|

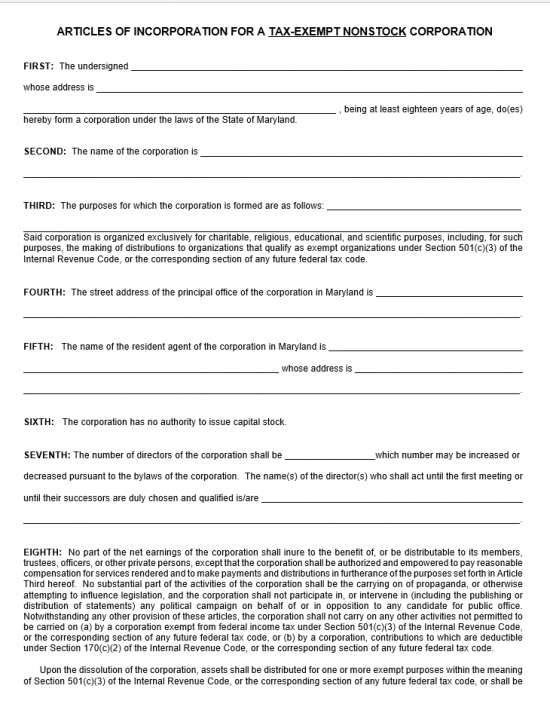

Maryland Articles of Incorporation Tax-Exempt Nonstock Corporation |

The Maryland Articles of Incorporation Tax-Exempt Nonstock Corporation is a basic template for presenting the minimum information the Maryland Department of Assessments and Taxation requires of Incorporators wishing to form such an entity. This submittal may need to be accompanied with additional information, depending upon the goals or nature of the nonstock corporation being formed.

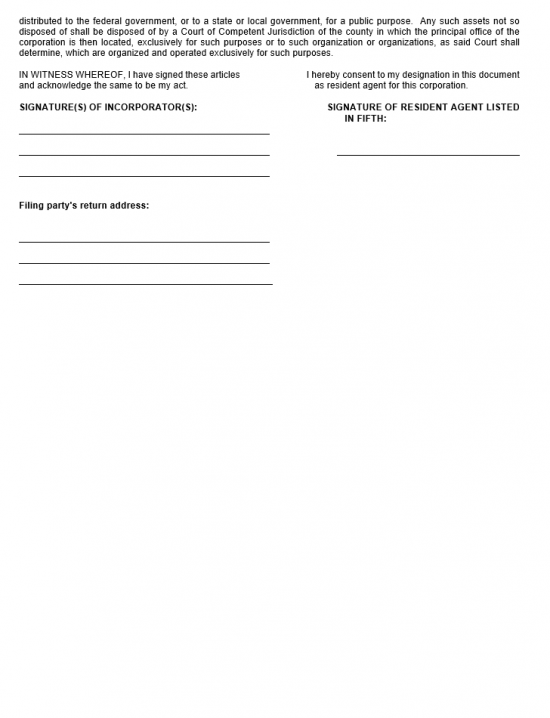

All relevant documents and the Maryland Articles of Incorporation Tax-Exempt Nonstock Corporation may be dropped off or mailed to State Department of Assessments and Taxation, Charter Division, 301 W. Preston Street, 8th Floor, Baltimore, MD 21201-2395. The filing fee for submitting this will be a minimum of $170.00 ($100.00 fee + $20.00 organization and capitalization fee + $50.00 Maryland Not-For-Profit Development Center Program Fund). You may choose to expedite the processing of this filing to 7 days for an additional $50.00. You may also file online, at https://egov.maryland.gov/businessexpress, where you will also be responsible for the $170.00 filing fee plus a %3 convenience/processing fee. Methods of payment are as follows: In person, you may pay by cash, check, or money order. By mail, you may pay by check or money order. Online Filing will require a credit card payment and a login. Checks and money orders should be made payable to Maryland Department of Assessments and Taxation.

How To File By Paper

Step 1 – Download the Maryland Articles of Incorporation Tax-Exempt Nonstock Corporation by selecting this link: Maryland Articles of Incorporation Tax-Exempt Nonstock Corporation

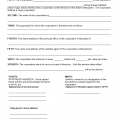

Step 2 – Locate the First Article, then after the word “undersigned,” enter the Full Name of each Incorporator. On the second blank line, after the words “address is,” report the Mailing Address of each Incorporator.

Step 3 – Document the Full Name of this nonprofit corporation on the space provided in the Second Article. The Maryland State Department of Assessments and Taxation will require this to be a unique business name in their records. Also it must have one of these words of incorporation as a suffix (Corporation, Incorporated, Limited, Corp., Inc., or Ltd.).

Step 4 – The Third Article requires a report on the Purpose of this corporation. That is the reason for and method of its operations in the State of Maryland.

Step 5 – Report the Principal Office Street Address in the Fourth Article.There will be a two lines provided so that you my list the physical address (Building Number, Street, Site Number, City, State, Zip Code).

Step 6 – In the Fifth Article enter the Full Name of the Resident Agent. That is, the individual who has agreed to receive service of process on behalf of the corporation being formed. Enter this party’s Full Name on the first blank line. Then, enter the Resident Agent’s Full Address on the second blank line in the Fifth Article.

Step 7 – The Sixth Article shall verify the tax-exempt nonprofit corporation has no authority to issue capital stock.

Step 8 – Report the Number of Directors in the first blank space of the Seventh Article. Then on the second blank space list the Full Name of each of the Initial Directors.

Step 9 – The Eighth Article will state additional provisions, specifically making use of required 501(c)(3) language which will bind the corporations operations to Section 501(c)(3) and Section 170(c)(2).

Step 10 – The last section will require the attention of two parties, the Incorporators and the Resident Agent. Below the 501(c)(3) compliant language provision, all Incorporators name in the First Article must sign their Names on the blank lines provided. On the right of this will be an acknowledgment paragraph which the Resident Agent named in the Fifth Article must sign. Finally, you must supply the Mailing Address where these articles may be returned. This should be done under the heading “Filing party’s return address:” on the spaces provided.

Step 11 – Next, you must make sure all applicable fees will be paid for at the time of submission. This may be done by enclosing a check or money order made payable to “State Department of Assessments and Taxation.” There are a minimum of three fees that must be paid in full when submitting these articles: the Filing Fee of $100.00, the Organization and Capitalization Fee of $20.00, and the Assessment for the Maryland Not-For-Profit-Development Center Program Fund for $50.00. This will total to $170.00. Normally, processing may take up to eight weeks however you may expedite this to 7 days for a $50.00 expedited processing fee. You may send (or hand deliver) the Maryland Articles of Incorporation for Tax-Exempt Nonprofit Corporation, all appropriate documents, and Full Payment for applicable fees to:

State Department of Assessments and Taxation, Charter Division

301 W. Preston Street, 8th Floor

Baltimore, MD 21201-2395

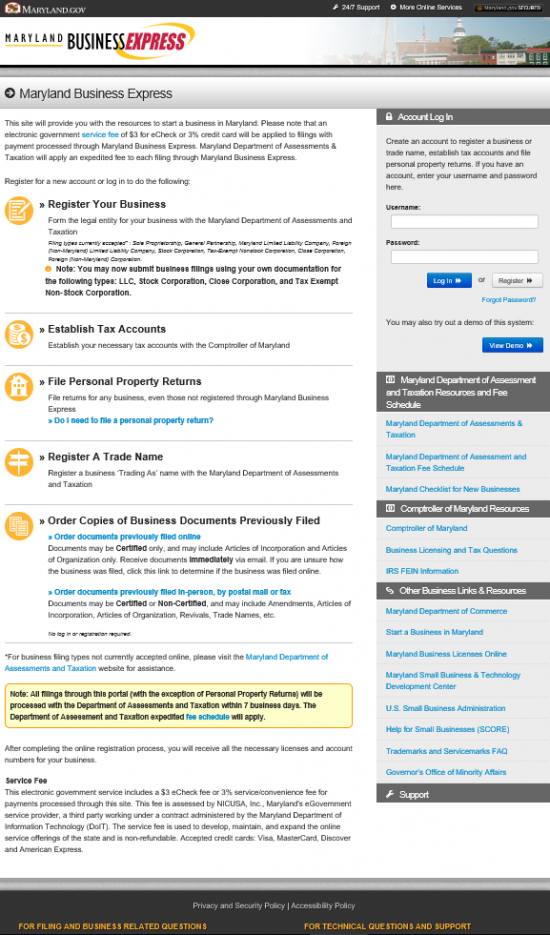

How To File Electronically

Step 1 – Go to the Maryland Business Express site by clicking here: https://egov.maryland.gov/businessexpress. You will need to provide your login information on the right hand part of the page, then select the button labeled “Log In.”

Step 2 – Now, locate the link below the introduction labeled “Tax-Exempt Nonstock Corporation File Articles of Incorporation to a Nonstock Corporation”

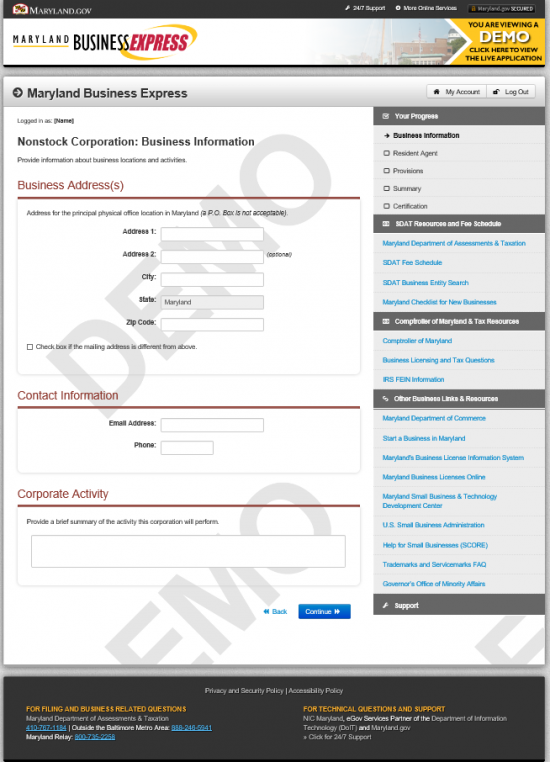

Step 3 – This page is the Nonstock Corporation: Business Information page. It will contain three sections requiring attention. The first section, “Business Address(s),” will require a report the Principal Office Address of the Tax-Exempt Nonstock Corporation. This should be the physical location of the corporation itself and may not contain a P.O. Box. Enter the Building Number and Street in the field labeled “Address 1.” If the corporation’s physical address contains a site number, enter this in Address 2. List the City used in the Principal Office Address in the text box labeled “City.” Finally, list report the Zip Code where the Principal Office. If the corporation has a separate Mailing Address, you must report this by selecting the box labeled “Check if the mailing address is different from above,” then enter the Mailing Address in the fields that appear below.

Step 4 – In “Contact Information,” report the E-Mail Address and the Phone Number of the Contact Person who will be able to answer questions regarding these articles in the appropriately labeled text boxes.

Step 5 – In “Corporate Activity,” you must document what the purpose of creating this Tax-Exempt Nonprofit Corporation and how it will operate as such in the State of Maryland.

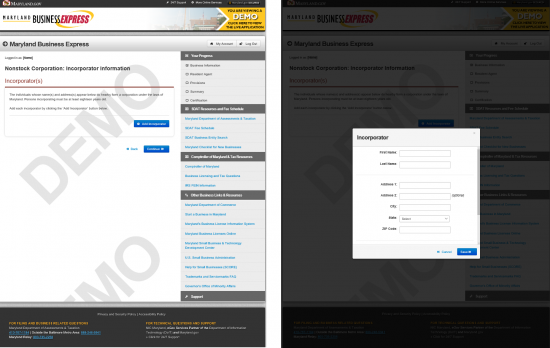

Step 6 – The next screen will require information regarding the Incorporators of this Tax-Exempt Nonprofit Corporation. Each Incorporator being listed must have his/her Name entered. First, select the button labeled “Add Incorporator.” This will deliver a popup window.

Step 7 – In the Incorporator window, enter the First Name, the Last Name, and the Full Address of an Incorporator in the fields provided. Once this is done select the button labeled “Save.” If you wish to add another incorporator simply select the button labeled “Add Incorporator.” You may review the information you input for each Incorporator in a table that appears on the screen. Once you have entered all the Incorporator’s information, select the bottom labeled “Continue.”

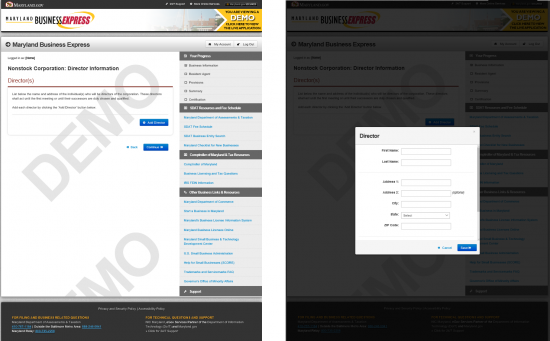

Step 8 – The next screen requires similar information for the Initial Directors of the corporation being formed by these articles. First select the button labeled “Add Director”

Step 8 – The next screen requires similar information for the Initial Directors of the corporation being formed by these articles. First select the button labeled “Add Director”

Step 9 – Several fields will appear in a pop up window. Enter the appropriate Director information in that field. You will need to enter the First Name, Last Name, and Address (Address 1, Address 2, City, State, State, Zip Code) for each Director separately. You must select the button labeled “Save” in order to save the information into your articles. Once you have done this select the “Continue” button.

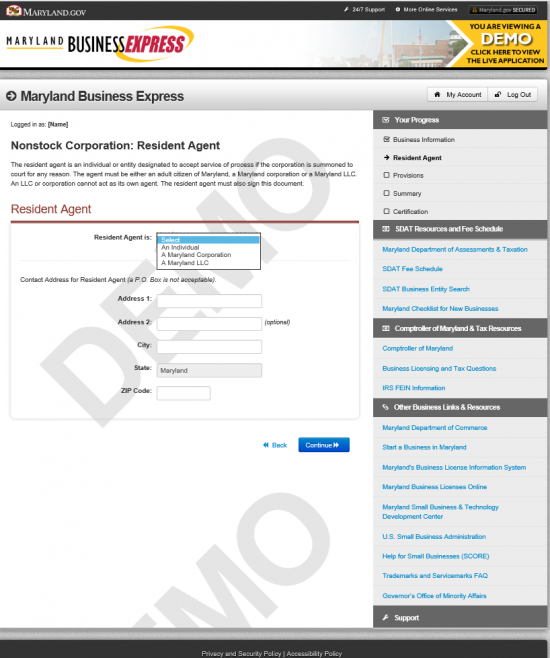

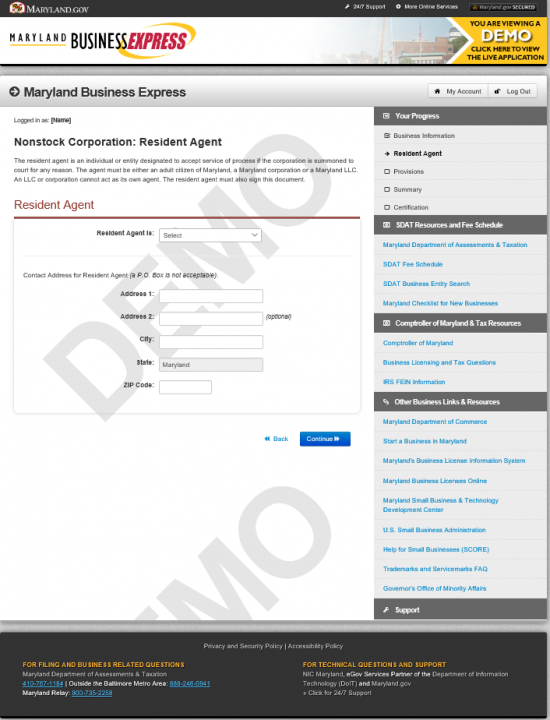

Step 10 – The next page is where you will report the Address for the Resident Agent. You must first select the type of Resident Agent that has been named for this corporation. Use the dropdown menu in the first field, labeled “Registered Agent is” to report this. You may choose “An Individual,” “A Maryland Corporation,” or “A Maryland LLC.”

Step 10 – The next page is where you will report the Address for the Resident Agent. You must first select the type of Resident Agent that has been named for this corporation. Use the dropdown menu in the first field, labeled “Registered Agent is” to report this. You may choose “An Individual,” “A Maryland Corporation,” or “A Maryland LLC.”

Step 11 – The Resident Agent is the entity that will receive service of process on behalf of the corporation being formed. Thus, the address entered in the next fields may not contain a P.O. Box Number. It must be the physical location of the Resident Agent in the State of Maryland. Enter the Street Address in Address 1 and Address 2. Then enter the City and Zip Code in the text boxes provided.

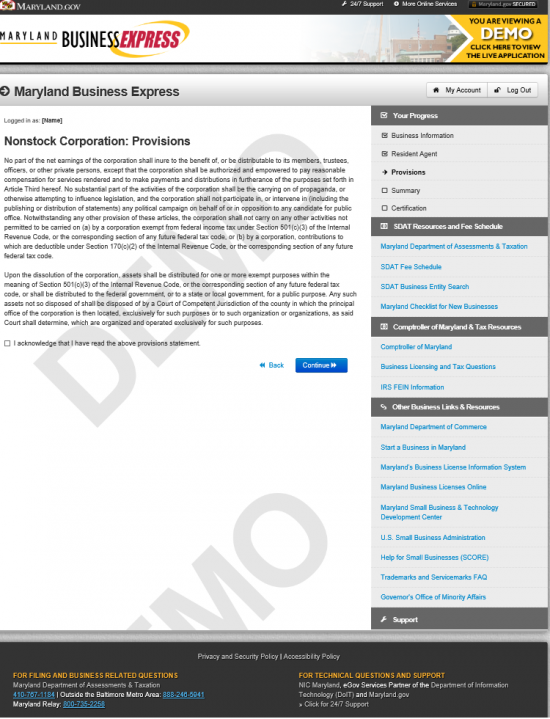

Step 12 – The provisions on this next page contain the 501(c)(3) compliant language that must be present if a forming corporation will apply for Tax-Exempt Status. Read this carefully as the corporation being formed must operate in this manner. Note: This does not grant a corporation tax-exempt status, only the I.R.S. may do this.

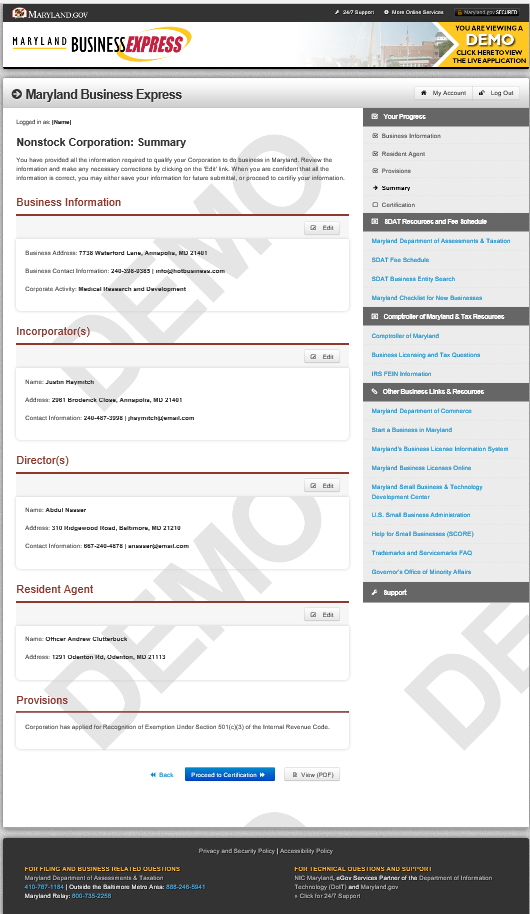

Step 13 – The Nonstock Corporation Summary page will allow you to review the information you entered for the Business Information, Incorporator(s), Director(s), Resident Agent, and Provisions sections. You may edit any one of these sections by using the corresponding “Edit” button. Once all this information has been verified select the button labeled “Proceed to Certification.”

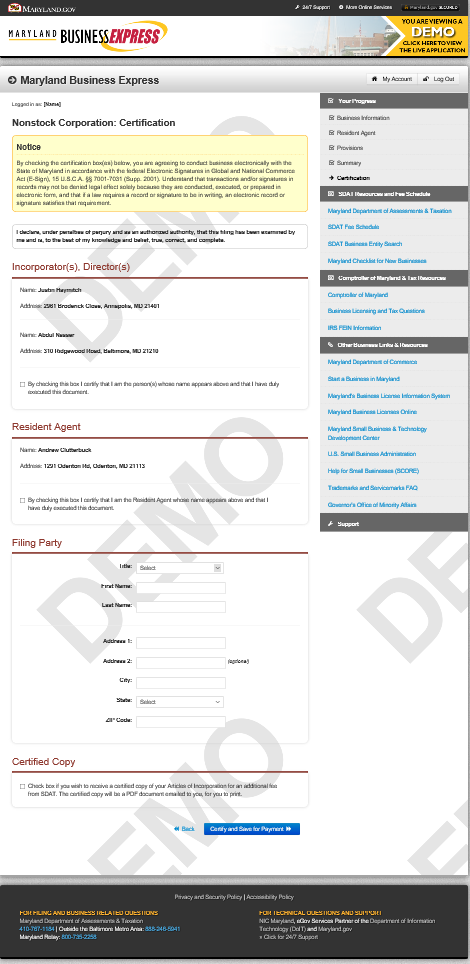

Step 14 – Locate the section labeled “Filing Party.” First, use the drop down to select the Title of the Filing Party. You may choose Officer, Director, Attorney, Agent, Authorized Person, Member, Partner, Trustee, or Other. Then enter the First Name, Last Name, and Full Address of the party filing this document with the Maryland State Department of Assessments and Taxation. If you wish to have a Certified Copy mailed to you (this will cost an additional $5.00) then select the box in the Certified Copy heading. This is optional. Once you have finished entering all the information that needs to be entered on this page, select the button in the lower right corner labeled “Certify and Save for Payment.”

Step 14 – Locate the section labeled “Filing Party.” First, use the drop down to select the Title of the Filing Party. You may choose Officer, Director, Attorney, Agent, Authorized Person, Member, Partner, Trustee, or Other. Then enter the First Name, Last Name, and Full Address of the party filing this document with the Maryland State Department of Assessments and Taxation. If you wish to have a Certified Copy mailed to you (this will cost an additional $5.00) then select the box in the Certified Copy heading. This is optional. Once you have finished entering all the information that needs to be entered on this page, select the button in the lower right corner labeled “Certify and Save for Payment.”

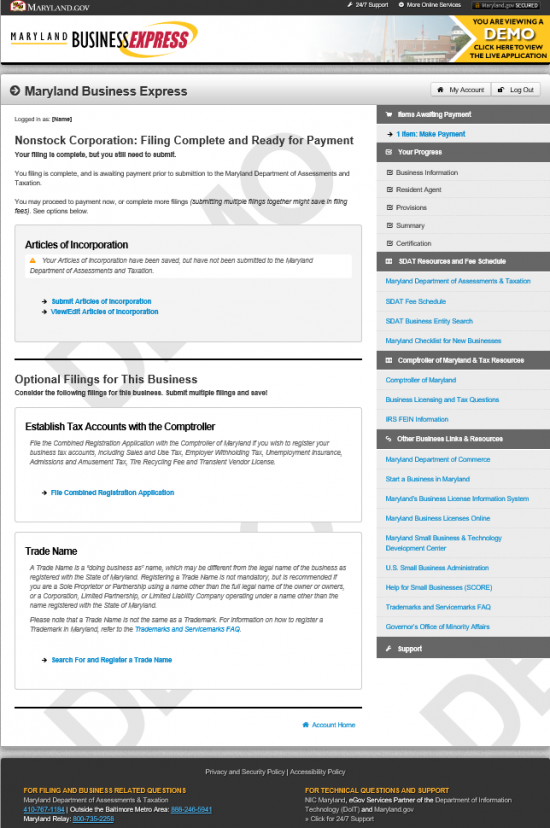

Step 15 – This screen will give you a choice to file other articles, review suggested optional filings, view a PDF of the articles you just submitted, or proceed to review the payment information. When you are ready to proceed, under the heading “Articles of Incorporation,” select the link labeled “Submit Articles of Incorporation.”

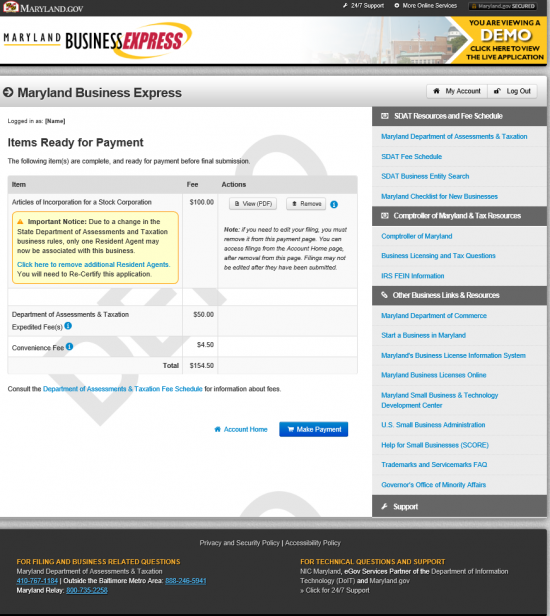

Step 16 – The “Items Ready For Payment” page will display the payment information for submitting your articles. There will be a $100.00 Filing Fee for the Maryland Articles of Incorporation for Tax-Exempt Nonprofit Corporations, a $50.00 Department of Assessments and Taxation Fee, and a $4.50 Convenience Fee. If you have ordered a Certified Copy of your articles there will be an additional Fee of $5.00. You may review the information you submitted one last time via the “View PDF” button in the box labeled Actions. Once you select “Make Payment,” you will be directed to an area where you may input your payment information. Full Payment will finalize the filing process for the Filing Party.

Step 16 – The “Items Ready For Payment” page will display the payment information for submitting your articles. There will be a $100.00 Filing Fee for the Maryland Articles of Incorporation for Tax-Exempt Nonprofit Corporations, a $50.00 Department of Assessments and Taxation Fee, and a $4.50 Convenience Fee. If you have ordered a Certified Copy of your articles there will be an additional Fee of $5.00. You may review the information you submitted one last time via the “View PDF” button in the box labeled Actions. Once you select “Make Payment,” you will be directed to an area where you may input your payment information. Full Payment will finalize the filing process for the Filing Party.