|

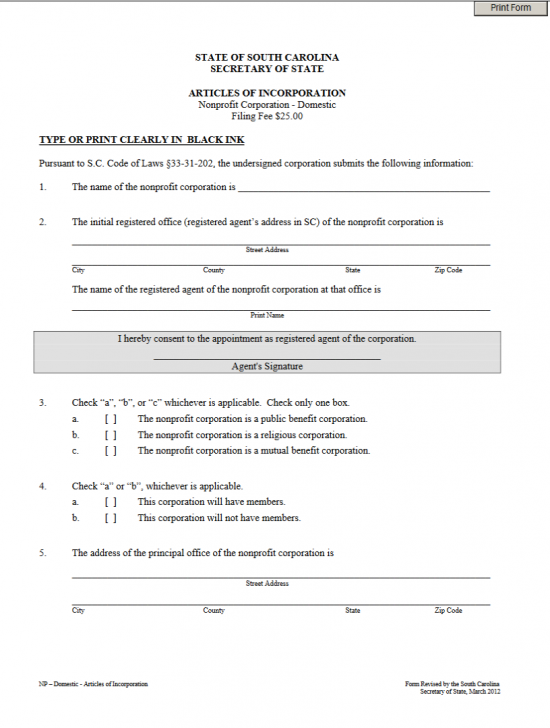

State of South Carolina Articles of Incorporation Nonprofit Corporation – Domestic |

The State of South Carolina Articles of Incorporation Nonprofit Corporation – Domestic Nonprofit is a required filing with the South Carolina Secretary of State for Incorporators wishing to create a nonprofit corporate entity. In fact, one creates a nonprofit corporation, in the eyes of the state, by submitting this completed form, the required paperwork for the entity type meant to accompany this form, and the full payment of the Filing Fee ($25.00). Regardless of whether this is a mutual benefit nonprofit corporation or a religious nonprofit corporation, these requirements must be fulfilled. The supporting paperwork and/or the language required with the submission of these articles will depend mainly upon the type of nonprofit entity being formed. For instance, political nonprofits will need to supply a completed Form CL-1 (First Report to Corporations) and entities wishing to apply for Tax-Exempt Status with the IRS will need to use 501(c)(3) compliant language in the formation of the nonprofit entity. Anyone not familiar with the process of forming a nonprofit corporation is, therefore, encouraged to seek counsel with a South Carolina Attorney before filling out this paperwork.

The South Carolina Articles of Incorporation Nonprofit Corporation – Domestic must be submitted in duplicate with all the appropriate paperwork and a check in the amount of $25.00 made out to the “Secretary of State.” This is the minimum Filing Fee. If the forming nonprofit is a political corporation then the CL-1 must be submitted and the total Filing Fee for the submission of this paper work will be $50.00 ($25.00 Articles Fee + $25.00 CL-1 Fee). This may submitted by mail to South Carolina Secretary of State’s Office, Attn: Corporate Filings, 1205 Pendleton Street, Suite 525, Columbia, SC 29201.

How To File

Step 1 – Download the State of Carolina Articles of Incorporation – Domestic Nonprofit Corporation. This form is mandatory. If you are forming a political organization then you must also download, fill out, and submit the CL-1. If the forming nonprofit corporation intends to apply for Tax-Exempt Status, it would be strongly recommended to download the 501(c)(3) attachment.

Step 2 – In Article 1, enter the Full Name of the nonprofit corporation on the blank line following the words “The name of the nonprofit corporation is.” Make sure include your chosen corporate designator (i.e. Corporation, Corp., etc.)

Step 3 – In Article 2, you will need to give a report on the Identity of the Registered Agent and the geographical location of the Registered Office. Do this by entering the Building Number, Street, and Suite Number (if applicable) on the blank line labeled “Street Address.” On the second line enter the City, County, State (Must be South Carolina), and Zip Code of the Physical Location of the Registered Office where the Registered Agent will be found.

Step 4 – On the next line, labeled “Print Name,” enter the Full Name of the Registered Agent.

Step 5 – In the Registered Agent must sign the line labeled “Agent’s Signature” in the grey box as confirmation of his or her acceptance of this appointment.

Step 6 – Article 3 seeks to define what kind of nonprofit corporation is being created and registered on this form. If this is a Public Benefit, mark the box in 3a. If this is a Religious Corporation, mark the box in 3b. If this is a Mutual Benefit Corporation then mark the box in 3c. You may only form one of these entities so you may only mark one box in this section.

Step 7 – If this nonprofit corporation will have members then locate Article 4 and place a mark in the box in 4a. If this corporation will not have members then place a mark in the box in 4b. You may only choose one of these options.

Step 8 – In Article 5 enter the Street Address (Building Number/Street/Unit Number) of the forming nonprofit corporation’s Principal Office. Then on the next line enter the Principal Office’s City, County, State, and Zip Code.

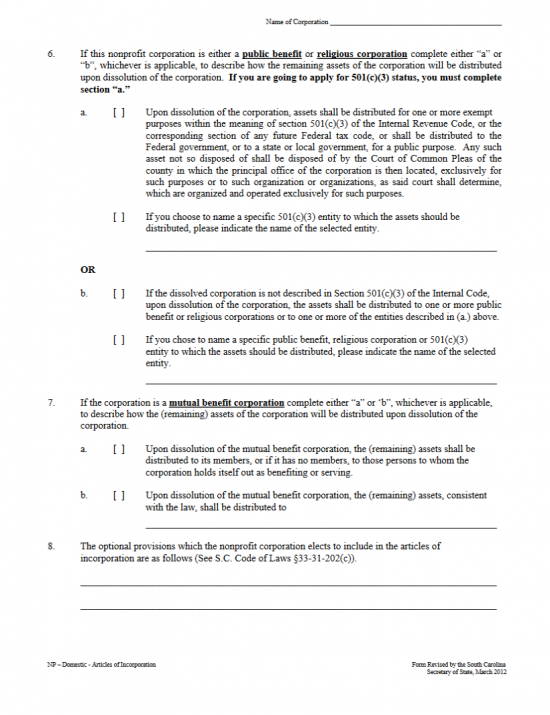

Step 9 – At the top of the next page, on the right, enter the Name of the Corporation (precisely as it is documented in Article 1) on the space provided.

Step 10 – Article 6 must be filled out only if the forming nonprofit is either a public benefit nonprofit corporation or a religious nonprofit corporation. You must choose to fill out either 6a or 6b however, if (at any point) the corporation will seek 501(c)(3) status then you may only fill in 6a. If the nonprofit will allow the assets to be distributed upon the wishes of the I.R.S. and the Court of the Common Pleas then mark the first box in 6a. If you wish to distribute the nonprofit corporation’s assets to a specific entity upon the forming nonprofit corporation’s dissolution, then place a mark in the second box in 6a and enter the Full Name of the entity who shall receive said assets. If the corporation will not be applying for Tax Exempt Status and will allow its assets to be distributed to public use (in general) upon dissolution then mark the first box in 6b. If, upon dissolution, the forming nonprofit wishes its assets to be distributed public benefit, religious corporation, or Tax Exempt entity then mark the second box in 6b and enter the Name of the corporate recipient of these assets.

Step 11 – Article 7 will only apply to mutual benefit corporations. If this is a mutual benefit corporation then you must mark one of the boxes present. If, upon dissolution, the nonprofit corporation’s assets is to be distributed to its members or (if no members) to the entity(ies) it serves, then place a mark in the first box in Article 7. If this corporation wishes to distribute its assets, upon dissolution, to a specific entity then mark the second box in Article 7 and enter the Name of the recipient entity on the space provided.

Step 12 – You may add additional Provisions to these articles as per Article 8. There will be some space available here, however if there is not enough room, you may continue on a clearly labeled sheet of paper. Make sure to note the continuation on one of the blank lines in Article 8.

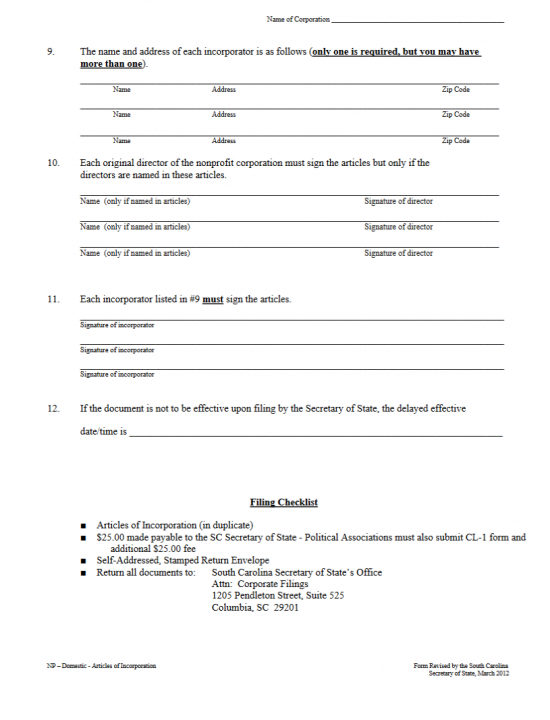

Step 13 – Each Incorporator of the forming nonprofit must be listed in Article 9. Each blank line will have a space noted for the Incorporator Name, Incorporator Address, and Incorporator Zip Code. There is enough room for three Incorporators to be listed however you may continue the Roster on a clearly labeled sheet of paper.

Step 14 – If any of the Directors have been Named in this document, then he/she must provide a his/her Printed Name and Signature on one of the lines in Article 10.

Step 15 – In Article 11, each Incorporator must sign his or her Name on one of the Signature Lines provided. There will only be enough room for three however this list of Signatures may be completed on a separate sheet of paper.

Step 16 – You may choose a delayed Effective Date for the articles in Article 12. This would be a Date where the forming corporation’s corporate status is granted after a successful Filing Date. If this is desired then enter the desired delayed Effective Date in Article 12. If you wish the Effective Date to be upon the Filing Date, then leave this article blank.

Step 17 – When you are ready to submit the State of South Carolina Articles of Incorporation, gather all documents and filings that must be submitted into one package. You must pay for all applicable of Fees at the time of Filing in addition to the State of South Carolina Articles of Incorporation Filing Fee of $25.00.

Mail To:

South Carolina Secretary of State’s Office

Attn: Corporate Filings

1205 Pendleton Street, Suite 525

Columbia, SC 29201