|

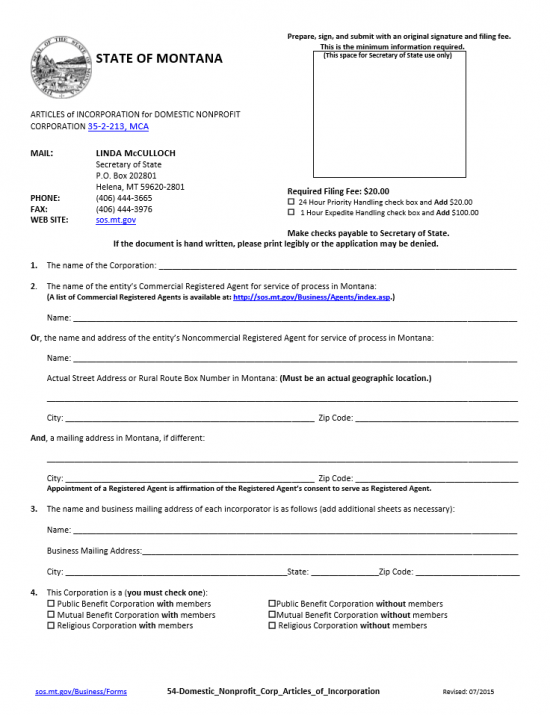

Montana Articles of Incorporation for Domestic Nonprofit Corporation |

The Montana Articles of Incorporation for Domestic Nonprofit Corporation was created by the Montana Secretary of State to facilitate the incorporation process required by this governing entity when an Incorporator wishes to form a nonprofit corporation, of any type, in the State of Montana. This form will allow for the 501(c)(3) IRS compliant language that must be filed with the articles of incorporation for a nonprofit corporation. If the nonprofit corporation being formed wishes to apply for Tax Exempt status, the submitter must make sure to attach the letter available with this form. It should be noted that only the I.R.S. may grant Tax Exempt Status. A variety of entity types may be created by this form: Public Benefit, Mutual Benefit, and Religious corporations. Each entity type, of course, will need to fulfill a set of criteria placed upon its formation by various governing bodies and some may require a very specific process (such as apply for Tax Exempt Status with the I.R.S.). It is therefore considered wise to consult with an attorney, or similarly appropriate professional, before filing these articles.

The submittal package must consist of several components. Even the most basic filings must contain the Montana Articles of Incorporation for Domestic Nonprofit Corporation, any additional paperwork, and the Filing Fee. You may choose to receive a certified copy however bear in mind that you will need to send a copy of the articles being submitted to receive one. Otherwise you will receive a certified letter verifying the successful filing of your documents within ten days. You may choose to expedite the filing process by indicating the desire to do so on the form. You must also submit the handling fee for the expedited service with the package ($20.00 for 24 hour expediting, $100.00 for 1 hour expediting). All checks are payable with a check made out to “Secretary of State.”

How To File

Step 1 – Download the Montana Articles of Incorporation for Domestic Nonprofit Corporation by selecting the link labeled “Download Form.” If the entity being created by these articles intends to apply for Tax Exempt Status, you will also need to select and download the link labeled “Download 501(c)(3) Compliant Language” as you will need to attach this document to the articles being submitted.

Step 2 – In Article 1, enter the Full Name of the corporation these articles concern themselves with. This must be the Full Name of the nonprofit corporation as it is to appear in the Montana Secretary of State records and should include the appropriate suffix for its entity type.

Step 3 – Article 2 will be composed of two sections and you must only fill in one. If the Registered Agent for the forming corporation is a commercial registered agent, then fill in the Name of the commercial Registered Agent on the first line. (You may find a list of Montana approved commercial Registered Agents here: ). If the Registered Agent of this corporation is not a Registered Agent you may skip this first section and proceed to the next section of this Article. Otherwise proceed to Step 7.

Step 4 – If the Registered Agent for this entity is a noncommercial entity, then locate the second blank line in this Article. Here, (after the word “Name”) report the Full Name of the noncommercial Registered Agent.

Step 5 – On the blank lines beneath the words “Actual Business Address,” report the physical location of the Registered Agent. This may not be a P.O. Box. Only a Street Address or a Rural Bo Number will be considered the Physical Location of the Registered Agent. Below this you must enter City and Zip Code of the Physical Location of the Registered Agent.

Step 6 – If the entity’s noncommercial Registered Agent receives its mail in a location other than its Physical Location then you must report this address. Locate the blank line below the words “Mailing Address,” here you may enter a P.O. Box if it is considered part of the Mailing Address for the Registered Agent. Report the Mailing Address of the noncommercial Registered Agent in this section. Otherwise you may leave this section blank.

Step 7 – In Article 3, you will need to report the information pertaining to the Incorporators of this entity. Each Incorporator must list his/her Full Name and his/her Business Address. If there is not enough room to do this you may continue this on a separate sheet of paper that is clearly labeled.

Step 8 – In Article 4, you must define the entity type by placing a check mark in the appropriate box. There will be several Entity types to choose from: Public Benefit Corporation, Mutual Benefit Corporation or Religious Corporation. The column on the left will list these choices with members while the column on the right will list these choices without members, you may only choose one.

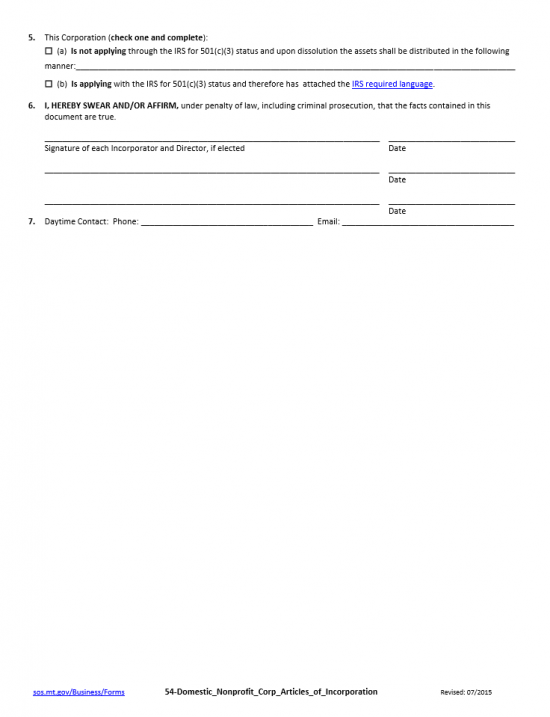

Step 9 – In Article 5 you must note whether this nonprofit corporation plans on applying for Tax Exempt Status or not. If so then place a check mark in the first box and report how the assets of this corporation will be distributed upon its termination or dissolution on the blank space provided. If this corporation does plan on applying for Tax-Exempt Status then place a mark in the second box and attach the IRS 501(c)(3) compliant attachment.

Step 10 – Next each Incorporator must provide his/her Signature and Signature Date in Article 6. You may continue the Signature lines on a separate clearly labeled sheet of paper and attach it.

Step 11 – Finally, in Article 7, provide a Contact Phone Number and Contact Email, of the Contact Person, the Montana Secretary of State may use as a point of contact regarding these articles.

Step 12 – It is always a good idea to review the information you are submitting. Once this form has been filled out, take a moment to do this. If your articles are rejected you will need to pay fees a second time for another submittal. A decision will be made within 10 days and you will receive a letter certifying the articles you have submitted as being accepted. All fees that are applicable must be paid in full at the time of submittal. The Filing Fee for the Montana Articles of Incorporation for a Nonprofit Business is $20.00. If you wish to expedite the filing to 24 hours, then locate the first check box in the top right section labeled “24 Hour Priority Handling” and include an additional $20.00 payment. If you wish to expedite the filing to one hour then mark the second box of this section and include an additional $100.00. You will also need to submit one original and all required paperwork at once with these payments. If you wish to receive a certified copy, you must include a copy of the articles being submitted. All such submittal packages must be sent to:

Linda McCullogh

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801