|

District of Columbia Foreign Registration Statement Form | Form FN-1 |

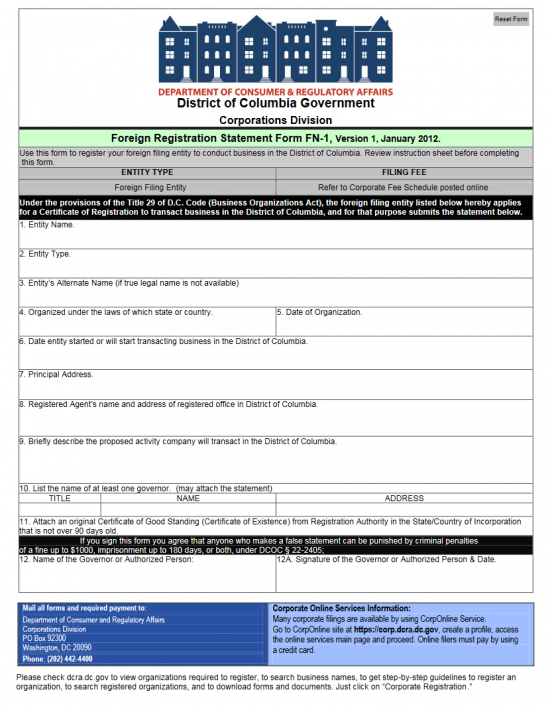

The District of Columbia Foreign Registration Statement Form | Form FN-1 must be received and approved by the Washington DC Department of Consumer and Regulatory Affairs from a foreign corporation seeking to legally conduct business, prior to operating as such, in the District of Columbia. This form will guide the submitter in satisfying the basic reporting requirements all foreign corporations must fulfill. Another requirement all foreign corporations must fulfill is to submit the Washington DC Foreign Registration Statement Form | Form FN-1 with a Certificate of Existence issued by the governing body of the foreign corporation’s home jurisdiction (usually this is the Secretary of State) and dated within 90 days of the application date.

The Washington DC Department of Consumer and Regulatory Affairs will accept the Washington DC Foreign Registration Form, the Certificate of Existence, all additionally required paperwork for the entity type, and a check made payable to DC Treasurer for the Filing Fee ($220.00) by mail at Department of Consumer and Regulatory Affairs, Corporations Division, PO Box 92300, Washington D.C. 20090. You may pay by credit card by submitting online (http://dcra.dc.gov), provided you have an account with the Washington DC Department of Consumer and Regulatory Affairs.

How To File

Step 1 – Select the “Download Form” link above. This will allow you to save a PDF version of the District of Columbia Foreign Registration Statement Form | Form FN-1. You may enter information onto this form by printing it (with a printer), then typing in the information or you may use a PDF editing program to fill in the information then print it and have it signed.

Step 2 – In the First Item, there will be a blank line provided so the Full True Name of the filing entity may be documented. The Full True Name of a corporate entity is the one used in the governing body’s record books. It may be found on the Certificate of Existence that must accompany this registration form.

Step 3 – Report the Entity Type in the Second Item. That is, report what type of corporation the filing entity is (i.e. nonprofit, profit, professional, etc.)

Step 4 –If the filing entity does not have a Name it may use in the District of Columbia (i.e. another entity is using it), then a Fictitious Name must be adopted. This may be a wholly different Name or the True Full Name with the State Noted as part of the Name. Make sure the Name will not create any confusion when trying to Identity this company. If the corporation may use its True Full Name, do not adopt a Fictitious Name and leave this section blank.

Step 5 – Report the Jurisdiction where this entity is incorporated in Item 4. Then, in Item 5, report the Date the filing entity Incorporated in its State of Jurisdiction.

Step 6 – In Item 6, report the Date this corporation has conducted business or intends to conduct business in the District of Columbia. Note: You may note “Upon Registration,” if it has not conducted business yet. If it has, then you must contact the District of Columbia Department of Consumer and Regulatory Affairs for specific instructions or fees to avoid the possibility of having this filing rejected.

Step 7 – In Item 7, report the Principal Office’s Address in the filing entity’s State of Jurisdiction. If there is no Principal Office then report the Corporate Address. Make sure this Address is up to date and complete.

Step 8 – The District of Columbia Registered Agent must be reported in Item 8. In the space provided, enter the Full Name of the District of Columbia Registered Agent. Then, in the same box, report the Full Physical Address of the geographic location of this agent’s District of Columbia’s Registered Office. This must be a Building Number, Street, Unit Number, City, State (must be District of Columbia), and Zip Code where this office may be found.

Step 9 – Provide the filing entity’s Purpose for operating in the District of Columbia in the blank space in Item 9. Include a definition of the corporate activities, transactions, and business in the District of Columbia.

Step 10 – Item 10 will provide a table so that some basic information regarding the Officer, Director, or Manager authorized by the filing entity to submit this form on behalf of the foreign corporation. There will be a column for this party’s Title, Name, and Address.

Step 11 – Item 11 will require you attach a Certificate of Existence issued by the governing body of the filing entity’s State of Jurisdiction and issued within 90 days of the Filing Date.

Step 12 – The party reported in Item 10 must Print his/her Name in the first box in Item 12 then provide his/her Signature and Date of Signature in the second box of Item 12.

Step 13 – Next organize all the required paperwork, including the mandatory Certificate of Existence in a package with the District of Columbia Foreign Registration Form | Form FN-1 and a check for the Full Filing Fee. This should be in the amount of $220.00 and payable to “DC Treasurer.”

Mail To:

Department of Consumer and Regulatory Affairs

Corporations Division

PO Box 92300

Washington D.C. 20090

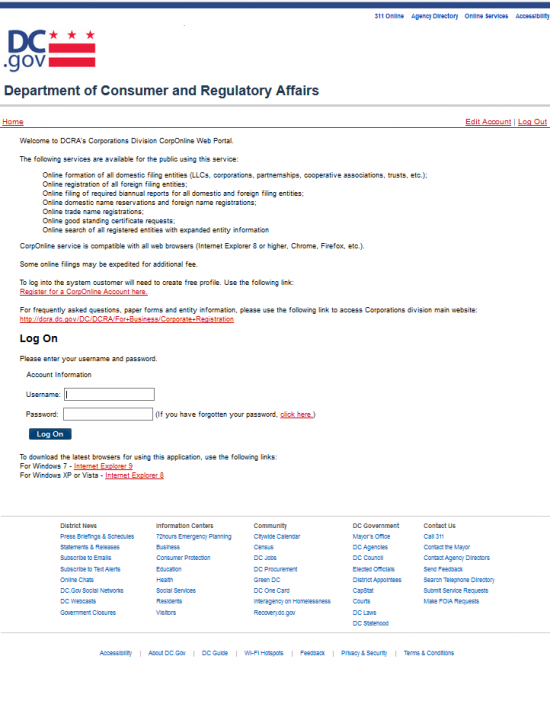

How To File Online

Step 1 – You must have an account with the District of Columbia Department of Consumer and Regulatory Affairs. Log in with your account here: https://corp.dcra.dc.gov/Account.aspx/LogOn?ReturnUrl=%2fHome.aspx.

Step 2 – In the “Business Filings” tab, locate the column heading “Foreign.” Then select the link labeled “FN-1 For Profit Foreign Corp Reg Form Web.”

Step 2 – In the “Business Filings” tab, locate the column heading “Foreign.” Then select the link labeled “FN-1 For Profit Foreign Corp Reg Form Web.”

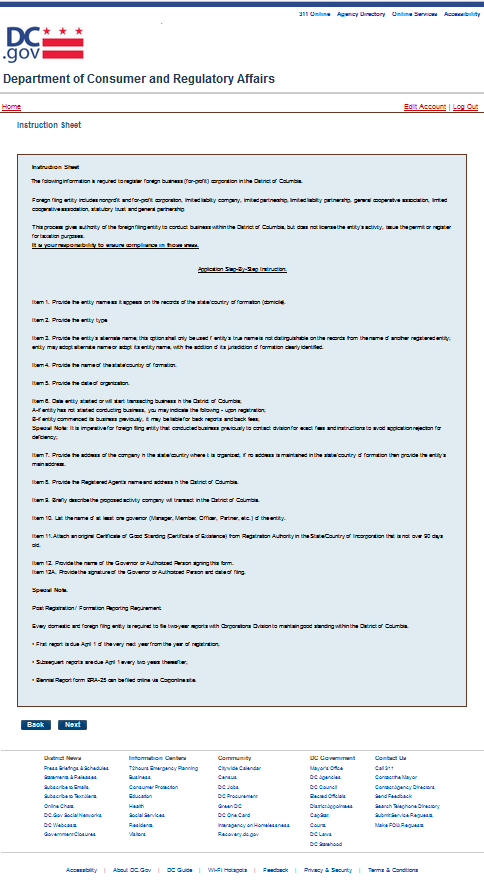

Step 3 – This page will display the instructions for filling out the online District of Columbia Foreign Registration Form. Read this carefully then, when you are ready to proceed, select the button labeled “Next.”

Step 3 – This page will display the instructions for filling out the online District of Columbia Foreign Registration Form. Read this carefully then, when you are ready to proceed, select the button labeled “Next.”

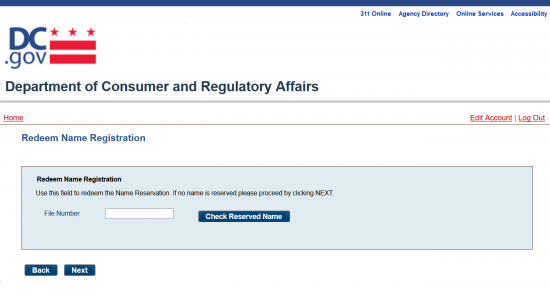

Step 4 – This page will give those who have successfully Reserved a Name the opportunity to utilize the Name Reservation. If this is the case, you may redeem the Name Registration by entering the File Number you received in the text box and selecting the button labeled “Check Reserved Name.” Select the Name then click on the “Next” button. If you have not Reserved a Name then leave this field blank and select “Next.”

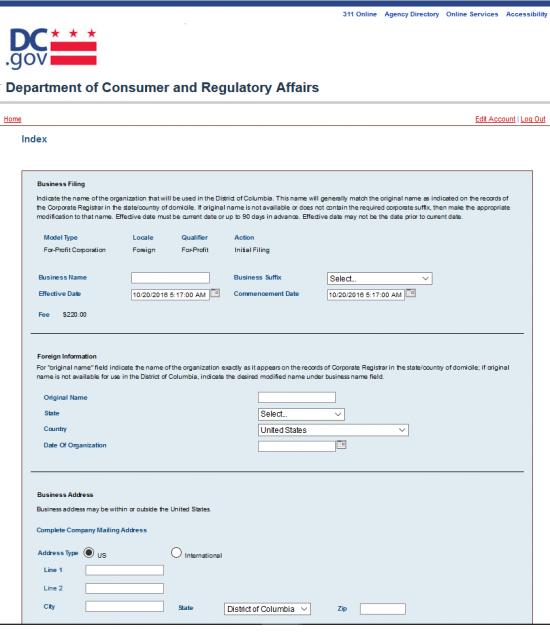

Step 5 – In the “Business Name” field, report the Name of the corporation as it will be known in the District of Columbia. Note: Only enter a Fictitious Name if the True Name of the filing entity is unavailable in the District of Columbia or otherwise not compliant.

Step 6 – Use the “Business Suffix” field to select the word of incorporation used in the True Name of the foreign corporation.

Step 7 – In the field labeled “Effective Date,” you may choose a Date anytime within 90 days after the Filing Date. If not, you may also leave the Date auto populating this field so the Date of Effect and the Filing Date occur simultaneously.

Step 8 – Enter the Date you expect the foreign corporation will begin conducting business in the District of Columbia in the field labeled “Commencement Date.” If this Date is prior to the Filing Date, contact the District of Columbia Department of Consumer and Regulatory Affairs for instructions specific to your situation.

Step 9 – If you had to enter a Fictitious Name in the “Business Name” field, then enter the True Name of the foreign corporation exactly as it appears on the Certificate of Good Standing or Certificate of Existence that will be submitted with this form. Then, choose the State of Incorporation from the “State” drop down list and the Country from the “Country” drop down list. Finally, report the Date of Incorporation in the field labeled “Date of Organization.”

Step 10 – Under the heading “Business Address,” locate the line labeled “Address Type.” If the foreign corporation’s Mailing Address is in the United States then choose the radio button labeled “US.” If the Mailing Address is outside of the United States then select “International.”

Step 11 – To report the Mailing Address use the fields provided. You may use the fields labeled “Line 1” and “Line 2” to enter the Building Number, Street, and Unit Number of the foreign corporation’s Mailing Address then use the “City,” “State,” and “Zip” fields to report the remainder of the Mailing Address.

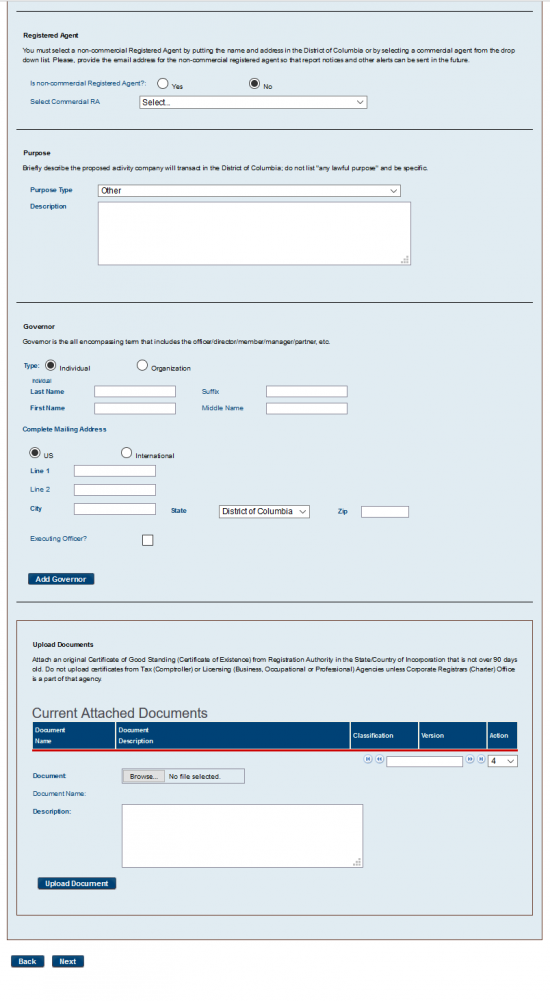

Step 12 – In the section labeled “Registered Agent,” you must document the District of Columbia Registered Agent who has agreed to receive Service of Process on behalf of the corporation. First, you will need to define the type of District of Columbia Registered Agent obtained. If this is a private party then select the radio button labeled “Yes.” If this is a commercial Registered Agent, select the radio button labeled “No.” For our purposes, select “Yes.”

Step 13 – Next, report the Full Name of the District of Columbia Registered Agent in the field labeled “Name.”

Step 14 – Report the Email Address of the District of Columbia Registered Agent in the field labeled “Email.”

Step 15 – Beneath the words “Complete Mailing Address,” select the radio button labeled “US” or “International” to indicate whether the Mailing Address is located within the United States or in a Foreign Country.

Step 16 – Using the “Line 1” and (if necessary) “Line 2” fields to report the Building Number, Street, and Unit or Suite Number of the Mailing Address.

Step 17 – You will be provided with a “City,” “State,” and “Zip” field to report the Mailing Address’ City, State, and Zip Code.

Step 18 – In the “Purpose” section, select the Industry the foreign corporation operates in using the drop down list labeled “Purpose Type.”

Step 19 – In the text box labeled “Description,” report the specific purpose of the corporation’s activities in the District of Columbia.

Step 20 –Under the heading labeled “Governor,” report the entities responsible for this corporation’s activities and management (Directors, Officers). On the line labeled “Type” select the radio button labeled “Individual” or the radio button labeled “Organization” to indicate if the party being reported is a person or a business (respectively). For our purposes select “Individual.”

Step 21 – Enter the Last Name, any applicable Suffix, First Name, and Middle Name of the filing entity’s Officer/Director being reported.

Step 22 – Under the words “Complete Mailing Address,” select “US” or “International” to classify the location of the Mailing Address being reported. Then, utilizing the fields “Line 1,” “Line 2,” “City,” “State,” and “Zip.”

Step 23 – If this is an “Executing Officer” click on the check box below the Address. If not, leave this blank. When you are ready, click the button labeled “Add Governor.” Each Officer or Director will be displayed in a table directly above this section.

Step 24 – You may upload required paperwork, such as the Certificate of Existence naming the Filing Entity and issued within the past ninety days of the submission date from the foreign entity’s State of Jurisdiction, in the section labeled “Upload Documents.” First, select the “Browse” button and locate the file on your computer. A “Description” text box has been provided should you wish to add a description of the file. When ready, select the button labeled “Upload Document.” You may attach any other files that are necessary for this filing as well. All files uploaded will be displayed in the table directly above the “Browse” button. When you have entered all the information that must be reported and have uploaded all necessary files, select the button at the bottom of the page labeled “Next.”

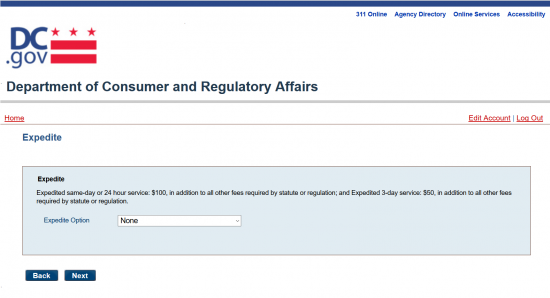

Step 25 – If you would like to Expedite this filing, you may do so on this page. You may Expedite to 1 Day service for an additional $100.00 or Expedite to 3 Day Service for an additional $50.00. Use the drop down menu here to indicate which of these options you prefer. If you do not want to Expedite this filing, choose “None.” When you are ready, select the button labeled “Next.”

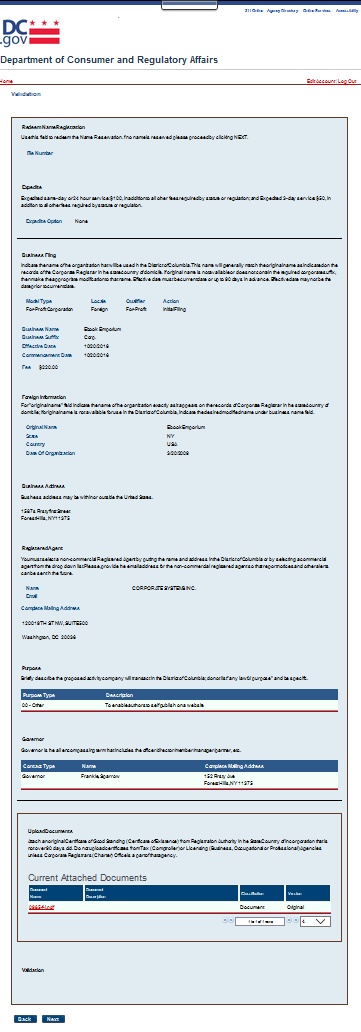

Step 26 – This page allows for an at-a-glance review. Here, all the sections will display the information entered on one page. If any section requires editing you may navigate to it using the “Back” button at the bottom of this page. If all the information is correct, select the button labeled “Next.”

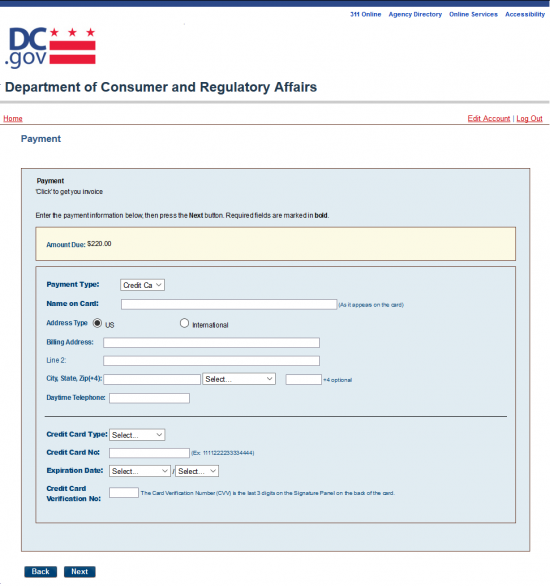

Step 27 – Select “Credit Card” from the drop down list. This will generate several fields where you may report the payment information for the credit card used to pay the $80.00 Filing Fee plus any applicable service being ordered. The Filing Fee must be paid at the time of submission in order for the District of Columbia Department of Consumer and Regulatory Affairs to review this form. This is a nonrefundable fee.