|

Utah Articles of Incorporation Professional Corporation |

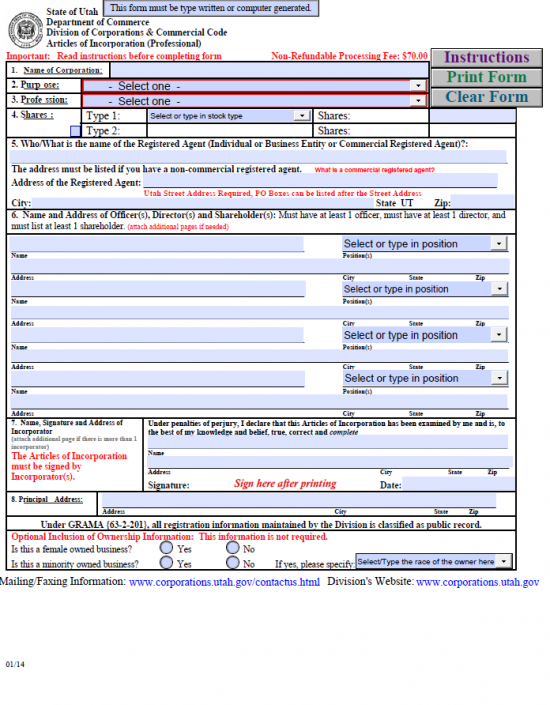

The Utah Articles of Incorporation Professional Corporation must be submitted to the Utah Secretary of State Division of Corporations and Commercial Code in duplicate. This must be one signed original and one exact copy. There will be several other requirements Incorporators must fulfill when creating such a corporation. For instance, in order to and operate a Utah Professional Corporation, all Incorporators, shareholders, and officers (except the Secretary and Treasurer) must be licensed to in the Profession of the professional corporation. Additionally, the Name of the corporation must have a word of incorporation specific for professional corporations (i.e. Professional Corporation or P.C.).

The Utah Articles of Incorporation Professional Corporation must be submitted with a full payment of the $70.00 Filing Fee. If you are filing in person this may be paid with a check/money order, credit card, or cash. If filing by mail, you must submit a payment with a check or money order. If filing by fax or online, you must pay with a credit card. When filing by fax, the Utah Fax Cover letter must be filled out and submitted. This must contain the information necessary for a credit card payment. All checks or money orders must be payable to “State of Utah.”

How To File

Step 1 – Download the Utah Articles of Incorporation Professional Corporation by selecting the “Download Form” link above. If you intend on filing by fax, then you must also download the Utah Fax Cover Letter by selecting the “Download Cover Letter” link above. Keep in mind that you may not enter the information in the Utah Articles of Incorporation Professional Corporation by hand. This must be done either onscreen with an appropriate program or printed then typing in the information requested. If any sections do not contain enough room, you may continue reporting the information on a separate sheet of paper that is properly labeled, attached, and (preferably) cited in the articles.

Step 2 – The First Article, labeled “Name,” will require you to enter the Full Name of the professional corporation being formed by this document in the available space. This should have the appropriate word of incorporation in the Name (i.e. Professional Corporation, P.C., PC, etc.).

Step 3 – In the Second Article, or “Purpose,” report the reason this corporation is being formed and how it will behave as a professional corporation in the State of Utah. If using a PDF program use the drop down menu to select Architect, Attorney, Certified Social Worker, Chiropractor, Clinical Social Worker, Doctor of Dentistry, Doctor of Medicine, Landscape Architect, Naturopath, Nurse, Optometrist, Osteopathic Physician, Osteopathic Surgeon, Pharmacist, Physical Therapist, Physician, Podiatric Physician, Professional Engineer, Psychologist, Public Accountant, Real Estate Agent, Real Estate Appraiser, Real Estate Broker, Surgeon, or Veterinarian.

Step 4 – In the Third Article, “Profession,” enter the licensed profession this corporation will be rendering services in. If filling this document out onscreen, you use the drop down menu to select Architect, Attorney, Certified Social Worker, Chiropractor, Clinical Social Worker, Doctor of Dentistry, Doctor of Medicine, Landscape Architect, Naturopath, Nurse, Optometrist, Osteopathic Physician, Osteopathic Surgeon, Pharmacist, Physical Therapist, Physician, Podiatric Physician, Professional Engineer, Psychologist, Public Accountant, Real Estate Agent, Real Estate Appraiser, Real Estate Broker, Surgeon, or Veterinarian.

Step 5 – Next, in Article Four, you will need to report the Total Number of Shares this corporation has been authorized to issue. If this is common stock then, report this in the box labeled “Type 1” then enter the Total Number of Shares of Common Stock this corporation may issue in the box labeled “Shares.” If the Shares this corporation may issue is divided into Classes, then you must report the Total Number of Authorized Share in each Class. If filling this out on screen, you will need to place a check mark in the box next to words “Type 2” before entering information in this line.

Step 6 – In Article Five, report the Full Name of the Utah Registered Agent who will accept service of process documents aimed at the forming corporation on behalf of the corporation. You must enter the Full Name of the Utah Registered Agent (as it appears on the record books) whether it is an Individual, Business Entity, or Commercial Utah Registered Agent. If the Utah Registered Agent is noncommercial you must report his/her/its Full Address utilizing the two blank lines labeled “Address of the Registered Agent.” Note: This must be the location where the Registered Office may be physically found. P.O. Boxes are not an acceptable address.

Step 7 – In Article Six, you will need to list the Identity and Address of each initial Officer(s), Director(s), and Shareholder(s). There must be at least one of each reported here. There will be two blank lines afforded to one entry, each of which is labeled and partitioned. On the first line report the Full Name of an Officer, Director, or Shareholder then enter or select the Title of this individual. If filling out on screen you may choose Director, Officer, President, Vice-President Treasure, Secretary, Shareholder, or type in the position. Then on the second line, enter the Full Address this individual is located. There is enough room for four individuals to be reported however if necessary, you may continue this Roster on a separate sheet of paper.

Step 8 – Next, in Article Seven, the Incorporators mut provide their Printed Name, Full Address, Signature, and Date of Signature. Note: While there is only enough room on this form for one Incorporator to provide this, all Incorporators must make sure to report their Name and Address in Print, Sign this document, then report the Date of Signature. This section must be continued on another sheet of paper then attached if there is more than one Incorporator.

Step 9 – In Article Eight, the Full Address of the Principal Office must be documented. Enter the Building Number, Street, and Suite Number of the Principal Office on the blank line provided just above the word “Address.” Then, on the same blank line in the areas marked “City,” “State,” and “Zip,” enter the City, State, and Zip Code of the Principal Office’s Address.

Step 10 – The bottom of this document contains optional questions. You may fill them in or leave them blank. Locate the question “Is this a female owned business?” If this corporation’s owner is a female then select the first radio button otherwise, select the second radio button. Below this, locate the question “Is this a minority owned business?” If so then select the radio button labeled “Yes,” then report the owner’s race or select it from the drop down provided after the words “If yes, please specify.” If not then select the radio button labeled “No.”

Step 11 – Next you will need to make sure all the information presented on and with the Utah Articles of Incorporation is accurate and up to date. This should be packaged with any additional paperwork that may be required for the specific entity being formed then filed, in duplicate, with the Utah Secretary of State Division of Corporation and Commercial Codes. This may be done in person, by mail, by fax, or online. A full payment for the $70.00 Filing Fee must be presented at the time of filing. If paying by check, make the check payable to “State of Utah.” You must pay with a check or money order when filing in Mail. If filing by fax or online, you must pay with a credit card. If filing in person, you may pay with a check/money order, credit card or cash. If faxing in this filing, make sure to fill out all the information contained on the Utah Fax Cover Sheet then send it with the document. This is the only way a payment may be processed for this type of filing. Expedited filings are available for an additional $75.00. This will expedite the review process to 24 hours. The average review time is five to eight business days depending on the workload in the Division of Corporations and Commercial Code.

Mail To:

State of Utah, Division of Corporations & Commercial Code

160 East 300 South, 2nd Floor, Box 146705

Salt Lake City, UT 84114-6705

Bring To:

State of Utah, Division of Corporations & Commercial Code

160 East 300 South, Main Floor

Salt Lake City, UT 84114-6705

Fax To:

(801)530-6438