|

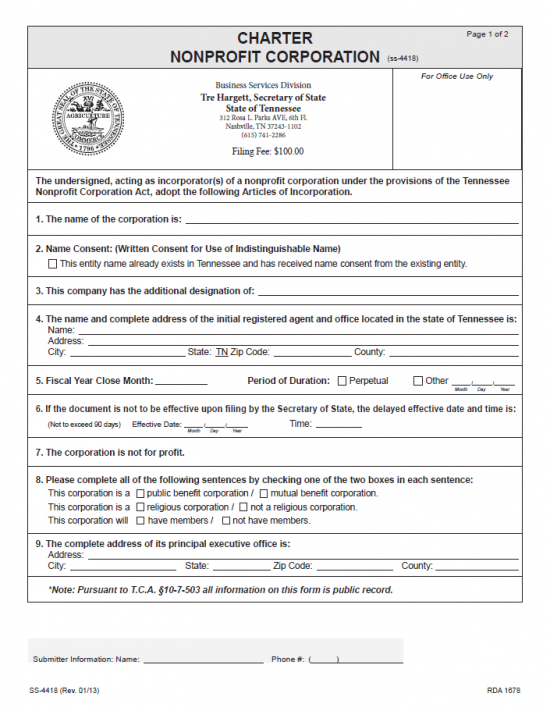

Tennessee Articles of Incorporation Charter Nonprofit Corporation | Form SS – 4418 |

The Tennessee Articles of Incorporation Charter Nonprofit Corporation | Form SS – 4418 will need to be filled out then submitted by mail or online to the Tennessee Secretary of State. When an entity wishes to form to a nonprofit corporation, the Incorporator(s) must fulfill state requirements by reporting and registering certain information with the Tennessee Secretary of State. If this is done to the satisfaction of this governing body, a Certificate of Incorporation will be granted to the entity. This becomes the Effective Date, marking the start of the nonprofit corporation’s lifespan and the day it is allowed to operate as a nonprofit corporation in the State of Tennessee. It should be noted this does not automatically grant Tax-Exempt Status to the nonprofit corporation. Only the Internal Revenue Service may do this and Incorporators wishing to apply for Tax-Exempt Status will need to go through a separate filing process with the I.R.S.

The Tennessee Articles of Incorporation must be submitted with full payment of the Filing Fee. The Filing Fee is $100.00 and may be paid for by either check, cashier’s check, money order, or a credit card depending upon how you file. If you are filing by mail, you may only pay with a check, cashier’s check, or money order made out to Secretary of State (for $100.00). You may mail the articles to Secretary of State’s office, 6th FL – Snodgrass Tower, ATTN: Corporate Filing, 312 Rosa L. Parks Ave, Nashville, TN 37243. If you wish to pay in cash then you must submit the articles in person at Secretary of State Business Services Division, 6th FL – Snodgrass Tower, 312 Rosa L. Parks Ave, Nashville, TN 37243. If filing online (http://sos.tn.gov/business-services/non-profit-corporations) you may only pay with a credit card. It should be noted, there will be a slight convenience charge when filing online.

How To File

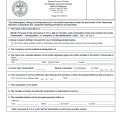

Step 1 – Use the link above (“Download Form”) to obtain the Tennessee Articles of Incorporation Charter Nonprofit Corporation. You may also click here: Form SS-4418. Save this file as a PDF. You may use a PDF program to enter information on screen or you may print it then enter the information on paper.

Step 2 – In the first item, Article 1, report the Full Name of the corporation, including the necessary corporate designator, the nonstock corporation being chartered by these articles on the blank line provided.

Step 3 – If you had to obtain consent from another entity with a similar or same name you must check the box in Article 2 then include a completed Application to Use an Indistinguishable Name and an additional payment of $20.00.

Step 4 – If this corporation has an Additional Designation, this must be reported in Article 3 on the blank line provided. An Additional Designation will indicate certain kinds of nonstock corporations that (in most cases) will require that additional permissions from the appropriate governing authority be submitted as well (i.e. Bank, Credit Union, Trust, etc.).

Step 5 – Enter the Full Name of the Tennessee Registered Agent obtained to serve this nonstock corporation on the line labeled “Name” in Article 4. Then, on the “Address” line, enter the Building Number, Street, and Unit Number of the physical Address of the Tennessee Registered Office. On the third line of this article, enter the City, Zip Code, and County of the Registered Office’s physical Address.

Step 6 – Next, in Article 5, two topics will need to be covered. On the first blank line, enter the Fiscal Year Close Month for this nonprofit corporation. Then indicate if this nonstock corporation will operate with or without a specific Date of Dissolution. If not, then check the box labeled “Perpetual.” If this corporation will operate with a specific Date of Dissolution, then place a check mark in the second box then enter the Date of Dissolution in the space provided.

Step 7 – You may indicate when these articles will take Effect in Article 6. If you would like a specific Effective Date and Time for these articles to take Effect then enter the Date in space labeled “Effective Date” (mm/dd/yyyy) and the Time in the blank space labeled “Time.”

Step 8 – Article 7 will bind the nonstock corporation being chartered to operating as nonprofit corporation in the State of Tennessee.

Step 9 – In Article 8, you must further define the nature of the nonstock corporation being chartered by these articles. On the first line, place a check mark in the first box if this is a Public Benefit Corporation. If this is Mutual Benefit Corporation place a check in the second box of this line.

Step 10 – On the second line, of Article 8, place a mark in the first box if this is a Religious Corporation. If this is not a Religious Corporation then place a check mark in the second box.

Step 11 – On the third line, of Article 8, place a mark in the first box if this nonstock corporation will have Members. If not, then place a mark in the second box.

Step 10 – Report the Full Address of the nonstock corporation’s Principal Office in Article 9. This may not be a P.O. Box but, rather, the geographic location of the Principal Office. Enter the Building Number, Street, and Unit Number of the Principal Office on the first line. Then on the second line, in the appropriately named spaces, enter the City, State, Zip Code, and County where the Principal Office is located. Note: The Submitter of this form must provide his or her Printed Name at the bottom of the first page as well as his/her Phone Number.

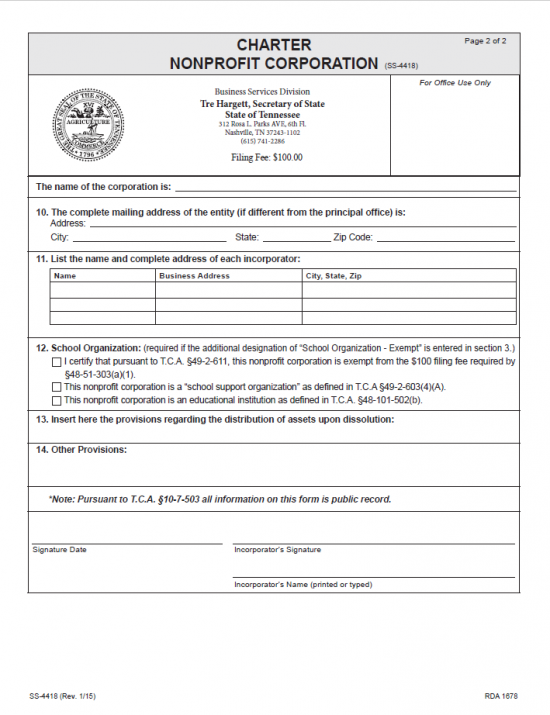

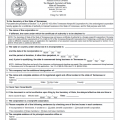

Step 11 – On the first blank line of this page, enter the Full Name of this nonstock as it was previously reported. Article 10 is reserved solely for the use of nonstock corporations whose Principal Office has a Mailing Address that is different from the Physical Location listed in Article 9. If this is the case, then you must report the Full Mailing Address here. Start by entering the Building Number, Street, and Unit Number on the first blank line. Then on the second line, use the “City,” “State,” and “Zip Code” fields to report the rest of the Mailing Address of the nonstock corporation being formed by these articles.

Step 12 – In Article 11, you must use the table provided to report the Full Name and Address of each Incorporator. The first column, “Name,” will be where you report the Name of an Incorporator. Then, in the column labeled “Business Address,” enter the Building Number, Street, and Unit Number in that Incorporator’s Address. Finally, in the column labeled “City, State, Zip,” report the City, State, and Zip Code of that Incorporator.

Step 13 – In Article 12, if this nonstock corporation is exempt from the Filing Fee (as per T.C.A 49-2-611), check the first box. If this nonprofit is a school support organization (T.C.A. 49-2-603), place a check in the second box. If this nonprofit is an educational institution (T.C.A. 48-101-502(b)), then place a check in the third box. Only mark the boxes that directly apply to the nonstock corporation being formed by these articles pursuant to the Tennessee laws cited.

Step 14 – Report any Provisions that relate to the Dissolution of the nonstock corporation being formed by these articles and the distribution of the remaining assets of that time on the blank line provided.

Step 15 – If there are other Provisions that apply to these articles, you must report them in the space provided in Article 14.

Step 16 – The bottom of the page must bear an Incorporator’s Signature and Printed Name on the two (appropriately labeled blank lines) on the right and the Signature Date on the left.

Step 17 – You may require additional paperwork in order to file these articles. Once you have gathered and confirmed that all documents and filings, necessary for this filing, are present and accounted for, you may send the Tennessee Articles of Incorporation Charter Nonstock Corporation to the Tennessee Secretary of State or file them in person. You may pay by check, cashier’s check, money order or cash if you are filing in person. If you are filing by mail, you may not pay by cash.

Mail To:

Secretary of State’s office

6th FL – Snodgrass Tower

ATTN: Corporate Filing

312 Rosa L. Parks Ave

Nashville, TN 37243

Bring To:

Secretary of State

Business Services Division

6th FL – Snodgrass Tower

312 Rosa L. Parks Ave

Nashville, TN 37243

How To File Electronically

Step 1 – Go to the Tennessee Secretary of State’s Nonprofit Corporation page at http://sos.tn.gov/business-services/non-profit-corporations.

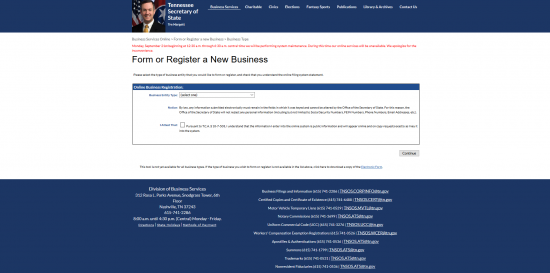

Step 2 – The bottom of the page will contain several tabs, each with several headings and paragraphs. Locate the heading labeled “Form or Register a New Business,” then select it with your left mouse button.

Step 3 – Read this entire page. When you are ready, select the red button labeled “Start Now.”

Step 4 – This is the first screen of the Online Registration process. The Business Entity Type field will contain a drop down list. Select “Nonprofit Corporation” from this list.

Step 5 – Read this entire page. If you agree with the conditions provided, then check the box labeled “I Attest That” and select the button labeled “Continue.”

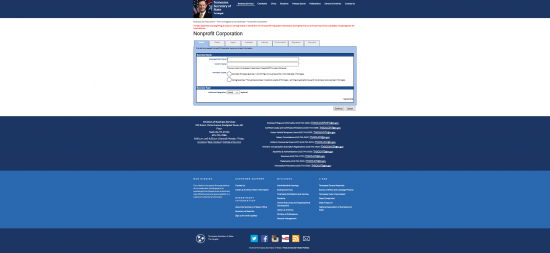

Step 6 – This is the Name page of this online form. Here, you must enter the Full Name of the nonstock corporation being formed by these articles in the first field (“Business Entity Name”) then, re-enter this Name in the field labeled “Confirm Name.”

Step 7 – In the “Formation Locale” section below, select the first radio button labeled “Domestic Tennessee Business.”

Step 8 – In the section labeled “Business Type,” locate the field labeled “Additional Designation.” If the nonprofit corporation has an additional designation, then you must select the appropriate Business Entity Type from the drop down list provided. You may choose: Captive Insurance Company, Insurance Company, Litigation Financier, Massachusetts Trust, Neighborhood Preservation Corp., School Organization – Exempt, or Trust Company. You may only choose one but if none apply to the nonprofit corporation being formed then you may leave this field blank. Once you have entered all of the information necessary for this page, select the button labeled “Continue.”

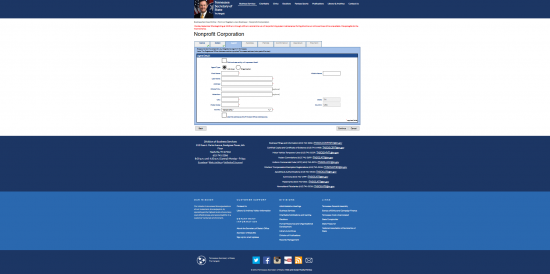

Step 9 – This page is the Detail page. First you must indicate the lifetime of the forming nonstock corporation, using the drop down list labeled “Period of Duration.” You will have four choices: Expires, Expires – 5 years, Expires – 50 years, Perpetual. If there is a specific Date where this corporation intends to dissolve, then select “Expires.” This selection will generate a Date field directly below this field where you may enter the Date of Dissolution. If this corporation intends to operate without a Dissolution Date defined then select “Perpetual.” If you choose either “Expires – 5 years” or “Expires – 50 years” the date will be displayed directly below this field. Make sure to report this duration as accurately as possible before moving on to the next question.

Step 10 – Next, you must use the drop down list, labeled “Fiscal Year Close,” to indicate the last month of this nonstock corporation’s Fiscal Year.

Step 11 – The Effective Date field will give the option of either selecting a Date of Effect for these articles (within 90 days after the Filing Date) or simply allowing the articles to go in Effect on the Filing Date. If you wish a separate date for the Effect of this form being submitted successfully then enter the desired Date of Effect in the text field provided (use a mm/dd/yyyy format). If you leave this field blank the Filing Date will be the Date of Effect.

Step 12 – The next section will seek to tighten the definition of this nonstock corporation type. On the first line, indicate if this is a Public Benefit Corporation or a Mutual Benefit Corporation by selecting the appropriate radio button. Then, on the next line, indicate if this is a Religious Corporation by selecting the first radio. If not select the second radio button. Finally if this nonstock corporation will have Members, select the first radio button the third line. If not, select the second radio button on the third line.

Step 13 – Below the words “Asset Distribution,” select the first radio button if the nonprofit corporation will distribute its assets amongst its members (after the payment of all debts) in respect to membership interests. If this nonprofit will distribute its assets to another nonprofit corporation (upon dissolution) then select the second radio button. If neither of these describe the distribution of assets upon dissolution, select the third radio button (labeled “Other”), this will generate a text box where you may fully describe how assets will be distributed upon dissolution.

Step 14 – If there are any other Provisions which must be included, select the button labeled “I wish to include a statement of other provisions.” This will generate a text field where you may name such provisions. When you are ready, select the button labeled “Continue.”

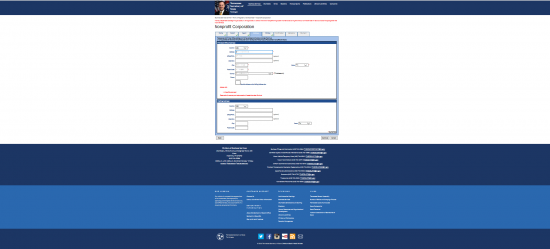

Step 15 – Here, in the “Agent” section, you must report the Full Name and Full Identity of the Registered Agent. If the forming nonprofit will be its own Registered Agent, then select the check box labeled “This business entity will represent itself.” This will replace the Name fields with the Name of the nonprofit being formed.

Step 15 – Here, in the “Agent” section, you must report the Full Name and Full Identity of the Registered Agent. If the forming nonprofit will be its own Registered Agent, then select the check box labeled “This business entity will represent itself.” This will replace the Name fields with the Name of the nonprofit being formed.

Step 16 – Next to the words “Agent Type,” select the first radio button if the Registered Agent is an Individual and the second radio button if the Registered Agent is an Organization.

Step 17 – Assuming the Registered Agent is an individual, use the first three fields (First Name, Middle Name, and Last Name) to enter the Full Name of the Registered Agent.

Step 18 – In field labeled “Address,” enter the Building Number/Street/Unit Number of the Street Address of the Registered Agent’s Office. This may not be a P.O. Box.

Step 19 – In the field labeled “STE/APT/FL” report any applicable Unit Number or Floor in the Registered Agent’s Address.

Step 20 – In the field labeled “Attention,” report the Contact Name (if applicable) for the Registered Agent’s Office.

Step 21 – Enter the “City” of the Registered Office in the field labeled “City.”

Step 22 – Enter the Zip Code of the Registered Agent in the field labeled “Postal Code.”

Step 23 – Use the drop down list, labeled “County,” to report the County where the Registered Office is located.

Step 24 – The Address section will require the Physical Address of the Principal Office of this nonstock corporation. The top section must be where the Principal Office may be physically found while the bottom section will only be required if the Principal Office has a separate Mailing Address. In the section at the top, “Principal Office Address,” select the Country where the Principal Office is located using the first drop down list. Then in the “Address” field, report the Building Number and Street of the Principal Office. If there is an applicable Unit Number or Floor in this Address, report it in the field labeled “STE/APT/FL.” Report any applicable Contact Person’s Full Name in the field labeled “Attention.” Next, report the City, State, Postal Code, County, and Phone Number for the Principal Office in the appropriately labeled fields. Note: County and State are both drop down lists.

Step 25 – If this Principal Office receives its mail at a separate location, enter this Mailing Address utilizing the Country, Address, STE/APT/FL, Attention, City, State, and Postal Code Fields provided. If the Principal Office does not have a separate address then leave the section labeled “Mailing Address” blank. When you are ready, select the button labeled “Continue.”

Step 26 – Next you must give a Roster on the Incorporators of this nonprofit corporation. Locate the section at the bottom labeled “Add/Edit Incorporators.” Enter the First Name, Middle Initial (labeled “MI”), and Last Name of an Incorporator. Then utilizing the fields on the right (Country, Address, STE/APT/FL, Attention, City, State, and Zip), document the Address of the Incorporator you are reporting on. When you are done with one entry, select the button labeled “Add.” This will display the information you entered in the top portion of this page, labeled “Incorporators,” while leaving the “Add/Edit Incorporators” section blank so that you may add another entry. Select “Add” after each entry for each Incorporator you are reporting on. When ready, select the button labeled “Continue.”

Step 27 – This is the Confirmation page. Here, you may review all the information you entered on one screen. If any section needs to be edited, you may navigate to it using the tabs along the top. When all the information present has been verified as being up to date and accurate, select the button labeled “Continue.”

Step 28 – This page will require an Electronic Signature before you may proceed. This must be entered by an Incorporator that has been previously listed here. First the Incorporator must read the entire page. Then, the Incorporator must select the box labeled “I certify.”

Step 29 – In the field labeled “Incorporator’s First Name,” the Incorporator must enter his/her First Name. Next to this, the Incorporator must enter his or her Middle Initial in the field labeled “MI” and his/her Last Name in the field labeled “Last Name.”

Step 30 – The Incorporator must then enter his/her Phone Number in both the “Contact Phone” and “Confirm Phone” fields.

Step 31 – Finally the Incorporator should enter his/her Email Address in both the “Contact Email” and “Confirm Email” fields. Once this has been done, you may select the button labeled “Continue.” This will direct the browser to the Payment Screen where the Card Holder may enter his/her Credit Card Information for payment of the $100.00 Filing Fee. Unless, this is corporation qualifies to be exempt from this fee, the articles will not be processed until payment has been received. Make sure the Credit Card information is entered correctly as denial due to lack of funds will result in a possible $40.00 penalty.