|

Idaho Foreign Registration Statement |

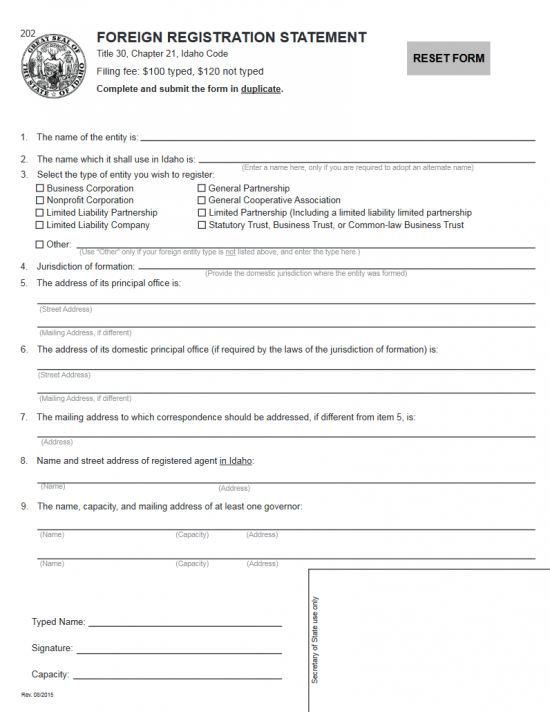

The Idaho Foreign Registration Statement is a mandatory registration when a foreign entity wishes to operate as a corporation in the State of Idaho. This should be submitted in paper and in duplicate. It may be mailed directly to the Idaho Secretary of State at Office of the Secretary of State, 450 N. 4th Street, P.O. Box 83720, Boise, ID 83720. The articles should be submitted with a Certificate of Existence or a Certificate of Good Standing, issued by the governing authority in its origin state, within ninety days of the filing date.

It should be noted that if an entity’s true name, as it appears on the Certificate of Existence, does not conform to the name requirements or conflicts with an existing Idaho corporation’s name then it must declare an assumed name. In some cases, this may simply be a matter of adding the words Incorporated or Corporation to the existing name or it may involve an entirely different name to be filed. In any case, the Incorporator must bear in mind that it is up he/she to be fully abreast of all state requirements. It is usually considered wise to consult an attorney to do so.

The filing fee for this document is $100.00 if it is submitted as a typed document. If the submitter must hand write the information onto this registration then the filing fee will be $120.00. One has the option to request expedited service and, if so, an additional $20.00 processing payment must be made to order this service. The Idaho Secretary of State will accept payments in the form of a check, money order, or prepaid account. If the Incorporator has a prepaid account he/she merely needs to attach a cover sheet giving the details for this payment to be tendered. If the Incorporator(s) wish to pay by check or money order they must make it payable to “Secretary of State.”

How To File

Step 1 – On the blank line in Item 1, enter the true name of the entity forming this corporation exactly as it is written on its original articles of incorporation (in its origin state).

Step 2 – In Item 2, if the true name of the corporation is not unique or does not conform to the State of Idaho’s name requirements then you must enter the assumed name it shall legally operate under in this state on the space provided. If this entity will operate under its true name then leave this item blank.

Step 3 – The Third item will require you define the entity type you are forming in this state. There will be several choices that are clearly labeled: Business Corporation, Nonprofit Corporation, Limited Liability Partnership, Limited Liability Company, General Partnership, General Cooperative Association, Limited Partnership (Including a limited liability limited partnership), and Statutory Trust, Business Trust, or Common-aw Business Trust. You may only may only choose one by placing a check mark in the box provided just before that choice. If the entity type is not listed here, there will be a box labeled as “Other” next to a blank line that you may select. If you choose other, you must define the entity type being formed.

Step 4 – In the Fourth Item, report the Jurisdiction of the origin state of the foreign corporation on the space provided.

Step 5 – In the Fifth Item, report the full Street Address of the corporation’s Principal Office on the first blank line. This must be the address where the corporation’s Principal Office is physically located. (Do not use a P.O. Box on this line).

Step 6 – On the second blank line in the Fifth Item, report the Mailing Address of this corporation’s Principal Office. This may include a P.O. Box.

Step 7 – On the first blank line in Item 6, report the Domestic Principal Office. That is the Principal Office in the state where this corporation was first formed. This must be the Physical Street Address.

Step 8 – On the second blank line in Item 6, report the Mailing Address for the Domestic Principal Office if it is different from the Street Address.

Step 9 – In Item 7, report the Address where correspondence with this corporation will be reliably received, if it differs from the Street Address of the Principal Office (in Item 5).

Step 10 – In Item 8, enter the Full Name and Full Address of the Registered Agent appointed by this corporation. The Registered Agent is the entity approved by the corporation to receive service of process documents generated by a court should this corporation be sued.

Step 11 – In Item 9, report the Full Name, Capacity or Title, and Full Address of at least two officers in the original corporation forming the entity.

Step 12 – On the last three lines, Type or Print your Full Name. Then Sign your Full Name and report the Capacity or Title you hold.

Step 13 – The next page, labeled as “Instructions,” will give the opportunity to provide your Phone Number and E-Mail Address. This precaution will give you the opportunity to avoid a longer processing should there be any errors or issues with the filing.

Step 14 – Once you have verified all the information is correct you may gather the duplicate Idaho Foreign Registration Applications that you have filled out, the Certificate of Existence issued within ninety days of the filing date by the original governing authority, any supporting documentation, and the full payment of all appropriate fees ($100.00 for typed registrations, $120.00 for handwritten registrations, and an optional additional $50.00 expedited service fee) and mail it to:

Idaho Secretary of State at Office of the Secretary of State

450 N. 4th Street

P.O. Box 83720

Boise, ID 83720

All fees are payable by check/money order made out to “Secretary of State” or through a prepaid customer account. If paying with a prepaid account, you must include a cover sheet with payment details.