|

Vermont Secretary of State Application For Certificate of Authority of a Non-Vermont Corporation (Profit, Nonprofit, or Cooperative) | Form Corp – 1(F) |

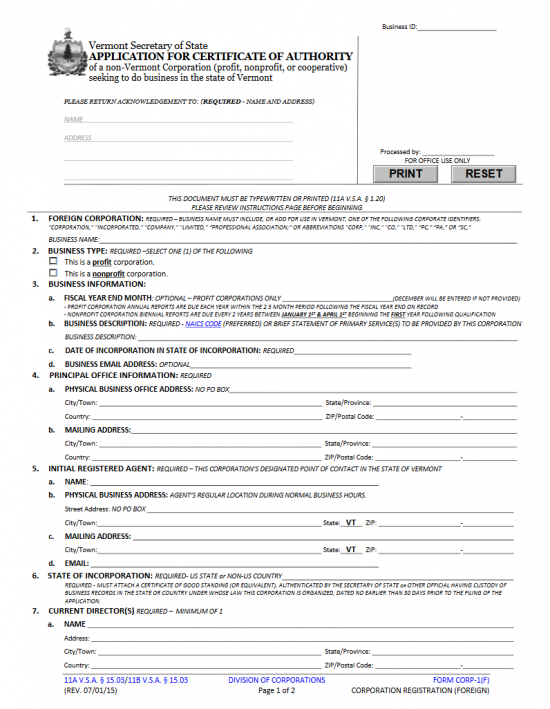

The Vermont Secretary of State Application For Certificate of Authority of a Non-Vermont Corporation (Profit, Nonprofit, or Cooperative) | Form Corp – 1(F) is required paperwork by the Vermont Secretary of State Corporations Division for foreign corporate entities wishing to do business in the State of Vermont. Foreign corporations are corporate entities who are already incorporated in other states or jurisdictions outside the State of Vermont. In order to do business in the State of Vermont, a foreign corporate entity will need to comply with the laws of this state by registering its presence and assure the state it will remain compliant with its laws. For instance, if the True Name of the foreign corporation may not be used in the State of Vermont because it is unavailable, the foreign corporation will need to adopt a Trade Name and submit a resolution drafted by its Board of Directors then certified by the corporate secretary to operate under this trade with the articles. Filing entities should make every effort to understand the process of applying for this certificate and are encouraged to seek legal consultation with a Vermont attorney.

The Vermont Secretary of State Corporations will require that a self addressed stamped envelop be included when submitting this application. The application package sent in should consist of either two original applications or one original and one copy, a Certificate of Good Standing, and a check made out to “VT SOS” in the amount of $125.00 to cover the Filing Fee. All other paperwork required by this application should be submitted simultaneously with these items. You may apply by paper in person or by mail at Vermont Secretary of State, Corporations Division,128 State Street, Montpelier, VT 05633-110 or online at https://www.vtsosonline.com/online/Account?referrer=BF.

How To File

Step 1 – Download the Vermont Secretary of State Application For Certificate of Authority of a Non-Vermont Corporation (Profit, Nonprofit, or Cooperative) from the above link (“Download Application”) or obtain the application by clicking here: Form Corp – 1(F).

Step 2 – Locate the series of blank lines in the upper left hand portion of this application. Report the Name and Address the Vermont Secretary of State may send mail relating to this application. This should be an up to date and accurate Mailing Address and should match the address on the self address stamped envelope being submitted with the application package.

Step 3 – In Item 1, report the True Name of the foreign corporation as it exists on the Certificate of Good Standing being submitted. If the True Name is missing a state required word of incorporation (i.e. Corporation, Incorporated, etc.) then you may add it to the True Name. If the True Name may not be used because it is already in use, the filing entity will need to apply for a Trade Name, report the Trade Name here, and include a Resolution to Do Business under said Trade Name that is drawn by the Board of Directors then certified by the corporation’s secretary.

Step 4 – If this is a Profit Corporation then check the first box in Item 2. If this is a Nonprofit Corporation then check the second box in Item 2. You may only choose one box.

Step 5 – Item 3a is optional. If you wish to report End Month of the Fiscal Year, you may do so here. If you do not, it will default to December.

Step 6 – In Item 3b, enter the NAICS code on the blank line provided or provide a description of how the corporation being registered will operate in the State of Vermont.

Step 7 – In Item 3c, enter the Date the foreign corporation applying for the Vermont Certificate of Authority incorporated in its parent state.

Step 8 – Item 3d is optional. You may report the corporate Email Address in the blank space provided.

Step 9 – Item 4 will require information regarding the Principal Office of the foreign corporation. In Item 4a, report the complete Physical Address for the foreign corporation’s Principal Address. Use the first line for the Street Address. Report the City and State on the second line then, the Country and Zip Code on the third line. If the foreign corporation’s Principal Office has a Mailing Address that differs from the Physical Address, you must document this in Item 4b. You may report this Address on the three blank lines provided following the words “Mailing Address.” Note: You may not use a P.O. Office Box as part of the Physical Address in Item 4a. This is only allowed in Item 4b.

Step 10 – All foreign corporations applying for this certificate must first name a Vermont Registered Agent who maintains an office in the State of Vermont.

Step 11 – Report the Name of the Vermont Registered Agent in Item 5a. Then, report the Physical Address where this entity may be found during business hours. That is, enter the actual location of the Registered Office in Item 5b. Enter the Building, Street, and (if any) the Suite or Unit Number on the blank line following the words “Street Address No P.O. Box.” You must also enter the City and the Zip Code of this location on the next line.

Step 12 – Some Vermont Registered Agents will maintain a different Mailing Address. If the one you are reporting does, then enter this Mailing Address in Item 5c. Use the first line for the Street Address and the second line for the City and Zip Code.

Step 13 – Enter the Email Address of the Vermont Registered Agent on the blank line in Item 5c.

Step 14 – Next, you must report the State of Incorporation in Item 6. This is the jurisdiction where the foreign corporation maintains its corporation status. If the filing entity is in another country, then report the Country. This Item will also require you attach a Certificate of Good Standing issued within 30 days prior to the Application Date by the appropriate governing authority (i.e. Secretary of State) for that jurisdiction.

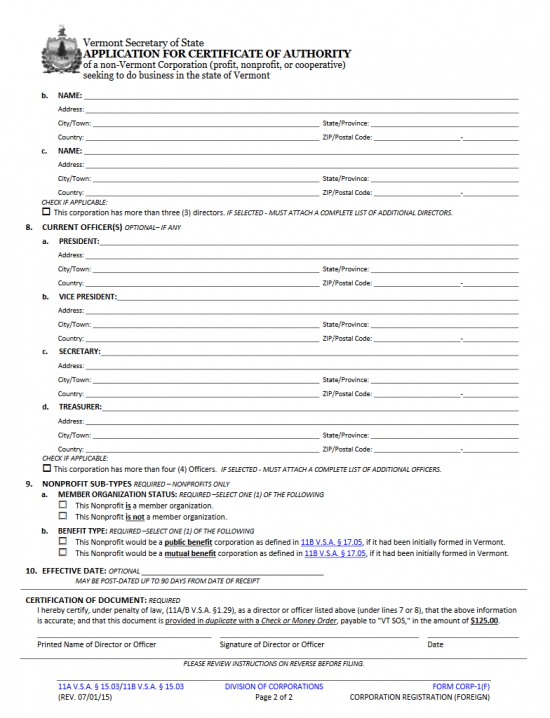

Step 15 – Next, you must document some information pertaining to all the Directors of the foreign corporation in Item 7. Each Director should have his or her own entry and there is enough room for three. If the foreign corporation has more than three Directors then place a check mark in the box labeled “This corporation has more than three (3) directors” and continue the entries. Each entry must contain a Director’s Full Name and that Director’s Complete Address.

Step 16 – Item 8 is optional. If the foreign corporation has any Officers you wish documented in this application, you may report them here. Each Officer should have his or her own entry here as well. Each entry should contain a corporate Title (President, Vice President, Secretary, and Treasurer). Enter the Officer’s Full Name on the blank line next to the Title, then enter that Officer’s Full Address utilizing the spaces labeled “Street Address,” “City/Town,” “State/Province,” “Country,” and “Zip/Postal Code.” If there are more Officers then you must check the box labeled “This corporation has more than four (4) officers,” and attach the remaining list of Officers on a separate sheet of paper that is clearly labeled.

Step 17 – Item 9 will only apply to nonprofit corporations. If the foreign corporation is a nonprofit corporation then you must define some specifics about it. If the foreign nonprofit corporation is a Member Organization then make a mark in the first box in Item 9a. If the foreign nonprofit corporation is not a Member Organization, them mark the second box in Item 9a. If this is not a foreign nonprofit corporation leave this Item blank.

Step 18 – If the foreign nonprofit corporation is a foreign Public Benefit corporation then select the first box in Item 9a. If the foreign nonprofit corporation is a foreign Mutual Benefit Corporation then select the second box in Item 9b. If this is not a foreign nonprofit corporation leave this Item blank.

Step 19 – Item 10 will provide the opportunity to delay the Effective Date of this application. You may choose any date within 90 days after the Application Date as the Date of Effect. If, however, you wish the Effective Date to be the same date the application is approved and a Certificate of Authority is granted, simply leave Item 10 blank.

Step 20 – The next step will be for a Director, or Officer, authorized by the foreign corporation to submit this application on its behalf to Print his or her Name, Sign his or her Name, then report the Date of Signature on the last line of this document.

Step 21 – Next you may organize your application package. The Vermont Secretary of State Corporations Division will require a payment, by check or money order, for $125.00 (the Filing Fee). The payment should be made payable to “VT SOS.” Additionally, the completed application should be submitted with either an exact copy or you will need to submit two completed identical originals. Finally, you will need to include a self addressed stamped envelope, a Certificate of Good Standing issued with the past thirty days by the Secretary of State (or similar authority) of the parent state the foreign corporation resides in. The typical processing time is five to ten business days but this will depend upon the daily operations, at the time, of the Vermont Secretary of State Corporations Division.

Submit To:

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, VT 05633-1104