|

Indiana Application for Certificate of Authority Foreign NonProfit Corporation | State Form 37035 (R10 / 3-16) |

The Indiana Application for Certificate of Authority Foreign NonProfit Corporation | State Form 37035 (R10 / 3-16) must be filled out and submitted to the Business Services Division of the Indiana Secretary of State Department before a foreign entity may operate as such in this state. This form must be submitted simultaneously with a Certificate of Existence (issued by the foreign entity’s governing body within 60 days of filing these articles), all required paperwork, and full payment of the $30.00 filing fee. Payments will be accepted as a check or a money order made payable to “Secretary of State.” The submittal package may then be mailed to Secretary of State, Business Services Division, 302 West Washington Street Rm. E018, Indianapolis, IN 46204.

This application may be used to incorporate the foreign entity as a Public Benefit Corporation, a Religious Corporation, or a type of Mutual Benefit Corporation. Incorporators should make sure they are abreast of all Indiana State laws before submitting this form and are encouraged to seek counsel from an appropriate professional. It is important to note that achieving Tax Exempt status is beyond the ability of the Indiana Secretary of State’s form to grant. This may only be done with via the Internal Revenue Service, furthermore this may require very specific language to be used on the articles forming the entity. It is strongly recommended that Incorporators contact the Internal Revenue Service or an Attorney before attempting to form a nonprofit corporation in this state.

How To File

Download Form

Download Certificate of Assumed Business Name

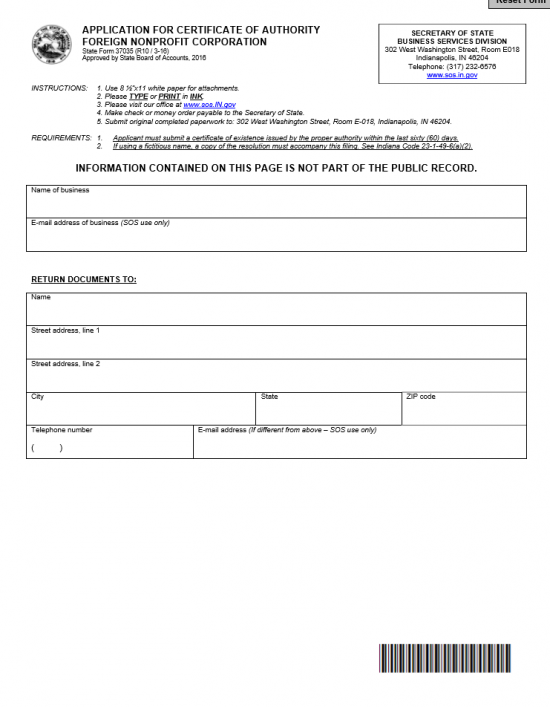

Step 1 – On the first row of the Cover Sheet, enter the Full Name of the business filing this application with the Indiana Secretary of State. Then, in the second row provide an E-Mail address for this business.

Step 2 – In the “Return Documents To” section, report the Full Name, Full Address, City, State, Zip Code, Telephone Number, and E-Mail Address of this entity’s contact for communication with the Indiana Secretary of State regarding this application. If the Contact Email is the same as the Business Email, you may leave that field blank.

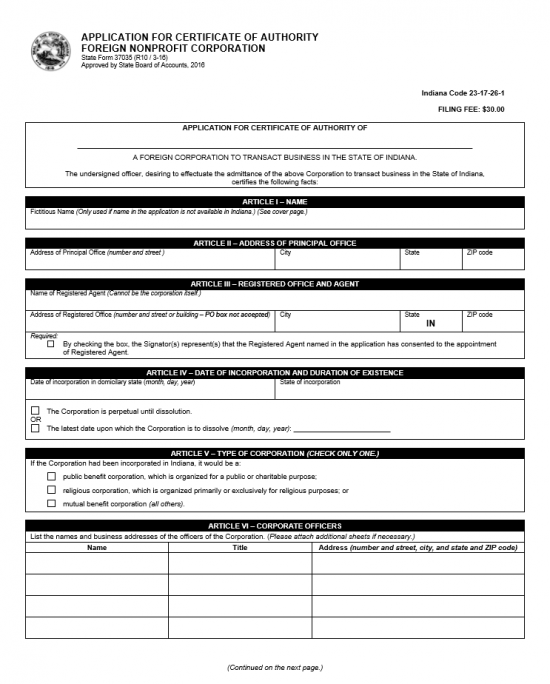

Step 3 – On the first blank line of the “Application for Certificate of Authority Foreign Nonprofit Corporation,” enter the True Name of the entity filing this application.

Step 4 – If the True Name of the filing entity may not be used in the State of Indiana, then it must adopt a Fictitious Name. If this is the case, report the Fictitious Name in the section labeled “Article I – Name.” Note: You must include the Certificate of Assumed Business Name which you may download here: Form 30353

Step 5 – In Article II – Address of Principle Office, document the Street Address, City, State, and Zip Code of the Principle Office in the table provided (in that order).

Step 6 – In Article III – Registered Office and Agent section, document the Full Name of the Registered Agent who shall act as such for this entity in the State of Indiana. This may not be the filing entity or the nonprofit this application shall form. Do this on the first row of this section.

Step 7 – Next, on the second row of the Article III – Registered Office and Agent section, report the Registered Agent’s Building Number, Street, and Suite Number in the first box. In the next box, report the Registered Agent’s City, the State Box is filled in (the Registered Agent must be in the State of Indiana) for the next box. In the last box, report the Zip Code of the Registered Agent’s Address.

Step 8 – In the third row of Article III – Registered Office and Agent, check the box to verify the Registered Agent has given clear indication of acting as such for this corporation.

Step 9 – In the first row of Article IV, report the Calendar Date the foreign entity incorporated in its origin state in the first box. Then in the second box, report the original State of Incorporation. If this corporation will operate without a dissolution date then mark the first check box on the second row. If there is a Dissolution Date, then mark the second box in the second row and report the Dissolution Date of this corporation in the space provided.

Step 10 – In Article V – Type of Corporation, you must define the entity type. You may do this by checking one of the boxes provided in this section. If this corporation is a Public Benefit Corporation, with a public benefit purpose or a chartable purpose, then choose the first box. If this corporation is a Religious Corporation, then check the second box. If this corporation is a Mutual Benefit Corporation, then check the third box. You may only choose one.

Step 11 – In Article VI – Corporate Officers, you must list all the Officers of this corporation. This may be reported in the table provided. Each row will have three columns requiring the Name, Title, and Address (Building Number, Street, City, State, Zip Code) be reported for each Officer. This list may be continued onto a separate sheet of paper that is clearly labeled and attached to this application.

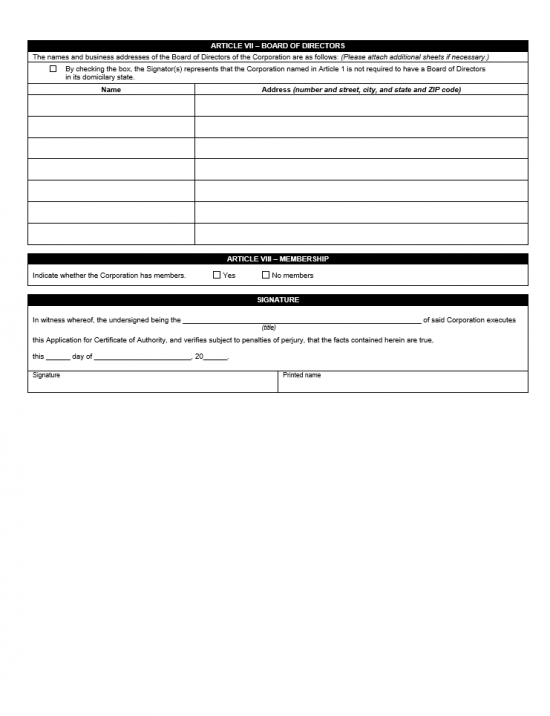

Step 12 – In Article VII – Board of Directors, indicate if the origin state requires the corporation to have a Board of Directors using the check box in the first row. If the origin state does not require the corporation to have a Board of Directors then place a check mark in the box, in the first row. If not, then leave this box blank. If this corporation does have a Board of Directors, then use the table provided to document the Name and Address of each one. If necessary, you may attach a separate sheet of paper with a continuation of this list.

Step 13 – In Article VIII – Membership, check the box labeled “Yes” if this corporation has members. If not then place a check mark in the box labeled “No Members.”

Step 14 – The Signature section will require several items to validate this application. First, the submitter must fill in his/her Title held with the filing entity on the first line. Then, after the words “herein are true,” the Date (Calendar Day, Month, Year) this application is being signed must be reported. Finally the Officer or Director authorized to submit this application must Sign his/her name then Print his/her Name.

Step 15 – The submittal package should consist of the Indiana Application for Certificate of Authority Foreign Corporation, all relevant or required attachments (make sure all attachments are on 8.5″ x 11″ paper), a Certificate of Authority (dated within sixty days of this filing) from the origin state, a check or money order made payable to “Secretary of State” for the full filing fee of $30.00. If one of the attachments is the Certificate of Assumed Business Name, you must include a payment for an additional filing fee of $26.00. All fees must be paid at the time of submittal. You may mail the submittal package to:

Secretary of State

Business Services Division

302 West Washington Street Rm. E018

Indianapolis, IN 46204