|

Colorado Articles of Incorporation For-Profit Corporation – Domestic |

The Colorado Articles of Incorporation For-Profit Corporation must be filed online with and approved by the Colorado Secretary of State when an entity wishes to conduct business, legally operate in the State of Colorado, as a For-Profit Corporation. This must be accompanied with payment for the $50.00 filing fee and any relevant or required documentation attached to the form . The online form, itself, is considered a cover letter for the attached documents. The main form page will lead to a area where you will have the opportunity to attach any and all documents that must accompany your submission to the Connecticut Secretary of State. The Transaction Preview page, which follows the Attachment page, provides a final review of the transaction involved . If the information is correct and all additional files have been accepted, you may select the “Accept” button in order to proceed with payment for the filing fee via a major credit card. The transaction will occur when you hit the “Pay Now” button.

If successful, your browser will be directed to the “Transaction Confirmation Page” which will have an image of your filing with an e-stamp reading “E-Filed” at the top of the page along with the filing date and document number in the top right corner. Your filing will be received in real time. It is highly recommended to save the image on this page for future reference. You may subscribe for email notifications regarding any filings with the Secretary of State that will affect the corporation you have filed a form for by visiting this page: http://www.sos.state.co.us/biz/businessFunctionsEmailNotification.do. This page will also deliver the Business I.D. number assigned by the Colorado Secretary of State upon approval of the submitted articles of incorporation.

How To File

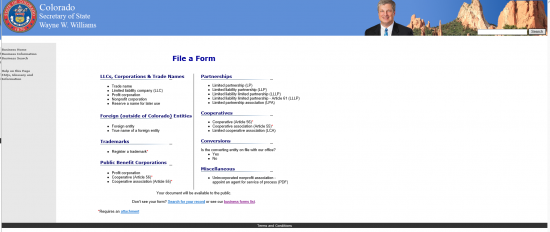

Step 1 – Go to: http://www.sos.state.co.us/biz/FileDoc.do, then select the link labeled “Profit Corporation” under the heading “LLC’s, Corporations, and Trade Names.”

Step 2 – Next input the name that you have selected for the forming corporation, and verified as unique, in the text box provided. Since this is a For Profit Corporation this must be in accordance with 7-90-601, C.R.S by containing one of the following terms: Corporation, Corp., Incorporated Inc., Company, Co., Limited, Ltd. Once you have entered the corporation’s name, select the button labeled “Next” in the lower left hand corner. This will direct the browser to the page where you may enter required information, attach files, and submit. Note: These instructions are specifically for corporations and not Ltd’s.

Step 2 – Next input the name that you have selected for the forming corporation, and verified as unique, in the text box provided. Since this is a For Profit Corporation this must be in accordance with 7-90-601, C.R.S by containing one of the following terms: Corporation, Corp., Incorporated Inc., Company, Co., Limited, Ltd. Once you have entered the corporation’s name, select the button labeled “Next” in the lower left hand corner. This will direct the browser to the page where you may enter required information, attach files, and submit. Note: These instructions are specifically for corporations and not Ltd’s.

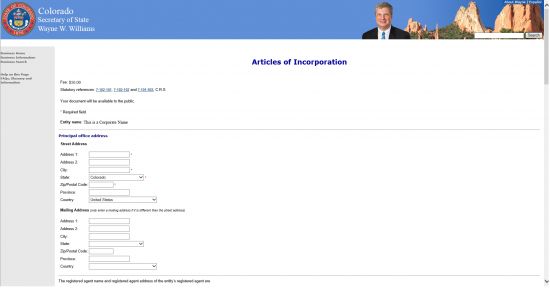

Step 3 – There will be several sections requiring attention. Verify that your corporate name has been entered correctly next to the term “Entity Name.”

Step 3 – There will be several sections requiring attention. Verify that your corporate name has been entered correctly next to the term “Entity Name.”

Step 4 – Next, in the “Principal office address” section, report the address of the forming corporation’s Principal Office. There will be two items: Street Address and Mailing Address. In “Street Address” enter the physical street address, city, state (must be Colorado), and zip code. You may leave province blank and leave “United States” in the “Country” drop down menu. If the forming corporation has a separate mailing address (such as a Post Office Box) report the address, city, state, zip code, province, and country where mail may be sent in the “Mailing Address” item.

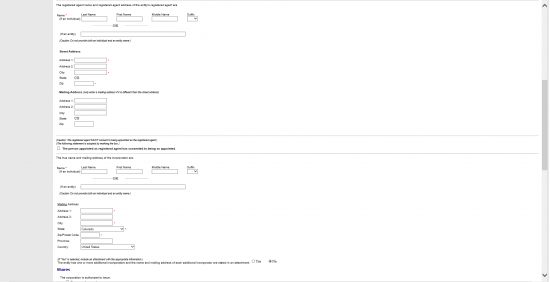

Step 5 – You must report the identity of the Registered Agent in the cells below the sentence beginning with the words “The registered agent name.” The Registered Agent is the adult, or corporate entity, authorized to reliably accept court documents on behalf of this new corporation, if it is sued or involved in court action. If the Registered Agent is an individual report the Last Name, First Name, Middle Name (if applicable), then select the appropriate Suffix (if applicable) from the drop down menu in the appropriate cells. If the Registered Agent is a corporation or similar entity, leave the Name item blank and enter this entity’s name in the cell next to the words “(If an entity).”

Step 6 – Under the heading “Street Address” in the Registered Agent section you may enter the street address of the Registered Agent in Address 1 and Address 2, then enter the City, and Zip Code. Note this must be located in the State of Colorado. If the Registered Agent has a separate Mailing Address then enter the full Address, City, and Zip Code under the heading, “Mailing Address.” Finally, use the left mouse button to select the box next to the words “The person appointed…:” to verify the Registered Agent consents to the terms of this appointment.

Step 7 – You must define the identity of the Incorporator of this For Profit Corporation in the section beneath the words “The true name and mailing address of the incorporator are:” by filling out either the full Name of the Incorporator (Last Name, First Name, Middle Name, Suffix) in the cells next to the word “Name” or by documenting the name of the entity (corporation, company, etc.) next to words “(If an entity).” You must only pick one.

Step 8 – Next, under the heading “Mailing Address,” enter the mailing address of the Incorporator. You must fill in Address 1, City, State, and Zip Code in the appropriate areas. Additional fields available are Address 2, Province, and Country.

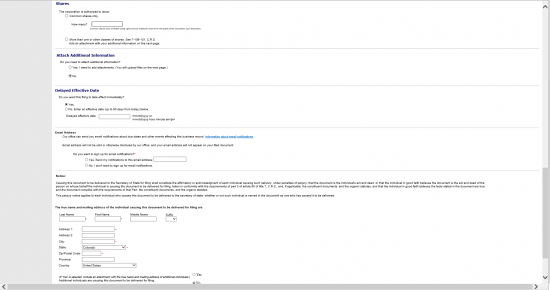

Step 9 – Under the heading, “Shares,” you must define the share information. Select the bubble labeled “Common shares only,” then indicate how many this corporation has been authorized to distribute in the cell next to the words “How many?” If there are more than one class of share, select the bubble labeled “More than one or other classes” and be prepared to attach the proper documentation indicating the various classes, series, and par value.

Step 10 – Under the heading, “Attach Additional Information,” indicate if you are attaching files to these articles by selecting the bubble beginning with “Yes…” or by selecting the bubble labeled with “No.” You will be able to attach these files on the next page.

Step 11 – All online filings are considered in real time and will be attended to by the Secretary in the order received. However, if you wish the effective date to be at a later time then, under the heading “Delayed Effective Date,” indicate this preference by selecting the bubble labeled “No” and entering the exact date of effect you wish in the cell next to the words “Delayed effective date.” If you wish the articles to go into effect fairly immediately then select the bubble next to the word “Yes.”

Step 12 – Under the heading “Email Address,” indicate if you would like to receive notifications by email regarding your business record by selecting either “Yes” then filling in your email address in the space provided or selecting the bubble next to the word “No…”

Step 13 – Under the heading, “Notice,” verify you have the right to form this corporation by filling in your Last Name, First Name, Middle Name, Suffix, and full Address in the appropriately labeled cells. If more than one individual is responsible for this filing then select “Yes” and be prepared to attach a document containing the full Name and Address of each individual on the next page. If there are no additional individuals then select the bubble labeled “No.”

Step 14 – Finally select the “Submit” button in the lower left hand corner of this page. This will direct you to a page where you may attach any additional documents. Once the attachments have uploaded successfully, you may pay by major credit card for this filing. You will receive a confirmation page with the word “E-file” at the top along with the date and document I.D. number the Secretary of State has assigned these articles. Your submission will not be considered complete until you have received this image. It is considered wise to save this image for your records.