|

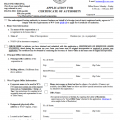

West Virginia Articles of Incorporation Profit/Nonprofit | Form CD-1 |

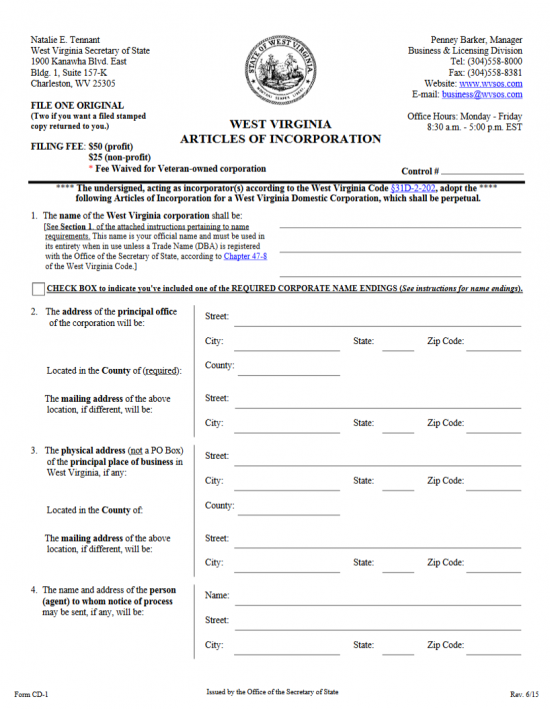

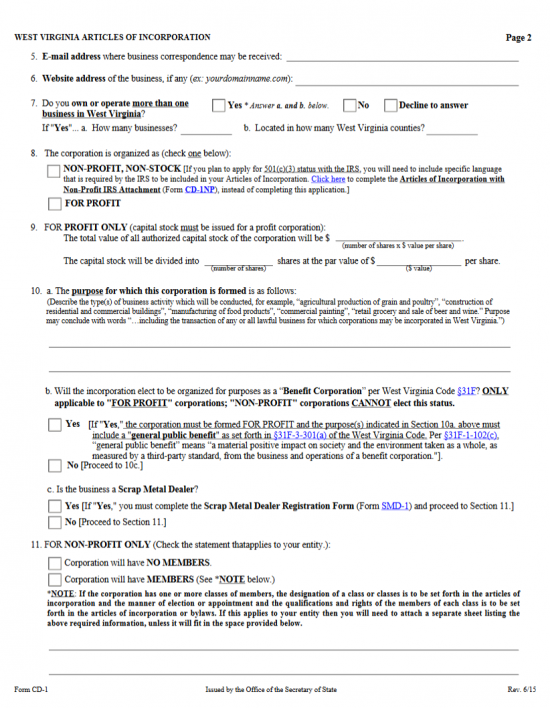

The West Virginia Articles of Incorporation Profit Corporation Profit/Nonprofit Corporations | Form CD-1 must be filed with the West Virginia Secretary of State for approval so that a filing entity may legally register its incorporation. This template form will guide forming corporations in satisfying the basic requirements for profit corporations and non-stock/nonprofit corporations however, the form listed here will not satisfy such requirements for non-stock/nonprofit corporations seeking Tax Exempt Status. That will require a different form altogether.

Here, you will need to report such information as the Name of the forming corporation, who the Service of Process Agent is, who the Incorporators are, and other items that are considered a necessity by the West Virginia Secretary of State. Other information may be necessary to accompany the West Virginia Articles of Incorporation depending upon the entity type and this will be left up to the Incorporator to provide. On the whole, Incorporators are expected to be fully aware of all requirements of forming the corporation they wish to create and are urged to seek consultation with a West Virginia attorney during this process.

When you are ready to report this information and submit the articles you may do so either online or by mail. To do so online go to https://www.business4wv.com/b4wvpublic/default.aspx and create a login to proceed with the online process. If filing by mail, you may send your documents to West Virginia Secretary of State, 1900 Kanawha Blvd. East Bldg. 1, Suite 157-K, Charleston, WV 25305 for approval. In either case, this must accompany a full payment for the Filing Fee of $50.00 for profit corporations or $25.00 for nonprofit corporations. Veteran owned corporations may qualify to be exempt from this fee but will need to provide proof of veteran status.

How To File

Step 1 – Select the link above (“Download Application”) or click this link: Form CD-1 to download the West Virginia Articles of Incorporation. You will need an appropriate PDF program to fill this out on the screen or you may print it then fill it out with a typewriter.

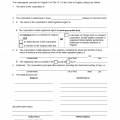

Step 2 – Locate Article 1, then enter the Full Name of the corporation being formed by this document. This should include one of the required terms of incorporation in the the Name (i.e. Corporation, Incorporation, Corp., or Inc.). Below Article 1 will be a check box labeled “Check box to indicate you’ve included one of the Required Corporate Name Endings.” Make sure to check this box once you have entered a Name with a corporate designator.

Step 3 – In Article 2, you will need to document the Street Address, City, State, Zip Code, and County where the Principal Office is located on the spaces provided. This must be the Physical Address where the Principal Office may be found and may not contain a P.O. Box. If there is a separate Mailing Address, locate the section labeled “The mailing address of the above location, if different, will be” then use the lines labeled Street, City, State, and Zip Code to report the Mailing Address.

Step 4 – If the forming corporation has selected a Service of Process Agent to whom court documents aimed at the corporation may be delivered to, then enter the Full Name of this Agent, in Article 4, on the blank line labeled “Name.” You will also need to use the Street, City, State, and Zip Code lines to enter the Address of this Agent. If you do not report a party and address in this article, court documents will be delivered to the Address in Article 2.

Step 5 – If the Principal Place of Business differs from the Principal Office location, this must be reported in Article 3. You will be provided with a line for Street (Building Number, Street, Unit Number), City, State, and Zip Code. You will also need to report the County of the Principal Place of Business directly below this. There will be an additional section to input a separate Mailing Address for the Principal Place of Business if it differs from the Physical Location. You may use the second set of Address Lines (Street, City, State, Zip Code) for this purpose directly below Principal Place of Business’s Physical Location Address.

Step 6 – In Article 5, report the Email Address where you may receive important Notices (i.e. regarding Annual Reports) from the West Virginia Secretary of State.

Step 7 – In Article 6, report the corporate website (if applicable).

Step 8 – If you own other businesses in West Virginia, you may need to report this in Article 7. If you do own other businesses in this state then select the check box labeled “Yes.” If you do not own other businesses in West Virginia then mark the check box labeled “No.” If you choose not to report any information in this article you may choose the box labeled “Decline to answer.” If you have answered “Yes,” then enter the Number of Businesses you own on the first blank line below this question and the Total Number of Counties you own a business in.

Step 9 – Article 8 will require you to report the categorization of the entity type for the corporation being formed. If these articles are registering a “Non-Profit, Non-Stock” corporation, then mark the first box in Article 8. If these articles are forming a “For Profit” corporation then select the second box.

Step 10 – Article 9 is required only by for profit corporations. If this is a nonprofit corporation then skip to Step 14. If this is a profit corporation then, on the first blank line in Article 9, enter the Total Value of the Authorized Capital Stock (Number of Shares multiplied by the Value Per Share). Next, enter the Total Number of Shares on the blank line after the words “The capital stock will be divided into” and the Par Value of each share on the blank line before the words “per share.”

Step 11 – In Article 10a, define the Purpose of this corporation’s formation. This should indicate the type of business activities that will be engaged in as a Virginia Corporation.

Step 12 – If this for profit corporation will be a Benefit Corporation then mark the first box in Article 10b (Note: If so, you must include this in the Purpose reported in Article 10a). If this will not be a Benefit Corporation then check the second box in Article 10b.

Step 13 – If the forming corporation is a Scrap Metal Dealer then, in Article 10c, mark “Yes” and attach a completed Form SMD-1. If not then mark the second box, labeled “No.”

Step 14 – Article 11 will apply only to nonprofit corporations. If this is a profit corporation skip to Step 15. If this is a nonprofit corporation with no Members then check the first box in Article 11. If this nonprofit corporation will have Members then mark the second box. If this corporation does have members you will need to provide the designation of each Member Class along with the qualifications and rights of each class, and how Members will be appointed/elected. There will be only two lines provided however, you will be allowed to attach a separate sheet of paper that is clearly labeled to present this required information.

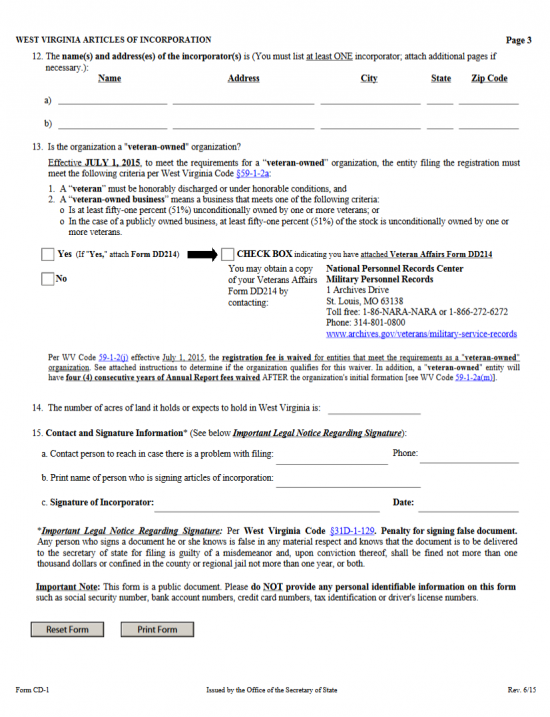

Step 15 – List all the Incorporators as per Article 12. You must list the Name, Address, City, State, and Zip Code of at least one Incorporator in Article 12. There is only enough room for two however, if there are more you may attach an additional sheet of paper with this information. Make sure all attachments are clearly labeled.

Step 16 – If this corporation is either 51% owned by at least one veteran (unconditionally), or has at least 51% of its stock owned by veterans, then check the box labeled “Yes,” complete and attach a Veteran Affairs Form DD214, and check the box labeled “Check Box indicating you have attached a Veteran Affairs Form DD214.” If this corporation is not owned by Veterans, according to these definitions, then select the box labeled “No.” Note: Qualifying Veterans must have been honorably discharged or discharged under honorable conditions.

Step 17 – In Article 14 report the Number of Acres of Land the forming corporation will hold or estimates it will hold in West Virginia on the blank line provided. Note: If the corporation owns more than 10,000 acres of land, then you must include an additional $0.05 for every acre over 10,000.

Step 18 – In Article 15a, you may elect to report the Full Name of a Contact Person on the first blank line along with that party’s Phone Number on the second line. This is optional, but in the event an issue needs to be clarified, a clear line of communication will contribute to a speedier process regarding rectification.

Step 19 – Article 15b will require the party signing these articles to Print his or her Name on the blank line provided.

Step 20 – Article 15c will require the Signature of an Incorporator and the Date of this Signature to be provided on the first and second blank line respectively.

Step 21 – Next, you must calculate your Total Fee. The Filing or Registration Fee for a For Profit Corporation is $50.00. The Filing or Registration Fee for a Non-Profit Corporation is $25.00. Qualifying Veteran owned corporations may have the fee waived. If the corporation holds more than 10,000 acres of land in West Virginia then you must add $0.05 per acre for every acre over 10,000 to the Registration Fee. Finally, if you would like a Certified Copy you may order as many as you like for $15.00 per certified copy. All payments must be made with checks payable to “West Virginia Secretary of State.”

Step 22 – Finally, you may submit at least one original West Virginia Articles of Incorporation Profit/Nonprofit Corporation, a check payable to West Virginia Secretary of State for all applicable Fees, and all required documentation to the West Virginia Secretary of State.

Mail To:

West Virginia Secretary of State

1900 Kanawha Blvd. East Bldg. 1 Suite 157-K

Charleston, WV 25305

How To File Online

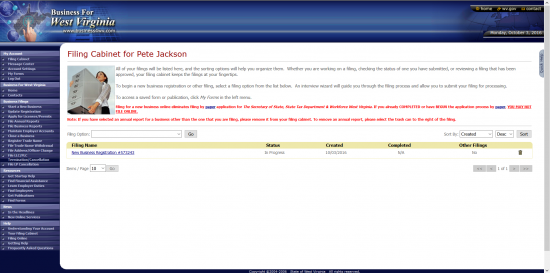

Step 1 – Go to the home page for the West Virginia Secretary of State here: http://www.sos.wv.gov/Pages/default.aspx then locate the drop down list below the words “Business and Licensing.”

Step 2 – Select “Online Business Registration.” This will take you to the Business portal for West Virginia at https://www.business4wv.com/b4wvpublic/default.aspx(Make sure you are logged into your account”).

Step 3 – Locate the menu item, on the right, labeled “My Account.” Select the link labeled “Filing Cabinet.”

Step 4 – Locate the drop down list labeled “Filing Option” in the center of the page. Select “Register a New Business.” Once you have done this select the button labeled “Go.”

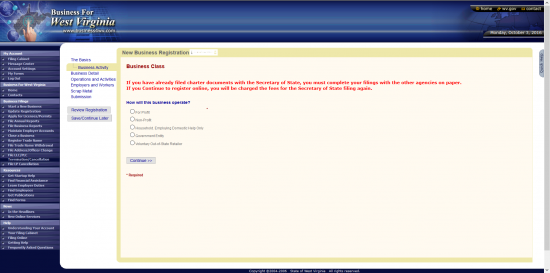

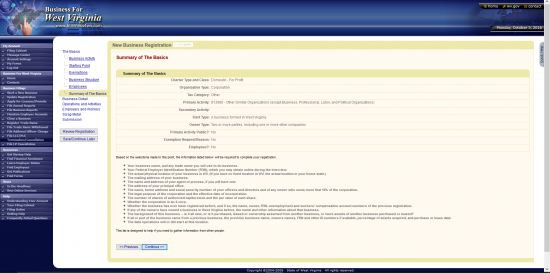

Step 5 – You will first need to define the type of entity being formed. Below the question “How will this business operate,” select the radio button labeled “For Profit.” When you are ready, select the “Continue” button.

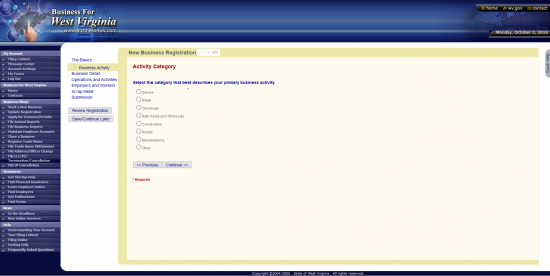

Step 6 – Next, you will need to define the industry the corporation will operate in. Using the corresponding radio buttons, you may select: Service, Retail, Wholesale, Both Retail and Wholesale, Construction, Rental, Manufacturing, or Other. You may only select one. For our purposes, select “Other,” then click on the “Continue” button.

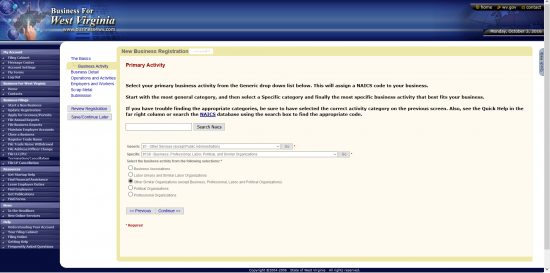

Step 7 – This next page will ask you to define the NAICS Code for your business. You may use the “Search NAICS” button to search the NAICS site or you may select your industry from the drop down list labeled “Generic.” For our purposes, select “81 – Other Services (except Public Administration).” This will generate another drop down list labeled “Specific.” For our purposes select “8139 – Business, Professional, Labor, Political, and Similar Organizations.” This will generate several radio buttons: Business Associations, Labor Unions and Similar Labor Organizations, Other Similar Organizations (except Business, Professional, Labor, and Political Organizations), Political Organizations, or Professional Organizations. For our purposes select the third radio button “Other Similar Organizations (except Business, Professional, Labor, and Political Organizations)” Select the “Continue” button when you are ready.

Step 4 – This next page will ask if you would like the information posted here, regarding your business, should be made public. You may select either the radio button labeled “Yes” or the radio button labeled “No.” For our purposes, select “No.” Then, select the “Continue” button.

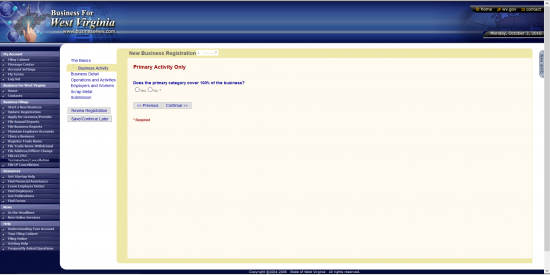

Step 5 – If the primary category covers %100 of the Business activity, then select “Yes.” If not, select “No.” Once you have made this selection click on the “Continue” button.

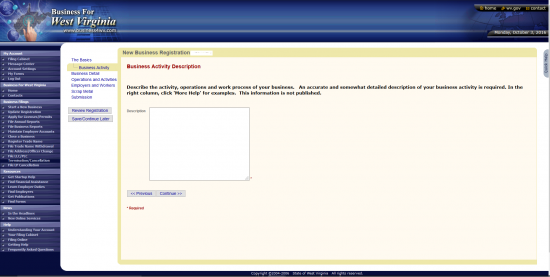

Step 6 – Next, you will have a text box provided to fully describe the operations of your corporation. Enter this information. Be specific. When ready, select the button labeled “Continue.”

Step 7 – This next page, “Starting Point,” will ask to describe the origin location of your business using radio buttons. You may select only one: A business formed in West Virginia, A business registered in another state and locating an operation in West Virginia, A business registered in another state and operating in West Virginia without a fixed location, An out-of-state business that will not do business in the state but is registering only to report withholding tax for WV residents who work in another state, or An out of state business that will not do business in the state but will have employees who live in West Virginia and work at home. For our purposes, select “A business formed in West Virginia” then select the button labeled “Continue.”

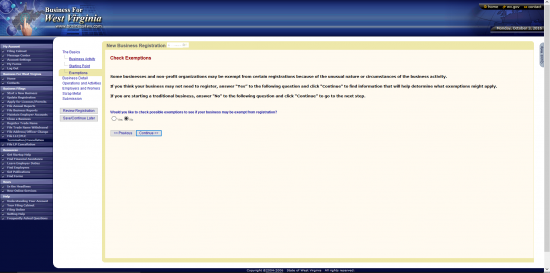

Step 8 – This next section will ask if you would like to check for any exemptions (certain businesses and nonprofits may qualify). If you believe the corporate type being formed will qualify for exemptions regarding this filing, then select “Yes” if you would like engage the wizard. Otherwise, select “No” and click on the “Continue” button. For our purposes select “No.”

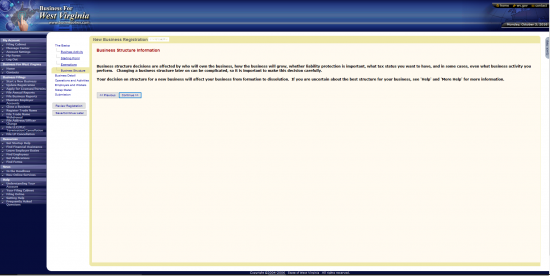

Step 9 – Read the paragraph on the “Business Structure Information” page, then select the “Continue” button.

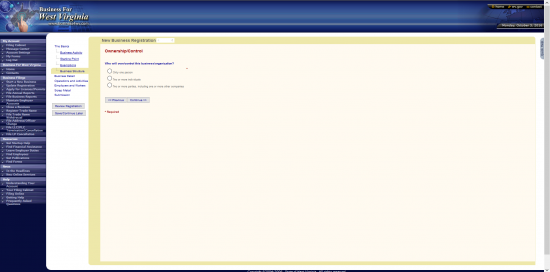

Step 10 – Here, you must define how the Business being formed will be owned or controlled. You may select the radio button labeled “Only one person,” the radio button labeled “Two or more individuals,” or the radio button labeled “Two or more parties, including one or more other companies.” You may only select one of these. For our purposes select the third radio button.

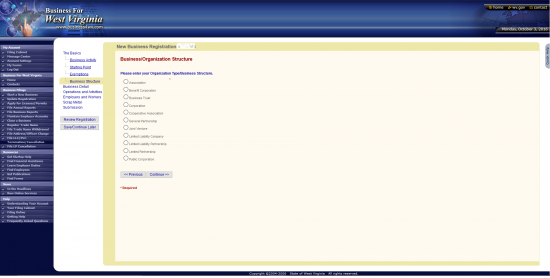

Step 11 – Now it will be time to solidify that a corporation will be formed by these articles. Below the words “Please enter your Organization Type/Business Structure” select the radio button labeled “Corporation.”

Step 12 – If you will have employees select the radio button labeled “Yes.” If not, select the radio button labeled “No.” For the purposes of these instructions, select “No,” then select “Continue.”

Step 13 – This next page will give you an opportunity to review the information you have entered. Make sure this is correct then select the button labeled “Continue”

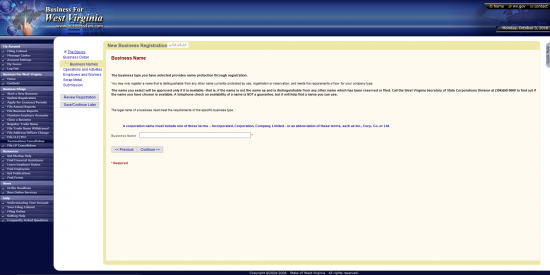

Step 14 – Enter the name of your corporation in the text box labeled Business Name then select “Continue”

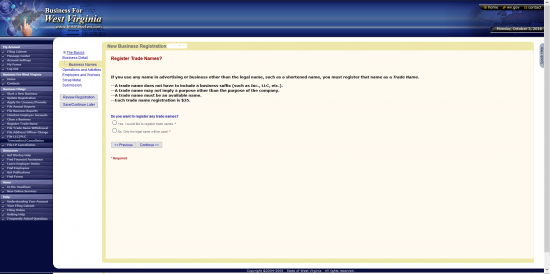

Step 15 – If you would like to register a Trade Name as well then select “Yes.” If not, select “No.”

For our purposes, select “No.” Then click on the “Continue” button.

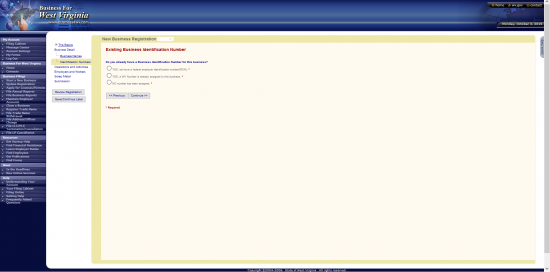

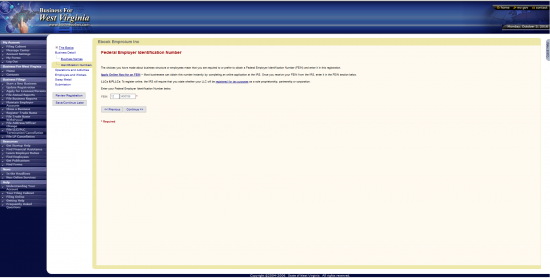

Step 16 – This next page will ask if you have a Federal Employer Identification Number. You may only choose one. If you have a FEIN select the first radio button. If you have a WV number then select the second radio button. If no number has been assigned then select the third radio button.

Step 17 – If you must enter an FEIN the page will direct you to do so. Enter your FEIN number on this page, otherwise skip to Step 18.

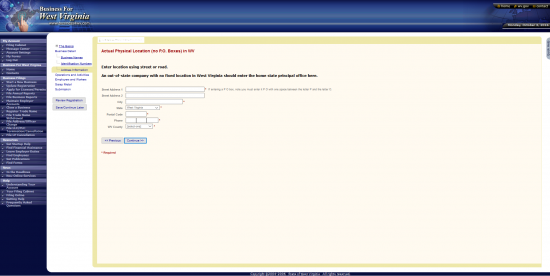

Step 18 – On this next page, you must enter the Physical Location of the Main Office for this corporation regardless of what state it is in. Use the two fields, “Street Address 1” and “Street Address 2,” to enter the Building Number, Street, and any applicable Unit Number. Then in the next text box, report the City. Below this will be a drop down menu to select the State. The next box will require the Zip Code to be entered. Finally, Enter the Phone Number in the boxes labeled “Phone” and select the County (if in WV) from the “County” drop down list. Once you have entered the information on this screen, select the “Continue” button. Note: Do Not Enter a P.O. Box in this screen.

Step 19 – Next, you will need to report where Tax Returns may be sent. This will require a valid Building Number, Street, and Unit Number entered in either “Street Address 1” or, if more room is needed, “Street Address 1” and “Street Address 2.” You may continue reporting this Address using the “City,” “State,” “Country,” and “Postal Code” fields. Once you have entered the required information on this page, select the button labeled “Continue.”

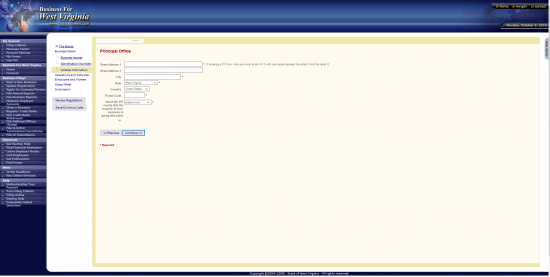

Step 20 – On this screen you must enter the Principal Office location where the main business in West Virginia will take place. You may enter the Street portion of the Address using up to two fields, “Address 1” and “Address 2.” In the appropriately named fields that follow, report the City, State, Country, Postal Code, and West Virginia County where this office located.

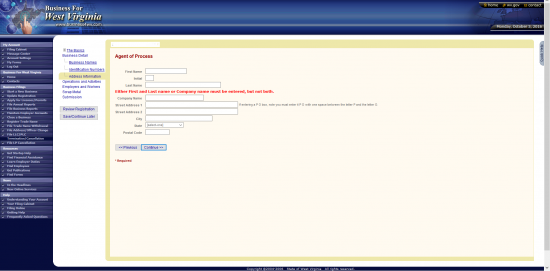

Step 21 – Next you must report the Identity and Location for the corporation’s Agent of Process. That is, to who and where should court generated documents aimed at the forming corporation be delivered. When reporting the Full Name of this party, you may either use the fields labeled “First Name,” “Initial,” and “Last Name” to report an Individual’s Name or the field labeled “Company Name” to report the Name of a company. You may not fill out a Name for both an Individual and a Company. The remaining fields, “Street Address 1,” “Street Address 2,” “City,” “State,” and “Postal Code” must have information making up the Physical Address of the Agent of Process. When ready, select “Continue.”

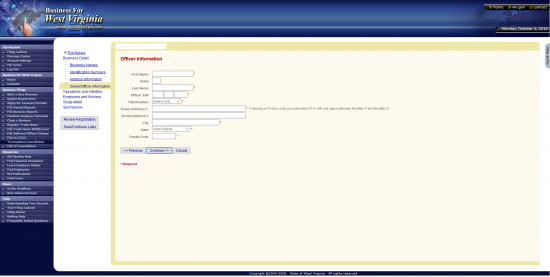

Step 22 – Next you must report the governing parties of this corporation. This screen provides a table which will update each time you enter an Officer or Director’s information on the next page. To begin, locate the button labeled “Add Record,” then click it.

Step 23 – For each party, Officer or Director, enter the First Name, Initial (optional), Last Name, Social Security Number (in the field labeled “Officer SSN”), Title or Position (i.e. President, Director, etc.), Street Address, City, State, and Postal Code using the fields provided. Once you are done, select the button labeled “Continue.”

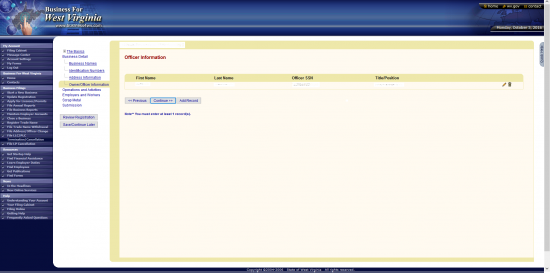

Step 24 – This table will display each entry’s information in a table. When you are ready to proceed, select the button labeled “Continue.”

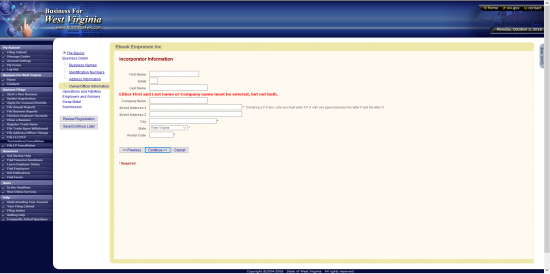

Step 25 – This next page will require similar information for the Incorporators involved with this registration. The screen will display a table of the Incorporator’s information with each entry. To begin, select “Add Record.”

Step 26 – On this screen you will be given several text boxes to report the Identity and Location of each Incorporator. Keep in mind that you may report either an Individual or a Business. If you are reporting an Individual, then use the “First Name,” “Initial.” and “Last Name” fields to report this party’s Name. If you are reporting a Company, then you may use the field labeled “Company Name.” Do not report an Individual and a Company’s Identity here. It must be one or the other. The next several fields are provided so that you may report the location of the party being reported. Use the “Street Address 1,” “Street Address 2,” “City,” “State,” and “Postal Code” fields to report this information.

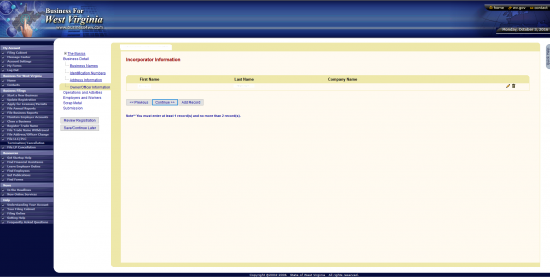

Step 27 – This page will display each entry you have made regarding an Incorporator’s information. When you are ready, you may select “Add Record” to report another Incorporator or you may select “Continue” to proceed.

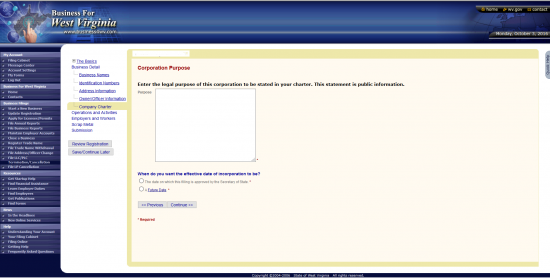

Step 28 – Next you will need to report the Purpose of this corporation. Do this in the text box provided. Then define the Effective Date using the radio buttons following the question “When do you want the Effective Date of the corporation to be?” If you would like it to be the same day as the Filing Date, select the first radio button. If you would like it to be on a later date, select the second radio button then enter the Date in the field that appears. For our purposes, select the first button. Once you are done select the button labeled “Continue.”

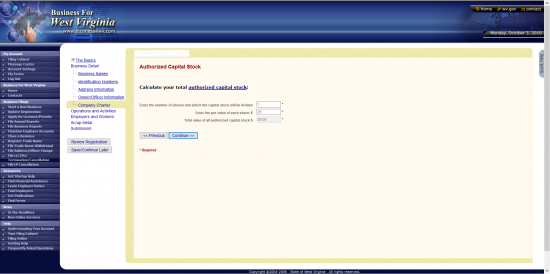

Step 29 – The Authorized Capital Stock page will require some information regarding the Shares this corporation will issue. In the first field, enter the Total Number of Shares this corporation may issue. Then in the second box enter the Par Value of Each Share. Notice, the Total Value of all Authorized Capital will auto-populate. Once you have entered all the information required, select the button labeled “Continue.”

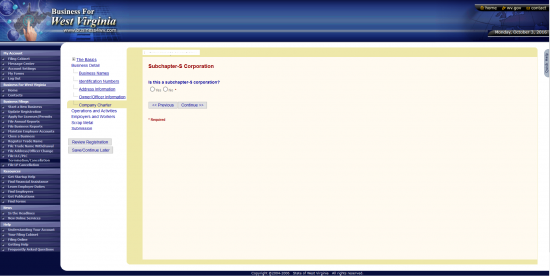

Step 30 – Indicate if this is a Subchapter-S Corporation by selecting either the radio button labeled “Yes” or the radio button labeled “No.” For the purposes of this article select “No.” Once you are done, click on the “Continue” button.

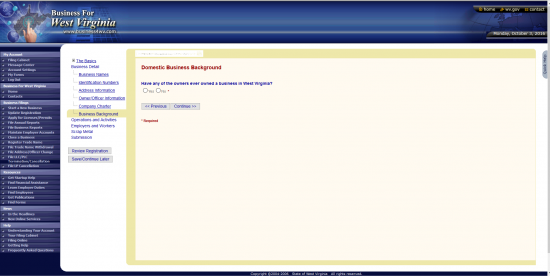

Step 31 – If you own other businesses in West Virginia, you may indicate this by choosing “Yes” or “No.” For the purposes of this article select “No” then select “Continue.” Note: If you do own other businesses, you will need to report how many businesses you own and how many counties you operate a business in.

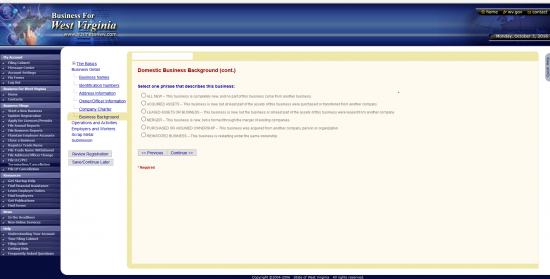

Step 32 – On this screen, you will be asked to define this business a bit more. There will be several radio buttons, each with a choice. You may only choose one: All New, Acquired Assets, Leased Assets or Business, Merger, Purchased or Assumed Ownership, or Reinstated Business. Make sure to choose the one that defines your business accurately. For the purposes of this article, select the radio button labeled “ALL NEW.” Then select the “Continue” button.

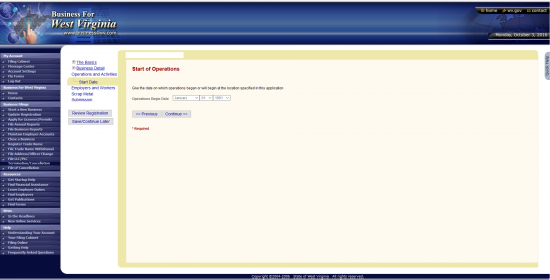

Step 33 – On this page, use the drop down lists to select the Start of Operations for your business. If the corporation has already begun conducting business, enter this Date. If the corporation will begin conducting business, report the Date it will begin conducting business, then select the “Continue.”

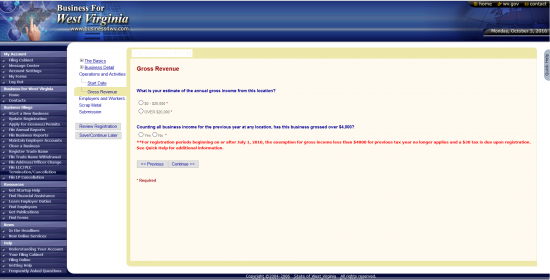

Step 34 – On the next page, select the first radio button if you expect the corporation to make $20,000.00 or less for the Annual Gross Revenue. If you expect the corporation to make more than $20,000.00 in Annual Gross Revenue then select the second radio button.

Step 35 – If all the business income in other locations is greater than $4,000.00 select “Yes” on the second question. If not, then select “No.” Note: If there is such an income, there will be a minimum $30.00 tax due upon this registration period is after July 1, 2010. When ready, select the “Continue” button.

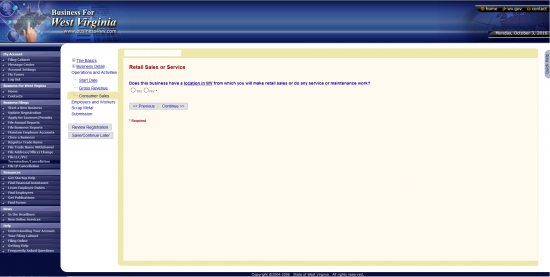

Step 36 – Indicate if this business has any other locations in West Virginia where retail sales or service/maintenance work has been provided by either checking the radio button labeled “Yes” or the radio button labeled “No.” For our purposes select “No” then select “Continue.”

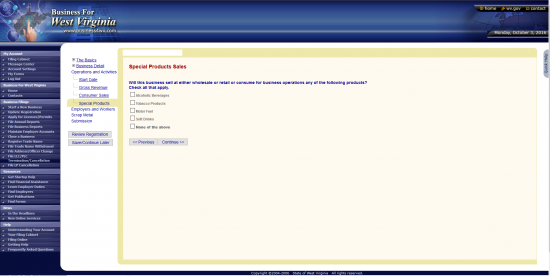

Step 37 – If this business will sell (wholesale or retail) the products on this page (Alcoholic Beverages, Tobacco Products, Motor Fuel, Soft Drinks), you must report it here. You can select as many check boxes as you like. If the corporation being formed will sell none of these then select the box labeled “None of the above.” For our purposes select “None of the above,” then select the “Continue” button.

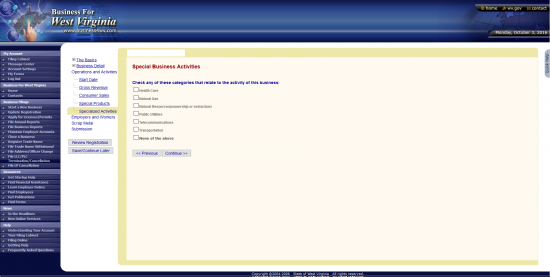

Step 38 – Next you must define if this corporation engages in specific business activities. You may select one or all of the items (Health Care, Natural Gas, Natural Resources, Public Utilities, Telecommunications, Transportation) on this page or you may select “None of the above.”

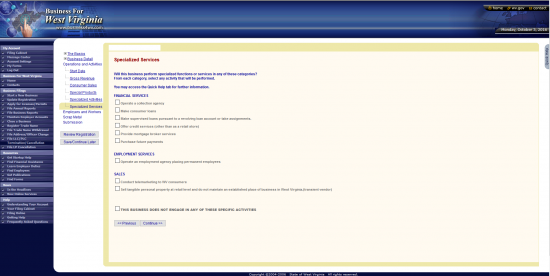

Step 39 – If this corporation will provide any of the specialized services on this page, you must check the box next to the appropriate service. You may select: Operate a collection agency, Make consumer loans, Make supervised loans pursuant to a revolving loan account or takes assignments, Offer credit services (other than a retail store), Provide mortgage broker services, Purchase future payments, Operate an employment agency placing permanent employees, Conduct telemarketing to WV consumers, and/or Sell tangible personal property at retail level and do not maintain an established place of business in West Virginia (transient vendor). If this corporation will not perform any of these services you may select the last check box, labeled “THIS BUSINESS DOES NOT ENGAGE IN ANY OF THESE SPECIFIC ACTIVITIES.” For our purposes select the last check box, then select the “Continue” button.

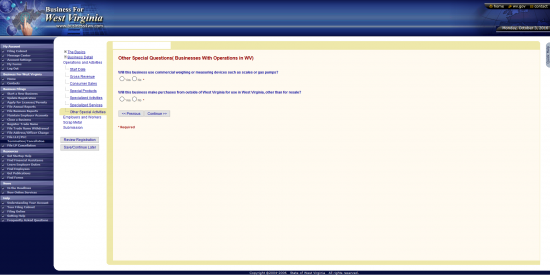

Step 40 – If the forming corporation will use commercial weighing/measuring devices (i.e. gas pumps), select the first radio button. If not, select the second radio button. For our purposes, select the second radio button (labeled “No”).

Step 41 – If this corporation intends on purchasing out of state items for use in West Virginia (excluding resale purposes) then select the button labeled “Yes” in the second question. Otherwise select “No.” Once you have made the appropriate selections, select “Continue.” For our purposes select “No.”

Step 42 – Use the drop down list to indicate the Month that marks the end of your fiscal year for Federal Tax Purposes. When ready, select “Continue.”

Step 43 – If this corporation is a subsidiary of another company then mark the radio button labeled “Yes.” If not then mark the radio button labeled “No.” (Select “No” for our purposes). Once you have done this click on the “Continue” button.

Step 44 – This page will inform you to gather any payroll information you must report. Once you have read the statement provided, select “Continue.”

Step 45 – This page is a warning for businesses who have indicated they will not have employees as we did so earlier. If you will have employees and are not reporting them here, you will have to report them at the time of hiring. Select the first radio button, if you do not anticipate hiring any employees or intend to. If you would like to change your answer to report employee payroll information, then select the second radio button. When you are ready select “Continue.” We will keep the answer the same as earlier so select the first radio button then select the “Continue” button.

Step 46 – You will need to report where Payroll will be kept if you have employees or in case you do hire any employees. If payroll will be kept in the Principal Office, select the first radio button. If not then select the second radio button (this will prompt address fields to appear as you will need to report the payroll address). For our purposes, select the first radio button then select “Continue.”

Step 47 – You must indicate where Unemployment Compensation Payroll reports be sent. Select the appropriate Address by clicking in the corresponding radio button or you may enter a new address by selecting “At a different location.” For our purposes select the Principal Office Address then select “Continue.”

Step 48 – Certain exemptions apply for Veteran owned corporations. Read this page very carefully. If this is such a corporation select the radio button labeled “Yes.” If so, then you must fax Form DD214 to 304.558.5758 or mail it to Business and Licensing Division, 1900 Kanawha Blvd, East, Building 1 Suite 157-K, Charleston, WV 25305. These articles will not be processed if you choose yes and do not submit a completed DD214 to this fax number or address. Otherwise, select “No.” For our purposes, select “No,” then select “Continue.”

Step 49 – If the corporation has a website, then enter the website address in the text box provided. If not, then you may leave this field blank. Select the Continue button when you are ready.

Step 50 – The Submitter of these articles will be submitting to several agencies simultaneously: to the West Virginia Tax Department, the West Virginia Secretary of State, and the West Virginia Unemployment Compensation Division. Each one of these will require a separate Electronic Signature. For the West Virginia State Tax Department, the Submitter will need to enter his/her Name in the field “Authorize By (Enter Name),” report the Date, and document his/her Title. For the West Virginia Secretary of State, the Submitter must enter his or her Name, select their Capacity (position/title), and report his/her Email. For the West Virginia Unemployment Compensation Division, the Submitter will need to enter his or her Name then document his/her Capacity(position/title). Once this is done, you may select “Review Registration.” This will give one final opportunity to review or edit any information presented before check out. The West Virginia Articles of Incorporation will cost $100.00 to file for a profit corporation and $50.00 for a nonprofit/nonstock corporation however other fees may apply. You may pay by credit card. Make sure to print your receipt upon payment.