|

Tennessee Application for Certificate of Authority For Profit Corporation | Form SS – 4431 |

The Tennessee Application for Certificate of Authority For Profit Corporation | Form SS – 4431 may be submitted to the Tennessee Secretary of State in person, by mail, or electronically. This will need to be accompanied by full payment of the $600.00 Filing Fee for these articles. The options for the method of payment is contingent upon how this is filed. You may pay with a check, cashier’s check, money order, or cash if you are submitting this filing in person. If it is being submitted by mail you may pay the Filing Fee with a check, cashier’s check, or money order but not cash. If you are filing electronically, you may only pay with a credit card.

You may file online by going to http://sos.tn.gov/business-services/for-profit-corporations. You may file by mail to Secretary of State’s Office, 6th FL – Snodgrass Tower, ATTN: Corporate Filing, 312 Rosa L. Parks Ave, Nashville, TN 37243. You may file in person at Secretary of State’s Office, 6th FL– Snodgrass Tower, ATTN: Corporate Filing, 312 Rosa L. Parks Ave, Nashville, TN 37243.

This application, depending upon the type of entity being formed, may require additional paperwork in order to be filed properly. For instance, a foreign insurance company, medical practice, or professional corporation will likely require that permissions and/or licenses from the appropriate licensing or regulatory board. All foreign corporations submitting this application will also need to furnish a Certificate of Existence from the state that foreign corporation is incorporated in. The Certificate of Existence must bear the exact True Name of the filing entity, be issued by the governing authority, and issued within two months of the Filing Date.

How To File

Step 1 – Download the Tennessee Application for Certificate of Authority For Profit Corporation by selecting the link labeled “Download Form” or this link: Form SS-4431. This is a PDF file which should be saved to your computer then filled in using a PDF editing program or printing it then filling out the information manually.

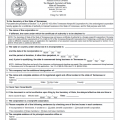

Step 2 – In Item 1, report the True Name of the foreign for profit corporation on the blank space provided. If the foreign profit may not use its True Name to operate in the State of Tennessee, then it must report the Assumed Name it must operate under on the blank line following the words “If different, the name under which the certificate of authority is to be obtained is.” Note: If the only reason the corporation may not use its True Name is because it does not contain an acceptable word of incorporation, then add the corporate designator to the True Name and report it here. If there are other reasons (i.e. another entity possesses this Name in this state), you will need to submit an Application to Operate Under an Assumed Name as well.

Step 3 – In Item 2, you must report where the filing entity is incorporated. Enter the State or Country where the foreign corporation is incorporated on the first blank line available. On the next line, report the Month, Day, and Year the foreign corporation incorporated.

Step 4 – The third line, in Item 2, will only apply to foreign corporations who intend on dissolving or terminating their Corporate Status on a specific date. If this is such a corporation, enter the Date of Termination on the third blank line labeled “Month / Day / Year.” Otherwise, you may leave this item blank.

Step 5 – The fourth line, in Item 2, applies only to foreign corporations who have already been doing business in Tennessee. If this is the case, then enter the Month, Day, and Year the filing entity first conducted business in this state. Otherwise, you may leave this line blank.

Step 6 – Item 3 will only apply to foreign corporations who have an additional designation. Additional Designations apply if the filing entity is a Bank, Captive Insurance Company, Credit Union, For-Profit Benefit Corporation, Insurance Company, Litigation Financier, Massachusetts Trust, Professional Corporation, or Trust Company. Report any applicable Designation on the blank line in Item 3.

Step 7 – In Item 4, you must report the Full Name and the Complete Address of the Registered Agent and the Registered Office. On the first line enter the Full Name of the Registered Agent. Then use the line labeled “Address” to report the Building Number, Street, and Unit Number. The third line will contain a blank lines to enter the City, Zip Code, and County of the Registered Office. Note: The Address reported here must be the actual location of the Registered Office and not a Mailing Address separate from this location.

Step 8 – In Item 5, enter the Fiscal Year Close Month for the foreign corporation.

Step 9 – Item 6 will apply only to filing entities who wish to prolong the time of this application taking Effect. If this is the case enter the Month, Day, and Year then the Tim you wish the Certificate of Authority to take Effect on the blank lines provided. You may only choose a Date between the Filing Date and 90 Days after the Filing Date. If you leave this section blank the Date of Effect will be the same as the Filing Date.

Step 10 – Item 7 will hold the filing entity to operating as a for profit corporation in the State of Tennessee.

Step 11 – In Item 8, you must report the Full Address of the Principal Office. The Building Number, Street, and Unit Number of the filing entity’s Principal Office should be reported on the first line. Then, on the second line, you must report the City, State, and Zip Code of the Principal Office’s Address.

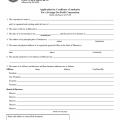

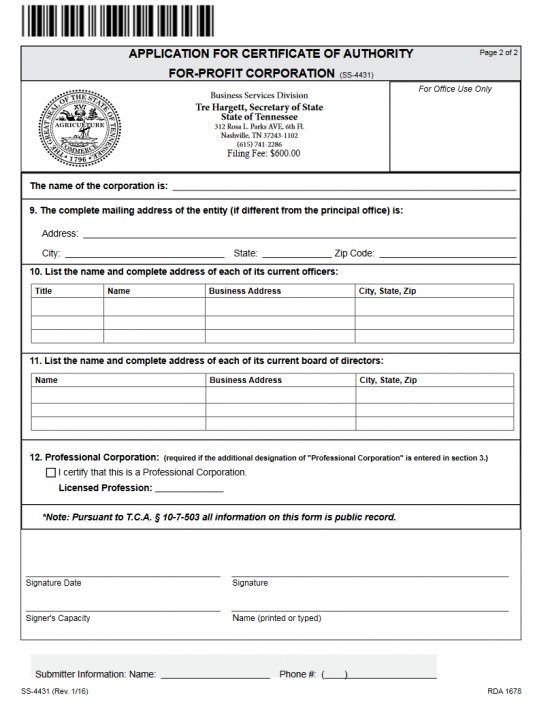

Step 12 – On the top of the second page, of this application, enter the True Name of the foreign corporation on the first blank line, just above Item 9.

Step 13 – Item 9 only applies to filing entities whose Principal Office Mailing Address differs from the actual Address of the Principal Office. If this is the case, enter the Mailing Address of the Principal Office in Item 9. Do this by entering the Building Number/Street/Unit Number on the first line then the City/State/Zip Code on the second line.

Step 14 – Item 10 requires the Title, Name, and Business Address of each of the Officers currently serving the foreign corporation. In the column labeled “Title,” enter the Officer’s Title (i.e. President, Vice-President, etc.). Then in the “Name” column, enter the Full Name of the Officer being reported. In the column labeled “Business Address,” report the Street Address for the Officer’s official Address. Finally report the City, State, and Zip Code of the Business Address in the last column.

Step 15 – In Item 11, report the Name, Business Address (Building/Street/Unit Number), and City/State/Zip Code for the Directors serving on the Board of Directors. Use the left column to enter a Director’s Name, the middle column to enter the Business Address, and the last column to enter the City/State/Zip Code of the Director’s Business Address.

Step 16 – Item 12 applies only to foreign corporations who are a Professional Corporation. If this is a Professional Corporation then select the box labeled “I certify that this is a Professional Corporation.” Then on the blank line provided enter the Name of the Licensed Profession for this corporation.

Step 17 – At the end of this document will be four blank lines: Signature Date, Signature, Signer’s Capacity, and Name (printed or typed). Here, an authorized representative (i.e. Officer or Director) must provide the Date he/she is signing this document in “Signature Date.” Then he or she must Sign his or her Name on the blank line labeled “Signature.” Next, this party must report their official Title with the filing entity on the line labeled “Signer’s Capacity.” Finally, he or she must print or type his/her Name on the line labeled “Name (printed or typed).”

Step 18 – Finally the Submitter of this application must report his or her Name and Phone Number on the blank spaces on the last line of this document.

Step 19 – Organize all other filings, documents, etc. that must accompany the Tennessee Application for Certificate of Authority For Profit Corporation into one package. Make sure to include the Filing Fee of $600.00 for the Tennessee Application For Certificate of Authority Form SS-4430 plus whatever other applicable fees will be due. This may be paid for with a check, cashier’s check, or money order made out to “Secretary of State,” if submitting by mail. If submitting in person you may pay with a check, cashier’s check, money order, or cash.

Step 19 – Organize all other filings, documents, etc. that must accompany the Tennessee Application for Certificate of Authority For Profit Corporation into one package. Make sure to include the Filing Fee of $600.00 for the Tennessee Application For Certificate of Authority Form SS-4430 plus whatever other applicable fees will be due. This may be paid for with a check, cashier’s check, or money order made out to “Secretary of State,” if submitting by mail. If submitting in person you may pay with a check, cashier’s check, money order, or cash.

Mail To:

Secretary of State’s Office

6th FL – Snodgrass Tower

ATTN: Corporate Filing

312 Rosa L. Parks Ave

Nashville, TN 37243

Bring To:

Secretary of State’s Office

6th FL – Snodgrass Tower

ATTN: Corporate Filing

312 Rosa L. Parks Ave

Nashville, TN 37243

How To File Electronically

Step 1 – Go to http://sos.tn.gov/business-services/for-profit-corporations.

Step 2 – Under the heading “Online Services,” select the link labeled “Form or Register a New Business.”

Step 3 – Read the information provided on the left. When you are ready, select the button on the right labeled “Start Now.”

Step 4 – In the box labeled “Online Business Registration,” locate the drop down list labeled “Business Entity Type.” Then select “For Profit Corporation.” Read the information on this page and select the check box labeled “I Attest That.” When you are ready select “Continue.”

Step 5 – This will be the first page of the online filing. Make sure the “Name” tab is selected then locate the field labeled Business Entity Name. Enter the True Name of the foreign corporation as it appears on its Certificate of Existence in both the “Business Entity Name” and “Confirm Name” fields.

Step 6 – Next to the words “Formation Locale” select the radio button labeled “Foreign Business.” This will generate several required fields.

Step 7 – The next section on this page, “Foreign Entity Detail,” requires you select the State or Country where this entity was incorporated from the drop down list.

Step 8 – In the next field, labeled “Formed On,” enter the Date this entity Incorporated in its home state.

Step 9 – The next field will apply only to corporations who have been conducting business in the State of Tennessee before submitting this application. If this is the case, report the Date the foreign corporation first conducted business in the State of Tennessee in the field labeled “Commenced Doing Business in TN On.” If this is not the case, then select the box labeled “This business entity has not yet commenced doing business in Tennessee.”

Step 10 – Next, in the field labeled “Certificate of Existence Date,” enter the Date of the Certificate of Existence as it is reported on the Certificate of Existence.

Step 11 – If the filing entity requires an Additional Designation, you must report this by selecting the Designation from the drop down list labeled “Additional Designation.” You may choose Captive Insurance Company, For Profit Benefit Corporation, Insurance Company, Litigation Financier, Massachusetts Trust, National Bank (Corp), Professional Corporation, or Trust Company. If these Designations do not apply to the foreign corporation then you may leave this blank. When you are ready, select the button labeled “Continue.”

Step 12 – This next tab, “Details,” will require some calendar information. In the field labeled “Period of Duration,” you must indicate if the foreign corporation operates under a predefined lifespan and, if so, what that lifespan is. A drop down list will be provided in this field for this purpose. If the foreign corporation intends to operate indefinitely then select “Perpetual.” If this corporation will expire in 5 or 50 years, then select “Expires – 5 years” or “Expires – 50 years” respectively. Selecting one of these will generate the Date of Expiration below this field. Selecting “Expires” will generate a field where you may enter the Date of Expiration directly below this field.

Step 13 – In the field labeled “Fiscal Year Close,” enter the last month of the Fiscal Year for the foreign corporation.

Step 14 – The last field on this page, applies only to foreign corporations who do not wish this application to be Effective upon a successful Filing Date. If the filing entity wishes to delay the Date of Effect, this may be done by naming this Date in the field provided. You may only choose a Date within 90 Days of this application’s Filing Date. If the filing entity wishes the filing to be immediate upon the Filing Date then leave this field blank. When you are ready, select “Continue.”

Step 15 – Next, in the “Agent,” tab you must report the Identity and Geographic Location of the Registered Agent and the Registered Agent’s Office. The first step in reporting this will be to indicate if the filing entity’s Tennessee location will act as its own Registered Agent. If this is the case select the box at the top of this section labeled “This business will represent itself.” If not, then leave this box blank.

Step 16 – In the text field labeled “Agent Type,” report whether the Registered Agent is an Individual by selecting the first radio button. If the Registered Agent is an Organization, select the second radio button. You must choose one of these. If the Registered Agent is an Individual then, you must report the Full Name across three fields (First Name, Middle Name, Last Name). If the Registered Agent is an Organization then you will need to report the SOS# in the field provided.

Step 17 – Next, you will need to report the Street Address designated to the physical location of the Registered Agent in the field labeled “Address.” This should be composed of a Building Number, Street, and (if applicable) Unit Number. The text field below this, “APT/STE/FL” is provided to report a Unit Number or Floor Number.

Step 18 – If a Contact Name has been provided by the Registered Agent, report this in the field labeled “Attention.”

Step 19 – Report the City where the Registered Office is located in the “City” field then enter the Zip Code in the “Postal Code” field.

Step 20 – Finally, use the drop down list in the last field to select the County where the Registered Office is located. When you are ready, select the button labeled “Continue.”

Step 21 – The Address tab will require the Principal Office’s physical location reported in the first section and (if different) the Principal Office’s Mailing Address in the second section. In the first field of the Principal Office Address section, select the Country where the Principal Office is located from the drop down list provided.

Step 22 – Use the “Address” (Building Number/Street) and the “STE/APT/FL” (Unit Number or Floor Number if applicable) to report the Full Street Address of the Principal Office.

Step 23 – If there is a designated Contact Person for the Tennessee Secretary of State to correspond with, then enter this party’s Name in the field labeled “Attention.” This field is optional.

Step 24 – Next, you must enter the City, Select the State, and enter the Zip Code in the “City,” “State,” and “Postal Code” fields.

Step 25 – Select the County where the Principal Office is located from the field labeled “County.”

Step 27 – Enter a Contact Phone Number for the Tennessee Secretary of State to use in the “Phone” field.

Step 28 – The “Mailing Address” section will only apply to filing entities who receive their mail at an Address separate from their physical location. If this is not the case, you may leave this section blank and select “Continue.” If this entity’s Principal Office does maintain a separate Mailing Address, then select the Country for this Mailing Address from the drop down list in the first field.

Step 29 – Enter the Building Number and Street of the Principal Office’s Mailing Address in the field labeled “Address.”

Step 30 – In the field labeled “STE/APT/FL,” enter the Unit Number, Floor, or P.O. Box of the Principal Office’s Mailing Address.

Step 31 – If a Contact Name must be listed in the Mailing Address, enter this Name in the field labeled “Attention.”

Step 32 – In the field labeled “City,” enter the City listed in the Principal Office’s Mailing Address then select the State from the “State” field. The “Postal Code” field is reserved for the Zip Code in the Principal Office’s Mailing Address. When all the information that must be reported on this page has been, select the button labeled “Continue.”

Step 33 – The Parties tab will require an entry for each Director on the foreign corporation’s Board of Directors and each Officer serving this corporation to be reported. There are three sections: Directors, Officers and Directors, and Add/Edit Officers and Directors. If all the Officers being reported are also Directors then place a check in the box labeled “Board of Directors are the same as the Officers listed below.” If this is not the case, leave this box blank.

Step 34 – The Officers and Directors section will provide a table that will auto-populate each time you enter the required information for these parties. You may edit or delete any rows in this table. In order to do this, enter the required information in the Add/Edit Officers and Directors section. Start by indicating if the party being reported is an Officer or Director by selecting the radio button labeled “Officer” or the radio button labeled “Director.”

Step 35 – The next field, “Title,” requires you to report the position the individual being reported holds (i.e. President, Vice-President, etc.).

Step 36 – Use the next three fields, “First Name,” “MI,” and “Last Name,” to report the Full Name of the party being reported.

Step 37 – In the field labeled “Country,” select the country where this party is located.

Step 38 – Report the Building Number and Street of the party’s Address in the “Address” field.

Step 39 – Use the field labeled “STE/APT/FL” to report any applicable Unit Number or floor.

Step 40 – If a Contact Name is provided for this party (other than the Name of the Individual being reported), you may enter this in the “Attention” field.

Step 41 – In the “City” field, report the Officer or Director’s City.

Step 42 – Enter the two letter code for the State in the Officer or Director’s Address.

Step 43 – In the field labeled “Zip,” enter the Zip Code in the Officer or the Director’s Address. When you are finished with this entry, select the button labeled “Add.” This will auto-populate the table above with the information you just entered. You may either enter information for another party (you must report each Officer and Director) or, when finished, select the button labeled “Continue.”

Step 44 – Review all the information you have just entered on the “Confirmation” page. If any of the entries you have made need to be edited, you may navigate to that section using the tabs along the top of this section. When you are ready select “Continue.”

Step 45 – Next, an authorized party, such as an Officer or a Director, must provide an Electronic Signature. This may be done by having that individual read this page then select the box labeled “I certify.” Next, the Signature Party will need to enter his or her First Name, Middle Initial (“MI”), Last Name, Phone Number and Email in the appropriately labeled fields. Note: You must enter the exact same Phone Number and exact same Email in the “Contact Phone” and “Confirm Phone” as well as the “Contact Email” and “Confirm Email” fields, respectively.

Step 46 – The section at the bottom of this page, Required Documents, will give the opportunity to upload the required documents necessary for this filing, such as the Certificate of Existence. These must be in a PDF format. Mark the radio button labeled “I will upload the required document(s)…” then use the browse button to upload the Certificate of Existence obtained by the filing entity to this application. When you are done, select the “Continue” button. You will be directed to an area where you may either print these documents to file by mail/in person or continue to file electronically. If filing electronically you will be directed to an area where you may enter the Credit Card information required for payment of the $600.00 Filing Fee.