|

North Carolina Articles of Incorporation Nonprofit Corporation | Form N-01 |

The North Carolina Articles of Incorporation Nonprofit Corporation | Form N-01 will need to be filled out and approved by the North Carolina Secretary of State before an entity is allowed to operate as a nonprofit corporation in the State of North Carolina. There are many different types of nonprofit corporation, for instance the entity may be a tax-exempt religious nonprofit corporation or a professional nonprofit corporation. In either of these examples, additional requirements or documents will need to be tended to. Furthermore, other governing bodies holding authority may have a mandatory process which must be successfully completed. It is for this reason that Incorporators are generally encouraged to seek consultation with a qualified professional before attempting to file this document with the North Carolina Department of the Secretary of State.

All required documents and the North Carolina Articles of Incorporation Nonprofit Corporation | Form N-o1 should be submitted with the Corporations Division Cover Sheet and a Full Payment of all applicable fees. The Corporations Division Cover Sheet will give you the option of how you wish to receive your documents as well as the opportunity to expedite these articles to Same Day Service (if delivered by 12:00 p.m.) or 24 Hour Service. Each service will carry an additional fee ($200.00 for Same Day or $100.00 for 24 Hour). The Filing Fee for these articles, which must be paid in full, should be considered separate and is $60.00. This is payable with a check or money order made out to Secretary of State.

How To File

Step 1 – Download both forms above. These are both PDF documents thus, either may be filled out on screen with an appropriate PDF program or you may print them and fill them out if you do not have such a program. Once you have downloaded them, open the North Carolina Articles of Incorporation Nonprofit Corporation.

Step 2 – In Article 1, on the space provided, enter the Full Name of the corporation being formed by these articles, including the required corporate designations appropriate for this entity (i.e. Corporation, Corp., Inc., Incorporated, etc.).

Step 3 – If the entity being formed is a Religious Corporation (pursuant to NCGS §55A-1-40(4)) then place a check mark on the space in Article 2. If not, then leave this section blank.

Step 4 – Enter the Full Name of the Registered Agent on the blank line in Article 3. All corporations, including nonprofits, must have obtained a Registered Agent to reliably receive court issued paperwork on behalf of that corporation.

Step 5 – The Physical Location of the Registered Agent’s Office must be documented accurately in Article 4. Enter this Physical Street Address on the first line of this article, then the City, Zip Code, and County on the second line (North Carolina Registered Agents are required to have a physical address in the State of North Carolina). This address may not contain a P.O. Box. If the Registered Agent receives mail at a separate location, you may enter the Street Address of the Mailing Address on the third blank line in this article then the City, Zip Code, and County of the Mailing Address on the fourth blank line.

Step 6 – In the Fifth Article, provide a Roster of the Incorporators. This must include the Full Name and Full Address of each one and may be completed on a separate sheet of paper if there is not enough room.

Step 7 – Indicate if this nonprofit corporations will have members in Article 6. If so, place a check mark in the first box while if not, place a check mark in the second box.

Step 8 – Article 7 will call for a detailed plan of how the nonprofit corporation will distribute its assets/properties when it dissolves to be attached. Make sure this is a complete detailing of this plan.

Step 9 – If there are any other provisions, conditions, etc. that should be reported with these articles they must be attached as per Article 8.

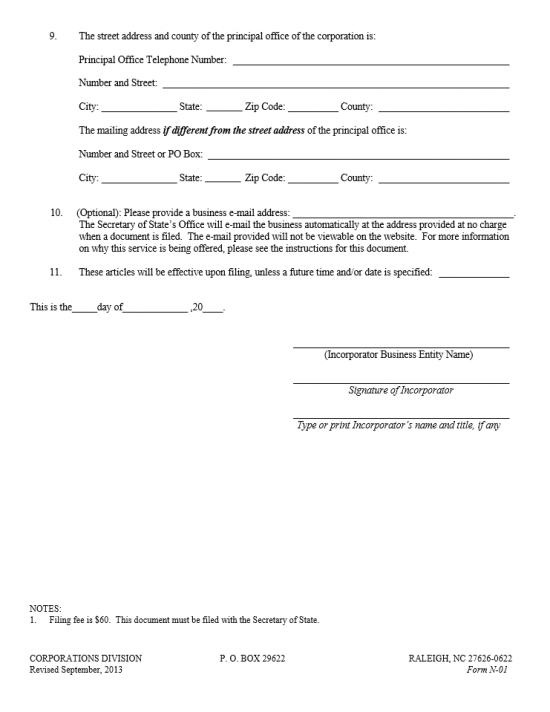

Step 10 – Article 9 will require the Full Address of the Physical or Geographical Location of the nonprofit corporation’s Principal Address to be documented on the first two lines. If the nonprofit corporation’s Principal Office will receive its mail at a separate address, then report the Mailing Address of the Principal Office on the third and fourth lines.

Step 11 – Article 10 is optional however highly recommended. If you provide a reliable Email Address, you will receive notification immediately upon approval with images of your certified documents and Certificate of Incorporation.

Step 12 – If the nonprofit corporation requires a Delayed Effective Date, report this Date in Article 11. This may be up to 90 days after filing. If the nonprofit corporation plans on being active as soon as the articles are approved then leave this article blank.

Step 13 – The bottom of this document will require the Date of Signature to be entered on the first line below the Eleventh Article. If this entity is being incorporated by a business, then report the Name of this business on the line labeled “Incorporator Business Name.” The Incorporator must then Sign and Print his/her Name and provide his/her Title on the last two lines.

Step 14 – Gather all documents, including a completed Corporations Division Cover Page and the North Carolina Articles of Incorporation Nonprofit Corporation and organize them into one clearly organized package. All fees must be paid at the time of filing with a check or money order payable to Secretary of State. This must include Full Payment of the $60.00 Filing Fee.

Step 14 – Gather all documents, including a completed Corporations Division Cover Page and the North Carolina Articles of Incorporation Nonprofit Corporation and organize them into one clearly organized package. All fees must be paid at the time of filing with a check or money order payable to Secretary of State. This must include Full Payment of the $60.00 Filing Fee.

Mail To:

Secretary of State

Corporations Division

P.O. Box 29622

Raleigh, NC 27626-0622

or Deliver To:

Secretary of State

2 South Salisbury Street

Raleigh, NC 27601-2903