|

Idaho Articles of Incorporation (Non-Profit) |

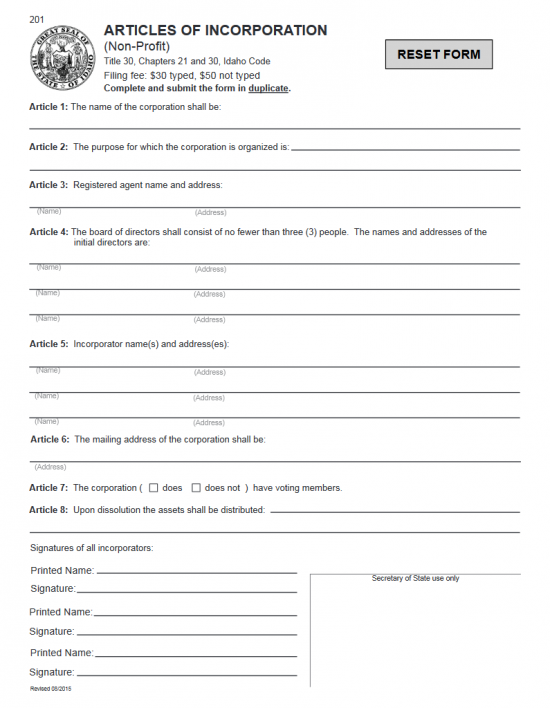

The Idaho Articles of Incorporation (Non-Profit) is a form provided by the Idaho Secretary of State meant to facilitate the fulfillment of an Incorporator’s responsibility to this governing entity when creating a non-profit corporation in this state. This is a required submittal as per Idaho Code Title 30, Chapters 21 and 30. It should be noted this will only satisfy the Idaho Secretary of State’s basic requirements. Different nonprofit entities will require different paperwork. For instance, a Tax Exempt Non-Profit Corporation must include a statement of purpose as well as a statement regarding the dissolution of assets. Such entity types, will also need to contact additional appropriate governing bodies to fulfill all state requirements (i.e. I.R.S.). It is up to the Incorporator to be abreast of all regulations the forming nonprofit is held responsible to follow.

The articles and any required paperwork may be mailed or delivered to this address:

Office of the Secretary of State

450 N. 4th Street

P.O. Box 83720

Boise, ID 83720-0080

The submittal package must be accompanied with full payment of the filing fee for the articles ($30.00 if typed, $50.00 if handwritten). You may have this process expedited for an additional $20.00. If paying by check or money order, make it payable to “Secretary of State.” If paying using a prepaid account, then submit a cover letter with the necessary details.

How To File

Step 2 – Report the Full Name of the corporation being formed on the space provided in Article 1. According to Idaho Code § 30-21-302, this must be a unique name and must contain one of these words: Corporation, Incorporated, Company, or Limited. You may substitute any of these words with the abbreviated version of that word.

Step 3 – In Article 2 write out a statement as to the purpose of the nonprofit corporation being formed. That is, why it is being formed.

Step 4 – Article 3 will require the Full Name and Street Address of the Registered Agent for this corporation. The entity being created by this form may not be named as the Registered Agent and the Address must be a physical location in the State of Idaho maintained by the appointed Registered Agent.

Step 5 – Article 4 will provide three blank lines to document the Full Names and Addresses of three Board of Directors for the nonprofit corporation. This may change in the future however must be reported now. As per Idaho Code § 30-30-603, there must be at least three member of the Board of Directors.

Step 6 – In Article 5, at least one Incorporator’s Full Name and Address must be listed. There will be enough lines to list three Incorporators.

Step 7 – The Mailing Address of the corporation must be entered on the blank line in Article 6.

Step 8 – Article 7 will define whether this nonprofit corporation will have voting members or not. If it does, then place a checkmark in the first box (labeled “does”). If this nonprofit corporation will not have voting members then place a checkmark in the second box (labeled “does not”).

Step 9 – In Article 8 define how the assets of this corporation will be distributed when it is dissolved on the blank lines provided.

Step 10 – The Incorporators listed in Article 5 must Print and Sign their Full Names at the bottom of this document.

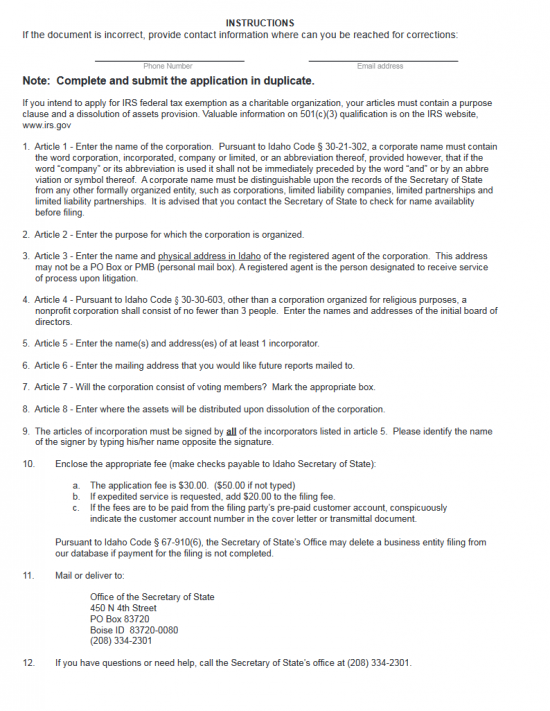

Step 11 – The next page, “Instructions,” write in your Phone Number on the first blank space then your E-Mail Address on the second space.

Step 12 – Once this is filled out properly and you have verified that all the initial information regarding your corporation’s creation is accurate you may submit this to the Idaho Secretary of State. This must be submitted with the Full Payment for the Filing Fee. The Filing Fee payment amount will depend upon whether it is typed or handwritten. If you have typed or used a printer to produce the completed document, the Filing Fee is $30.00. If you have entered the information by hand, the Filing Fee will be $50.00. Regardless of how you filled out the articles, if you choose to have the processing expedited, you should request as much and include an additional $20.00 to the Filing Fee. You may pay all applicable fees by check or by using a prepaid account (if you have an account with the Secretary of State). If paying by check then make the check payable to “Secretary of State.” If you are using a prepaid account with the Idaho Secretary of State, include a cover letter with the necessary account information.

To File by Mail or In Person, Submit to:

Office of the Secretary of State

450 N. 4th Street

P.O. Box 83720

Boise, ID 83720-0080