|

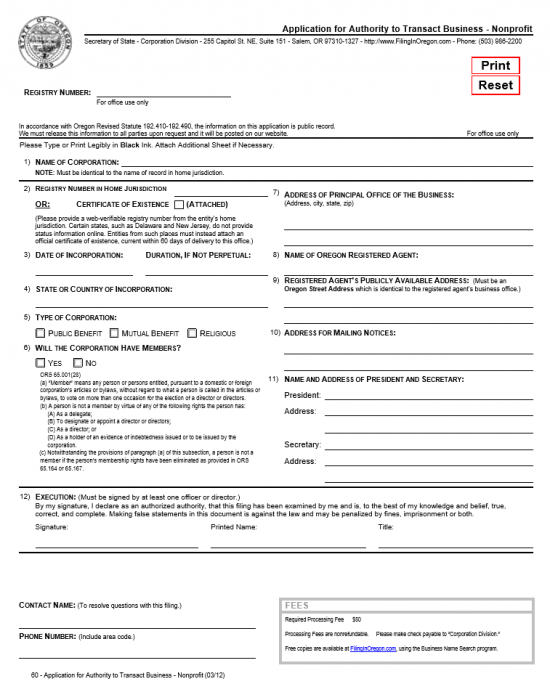

Oregon Application for Authority To Transact Business – Nonprofit |

The Oregon Application for Authority To Transact Business – Nonprofit is available to foreign nonprofit corporations seeking to operate as a nonprofit corporation within this state. This application must be completed and submitted to the Oregon Secretary of State Corporation Division for approval in order to remain in compliance with Oregon State Laws.

The Filing Fee for this form is $50.00 and this must be paid for with a check made out to Corporation Division if filing by mail or with a credit card if filing electronically. It is worth mentioning the State of Oregon will require the foreign nonprofits Registry Number with its home state or a Certificate of Good Standing dated within sixty days of the application date but you may only use a Registry Number if it is web verifiable free of charge to the Corporation Division of the Oregon Secretary of State.

How To File

Step 1 – Download the Oregon Application for Authority to Transact Business – Nonprofit by selecting the above link (labeled “Download Application”). This may be printed then filled out with black ink or filled out onscreen with an appropriate PDF program. All sections must be filled out completely, if there is not enough room, you may continue on a separate document that must be properly labeled then attached.

Step 2 – In the first item, report the Full Name of the applying foreign nonprofit corporation on the blank line provided. Make sure this is reported exactly as it appears on the record books of its home state’s governing bodies.

Step 3 – You will need to verify the corporate status the nonprofit holds in its parent state in Item 2. You may either enter the Registry Number on the first blank line (if it is easily verifiable online) or you may check the box and attach a Certifcate of Existence or Certificate of Good Standing dated within 60 days of the application date.

Step 4 – Under the words “Date of Incorporation” in Item 3, enter the Date the foreign nonprofit corporation incorporated in its parent state. Then under the words “Duration, If not Perpetual,” report the Date of Dissolution this corporation intends to dissolve on. You may enter the word Perpetual if this nonprofit intends to operate without a Dissolution Date.

Step 5 – Report the State or Country of Incorporation on the blank line in Item 4.

Step 6 – If this is a Public Benefit corporation place a check in the first box in Item 5. If this is a Mutual Benefit corportion, place a check mark in the second check box in Item 5. If this is a Religious Corporation, place a check mark in the third check box in Item 5. Only one of these boxes may be selected.

Step 7 – If this corporation will have members then place a check mark in the first box of Item 6 however, if this is corporation will not have members then place a check mark in the second box of Item 6. You may only choose one of these boxes.

Step 8 – Report the Full Address of the Principal Office of the foreign nonprofit corporation in Item 7.

Step 9 – The Registered Agent’s Full Name must be reported on the blank line in Item 8.

Step 10 – The Registered Agent’s public Office Address is required on the blank lines in Item 9. Make sure this is the physical Oregon location of the Registered Agent’s official Office.

Step 11 – Item 10 requires the Full Mailing Address where the Oregon Secretary of State may mail notices when seeking to provide information or make inquiries of the foreign nonprofit corporation.

Step 12 – The President of the foreign nonprofit corporation must provide his or her Name and Address in the first section of Item 11. In the second section of Item 11, the Secretary of the foreign nonprofit corporation must provide his/her Name and Address.

Step 13 – In Item 12, an authorized Officer or Director must provide his or her Signature on the first space, his or her Printed Name on the second blank space, and his or her Title.

Step 14 – At the end of this application will be an area where you may enter the “Contact Name” for the individual who the Corporation Division should contact if there are any issues regarding this application that must be resolved. Beneath this, enter the Phone Number for the Contact person.

Step 15 – You will need to include a Full Payment for the Filing Fee of this application at the time of submittal. This should be done with a check written out to Corporation Division for $50.00. Send this, any required additional documents, and the completed Oregon Application for Authority To Transact Business Nonprofit to the Corporation Division of the Oregon Secretary of State by mail.

Mail To:

Secretary of State

Corporation Division

255 Capitol Street NE Ste 151

Salem, OR 97310-1327