|

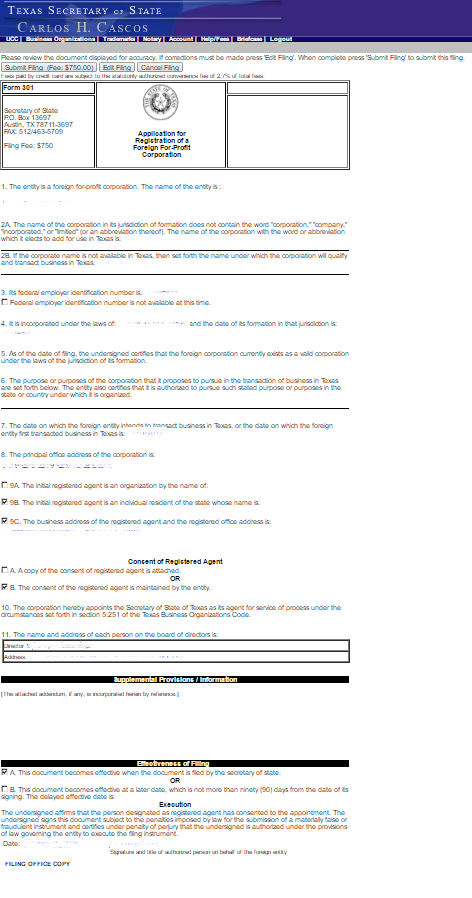

Texas Application for Registration of a Foreign For-Profit Corporation| Form 301 |

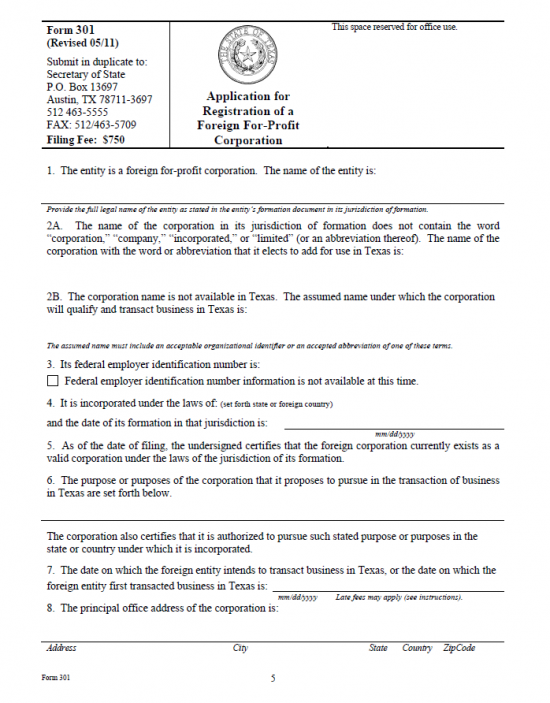

The Texas Application for Registration of a Foreign For-Profit Corporation| Form 301 functions as integral part in the registration process required of foreign, or out of state, profit corporations by the Texas Secretary of State as per Chapter 9, Texas Business Organizations Code (BOC). This process will also require a submission of the Certificate of Existence issued by the parent state of the foreign for-profit corporation. This template form will satisfy the basic requirements most out-of-state corporations will need to fulfill in reporting the information necessary for the Texas Secretary of State to make a valid assessment. Failure to register an out-of-state for-profit corporation may result in penalty fees issued by all governing bodies with an interest and the authority to uphold the law.

The Texas Application for Registration of a Foreign For-Profit Corporation | Form 301 carries a filing fee of $750.00. This may be paid with a check or money order (made payable to “Secretary of State”), a major credit card, or LegalEase Account. The Texas Secretary of State provides a variety of options in the method of submission. The Texas Application for Registration of a Foreign For-Profit Corporation | Form 301, and all accompanying paperwork may be delivered to the James Earl Rudder Office Building at 1019 Brazos, Austin, Texas 78701, mailed to Secretary of State, P.O. Box 13697, Austin, Texas 78711-3697, or faxed to (512) 463-5709 You may also submit these documents online at SOS Direct.

How To File

Download PDF Form

Download Word Form

Step 1 – You may download the Texas Application for Registration of a Foreign For-Profit Corporation | Form 301 by selecting either “Download PDF Form” or “Download Word Form,” then saving it to your computer. If you choose “Download PDF Form,” you must a PDF editor program or a browser with the required extensions for filling out a form onscreen. If not, then you must use MS Word to enter information but must select the link labeled “Download Word Form,” then saving it to your computer.

Step 2 – In Item 1, enter the Full Name of the foreign corporation submitting this application as it appears on its Articles of Incorporation (or equivalent documents) in its parent state.

Step 3 – Item 2A and Item 2B will deal specifically with foreign corporations bearing a Name that is either noncompliant with Texas State Law or is altogether unavailable in the State of Texas. If the foreign corporation’s Name does not contain a word of incorporation (i.e. Corporation, Incorporated, or an acceptable abbreviation of such), then rewrite the exact Full Name of the filing entity, as reported in Item 1, with a word of incorporation on the blank line in Item 2A. If the foreign corporation’s Name may not be used in the State of Texas, then enter the Assumed Name the foreign corporation will use to be identified as and operate under in the State of Texas.

Step 4 – In Item 3, enter the Federal Employer Identification Number of the filing entity on the blank line provided or, if unavailable, mark the check box labeled “Federal employer identification number information is not available at this time.

Step 5 – Name the State or Foreign Country the filing entity incorporated in on the first blank line in Item 4. Then, report the Date of Incorporation, as listed with the governing body in its parent state, on the second blank line.

Step 6 – Item 5 verifies the filing entity is a valid corporation in the State (or Foreign Country) listed above as of the date listed above.

Step 7 – In Item 6, define the Purpose of the foreign corporation’s business and/or presence in the State of Texas. Note: This must be a Purpose the foreign corporation is all owed to pursue in its home state of jurisdiction.

Step 8 – In Item 7, define the Date of the first Business Transaction by the foreign corporation in the State of Texas. This may be either a Date in the past or a Date in the Future. Note; Penalties may be assessed for foreign corporations who have engaged in business activities without gaining approval from the State of Texas to do so.

Step 9- In Item 8, use the blank line provided to report the Principal Office Address of the foreign corporation. This line will provide a labeled area for the Street Address (“Address”), the City (“City”), State (“State”), Country (“Country”), and Zip Code (“Zip Code”).

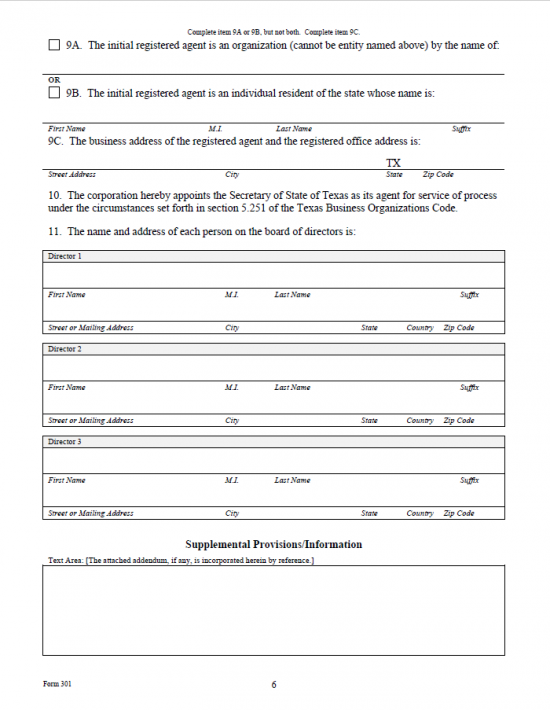

Step 10 – If the initial Registered Agent is a business entity then mark the box in Item 9A and enter the Full Name of this entity on the blank line provided. If the initial registered agent is an individual (who must be a resident of Texas), then mark the box in Item 9B and enter the Full Name of the initial Registered Agent on the blank line provided. Use the labeled areas to enter the First Name, Middle Initial, Last Name, and Suffix of this person. You may only check and fill out either Item 9A or 9B, not both.

Step 11 – In Item 9C, report the Registered Agent’s Official Business Address, or Registered Office, on the blank line provided. Enter the Building Number, Street and Unit Number above the area labeled “Street Address.” Then enter the City and Zip Code, of this Address, over the areas labeled “City” and “Zip Code,” respectively. This Address must be the location where the initial Registered Agent may be found during business hours and may not contain a P.O. Box. Item 10 will name the Texas Secretary of State as the filing entity’s Agent for Service of Process.

Step 12 – Next, in Item 11, each Director, Officer, or Governing Body serving the foreign corporation must be documented. You must enter at least one individual who manages this corporation’s decisions. Each individual must have his or her First Name, Middle Initial, Last Name, Suffix (if applicable), and Address (including country) documented in the spaces provided. This is a template form therefore if there is not enough room, you may add more space, as warranted.

Step 13 – In the section labeled “Supplemental Provisions/Information,” report any additional information and/or the Title of any attachments that will be present and must be included with the Texas Application for Registration of a Foreign For-Profit Corporation | Form 301 as a part of this document.

Step 14 – In the section labeled “Effectiveness of Filing,” define the Date of Effect for a successful filing by marking the appropriate section and providing any requested information. If the foreign corporation wishes the Date of Effect to be the same as the Filing Date, mark the box in Item 9A. If the Effective Date of this document is to be on a specific Date in the future then mark the box in Item 9B and enter the requested Date of Effect on the blank line provided (Note: This must be within 90 days of the Filing Date and may not be at any point before the Filing Date). If the Date of Effect is to be dependent upon a certain Event, then mark the box in Item 9C, enter the Date 90 days after the Signature Date, and report the Event that shall mark the Day of Effect in the text box provided.

Step 15 – The section labeled “Execution,” must be read then signed by an Authorized Representative (such as an Officer or Director). The Signature Date must be entered on the blank line, labeled “Date,” on the left side. Then the Authorized Representative must Sign his or her Name on the blank line labeled “Signature of authorized person…” Below this the party providing this Signature must Print or Type his or her Name.

Step 16 – The Texas Secretary of State will accept the Texas Application for Registration of a Foreign For-Profit Corporation | Form 301 in duplicate and all its accompanying paperwork in person, by mail, or by fax. A Filing Fee of $750.00 which may be paid with a check or money made out to “Secretary of State.” You may also choose to pay with a credit card but if you are faxing you must submit a completed Form 807.

Mail To:

Secretary of State

P.O. Box 13697

Austin, Texas 78711-3697

Deliver To:

James Earl Rudder Office Building

1019 Brazos

Austin, Texas 78701

Fax To:

(512) 463-5709

How To File Online

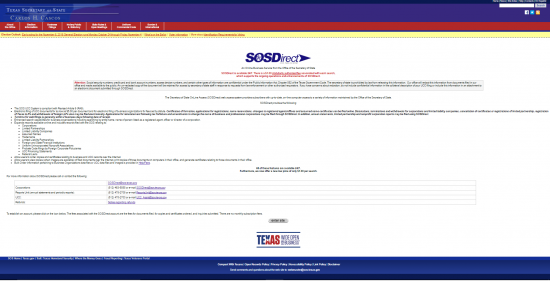

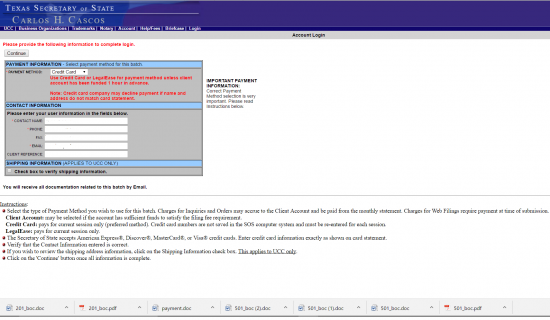

Step 1 – Open the Texas Secretary of State’s SOSDirect home page ( http://www.sos.state.tx.us/corp/sosda/index.shtml). This initial page will contain some important information for this entity. Read this page then select the button labeled “Enter.”

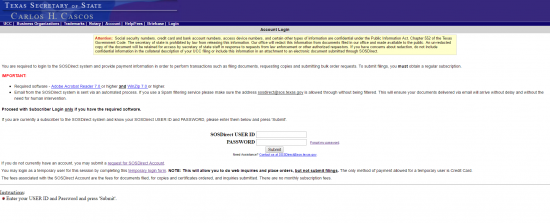

Step 2 – Enter your User ID and Password, in the appropriate fields then click on the button labeled “Submit.”

Step 3 – This initial page will require you verify the information that has auto populated this page (this information is taken from your profile). If it is up to date and correct, select the button labeled “Continue.”

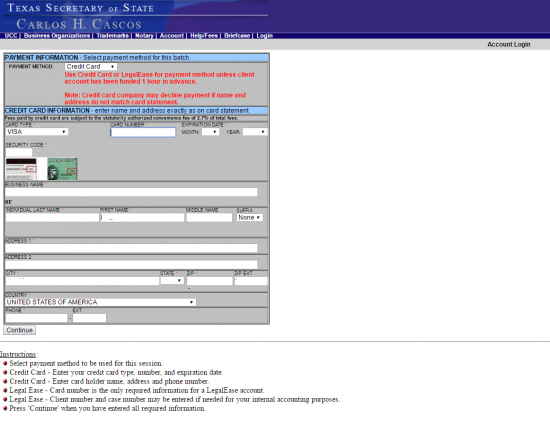

Step 4 – This page will concern itself with the payment method you wish to employ when filing this application. Enter your cardholder or Legalease information then select “Continue.” Note: credit card payments carry a %2.7 convenience fee for online filings

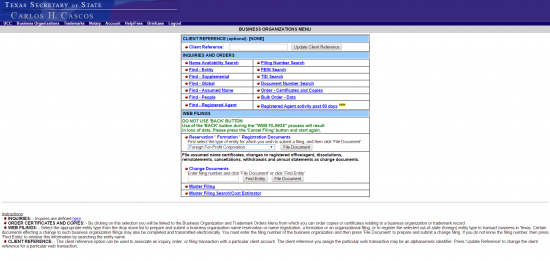

Step 5 – The session ID number will be provided to you on this page. This will help both you and the website keep track of your application. Make a note of this number, then locate the menu item near the top of the page labeled “Business Organization”and select it.

Step 6 – Locate the field labeled “Reservation Formation Registration Documents,” under the heading Web Filings. Use the drop down list to select “Foreign For-Profit Corporation.”

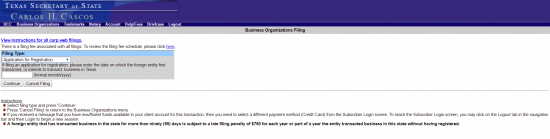

Step 7 – Select “Application for Registration” from the drop down list labeled “Filing Type.” In the Date field provided, enter the Date the foreign corporation first conducted business in the State of Texas or the Date it intends to first conduct business in the State of Texas. When ready, select “Continue.”

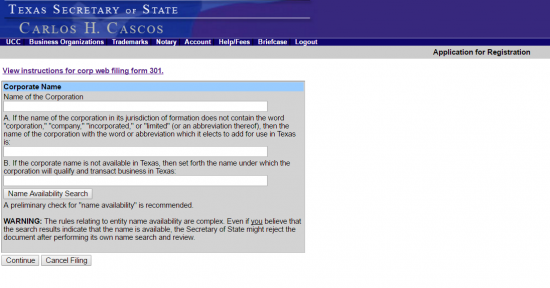

Step 8 – Locate the first field on the “Corporate Name” page. Enter the Full Name of the foreign corporation submitting this application as it is recorded with the governing body in its home state.

Step 9 – The second and third field require information only in certain cases. If the foreign corporation’s True Name does not contain a word of incorporation, then re-enter it in the second field with the preferred word of incorporation (i.e. Corporation, Incorporated, Corp., Inc., etc.). If the True Name of the foreign corporation may not be used in the State of Texas, then enter the Assumed Name this corporation shall be identified as in the State of Texas for all business occurring in Texas. You may only fill out one of these fields and only if they apply. When you are done entering information on this page, select the button labeled “Continue.”

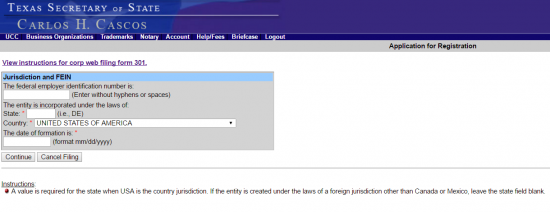

Step 10 – Locate the first field on the Jurisdiction and FEIN page. Here, enter the Federal Employer Identification Number (no hyphens or spaces).

Step 11 – In the second field, labeled “State,” report the home jurisdiction the foreign corporation has formed and operates in.

Step 12 – Report the Date of Incorporation in the last field on this page. This is the date the foreign corporation achieved its corporate status in its home state. When you are done, select the button labeled as “Continue.”

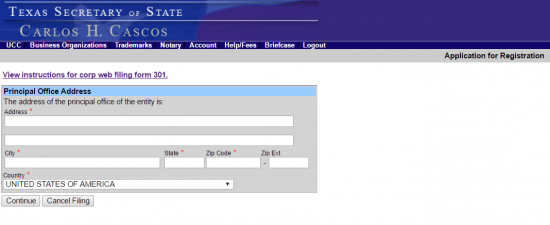

Step 13 – There will be several fields on the Principal Office Address page where you may utilize to report the Building Number, Street, Suite Number, City, State, Zip Code, and Country of the foreign corporation’s Principal Office Address. When you have done this, select the button labeled “Continue.”

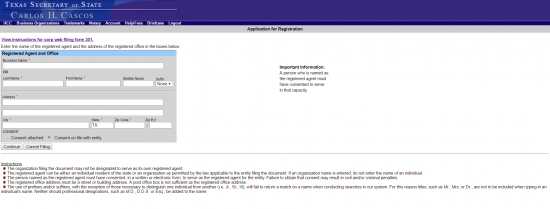

Step 14 – The Registered Agent and Office page will require the Full Name and Complete Address of the initial Registered Agent. You may report either a business entity or an individual. If the initial Registered Agent is an organization then you must report the Full Name in the first field on this page. If, however, the initial Registered Agent is an Individual, then you must utilize the second row (composed of the fields “Last Name,” “First Name,” “Middle Name,” and “Suffix).”

Step 15 – After reporting the Identity of the initial Registered Agent, you must report the Physical Address of the Registered Office where the Registered Agent may be found during business hours (to easily receive court documents on behalf of the filing entity). This Address may not contain a P.O. Box. That is it must be composed of the Building Number, Street, Suite Number, City, State, and Zip Code of the geographical location of the Registered Office. Below this will be two radio buttons (you must choose one). If the written Consent of the Registered Agent will be included with this application’s submission then select the first radio button. If this Consent is on file with the foreign corporation in question but will not be submitted then mark the second radio button. When you are done, select the button labeled as “Continue.”

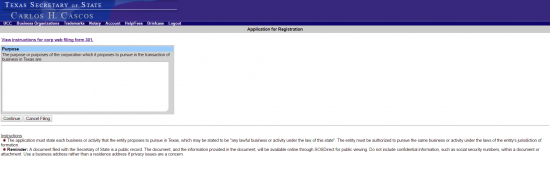

Step 16 – On the Purpose page, fully report the exact Purpose this corporation shall have in the State of Texas in the text box provided. It should be noted, the foreign corporation must be authorized to engage in activities towards this Purpose in its home state as well. Once this has been entered, select the “Continue” button.

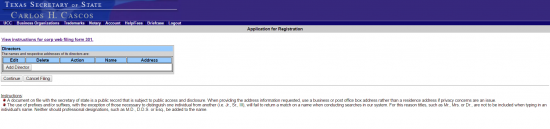

Step 17 – The Directors page will require you report the Names and Addresses of the current Directors serving on the Board of Directors. To begin this process, select the button labeled “Continue.”

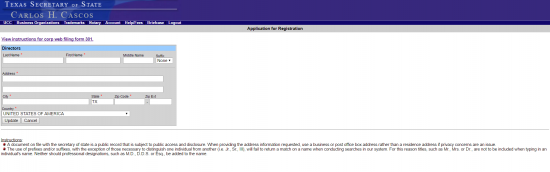

Step 18 – This entry page must be utilized for each Director you will report on. Here you must report the Full Name of a Director, on the first row, utilizing the fields labeled “Last Name,” “First Name,” “Middle Name,” and “Suffix.”

Step 19 – The second half of this page will require the Complete Address of the Director. You may use the fields labeled “Address,” “City,” “State,” “Zip Code,” and “Country” to document this. When you have done this select the button labeled “Update.”

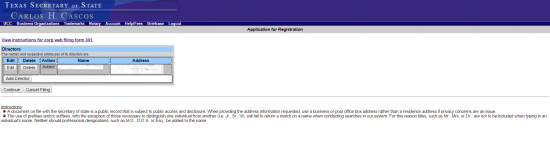

Step 20 – The next page will contain the information you have entered in a table. You may use the “Edit” and “Delete” buttons to correct any errors with the entry being displayed. Select “Add Director” if there are more entries. When you are ready select the button labeled “Continue.”

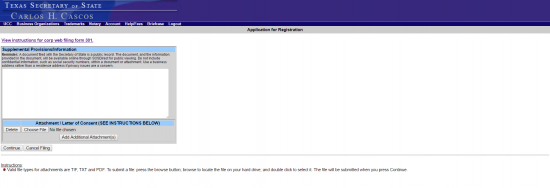

Step 21 – The Supplemental Provisions/Information page will provide a text box where you may either enter any additional information required for a successful submission of this application and/or list any attachments and upload any files to be submitted with this application. If you do need to attach any documents, use the “Choose File” button to select the file from your computer then select the “Add Additional Attachment(s)” to upload the documents.

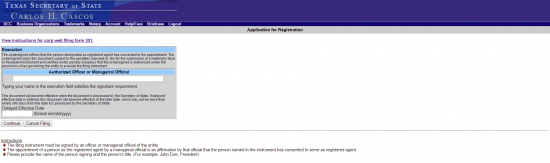

Step 22 – The Execution page will require the Electronic Signature of an individual Authorized to submit this application on behalf of the filing entity. This may be a Director, Officer, or Authorized Representative. Have this party read the paragraph on this page then type his or her Name in the text field labeled “Authorized Officer or Managerial Official.”

Step 23 – In some cases, having the Date of Effect the same day as the Filing Date may not serve the foreign corporation’s best interests. If this is the case you may enter any date no earlier than the Filing Date and no later than 90 days after the Filing Date as the Date of Effect in the field labeled “Delayed Effective Date.” If this field is left blank, the Filing Date will be the Date of Effect. When all the requirements of this page have been fulfilled then select the button labeled “Continue.”

Step 24 – The Review Page will give an overall picture of the information you have entered during your session. You may edit any of these sections using the button labeled “Edit Filing.” When you are ready, select the button labeled “Submit Filing (Fee $750.00).” This will direct you to the confirmation page that will finalize this application. You will receive a packing slip confirming your purchase via email.