|

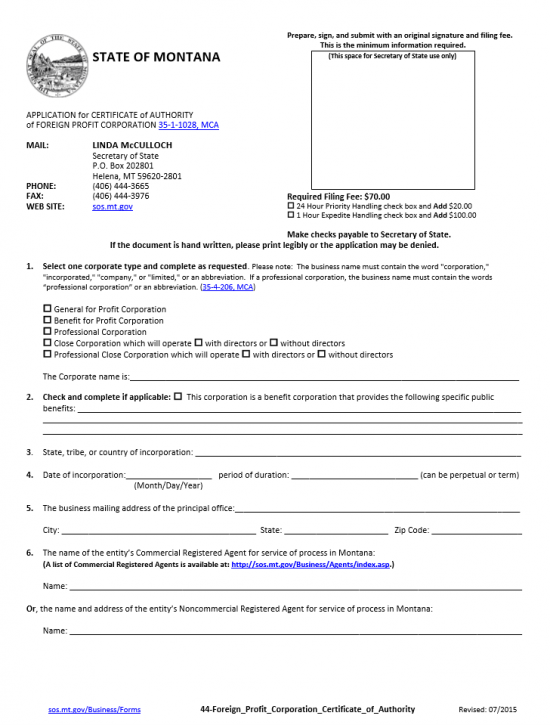

Montana Application for Certificate of Authority for Foreign Profit Corporation |

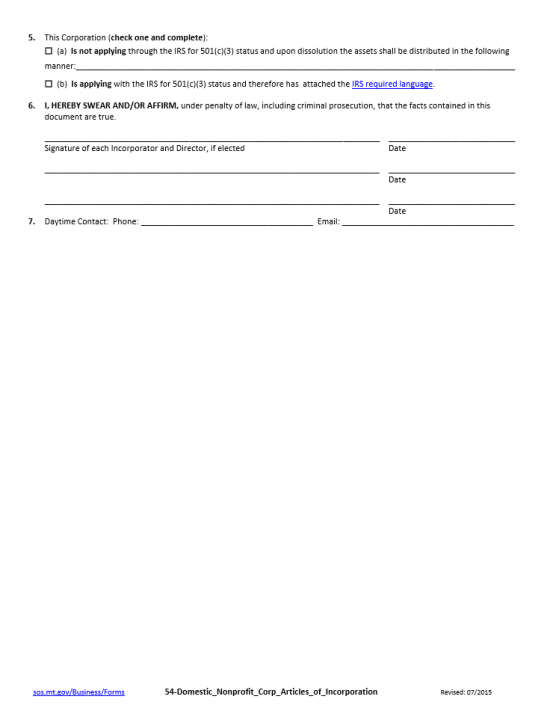

The Montana Application for Certificate of Authority for Foreign Profit Corporation must be submitted to the Montana Secretary of State whenever a foreign entity wishes to as a profit corporation within state borders. Any foreign profit corporation may apply for the right to do business in the state of Montana. This application may be used by general for profit businesses, professional corporations, benefit corporations, close corporations or professional closed corporations wising for the authority to do business in Montana. It should be noted that any corporation operating in the State of Montana must have a unique Name on the records with the Montana Secretary of State. This means that if the True Name of the filing entity or the Name it operates under in its home state is taken in the State of Montana, then it must operate under an assumed name that conforms with Montana guidelines.

You may submit this application by mail and it must be submitted with payment for the Filing Fee plus all applicable service charges. For instance you may choose to expedite the processing time to one hour if you submit an additional payment of $100.00 or you may choose to expedite it to 24 hours for an additional payment of $20.00. If you choose either of these services the applicable fee must be added to the Filing Fee of $70.00. This is payable with a check made payable to Secretary of State. It will take roughly ten business days for these documents to filed with the Montana Secretary of State, if not expedited. You will receive either a rejection letter outlining the reason for the rejection or if they are accepted, you will receive a letter certifying the application’s approval.

How To File

Step 1 – Download the Montana Application for Certificate of Authority for Foreign Profit Corporation by clicking this link: Montana Certificate of Authority or by clicking the “Download Form” link above. The information on this form may be filled out on screen,

Step 2 – In Item 1, you must define the entity type of the filing corporation. You will have several choices to choose from but may only choose one: General For Profit Corporation, Benefit for Profit Corporation, Professional Corporation, Close Corporation, or Professional Close Corporation. Please not that if this is a Close Corporation or Professional Corporation, you will have to indicate if there will be members or not by clicking the appropriate box.

Step 3 – Below the entity type section, you must enter the Full Name of the filing entity as it will operate in the State of Montana. For instance, if the filing entity’s name is unavailable and it will operate under an assumed name, the language should be similar to “ABC Incorporated operating as XYZ Incorporated.”

Step 4 – If the filing entity is a benefit corporation then check the box in Item 2. Next on the blank lines provided report the public benefit that shall be provided. If the filing entity is not a benefit corporation then you may leave this section blank.

Step 5 – In Item 3, report the Tribe, State, or County of Incorporation on the space provided.

Step 6 – Item 4 will require the original Date the filing entity has incorporated (in its domicile state). Enter this date on the blank line provided in the Month/Day/Year format. On the next blank line, following the words “period of duration,” report the time period this corporation shall conduct business (i.e. 10 years 4 months 2 days) or you may write in the word “Perpetual” if there is no such defined time period.

Step 7 – You must report the Business Mailing Address of the filing entity’s Principal Office on the first blank line in Item 5 (Building, Street, Suite Number). On the next three blank lines enter the City, State, and Zip Code of the filing entity’s Principal Office Business Address.

Step 8 – Each corporate entity operating in the State of Montana must have a Registered Agent, on record with the Montana Secretary of State, to receive service of process documents should this entity be called to court. If filing entity’s Registered Agent is commercial, then you only need to report the Name of the commercial Registered Agent on the first blank line in Item 6. If, however, the filing entity has obtained a noncommercial Registered Agent then, report the noncommercial Registered Agent’s Full Name must be reported on the second blank line of this section.

Step 9 – On the third and fourth blank lines, in Item 6, report the Full Actual Street Address of the noncommercial Registered Agent of the filing entity. This may be a Street Address or Rural Box Number and must be where the Registered Agent may be geographically located. You must fill in this information if you are using a noncommercial Registered Agent.

Step 10 – In the third section, beginning with the words “And, a mailing address…,” report the Mailing Address the noncommercial Registered Agent has. This section must be filled out if the noncommercial Registered Agent receives his/her/its mail at a location separate than the Street Address/Rural Box Number listed above. If there is no separate Mailing Address, this section may be left blank.

Step 11 – In Item 7, report the filing entity’s purpose for applying for a certificate of authority in the State of Montana. This is similar to describing how the corporation will conduct its affairs.

Step 12 – Enter the Full Name, Office Held, and Business Mailing Address for each functioning Officer in the filing entity’s structure in Item 8. Each individual should receive his/her own line. If an individual holds more than one office you may report both in the area labeled “Office Held” (i.e. Secretary/Treasurer).

Step 13 – Item 9 will require the Full Name and Business Mailing Address of each Director functioning in the filing entity’s structure.

Step 14 – In Item 10, an authorized Officer must provide his/her Signature. On the line to the right, you must provide the Date of this Signature. Below this line, he/she must Print his/her Name and report his/her Title.

Step 15 – This filing must be submitted with a reliable Contact Phone Number and Contact Email in the event the Montana Secretary of State needs to contact the filing entity regarding this application. This will be done in Item 11 by first entering the Phone Number on the first line and the Email on the second blank line.

Step 16 – The information on this form must be accurate and fully reported. If you have had to continue any sections on a separate sheet of paper, make sure that each one is properly labeled and attach them. You will need to submit the original Montana Application for Certificate of Authority for Foreign Profit Corporation, all required paperwork, and any attachments simultaneously with full payment of all applicable fees. The Filing Fee for this application is $70.00 and may be paid for with a check made out to “Secretary of State.” Typically the filing process will take ten business days but you may choose to expedite this for an additional fee. You may expedite this filing to 24 hour processing by placing a check mark in the box located in the top right hand corner of this form and labeled “24 Hour Priority Handling…” This will require an additional $20.00 payment. You may also choose to expedite the processing to 1 hour processing if you check the box of this section labeled “1 Hour Expedite Handling” and including an additional $100.00 in you payment. The Montana Application for Certificate of Authority for Foreign Profit Corporation must be filed by mailing to:

Linda McCulloch

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801