|

Utah Application for Authority to Conduct Affairs for a Foreign Corporation |

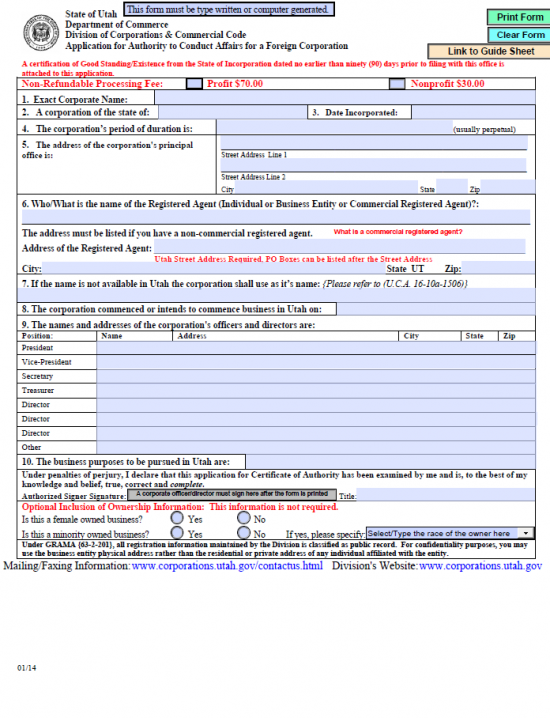

The Utah Application for Authority to Conduct Affairs for a Foreign Corporation may be used to register a foreign profit or nonprofit corporation with the Utah Secretary of State Division of Corporations and Commercial Code so that entity may operate as such within this state. This application must be submitted with a Certificate of Existence, or Certificate of Good Standing, issued by the jurisdiction where the foreign entity is incorporated. The Certificate of Existence, or Good Standing, must be dated within 90 days of the Application Date and must bear the Full True Name of the foreign entity applying for a Certificate of Authority. This application must also be submitted with full payment of the Filing Fee. This will depend upon the type of entity applying for this certificate. If the foreign corporation is a for profit corporation, the Filing Fee will be $70.00. If the foreign corporation is a nonprofit corporation, the Filing Fee will be $30.00.

You may pay the Filing Fee using cash, a check or money order, or a credit card. You may use a check or money order when filing by mail or in person. This must be made payable to “State of Utah.” If you wish to pay with a credit card, you must file in person, by fax, or online. If filing by fax, you must report your credit card information on the Utah Fax Cover Sheet. You may only pay in cash, if you are filing in person. Normally, the review process may take five to ten business days depending upon the activity and workload in the Division of Corporations and Commercial Code however, you may expedite this to 24 hours provided you request this and pay an additional $75.00. This is in addition to the Filing Fee so if this is the case, the payment will be $145.00. Expediting the application is purely optional however, and not a requirement of the application process.

How To File

Step 1 – Download the appropriate files from the links above. The “Download Application” link will deliver the Utah Application for Authority to Conduct Affairs for a Foreign Corporation while the “Download Fax Cover Letter” will deliver the Utah Fax Cover Letter (this must be filled out and submitted with the application if filing by fax). In both cases, you will need a PDF program or an appropriate browser to view these articles and enter the information on screen. If not, you will need to print the document and use a typewriter. Keep in mind, all the requested information must be entered, if there is not enough room to fully answer an item then continue the information on a separate sheet of clearly labeled paper. You may not fill out these forms by hand.

Step 2 – On the first line, next to the words “Non-Refundable Processing Fee,” check the first box if this is a Profit corporation or check the second box if this is a Nonprofit corporation submitting this application. Note: This will determine the Filing Fee that must be submitted with this application. You must choose one.

Step 3 – Next, in Item 1, report the Exact Corporate Name of this entity as it is reported on the Certificate of Existence (or Certificate of Good Standing) being submitted with this application.

Step 4 – In Item 2, enter the State where this entity is incorporated in the space provided. Next to this, in Item 3, enter the Date this entity incorporated in its home state.

Step 5 – If this entity operates without a specific Date of Termination or a specific Date of Dissolution and intends to operate indefinitely then enter the word “Perpetual” in the box in Item 4. If the foreign corporation does have an intended Date when it will cease corporate activity then report this date in the box for Item 4.

Step 6 – In Item 5, report the Full Address for the corporation’s Principal Office. To this end, use “Street Address Line 1” to enter the Building Number, Street, and Unit Number. If there is not enough space, you may use “Street Address Line 2” to continue reporting this Address. Then use the boxes labeled “City,” “State,” and “Zip” to complete the Address of the Principal Office of the foreign corporation.

Step 7 – In Item 6, you will need to report the Utah Registered Agent, who maintains a Registered Office in the State of Utah, and has consented to receive court documents aimed at the foreign corporation on behalf of the foreign corporation. Report the Full Name of the Individual, Business Entity, or Commercial Registered Agent who shall act as the Utah Registered Agent. If the Registered Agent is not a commercial Registered Agent then you must report the Address of the physical location of the Registered Office on the line labeled “Address of the Registered Agent.” This must be a Building Number/Street/Unit or Suite Number and may not be a separate Mailing Address or P.O. Box. Then on the next line, enter the City and Zip Code where the Principal Office is located

Step 8 – If the True Name of the foreign corporation applying for this Certificate of Authority is unavailable for use in Utah or noncompliant with U.C.A 16-10a-1506, then enter the Assumed Name the foreign corporation will operate under in the State of Utah in Item 7.

Step 9 – In Item 8, report the Date the foreign corporation wishes to begin operating in Utah on the space provided.

Step 10 – In Item 9 a table will be provided so that you may report the Full Name, Street Address, City, State, and Zip Code for the President, Vice-President, Secretary, Treasurer, three Directors, and a party that is relevant (i.e. Assistant Secretary). Any Address reported here may be a Business Address. This should be a full Roster of all the Officers and Directors serving this corporation and should be continued on another sheet of paper if there is not enough room.

Step 11 – In Item 10, indicate the Purpose of operating this business in the State of Utah.

Step 12 – Next, in the section with the paragraph beginning with the words “Under penalties of perjury,” an authorized Officer or Director, must Sign his or her Name, in the box following the words “Authorized Signer Signature.” Then, next to the word “Title,” he or she must provide the position held with the foreign corporation.

Step 13 – The last section, “Optional Inclusion of Ownership Information,” may be filled in or left blank. Either choice will not have an effect on the application’s review. The first question will ask if the owner is a female. If so, select the radio button labeled “Yes” and, if not, select the radio button labeled “No.” The second question will seek to define if the owner is a minority or not. If the owner is a minority, then select the radio button labeled “Yes” and report the race of the owner in the space provided on the right. If the owner is not a minority, then select the radio button labeled “No.”

Step 14 – Next, you must organize the submission package with a Certificate of Existence, dated within 90 days of the Application Date, and issued by the governing body of the home state, the completed original Utah Application for Authority to Conduct Affairs for a Foreign Corporation and one copy, and all additional paperwork that may be required for the entity type. This must be submitted with a full payment of the Filing Fee. If this is a Profit Corporation then you must submit a Filing Fee of $70.00 while if this is a Nonprofit Corporation then you must submit a Filing Fee of $30.00. This fee may be paid for in cash, with a check/money order, or by credit card depending upon the method of filing. If filing in person, you may remit payment by cash, check/money order, or a credit card. If filing by mail, you may only pay with a check or money order. If filing by fax or by email, you may only remit payment with a credit card. You will need to submit a Utah Fax Cover Letter with the proper payment and credit card information filled out, if you are submitting by fax. All checks and money orders must be payable to “State of Utah.” Note: There is an expedite service available but it will require an additional $75.00. This is optional and available upon request.

Mail To:

State of Utah, Division of Corporations & Commercial Code

160 East 300 South, 2nd Floor, Box 146705

Salt Lake City, UT 84114-6705

Bring To:

State of Utah, Division of Corporations & Commercial Code

160 East 300 South, Main Floor

Salt Lake City, UT 84114-6705

Fax To:

(801) 530-6438