|

Vermont Secretary of State Nonprofit Incorporation | Form Corp-1(N) |

|

|

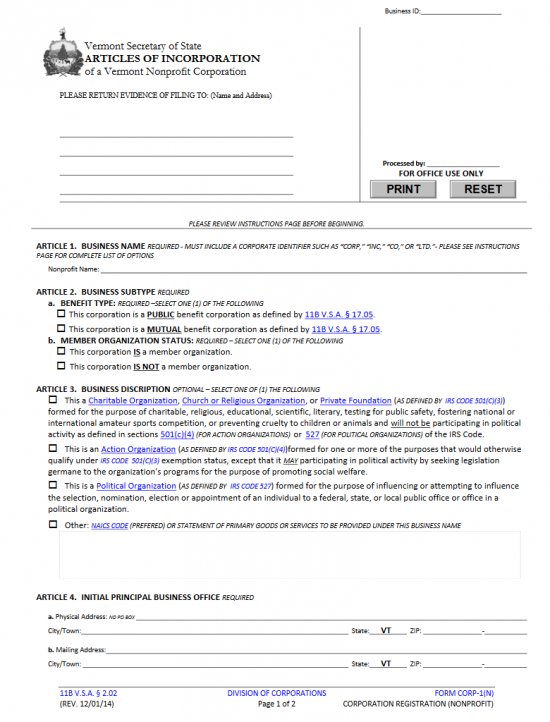

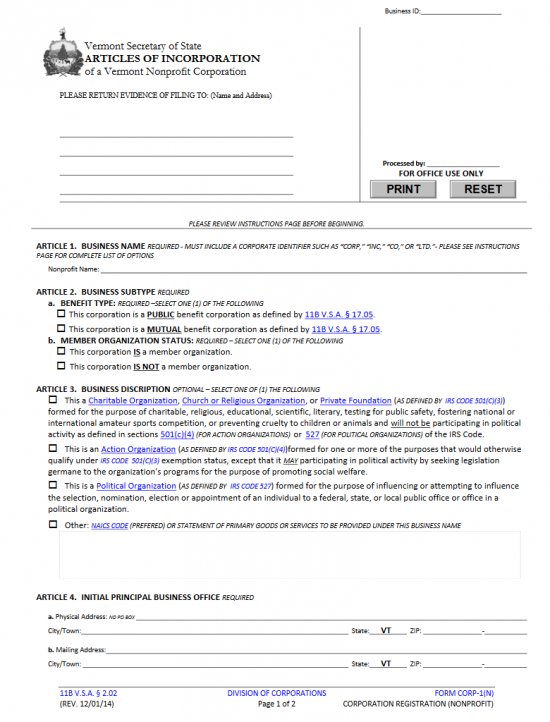

The Vermont Secretary of State Articles of Incorporation Nonprofit Corporation |Form Corp-1(N) must be used to submit the information required by the Vermont Secretary of State Corporations Division when an entity incorporates as a nonprofit corporation. This form may be considered appropriate both for Public Benefit Corporations and Mutual Benefit Corporations regardless of whether the forming entity has members. Some types of entities may need to submit additional information and most, if not all, will need to fulfill the requirements of other governing entities. Incorporators will be expected to take the initiative in gathering information regarding the formation process of a Vermont Nonprofit Corporation. It is recommended to consult a Vermont Attorney regarding this process before filing these articles.

The Vermont Secretary of State Corporations Division allows the Vermont Secretary of State Articles of Incorporation Nonprofit Corporation | Form Corp-1(N) to be submitted in person, by mail, or online. This must be accompanied by a self addressed stamped envelope, a copy (or second original) of the articles, any required documents, and payment of the $125.00 Filing Fee. When filing by mail or in person you may pay the Filing Fee, plus any additional fees, with a check or money order made out to “VT SOS.” The address you must bring or mail the articles to is Vermont Secretary of State, Corporations Division, 128 State Street, Montpelier, VT 05633-1104. When filing online, you may only pay with an echeck or a credit card. You may file online at https://www.vtsosonline.com/online/Account?referrer=BF.

How To File

Download File

Step 1 – Use the link above, “Download File,” to download the Vermont Articles of Incorporation Nonprofit Corporation or select this link: Form Corp – 1(N).

Step 2 – There will be several blank lines in the upper left hand corner of this page. Here, you will need to enter the Mailing Address where the Vermont Secretary of State may answer these articles. Enter a Recipient Name then a Recipient Address in this section.

Step 3 – The First Article, “Business Name,” must have the Name of the forming nonprofit documented, including words of corporate designation such as “Corporation,” “Incorporated,” or a generally accepted abbreviation. Enter the Full Name on the blank line provided here.

Step 4 – Next, you will need to define the type of nonprofit being formed. This will be done in Article 2a. Check the first box if this is a Public Benefit Corporation. If this is a Mutual Benefit Corporation then place a check in the second box.

Step 5 – If the nonprofit corporation will have members then check the first box in Article 2b. If not, then mark the second box in Article 2b.

Step 6 – Article 3 is optional however recommended to report if it is applicable. Here, you may give a description of the nonprofit corporation being formed. If this is a Charitable Organization, Church/Religious Corporation, or Private Foundation then mark the first box. If this is an Action Organization then mark the second box. If this is a Political Organization then mark the third box. If you prefer, you may check the fourth box then report the NAICS code or give a business description in the blank box.

Step 7 – You will need to enter the Physical Address of the forming nonprofit corporation’s Principal Office. If the Principal Office has a separate Mailing Address, this will need to be reported to. You may fulfill this requirement in Article 4. Report the Physical Address in Article 4a by reporting the Building, Street, and Suite Number on the first blank line, then reporting the City, on the blank line labeled “City/Town,” and the Zip Code on the blank line labeled “Zip.” Article 4a may not contain a P.O. Box. If the Principal Office does have a different Mailing Address then you must utilize the two blank lines in Article 4b to report the Mailing Address’s Building Number, Street, Suite Number or P.O. Box, City, and Zip Code.

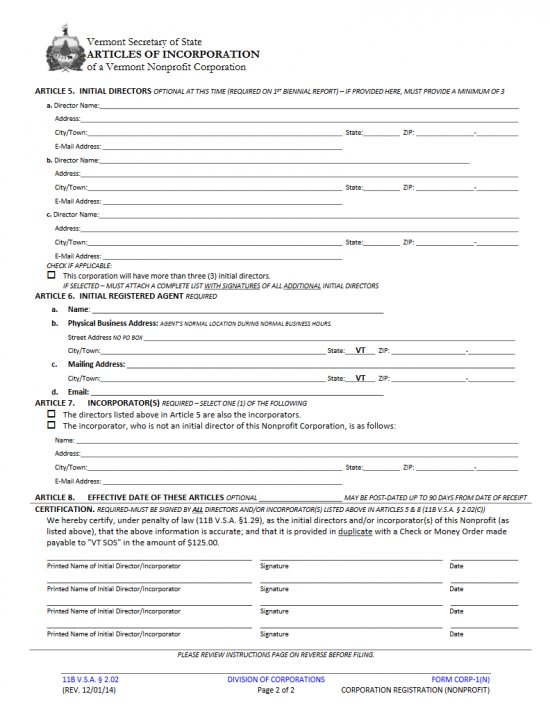

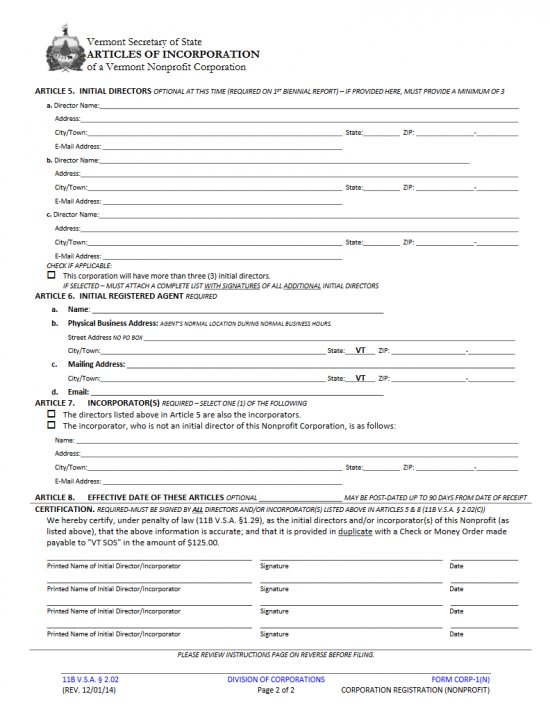

Step 8 – Article 5 is optional as it will require a report on the Initial Directors of this nonprofit corporation. Regardless of whether this is done here, you must report this information on the 1st Biennial Report. If you do fill out this section, you will need to report the Name and Addresses of at least three Initial Directors. If there are more, you must check the box at the bottom of this section labeled “This corporation will have more than (3) initial directors” and attach a full Roster. Make sure that each Director listed has his/her Full Name, Building Number, Street, Suite Number, City, State, and Zip Code provided.

Step 9 – You will need to inform the Vermont Secretary of State Corporations Division of the Vermont Registered Agent’s Name and Registered Office Address. You may report the Full Name of the Registered Agent on the blank line in Article 6a.

Step 10 – In Article 6b, use the blank lines provided to report the Physical Address of the Registered Office. This requires the Building Number, Street, and Unit Number (if applicable) be entered on the first blank line. Then in the space labeled City/Town, enter the City for the Physical Address. Finally, enter the Zip Code on the line labeled “Zip.”

Step 11 – If the Registered Agent has a Mailing Address that is different from the Physical Address, you must report this in Article 6c. Report the Building Number, Street, and Suite on the blank line directly following the words “Mailing Address.” Then in the spaces labeled “City/Town” and “Zip,” report the City and Zip Code in the Principal Office’s Mailing Address.

Step 12 – Report the Email of the Vermont Registered Agent in Article 6d.

Step 13 – If the Directors that have been previously named in Article 5 are also Incorporators then mark the first box in Article 7. If not then mark the second box and enter the Incorporator information on the blank lines directly below this box. This information should include the Full Name of the Incorporator on the first line, the Street Address (Building Number/Street/Unit) on the second blank line, the City, State, and Zip Code in the spaces provided on the third blank line, and the Incorporator’s Email on the fourth blank line.

Step 14 – You may designate a Delayed Effective Date for these articles in Article 8. This is optional. The Effective Date is when the corporation will actually gain corporate status. If you would like the Effective Date to be after the Filing Date then enter the desired Date on the blank space in Article 8. If not then leave Article 8 blank and the Effective Date will be the same as the Filing Date.

Step 15 – The final section of these articles will require that Initial Director/Incorporator Print his or her Name, Sign his or her Name, then enter the Date he or she has signed this form.

Step 16 – Next, you will need to submit the two Vermont Articles of Incorporation Nonprofit Corporations: either two originals or one original and one copy of that corporation. In addition, the Vermont Secretary of State will require you include a self addressed stamped envelope and a check for $125.00 (payable to VT SOS). You may submit this form, with all accompanying documentation, by mail or in person.

Submit To:

Vermont Secretary of State

Corporations Division

128 State Street

Montpelier, VT 05633-1104

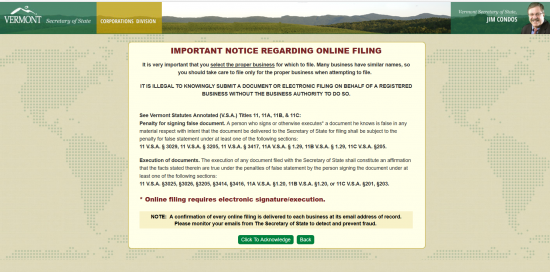

How To File Electronically

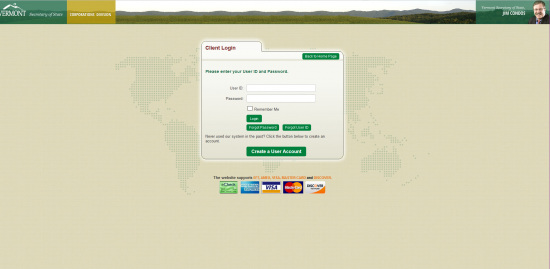

Step 2 – Next, you will need to provide your login information for the Vermont Secretary of State site by entering the Username and password you set up for this account then selecting the “Login” button.

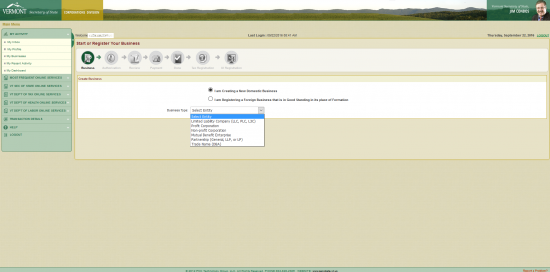

Step 3 – This is your dashboard. Select the drop down menu, labeled “VT Sec of State Services,” then click on the menu item “I am Creating a New Domestic Business”

Step 4 – Two radio buttons will appear under the heading “Create Business.” Select the radio button labeled “I am Creating a New Domestic Business.”

Step 5 – Select “Non-Profit Corporation” from the drop down list labeled “Business Type.” This will generate several appropriate fields.

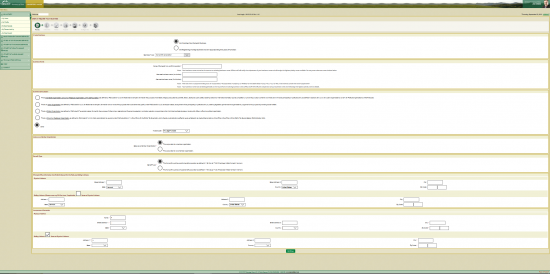

Step 6 – Next, in the field labeled “Name of Domestic Nonprofit Corporation,” enter the Full Name of the nonprofit corporation being formed by this online form. This is a mandatory field. There will be two additional fields that are optional: Alternate Business Name (1st Choice) and Alternate Business Name (2nd Choice). These provide you the opportunity to proved two additional preferences on what to Name your company, should the Name be taken. While these are optional, it is recommended you fill them out. Note: Remember to include a word of incorporation in the Name.

Step 7 – Next, you will need to describe the business being formed by these articles. There will be four radio buttons provided to this end. If this nonprofit corporation is forming as a Charitable Organization, Church/Religious Organization, or Private Foundation, then mark the first radio button. If this nonprofit corporation is forming as an Action Organization, then select the second radio button. If this nonprofit corporation is forming as a Political Organization, select the third radio button. If the nonprofit corporation is being formed as a Church or Religious Organization as per IRS Code 501(c)(3) then select the fourth radio button. If none of these descriptions fit the forming nonprofit corporation then select the fifth radio button labeled “Other” then enter the appropriate NAICS code. For our purposes, select “Other” then select the NAICS code “Any Legal Purpose.”

Step 8 – The section labeled “Status as a Member Organization” will contain two radio buttons. You must choose only one. If this nonprofit corporation is one with Members then select the first radio button however, if there are no members, select the second radio button.

Step 9 – In the section labeled “Benefit Type,” select the first radio button to indicate the forming nonprofit corporation is a Public Benefit Corporation or the second radio button to indicate the forming nonprofit corporation is a Mutual Benefit Corporation.

Step 10 – Next, you will need to report the Addresses used by the Principal Office in the section titled “Principal Office Information (No PO Box allowed for this field; see Mailing Address).” Here, you must use the fields in the subheading “Physical Address” to report the location of the Principal Office as it would appear on a map. You will have two fields to use for the Street Address (“Street Address 1” and “Street Address 2”), then a field for “City,” “State,” “Country,” and “Zip Code.” There is also a check box which you may use to auto populate the Mailing Address information with the same information entered in the Physical Address. If the Mailing Address and Physical Address are the same, check this check box. If not, then use the fields in Mailing Address to manually enter this information. Make sure you are accurate in both of these sections.

Step 11 – The next section, “Incorporator Information” will require two addresses to be reported. This will define where the Incorporator is located (“Physical Address”) and where the Incorporator receives mail (“Mailing Address”). The Physical Address section may not contain a P.O. Box Number, you must enter the geographical location using the “Street Address 1” and “Street Address 2” fields. Then report the City, State, Zip Code, and Country where the Principal Office is physically located in the appropriately named fields. If the Mailing Address is the same then select the box labeled “Mailing Address Same as Physical Address” to auto populate this section with the previously entered Address. If these are two different Addresses then make sure you accurately report the Mailing Address as well. When you are done, select “Continue.”

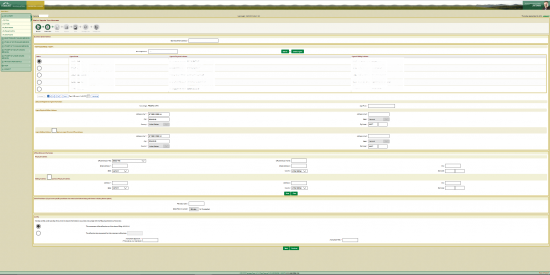

Step 12 – At the top of this next page, report the official Email Address this nonprofit corporation shall use in the first field.

Step 13 – The next section, labeled “New Registered Agent,” will require a report on which Vermont Registered Agent has been obtained for this nonprofit corporation. You may select one from by entering the Name of the Registered Agent obtained in the Search Field then selecting the button labeled “Search” or entering noncommercial Registered Agent Information and selecting the “Create Agent” button. For our purposes, enter the Name of the Vermont Registered Agent in the text field then select “Search.” This will generate a table of matching results. Highlight the row where your Registered Agent is listed. This will generate several fields that will be auto populated with the information on file with the Vermont Secretary of State. Verify it is accurate then proceed to the next section.

Step 14 – In the Officer/Director Information, you have the option of listing the Officers and Directors of the nonprofit corporation. This section is optional however, if you fill it out each entry must be filled out completely. You will need to select the Title of the individual you are reporting from the “Officer/Director Title” field, enter the Full Name of the individual being reported in the “Officer/Director Name” field, then enter the Officer or Director’s Physical Address in the “Physical Address” section. Here, you may auto populate the Mailing Address section by selecting the button labeled “Mailing Address Same as Physical Address.” If the two Addresses are not identical though, you will need to enter the Mailing Address manually (field by field). Once you have entered the information for one Officer or Director, select the button labeled “Save.” This will display your entry below this section for review. You may enter as many as necessary before proceeding to the next section.

Step 15 – If there are any other Provisions or Required Documents that need to be submitted with the Vermont Articles of Incorporation Nonprofit Corporation, you may use the “Browse” button in the “Other Provisions…” section to locate the file on your machine, then upload it.

Step 16 – In the “Certify” Section, select the first radio button if you wish these articles to have an Effective Date that is on the same day as the Filing Date. If you wish to select a separate Effective Date then click on the second radio button and enter the desired Date of Effect in the text field on that line.

Step 17 – An authorized Officer or Director must sign this document for submission as verification for its authenticity. Have an authorized Officer or Director enter his/her Name in the field labeled “Authorizer Signature” then, have this individual provide the Title he or she holds in the next text box. Once you hit the “Continue” button, you will be guided to a review area before submitting and paying for this document online. You may enter information for a credit card or an echeck to pay for the $125.00 Filing Fee in the payment area. The Vermont Articles of Incorporation Nonprofit Corporation will not be processed unless payment has been received. On the whole it will take two to seven business days to process this online form, though this may vary.