|

Hawaii Application for Certificate of Authority | Form FC-1 |

The Hawaii Application for Certificate of Authority for a Profit Corporation | Form FC-1 must be submitted to the Hawaii Department of Commerce and Consumer Affairs before a foreign corporation may operate as a profit corporation in the State of Hawaii. This must be submitted with a Certificate of Good Standing, issued by the governing body where the entity was formed and dated no more than sixty days from the filing date. This application may be submitted online, but you must have a login, which you may acquire by visiting https://login.ehawaii.gov then following the directions provided on the web page. Otherwise, you may submit this application by mail, along with the Certificate of Good Standing, and full payment of all appropriate fees. Payment of the filing fee ($25.00) and archiving fee ($1.00) will be mandatory for a successful submittal. You may choose to have a the process expedited for an additional $25.00 and/or receive a certified copy for an additional $10.00. It should be mentioned that a check denied for insufficient funds will accrue a $25.00 penalty charge. This application may be printed or it may be handwritten. If hand written, it must be filled in with black ink. You may mail the submittal package to epartment of Commerce and Consumer Affairs, Business Registration Division, P.O. Box 40, Honolulu, HI 96810.

How To File

Step 1 – Go to the Hawaii Department of Commerce and Consumer Affairs’ Foreign Corporation web page (http://cca.hawaii.gov/breg/registration/fpc/). Then download the link labeled “Paper Form FC-1 (Fillable PDF).” This will give you the opportunity to open or download the Application For Certificate of Authority | Form FC-1. This form may be printed or downloaded. If you have the appropriate PDF program, you may enter the information on the screen then print it. If you do not have such a program you may fill in the information using a typewriter or black ink.

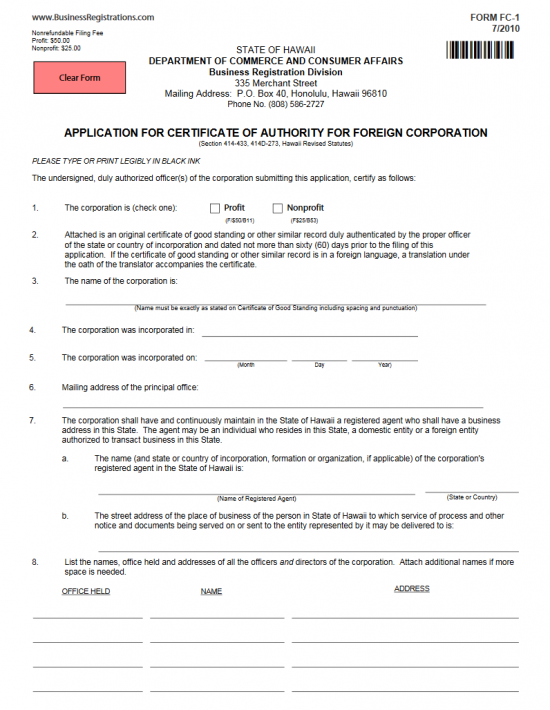

Step 2 – Once you have the form downloaded and ready to be filled out, locate Item 1. Here you must indicate if this entity will be a foreign profit corporation or a foreign nonprofit corporation. Check the box labeled Profit, if this corporation is concerned with making a profit. If not, then place a check mark in the second box if this will be a Nonprofit corporation.

Step 3 – Item 2 will require that you attach an original and official Certificate of Good Standing issued within sixty days of this filing date. If the origin state does not issue such certificates, then you must contact the governing entity and obtain a similar document that will verify the existence of the original entity.

Step 4 – The third item will require the exact name of the corporation as it appears on the Certificate of Good Standing. This must contain the same punctuation spacing and any abbreviations that are present.

Step 5 – Document the State/Country where this corporation was originally formed in Item 4.

Step 6 – Next, in Item 5, report the Month, Day, and Year the corporation was formed in its original state.

Step 7 – The mailing address of the Principal office of this corporation must be listed in Item 6.

Step 8 – Item 7a will require the Full Name of the Registered Agent that shall act as a reliable source of receipt for any service of process documentation a court issues should this corporation be sued on the first blank line. A Registered Agent may be an individual adult or a domestic corporation or a foreign corporation that operates in the State of Hawaii. If the Registered Agent is a corporation, you must report the State of Country where the Registered Agent was formed on the second blank line.

Step 9 – In Item 7b, report the Full Street Address of the Registered Agent appointed by this corporation. This Address must be located in the State of Hawaii.

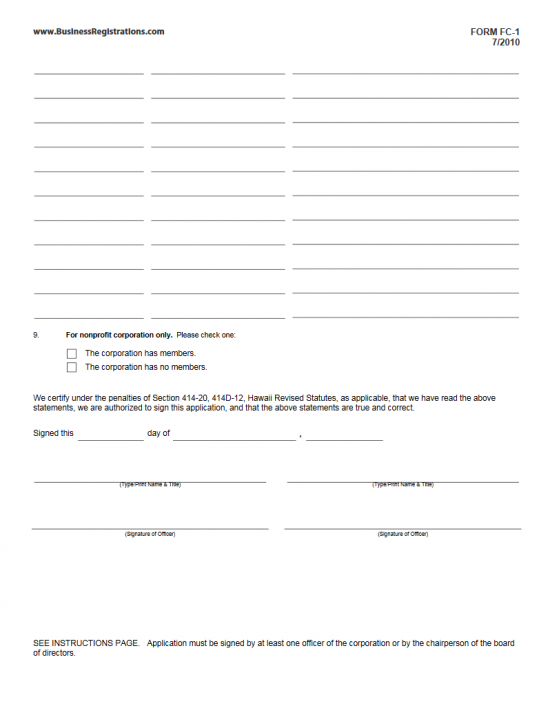

Step 10 – In Item 8, list the Name, Address, and Office of the Officers/Directors of this corporation in the table provided. Each row should have the Office Held, Name, and Address of each of these parties entered, in that order, on thHae spaces provided.

Step 11 – If this will be a foreign nonprofit corporation then you must address Item 9. If the corporation will have members then place a check mark in the first box. If this corporation will not have members then place a check mark in the second box.

Step 12 – The bottom of this application will have an Acknowledgment Paragraph, a Date Line, and a Signature Area. This must be filled out fully. First, next to the words “Signed this,” enter the Calendar Day of the Month this document is being signed. Then after the words “Day of” enter the Month and Year this application is being signed.

Step 13 – On the second to last line, the entity authorized (by the foreign corporation) to submit these articles must print and his/her Name and report his/her title. The line below this is the Signature line where this party must sign his or her full name. There will be enough room for two authorized signatures.

Step 14 – You may mail in the Hawaii Application for Certificate of Authority | Form FC-1 to the Hawaii Department of Commerce and Consumer Affairs. This must be accompanied with the Certificate of Good Standing issued by the origin state within sixty days of the filing date. Depending upon the nature of your corporation, other documents may be required, make sure these are included in your submittal package. All applications must be paid in full at the time of filing. The application fee for a foreign nonprofit corporation is $25.00 while the application fee for a foreign profit corporation is $50.00. There will be an additional archive fee of $1.00 regardless of the corporation type. If you wish a certified copy you must include an additional $10.00. You also have the option of having an expedited review provided the processing fee of $25.00 is submitted. All payments may be made by check, money order, or cashiers check payable to Department of Commerce and Consumer Affairs. You may mail this submittal package and appropriate payment to:

Business Registration Division

P.O. Box 40

Honolulu, HI 96810

How To File Electronically

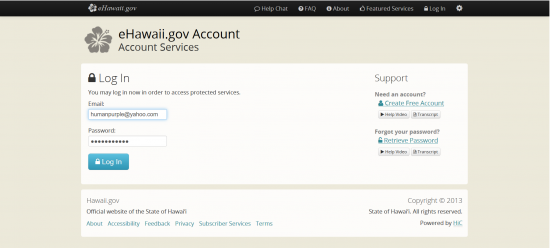

Step 1 – Go to https://login.ehawaii.gov/lala/login then enter your Email Address and Password. Once you have done this, select the button labeled “Log In.”

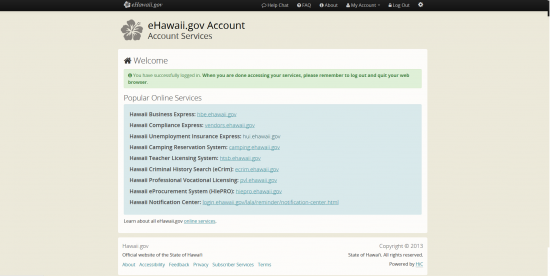

Step 2 – Click on the first link in the blue area (“Hawaii Business Express”).

Step 2 – Click on the first link in the blue area (“Hawaii Business Express”).

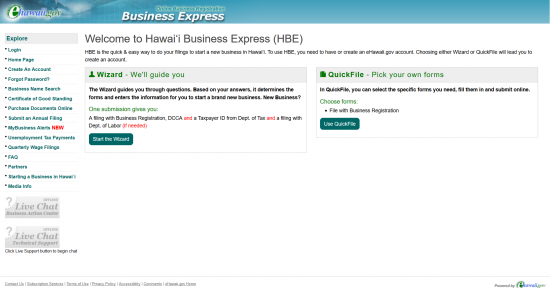

Step 3 – In order to obtain the correct form select the “Use QuickFile” link.

Step 3 – In order to obtain the correct form select the “Use QuickFile” link.

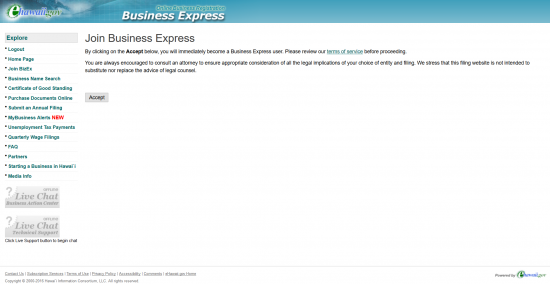

Step 4 – Read the introductory paragraph then the terms and conditions and click button labeled “Accept.”

Step 4 – Read the introductory paragraph then the terms and conditions and click button labeled “Accept.”

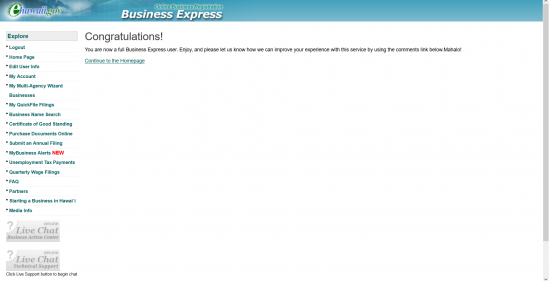

Step 5 – The confirmation page will let you know you are successfully able to use “Business Express.” Select the link labeled “Continue to Homepage.”

Step 5 – The confirmation page will let you know you are successfully able to use “Business Express.” Select the link labeled “Continue to Homepage.”

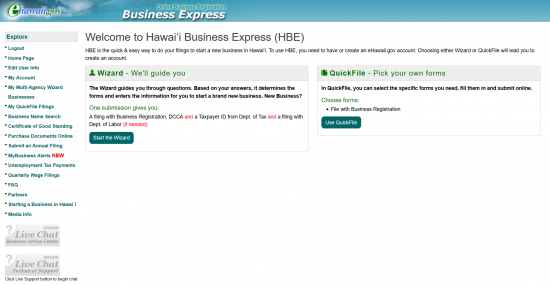

Step 6 – Your home page will have two portals. The first one will allow you to use a ‘wizard’ to help you complete the fields in this application. The link on the right will be the QuickFile link so that you may enter information directly into the Hawaii Application for Certificate of Authority | Form FC-1. Select the button on the right labeled “Use QuickFile.”

Step 6 – Your home page will have two portals. The first one will allow you to use a ‘wizard’ to help you complete the fields in this application. The link on the right will be the QuickFile link so that you may enter information directly into the Hawaii Application for Certificate of Authority | Form FC-1. Select the button on the right labeled “Use QuickFile.”

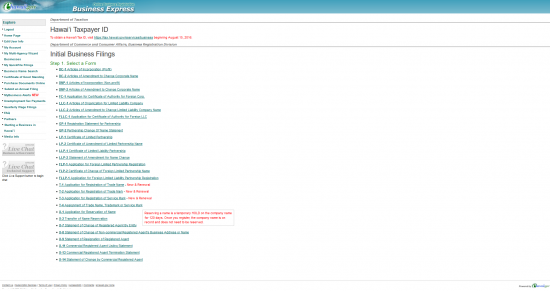

Step 7 – From the Initial Business Filings page, select the fifth link in the list, “FC-1 Application for Certificate of Authority for Foreign Corporation.”

Step 7 – From the Initial Business Filings page, select the fifth link in the list, “FC-1 Application for Certificate of Authority for Foreign Corporation.”

Step 8 – For those making multiple filings with multiple agencies, a pop up window will give a final suggestion/option to use the ‘wizard.’ This may be a good idea if you are filing with both the Hawaii Secretary of State and (for example) the I.R.S. For our purposes, select the button labeled “Continue” in the pop up window. This will open the FC-1 form.

Step 8 – For those making multiple filings with multiple agencies, a pop up window will give a final suggestion/option to use the ‘wizard.’ This may be a good idea if you are filing with both the Hawaii Secretary of State and (for example) the I.R.S. For our purposes, select the button labeled “Continue” in the pop up window. This will open the FC-1 form.

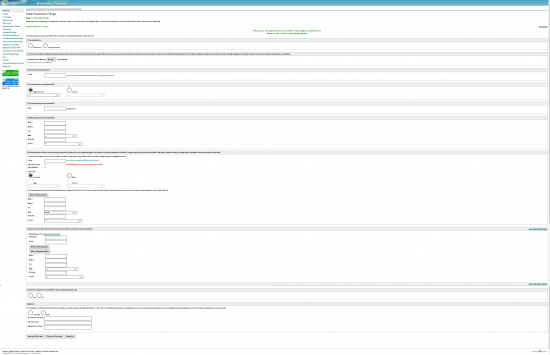

Step 9 – This is the Internet Form FC-1. In Item 1, indicate if this is a Profit Corporation or a Nonprofit Corporation. If this is a Profit Corporation select the first radio button. If this is a Nonprofit Corporation then select the second radio button. You may only choose one.

Step 10 – Item II will provide you with the opportunity to upload the required Certificate of Existence or Certificate of Good Standing obtained from the filing entity’s governing body within sixty days of this submittal. Use the button labeled “Browse” to do this.

Step 11 – In Item III, enter the Full and True Name of the filing entity. This must be entered precisely (including spacing and punctuation) as it appears on the Certificate of Good Standing, you have uploaded in Item II.

Step 12 – In Item IV, use the drop down list to indicate where the filing entity is incorporated and operating. Select the radio button labeled “State” (if this is an American or North American company), then select the State/Province/Territory the filing entity resides in. If this is a company outside of the United States and North America then select the radio button labeled “Country” and choose the country from the drop down list.

Step 13 – In Item V, report the Date of Incorporation in the field provided. Use the MM/DD/YYYY format to do this.

Step 14 – In Item VI, document the Full Mailing Address of the Principal Office. There will be several fields povided and a drop down list for the State and Country. Make sure to enter the full street address in Street 1 (Building Number, Street, and Suite Number). Street 2 is provided in case you need more room for this. You will also need to enter the Zip Code and City in the appropriate spaces.

Step 15 – The next item, Item VII, will obligate the foreign corporation to obtain and retain a Registered Agent who may accept service of process on behalf of the filing entity, in the event t is sued. In Item VIIa, report the Full Name of this entity in the “Name” field, then indicate if it is an Individual or Entity by selecting the corresponding radio button on the first line in the “Agent Type” section. Next, you will need to indicate where the Registered Agent resides. It is strongly recommended to obtain a Hawaii based Registered Agent. Thus select the radio button labeled “State” and select the State or Province where this Registered Agent resides from the drop down list provided.

Step 16 – Item VIIb requires the Full Address of the Geographical Location of the Registered Office of the Registered Agent. This must be where service of process may be personally received by this entity. If the Registered Agent is an individual who is physically located at the Principal Office Mailing Address, you may select the button labeled “Same As Mailing Address.” This will auto-populate the fields with this address. If this is an address that has not been previously reported then enter the specifics in the appropriate field.

Step 17 – In Item VIII, you will need to report the Office Held, Full Name, and Full Address of each Officer and Director serving the filing entity. The first entry will be labeled “Officer/Director #1” and will require the Title (i.e. President, Director) entered in the field labeled “Office Held.” Below the “Office Held” field, enter the Full Name of the individual being reported. Then enter the Full Address of this individual in the spaces provided. Once you are done, select the link on the left “Add Another Officer/Director.” This will generate another set of fields for the next entry. Each heading contains the opportunity to auto-populate the fields with either the Principal Office Mailing Address, the Registered Office Address, or you may delete the entry altogether.

Step 18 – If the corporation being registered to operate in the State of Hawaii is a nonprofit corporation then, in Item IX, indicate if it has members or not by selecting the radio button for “Yes” or the radio button for “No.”

Step 19 – The last section is the “Signature” section. Below the acknowledgement paragraph indicate if the Signature Party submitting these documents is an Individual or an Entity (such as a corporation) by selecting the appropriate radio button. Beneath these radio buttons will be an opportunity for the Submitter to enter his/her Name in the first field, enter his/her Title in the second field, and supply a digital Signature in the third field.

Step 20 – Once you have made sure the information you have entered is correct, select the button labeled “Review and Purchase.” Once you do, you will have one chance to see how all the information is presented on the form before your final submittal. Once you do submit this application your browser will be directed to a screen where you may either remit payment by filling in your account information or your credit card information. If this is a foreign profit corporation the Filing Fee will be $50.00. If this is a foreign nonprofit corporation, the Filing Fee will be $25.00.