|

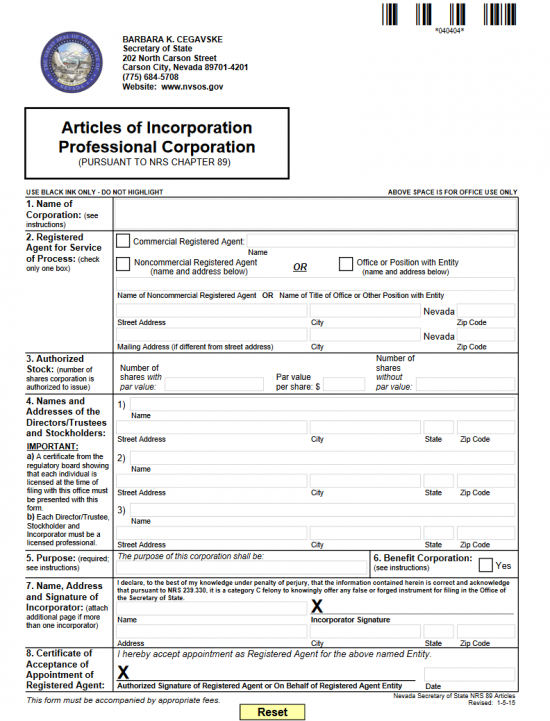

Nevada Articles of Incorporation for a Professional Corporation |

The Nevada Articles of Incorporation for a Professional Corporation should be completed and filed with the Nevada Secretary of State prior to conducting any business in this state. This form may be submitted in hardcopy or may be filed as a part of an online articles of incorporation form. The Nevada Secretary of State will place several requirements upon such a corporation, not the least of which, submitting approval from any relevant licensing or regulatory entities that must be satisfied if a single professional provides the same service. Also, since this entity type will focus on a specific and specialized service, each Director/Trustee must be licensed to deliver this service in the State of Nevada. Of course other governing entities such as the Internal Revenue Service will require information and/or must approve the formation of such a corporation and Incorporators are encouraged to take the initiative in knowing what they are responsible for. If there are any question regarding this process, it is generally recommended to seek consultation with an appropriate professional.

You will receive a stamped copy when this form is approved. If you wish a certified copy you will need to pay $30.00 in a addition to the Filing Fee. The Filing Fee will be determined by the amount of authorized stock the close corporation possesses. This Fee ranges from $75.00 to $35,000.00. You may also choose the additional service of expediting this filing. This too, would require an additional payment separate from the filing fee. The amount depends upon the level of service and will range from $125.00 to $1,000.00. All filings may be mailed to: Secretary of State, New Filings Division, 202 North Carson Street, Carson City, NV 89701-4201.

How To File

Step 1 – Select the “Download Form” link above. Then save the file on your computer. You may use a PDF program to edit the forms you are submitting or you may print it then fill it out. Make sure to use Black Ink.

Step 2 – In the First Article, document the Full Name of the professional corporation being formed. This must appear precisely the corporation is to be known. Remember to include an appropriate word of incorporation as a suffix.

Step 3 – In the Second Article, indicate if you have obtained a commercial Registered Agent by checking the first box, then entering the Full Name of the commercial Registered Agent on the blank space provided. If the Registered Agent is noncommercial then either check off the box next to the words “Noncommercial Registered Agent (name and address below)” or the box next to the words “Office or Position with Entity (name and address below).” Directly below this, enter the Full Name of the noncommercial Registered Agent. On the fourth line of this article, report the actual physical location of the noncommercial Registered Agent. You may report a separate Mailing Address for the Registered Agent on the fifth line.

Step 4 – In the Third Article, enter the Total Number of Shares with Par Value in the first box then the value of each share in the box labeled “Par Value Per Share.” In the third box, enter the Total Number of Shares without Par Value.

Step 5 – In the Fourth Article, report the Full Name and Full Address of each Director/Trustee. There is enough room for three entries. Each individual must have their own entry. Enter the Full Name in the first line and the Full Address on the second line of each entry. There is enough room for three however, you may continue on a separate document that is clearly labeled then attached. Note: Each one of these individuals must be approved by the State of Nevada to provide the service this corporation provides the public.

Step 6 – The Fifth Article requires the Purpose of this corporation to be defined. Make sure to be specific as your corporation will be held to this statement. In many cases, what is written here may depend upon the nature of the corporation so make sure this is an accurate statement.

Step 7 – If this is a Benefit Corporation check off the box in the Sixth Article, otherwise you may leave this blank. Note: You must define the benefit or public service in the Fifth Article if this is a Benefit Corporation.

Step 8 – Each Incorporator must provide his/her Printed Name, Full Address, and Signature in the Seventh Article. There is enough room for one to do this. However if there are more, this list of Names, Addresses, and Signatures must be completed on a clearly labeled sheet of paper that is attached to these articles.

Step 9 – In the Eighth Article, the Registered Agent obtained by this corporation must Sign his/her Name on the Signature line and provide the Date of Signature in the Date box.

Step 10 – You will now need to fill out the Customer Order Instruction Form or the 1 hour – 2 hour Expedite Customer Order Instruction Form. This depends upon your needs. Both forms will require information such as your Name, Address, Method of Payment, and Method of Delivery. The Customer Order Instruction Form will allow you to choose from Regular or 24 hour Expediting (24 hour expediting will cost an additional $125.00). The 1 hour – 2 hour Expedite Customer Order Form will allow you to choose either 1 hour Expediting (requiring an additional $1,000.00 payment) or 2 hour expediting (requiring an additional $500.00 payment). Both forms will give the opportunity to request, in writing, a certified copy for $30.00

Step 11 – Now you will need to calculate the Filing Fee you must pay for submitting this form. There are several Authorized Stock brackets to choose from. First, calculate the total value of the authorized stock the corporation will have. The Filing Fee will be $75.00 if the total stock is worth less than $75,000. If the total worth is $75,000.00 – $200,000.00 then the Filing Fee will be $175.00. If the total worth is $200,000.00 – $500,000.00 then the Filing Fee will be $275.00. If the total worth is $500,000.00 – $1,000,000.00 then the Filing Fee is $375.00. In some cases, the corporation may have more than $1,000,000.00. If this is the case you will need to submit a payment covering $375.00 plus $275.00 for every $500,000.00 or fraction of above $1,000,000.00. The filing fee must be paid when submitting. If you are paying this with a credit card, make sure to include an ePayment Checklist form with your credit card information. If you are paying by check, you must make it payable to “Secretary of State.”

Step 12 – Gather all documents that must be submitted with the Nevada Articles of Incorporation for a Professional Corporation, including any check payments, then mail this package to the Nevada Secretary of State.

Mail To:

Secretary of State

New Filings Division

202 North Carson Street

Carson City, NV 89701-4201

If Expediting You May Also Mail To:

Secretary of State – Las Vegas

Commercial Recordings Division

555 East Washington Avenue, Ste 5200

Las Vegas, NV 89101