|

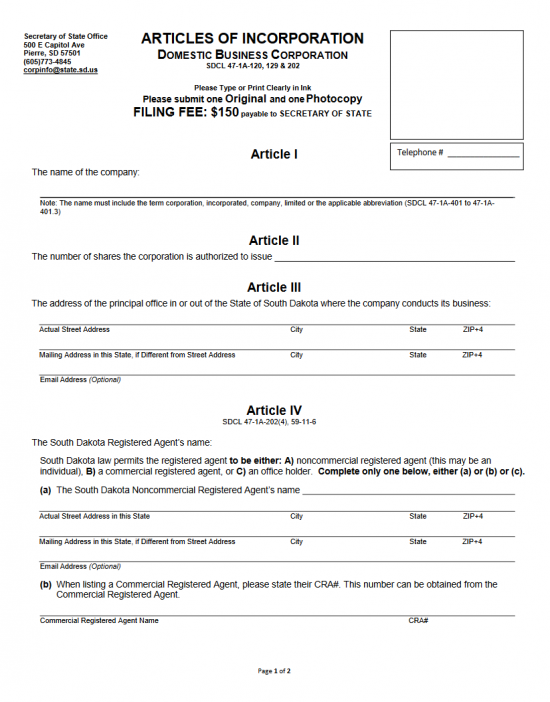

South Dakota Articles of Incorporation Domestic Business Corporation |

The South Dakota Articles of Incorporation Domestic Business Corporation must be submitted in duplicate with a full payment of the Filing Fee to the South Dakota Secretary of State whenever an entity wishes to incorporate as a for-profit corporation in this state. An entity will not be considered a corporation without a Certificate of Incorporation issued by the South Dakota Secretary of State in response to this template form. Several pieces of information will need to be reported on this form and this is considered the minimum amount of information that must be documented by all forming corporations. Some entities may be required to submit additional information. A good example is the professional corporation which must make sure it has obtained the proper permissions and/or licenses to render its services.

The Filing Fee which must be paid to the Secretary of State may be submitted as a check in the amount of $150.00. The articles must be completed and submitted simultaneously with all required paperwork and this payment. You may submit this package by mail to Secretary of State Office, 500 E Capitol Ave, Pierre, SD 57501. The average processing time for this filing is two to three weeks however this will depend upon the staff and workload of the South Dakota Secretary of State.

How To File

Step 1 -Select the link labeled “Download Form,” above this statement then save it to your computer as a PDF file.

Step 2 – In Article I, report the Full Name of the entity being incorporated on the blank line provided. This name must have a corporate designating suffix at the end of the Name being reported (i.e. Corporation, Corp., Corp, Incorporated, Inc., Inc.)

Step 3 – In Article II, enter the Total Number of Shares the corporation being created by these articles has been authorized to issue on the blank space provided.

Step 4 – Article III will have three blank lines. The first one is mandatory. Fill in the Full Address of the Principal Office on the first blank line. This may not contain a P.O. Box number and must be the geographical location of the Principal Office. If the Principal Office has a separate Mailing Address, report this address on the second blank line. This line is not mandatory for every entity as it will be required only if there is a separate Mailing Address. The third blank line will ask for the Principal Office’s Email Address, this is optional but is recommended to report.

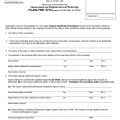

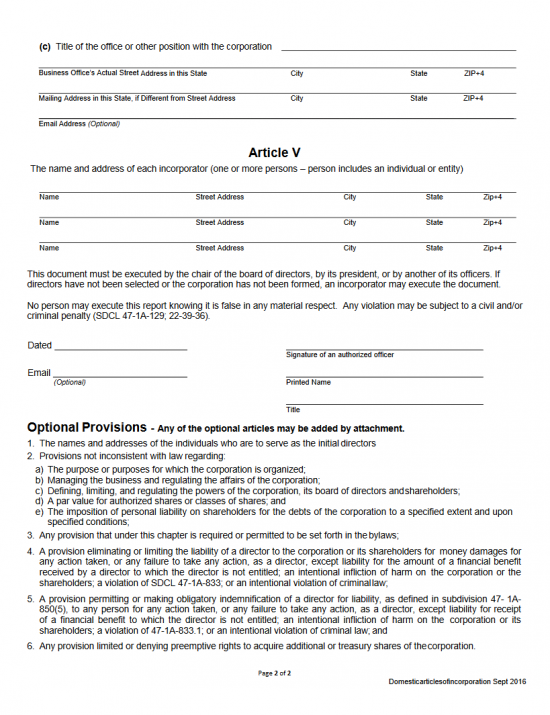

Step 5 – Article IV will require information regarding the Registered Agent obtained by the forming corporation. You may use either an individual, a commercial entity, or an Office Holder in the corporation so long as that party agrees to receive service of process on behalf of this corporation and maintains a physical Registered Office in the state of South Dakota. If you have chosen an individual as a Registered Agent, then locate section “a” and fill out this party’s Full Name on the first blank line. Then on the line below it, enter the Actual Street Address, City, State, and Zip Code where this party’s Registered Office is located. If this party has a separate Mailing Address, this must be filled out on the second blank line in section “a.” If desired, you may report this party’s Email Address on the third blank line. If the Registered Agent you obtained is a commercial Registered Agent, then skip section “a” and locate section “b.” In section “b,” enter the Full Name of the commercial Registered Agent as it appears in South Dakota State Records then enter this entity’s CRA# on the blank line provided in this section. If the Registered Agent chosen for this corporation is an Office Holder, then skip sections a and b then locate section “c.” In section “c,” enter the official position or Title this party holds in the corporation on the first blank line. On the second blank line, report the Actual Street Address, City, State, and Zip Code where this Registered Agent may be physically found. The second blank line should only be filled out if this party receives its mail at a Separate Mailing Address (enter the Address, City, State, and Zip Code). Finally, if desired, enter the Registered Agent’s Email Address on the third blank line. You may only fill in one of the sections.

Step 6 – In Article V, report the Full Name, Street Address, City, State, and Zip Code of each Incorporator. There will be enough room for three however if there is not enough room you may attach a separate document continuing the information required in this article. If so, make sure it is properly labeled.

Step 7 – Attach any additional Provisions that must be present at the time of formation to these articles.

Step 8 – The end of this form will require a Date of Signature, the Signature of an Authorized Officer, the Printed Name of the Signature Party, and the Title held by the Signature party.

Step 9 – Make one exact photo copy of the completed South Dakota Articles of Incorporation Domestic Business Corporation. Then package this with the original, all required paperwork for this entity type, a check for $150.00 payable to “Secretary of State,” then submit by mail.

Step 9 – Make one exact photo copy of the completed South Dakota Articles of Incorporation Domestic Business Corporation. Then package this with the original, all required paperwork for this entity type, a check for $150.00 payable to “Secretary of State,” then submit by mail.

Mail To:

Secretary of State Office

500 E Capitol Ave

Pierre, SD 57501