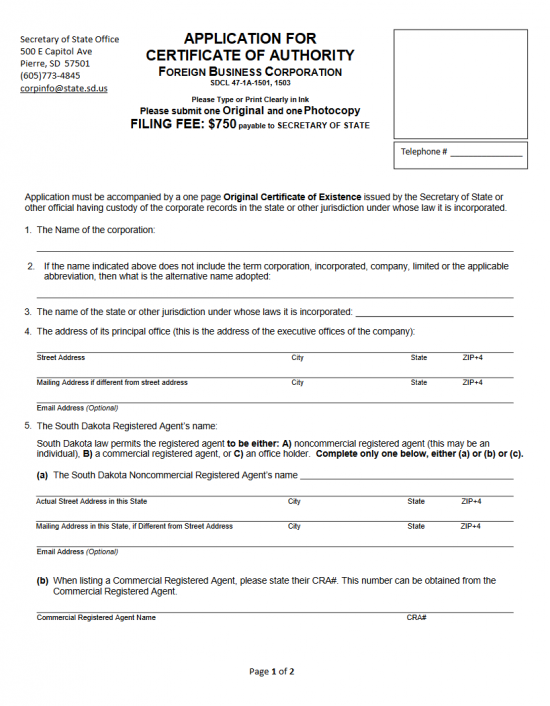

South Dakota Application for Certificate of Authority Foreign Business Corporation |

The South Dakota Application for Certificate of Authority Foreign Business Corporation must be filed by foreign for-profit corporations with the South Dakota Secretary of State before attempting to operate in this state. This document needs to be submitted in duplicate and include a check made out to the Secretary of State for $750.00 to cover the Filing Fee. In addition, the foreign corporation must also submit a Certificate of Existence issued by the state of jurisdiction’s governing body. These are by no means the only requirements for all foreign corporations. Some entity types will be required to file additional paperwork required by the Secretary of State and other governing entities will require their own processes to be completed. This may very significantly. For instance, professional corporations will need to appease licensing boards or regulatory boards while all corporations will need to fulfill Internal Revenue Services for the state or locality the foreign corporation will open in South Dakota

All foreign corporations will also need a Registered Agent. This is the party that will receive court generated documents such as service of process on behalf of the foreign corporation. The Registered Agent must have a Registered Office in the State of South Dakota where he/she/it may be physically located.

How To File

Step 1 – Obtain a blank copy of the South Dakota Application for Certificate of Authority Foreign Business Corporation by clicking on the “Download Form” link above and saving it to your computer.

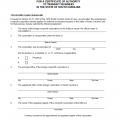

Step 2 – In the first Item, enter the Full Name of the foreign corporation as it is reported on the Certificate of Existence. This must appear exactly as it does on the Certificate of Existence.

Step 3 – Item 2 applies to foreign corporations that must adopt and Alternative Name in South Dakota. If this is the case, then enter the Alternative Name.

Step 4 – Report the parent state of the foreign corporation that holds jurisdiction on the blank line in Item 3.

Step 5 – In Item 4, enter the Street Address, City, State, and Zip Code of the Principal Office’s physical location on the first blank line. If the Principal Office has a separate Mailing Address, then enter this Mailing Address on the second blank line. You will have the option to enter the Email Address of the Principal Office (though this is not mandatory) on the third blank line.

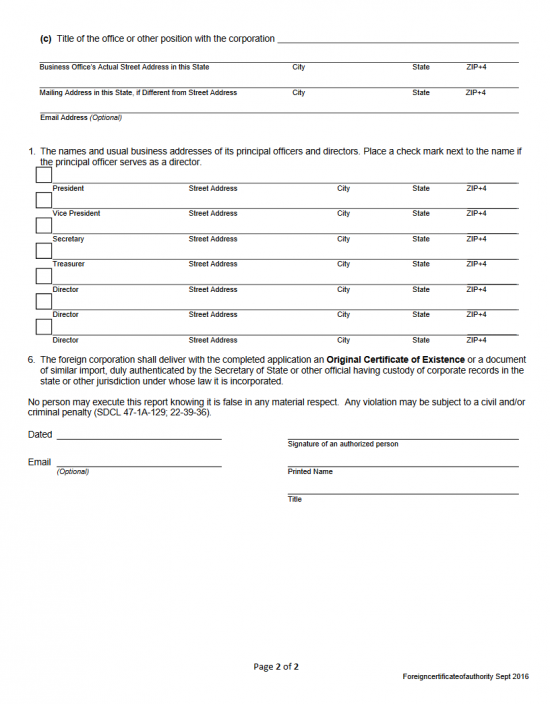

Step 6 – In Item 5, you must indicate the Identity, Type, and Location of the Registered Agent obtained. If this will be an individual then enter the Full Name of the Registered Agent on the first line in Item 5a. Then, enter the Full Address, starting with the Actual Street Address, on the second blank line. If the Registered Office has an alternate Mailing Address, this must be reported on the second line, otherwise you my leave this blank. If you wish to report the Registered Agent’s Email Address, you may do so on the third blank line. If you have obtained a commercial Registered Agent, then locate Item 5b, then enter the Full Name and CRA Number of the Registered Agent on the blank line provided. If the Registered Agent is an Office or a Title in the foreign corporation, then you must fill out Item 5c. Here, you must enter the Title of the Office on the first blank line. Then, on the second blank line, enter the Business Office’s Actual Street Address. This must be a physical location, if this entity has a separate Mailing Address, then report this Mailing Address on the second blank line. If you wish, you may also report the Registered Agent’s Email Address on the third blank line.

Step 6 – Just below Item 5, locate Section 1. Here you must report the Full Name and Address for the President, Vice President, Secretary, Treasurer, and Directors of the foreign corporation. If any of these parties also functions as a Director, then mark the box at the beginning of that line.

Step 7 – Item 6 requires you attach an Original Certificate of Existence from the Secretary of State issued by the governing body of the jurisdiction the foreign corporation is located in.

Step 8 – The bottom of this form will require the Signature of an Authorized Officer on the bottom right, the Printed Name of the Signature Party on the next line, and the Title of the Signature Party on the third line. To the left of this, the Signature Party must provide the Date of Signature on the blank line labeled “Dated” and, if desired, report his or her Email Address below the Date.

Step 9 – Next make a copy of the completed South Dakota Application for Certificate of Authority Foreign Business Corporation and write a check to the Secretary of State for $750.00 as a payment for the Filing Fee (any additional applicable fees must be added to this figure).

Step 10 – Package the two South Dakota Application for Certificate of Authority Foreign Business Corporation (original and copy), the Filing Fee Payment ($750.00), the original Certificate of Existence and any other required paperwork then submit by mail to the South Dakota Secretary of State.

Mail To:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501