|

Indiana Articles of Incorporation Domestic Corporation | State Form 4159 (R18 /3-16) |

The Indiana Articles of Incorporation Domestic Corporation | State Form 4159 (R18 /3-16) may be used to satisfy the filing requirements of registering a For-Profit Corporation (Indiana Business Corporation Law), a Benefit Corporation (Indiana Benefit Corporation Act), or a Professional Corporation (Professional Corporation Act 1983) with the Indiana Secretary of State. Each of these entity types will require an Incorporator to take the initiative to contact interested governing bodies during the formation before conducting business. For instance, a Professional Corporation may need specific licenses and permissions and will need to submit a Certificate of Registration with the articles and all three will need to file their own paperwork with the Internal Revenue Service. Incorporators are generally encouraged to seek legal counsel before taking this step to make sure they are familiar with the entire process of legally forming a corporation, of any type, in this State.

The Indiana Articles of Incorporation Domestic Corporation may be submitted by mail to the Secretary of State, Business Services Division, 302 West Washington Street Room E018, Indianapolis, IN 46204 with full payment of the $90.00. Payment should be in the form of a check or a money order that is made payable to “Secretary of State.” If you have registered with the Secretary of State, you may file online. You may login for this purpose or create an account here: https://inbiz.in.gov/business-entity/start.

How To File

Step 1 – Download the Articles of Incorporation Domestic Corporation here: Indiana Articles of Incorporation Domestic Corporation | State Form 4159 (R18 /3-16)

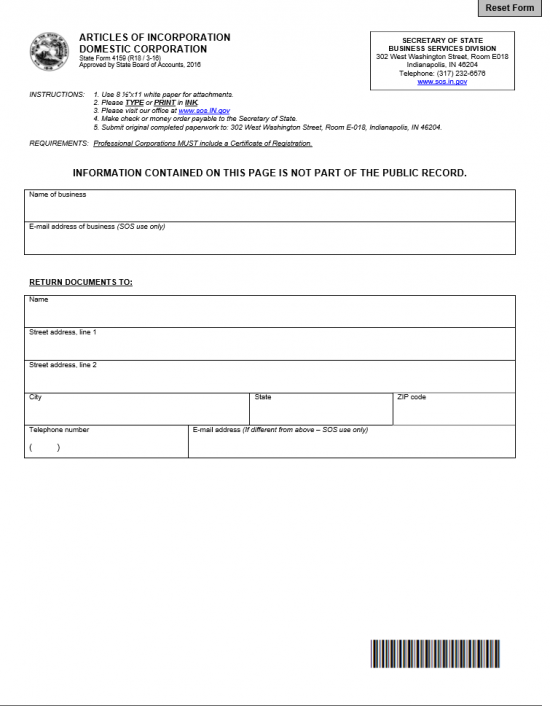

Step 2 – The first page of this form is a cover page which must be submitted with the articles. In the first box, enter the Name of the Business being formed. This should be the complete name of the entity being created including the necessary wording for that entity type.

Step 3 – Enter your Email Address. This will be a used as a method of contact by the Indiana Secretary of State.

Step 4 – The next section will be used provide an address where the documents may be returned. Fill in the Full Name of the contact who will receive these documents in the first box under the heading “Return Documents To:” Below this two boxes for the Street Address are provided then a separate box for the City, State, and Zip Code.

Step 5 – On the next line, enter the contact’s Phone Number and (if different from your email address listed above) the contact email. This will conclude the information required on the cover sheet.

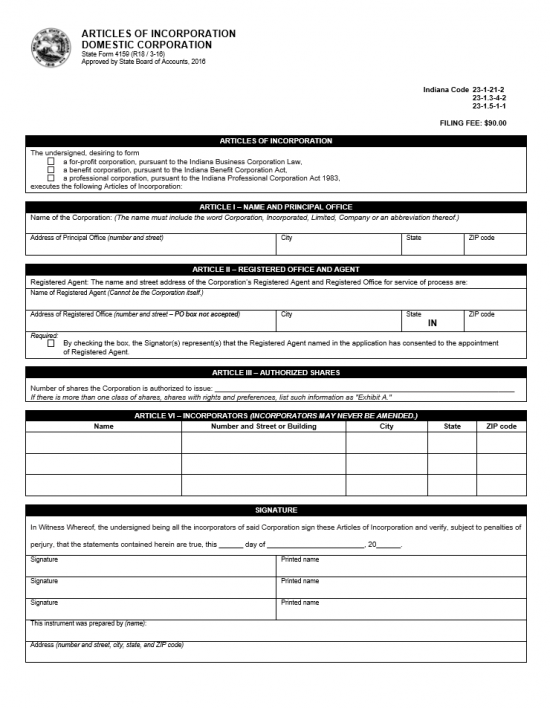

Step 6 – The next page is the Articles of Incorporation Domestic Corporation. Locate the box labeled “Articles of Incorporation” at the top then select the statement that describes the type of corporation being formed. Place a check mark in the first box if you are forming a For Profit Corporation. If you are forming a Benefit Corporation, place a check mark in the second box. If you are forming a Professional Corporation, then place a check mark in the third box.

Step 7 – In the section labeled “Article II – Registered Office and Agent,” you will need to report the Identity and Physical Street Address of the Registered Agent appointed by the corporation being formed. The first line is titled “Name of Registered Agent.” Here, enter the full name of the party who has agreed to accept then reliably deliver any court generated document should the corporation be sued in the future.

Step 8 – In the box labeled “Address of Registered Office,” report the Registered Agent’s Building Number and, if applicable, Suite Number. The next two boxes requiring attention will be to report the City and Zip Code for the Registered Agent’s Address.

Step 9 – The final box, “Required,” contains a check box. This check box shall act as acknowledgement the Registered Agent named above has accepted the responsibility that comes with the title. Place a check mark in this box if this is the case. If not, you must find a Registered Agent who has been informed of and has accepted this responsibility before continuing.

Step 10 – In Article III, “Authorized Shares,” enter the number of shares the forming corporation has been authorized to issue on the blank line provided. All stock information must accompany these articles. Thus if the corporation has separate classes of stock this information must documented on a clearly labeled 8.5 x 11 inch sheet of paper then attached to these articles.

Step 11 – Article VI, or “Incorporators,” will require the Full Name and Address of each Incorporator to be reported. This is one of the pieces of information on this form which may not be changed at a later date.

Step 12 – The “Signature” section will require the Calendar Day, Month, and Year this document is being signed on the first three available blank spaces. Below this will be three lines for the Signature(s) and Printed Name(s) of the Incorporators to be supplied. Below this section will be two more lines for the preparer to Sign his/her Name and provide his/her address.

Step 13 – The Indiana Articles of Incorporation For Profit Corporation must be submitted with full payment for the $90.00 filing fee. This may be remitted by check or money order made payable to “Secretary of State.” Full payment and all attachments must be submitted simultaneously with the Indiana Articles of Incorporation Domestic Corporation | State Form 4159 (R18 /3-16) by mail to:

Secretary of State

Business Services Division

302 West Washington Street Room E018

Indianapolis, IN 46204