|

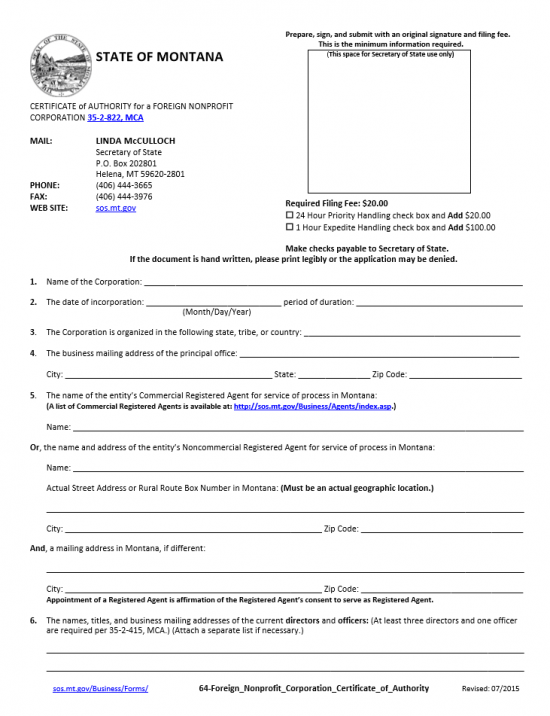

Montana Certificate of Authority for a Foreign Nonprofit Corporation |

The Montana Certificate of Authority for a Foreign Nonprofit Corporation is the application form required by the Montana Secretary of State should a out of state nonprofit corporation wish to operate as a nonprofit corporation within the State of Montana. This form will allow for 501(c)(3) compliant language to be attached should a Tax-Exempt Status be sought. This may be a requirement of the Internal Revenue Service but will not satisfy all requirements by this governing entity. It is important to bear in mind that only the Internal Revenue Service may grant Tax Exempt Status and must be contacted separately. Generally, it is a good idea to seek advice from an accountant or an attorney before filing this application, regardless of whether the intent to apply for Tax-Exempt Status exists.

The Montana Certificate of Authority for a Foreign Nonprofit Corporation may only be filed by mail and must include all paper work as well as Full Payment of all applicable fees. The Filing Fee for this certificate application is $20.00. Filing this certificate will usually take about ten business days however an expediting service is available. You may have this application process shortened to either 24 hours or 1 hour but will need to include the appropriate payment for the expediting level you have chosen ($100.00 for one hour or $20.00 for twenty-four hours).

How To File

Step 1 – Enter the Full Name of the corporation applying for this certificate in Item 1. If the Name is unavailable in the State of Montana make sure you also note the Assumed Name the filing entity will be known as in this state.

Step 2 – Report the Date of Incorporation on the first blank line of Item 2. Then on the second blank line in Item 2, report the period of duration this filing entity’s corporate status shall be in effect or write in the word perpetual.

Step 3 – The jurisdiction the filing entity exists under must be reported in Item 3. This may be a Tribe, State, or Country and, in most cases, is where the filing entity first submitted its articles of incorporation.

Step 4 – In Item 4, enter the Business Mailing Address used by the Principal Office.

Step 5 – Next, in Item 5, you must document the Identity and Location of the filing entity’s Registered Agent in the State of Montana. This may be a commercial Registered Agent or a noncommercial Registered Agent that maintains a physical address in the State of Montana. If you have commercial Registered Agent, you will only be required to fill in the first blank line of this section with the commercial Registered Agent’s Full Name. If you have a noncommercial Registered Agent then leave the first line of Item 5 blank and follow the instructions in Step 6. If your corporation does have a commercial Registered Agent proceed to Step 7.

Step 6 – If you have a noncommercial Registered Agent then leave the first blank line in Item 5 blank and locate the second blank line. Enter the Full Name of the noncommercial Registered Agent on the second blank line in Item 5 then on the third and fourth blank lines enter the Actual Address of this entity. This must be a physical location and may not contain a P.O. Bo Number. You may enter a Mailing Address, if separate from the Actual Address, in the section below this (below the line beginning with the words “And, Mailing Address).

Step 7 – In Item 6, you must report the Name and Addresses of at least three active Directors and one active Officer in the filing entity on the blank lines provided. If there is not enough room, properly label a sheet of paper and continue the list there.

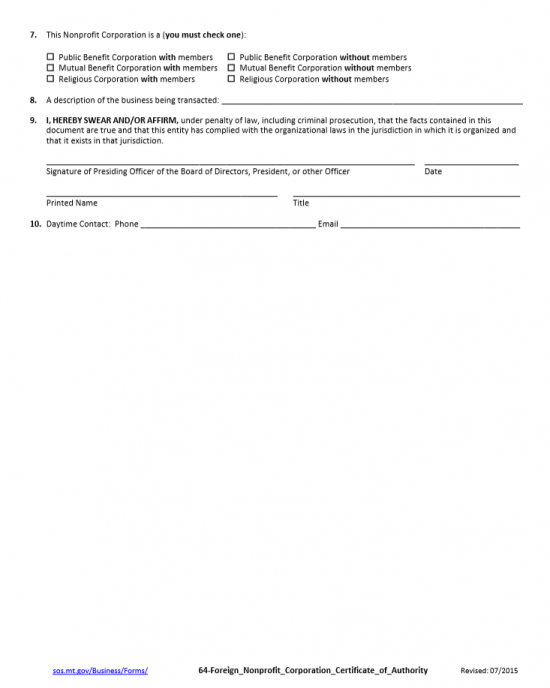

Step 8 – In Item 7, you must define the entity type of the foreign corporation submitting this application for certificate. You must choose only one entity type: Public Benefit Corporation with members, Mutual Benefit Corporation with members, Religious Corporation with members, Public Benefit Corporation without members, Mutual Benefit Corporation without members, or Religious Corporation without members. Place a check mark in the box next to the appropriate entity type.

Step 9 – Item 8 will call for a description of how business will be conducted by the filing entity in the State of Montana. This may be the purpose of the corporation. If this entity intends to apply for Tax-Exempt Status then 501(c)(3) compliant language must be used in this section. An attachment containing such language is downloadable in the link above. Download this document and attach it to this application if this is the case.

Step 10 – Item 9 requires that an authorized Officer of the filing entity Sign his/her Name and Date this Signature. Below this will be an area where the authorized Officer may Print his/her Name and write in his/her Title.

Step 11 – Next you will need to provide reliable contact information should the Montana Secretary of State need any further information or clarification regarding this application. Here, on the first line of Item 10, you must enter the Point of Contact’s Phone Number. Then on the second blank line you must provide the Point of Contact’s E-mail Address.

Step 12 – As mentioned above, you have the option of expediting the filing process. If so, then in the upper right hand corner of this document, you will find the option to expedite to twenty four hours at a cost of an additional $20.00 or you may expedite to one hour service for an additional charge of $100.00. If you wish to expedite the filing of this application to either of these time periods place a check mark in the appropriate box. Otherwise you may leave these boxes blank.

Step 13 – The Montana Certificate of Authority for a Foreign Nonprofit Corporation must be mailed in to the Montana Secretary of State with all appropriate or required paperwork and Full Payment of the $20.00 Filing Fee. If you have chose to expedite the filing, then you must add the Expedited Handling Fee for the appropriate level to this Filing Fee. You may remit payment with a check made payable to “Secretary of State.”

Mail To:

Linda McCulloch

Secretary of State

P.O. Box 202801

Helena, MT 59620-2801